Enhancement of Constant Attendant Allowance (CAA) under CCS (Extraordinary Pension) Rules, 1939 / 2023: DoP&PW OM dated 03.10.2024

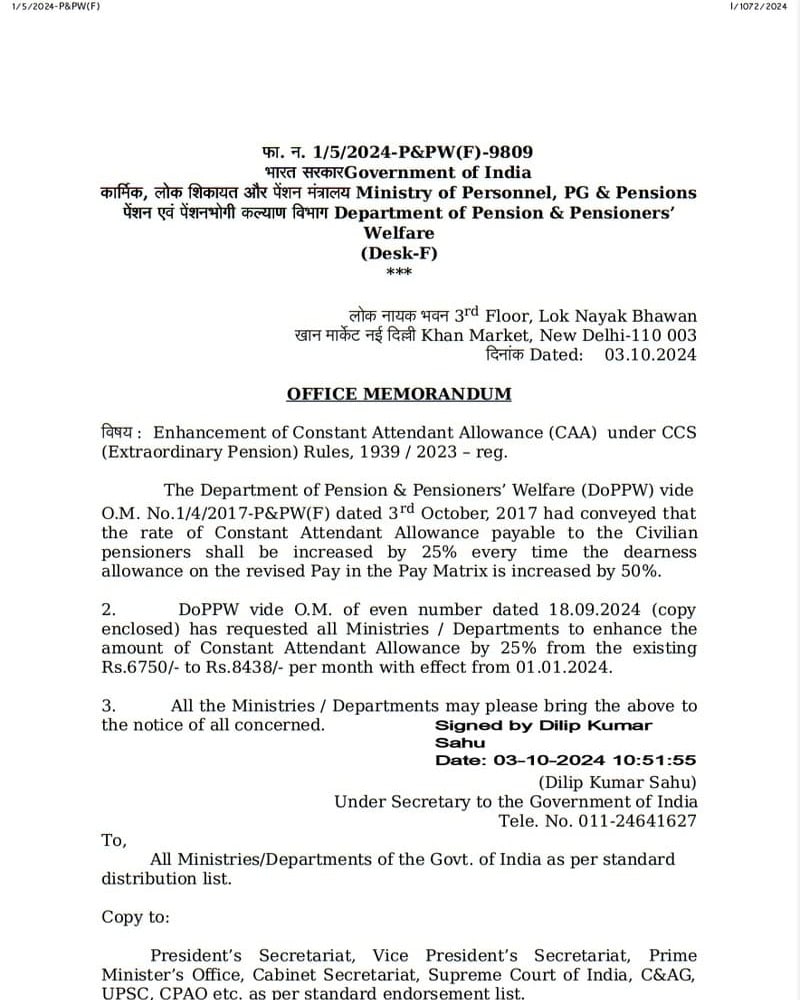

फा. न. 1/5/2024-P&PW(F)-9809

Government of India

Ministry of Personnel, PG & Pensions

Department of Pension & Pensioners’

Welfare

(Desk-F)

***

3rd Floor, Lok Nayak Bhawan

Khan Market, New Delhi-110 003

Dated: 03.10.2024

OFFICE MEMORANDUM

विषय : Enhancement of Constant Attendant Allowance (CAA) under CCS (Extraordinary Pension) Rules, 1939 / 2023 – reg.

The Department of Pension & Pensioners’ Welfare (DoPPW) vide O.M. No.1/4/2017-P&PW(F) dated 3

rd October, 2017 had conveyed that the rate of Constant Attendant Allowance payable to the Civilian pensioners shall be increased by 25% every time the dearness allowance on the revised Pay in the Pay Matrix is increased by 50%.

2. DoPPW vide O.M. of even number dated 18.09.2024 (copy enclosed) has requested all Ministries / Departments to enhance the amount of Constant Attendant Allowance by 25% from the existing Rs.6750/- to Rs.8438/- per month with effect from 01.01.2024.

3. All the Ministries / Departments may please bring the above to the notice of all concerned.

(Dilip Kumar Sahu)

Under Secretary to the Government of India

Tele. No. 011-24641627

Reference: Enhancement of Constant Attendant Allowance (CAA) under CCS (Extraordinary Pension) Rules on account of 50% DA: DoP&PW O.M. 18.09.2024

To,

All Ministries/Departments of the Govt. of India as per standard distribution list.

Copy to:

President’s Secretariat, Vice President’s Secretariat, Prime Minister’s Office, Cabinet Secretariat, Supreme Court of India, C&AG, UPSC, CPAO etc. as per standard endorsement list.

COMMENTS

Yes, as per O.M.dated 3-10-2024 issued it became increased to Rs.8,438/- from 1-1-2024.

Is 25℅ CAA applicable in to a pensioner if Dearness Relief reaches 50℅ to a pensioner? Please comment.

See my reply above to you.