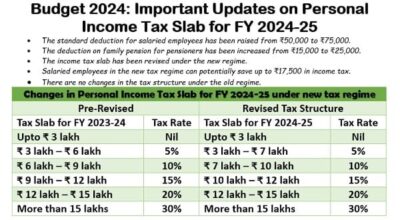

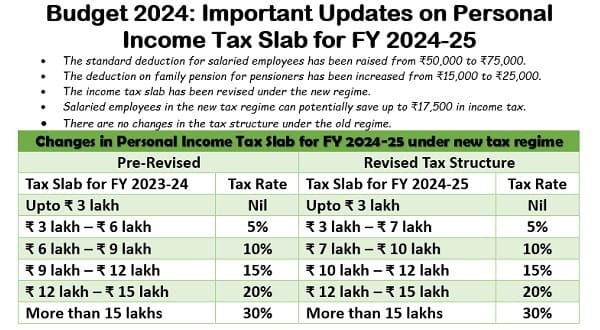

Tax Relief and Revised Tax Slabs in New Tax Regime – Union Budget 2024-25 – Changes in Income Tax Slab under New Tax Regime, Increase in Standard Deduction and Family Pension Deduction

Ministry of Finance

GOVERNMENT MAKES NEW TAX REGIME MORE ATTRACTIVE

STANDARD REDUCTION INCREASED FROM ₹ 50,000 TO ₹ 75,000

SALARIED EMPLOYEE STANDS TO SAVE UP TO ₹ 17,500

Posted On: 23 JUL 2024 1:14PM by PIB Delhi

Several attractive benefits to provide tax relief to salaried individuals and pensioners opting for the new tax regime were announced by the Union Finance and Corporate Affairs Minister Smt. Nirmala Sitharaman while presenting the Union Budget 2024-25 in the Parliament today.

Finance Minister proposed to increase the standard deduction for salaried employees from ₹50,000 to ₹75,000. Also, deduction on family pension for pensioners is proposed to be enhanced from ₹15,000 to ₹25,000 under the new tax regime. This will provide relief to about four crore salaried individuals and pensioners.

Smt. Sitharaman proposed to revise the tax rate structure in the new tax regime, as follows:

Tax Relief and Revised Tax Slabs in New Tax Regime

| 0-3 lakh rupees | Nil |

| 3-7 lakh rupees | 5 per cent |

| 7-10 lakh rupees | 10 per cent |

| 10-12 lakh rupees | 15 per cent |

| 12-15 lakh rupees | 20 per cent |

| Above 15 lakh rupees | 30 per cent |

As a result of these changes, a salaried employee in the new tax regime stands to save up to ₹ 17,500 annually in income tax.

******

Amendments relating to Direct Taxes – Income Tax

(A) Providing tax relief

A.1 Substantial relief is proposed under the new tax regime with new slabs and tax rates as under:-

| Total Income | Rate of Tax |

| Upto ₹ 3,00,000 | Nil |

| From ₹ 3,00,001 to ₹ 7,00,000 | 5 per cent |

| From ₹ 7,00,001 to ₹ 10,00,000 | 10 per cent |

| From ₹ 10,00,001 to ₹ 12,00,000 | 15 per cent |

| From ₹ 12,00,001 to ₹ 15,00,000 | 20 per cent |

| Above ₹ 15,00,000 | 30 per cent |

A.2 Standard deduction: Standard deduction to salaried individuals and pensioners is proposed to be increased from ₹ 50,000 to ₹ 75,000 under the new tax regime.

A.3 Family pension deduction: Deduction from family pension of ₹ 15,000 is proposed to be increased to ₹ 25,000 under the new tax regime.

A.4 Non-government employer contribution to New Pension scheme: It is proposed to increase the amount of deduction allowed to an employer in respect of his contribution to a pension scheme referred to in section 80CCD, from the extent of 10% to the extent of 14% of the salary of the employee. Further, a nongovernment employee in the new tax regime shall be allowed deduction of an amount not exceeding 14% of the employee’s salary in place of 10%.

****

COMMENTS