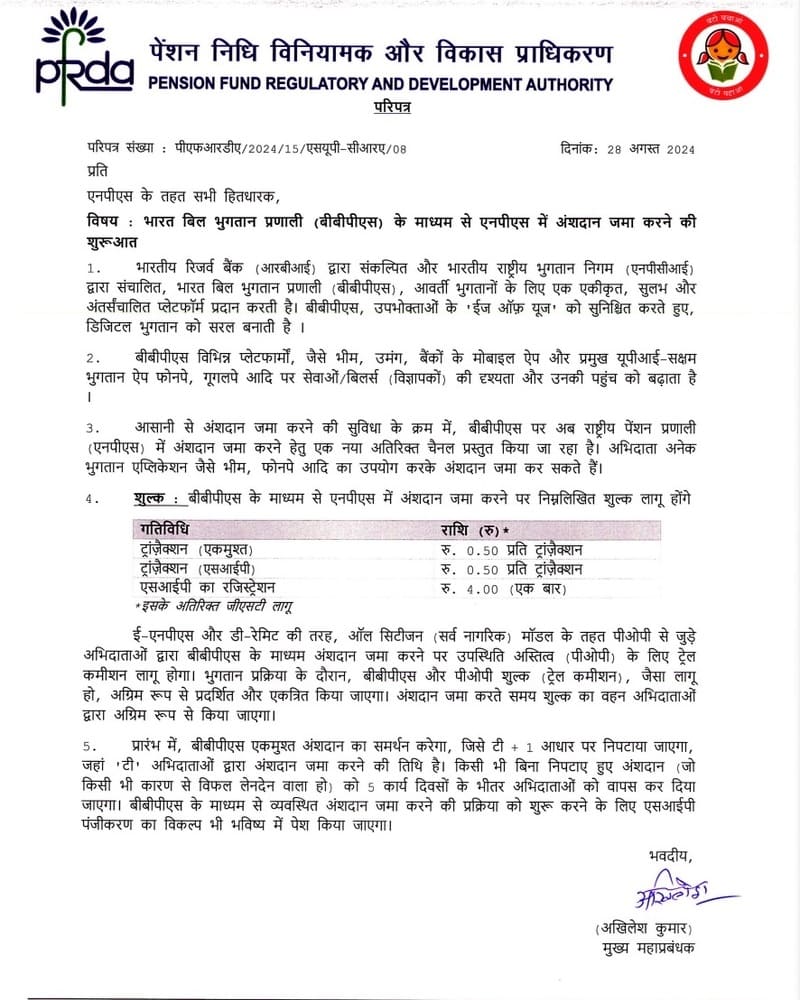

NPS Contributions through Bharat Bill Payment System (BBPS) – Introduction of new functionality: PFRDA Circular dated 28 Aug 2024

पेंशन निधि विनियामक और विकास प्राधिकरण

PENSION FUND REGULATORY AND DEVELOPMENT AUTHORITY

Circular

Circular No: PFRDA/2024/15/SUP-CRA/08

Date: 28 Aug 2024

To

All stakeholders under NPS

Subject: Introduction of NPS Contributions through Bharat Bill Payment System (BBPS)

1. The Bharat Bill Payment System (BBPS), conceptualized by the Reserve Bank of India (RBI) and driven by the National Payments Corporation of India (NPCI), offers a unified, accessible, and interoperable platform for recurring payments. BBPS simplifies digital payments, ensuring ease of use for consumers.

2. BBPS enhances the visibility and accessibility of services / billers across various platforms, including BHIM, UMANG, Mobile Apps of Banks and major UPI-enabled payment apps like PhonePe, GooglePay etc.

3. To facilitate easier contributions, a new additional channel for the National Pension System (NPS) contributions are now being introduced on BBPS. Subscribers can make contributions using multiple payment applications such as BHIM, PhonePe etc.

4. Charges: The following charges will apply for making NPS contributions through BBPS.

| Activity | Amount (Rs)* |

| Transaction (Lumpsum) | Rs. 0.50 per transaction |

| Transaction (SIP) | Rs. 0.50 per transaction |

| Registration of SIP Mandate | Rs. 4.00 (One time) |

*plus GST as applicable

Similar to eNPS and D-Remit, trail commissions to Points of Presence (POPs) will be applicable for contributions made through BBPS for subscribers associated with POPs under the All Citizen Model. BBPS and POP charges (trail Commission), as applicable, will be displayed and collected upfront during the payment process. The charges are to be borne by the subscribers upfront while making contributions.

5. Initially, BBPS will support lumpsum contributions, which will be settled on a T+1 basis where ‘T’ is the date of making contributions by the subscribers. Any unsettled contributions (failed transactions due to any reason) will be refunded to the subscribers within 5 working days. The option for SIP mandate registration to enable systematic contributions through BBPS will be introduced in due-course.

Yours sincerely,

(Akhilesh Kumar)

Chief General Manager

COMMENTS