Implementation of National Automated Clearing House (NACH) for auto- deduction of PLI/RPLI premium directly from the bank account

F.No PLI-56/11/2023-PLI-DOP

Government of India

Ministry of Communications

Department of Posts

Directorate of Postal Life Insurance

New Delhi-110021

Dated: 28.06.2024

Sub: Implementation of National Automated Clearing House (NACH) for auto- deduction of PLI/RPLI premium directly from the bank account-reg

1) PLI SBI NACH integration was rolled out PAN India in Jan 2024.

2) This facility aims at providing ease to PLI/RPLI customers by auto- deducting premium directly from the policyholders’ bank account linked to the NACH platform.

3) It also benefits the Department as it reduces lapsation rate of PLI/RPLI policies.

4) It is pertinent to highlight that, so far, only 1,068 PLI/RPLI customers have been registered for this facility, as detailed in the report enclosed ‘Annexure-I‘.

5) Notably, some Circles have not yet registered a single mandate in the system, whereas the Northeast, Maharashtra, and Chhattisgarh Circles have registered over 200 mandates on the system till date.

6) Number of users created for using the SBI portal for mandate processing across Circles has been obtained and is provided in ‘Annexure-II‘ for kind reference. Dedicated SBI mandate team is available to support the Circles/CPCs & also to facilitate the creation of new User IDs. Further, separate group, including at PLI Dte, IPPB, SBI, and the Nodal Office i.e. Bengaluru GPO, has also been put in place to address issues/queries, if any, and disseminate information among Circle SPOCS.

7) Detailed Standard Operating Procedures (SOP) and guidelines on this matter has already been circulated to the Circles via PLI Dte letter no. 29- 02/2023-LI dated 22-01-2024 and letter no. PLI-56/11/2023-PLI-DOP dated 08-04-2024.

8) Creative has also been designed by PLI Dte. highlighting the benefits & procedure for customers opting for NACH which is enclosed at ‘Annexure- III‘. Wide publicity amongst PLI/RPLI customers may be undertaken by the Circles and, if required, may get the above creative translated in the regional language.

9) This issues with the approval of competent authority.

(Pranav Kumar)

General Manager (PLI)

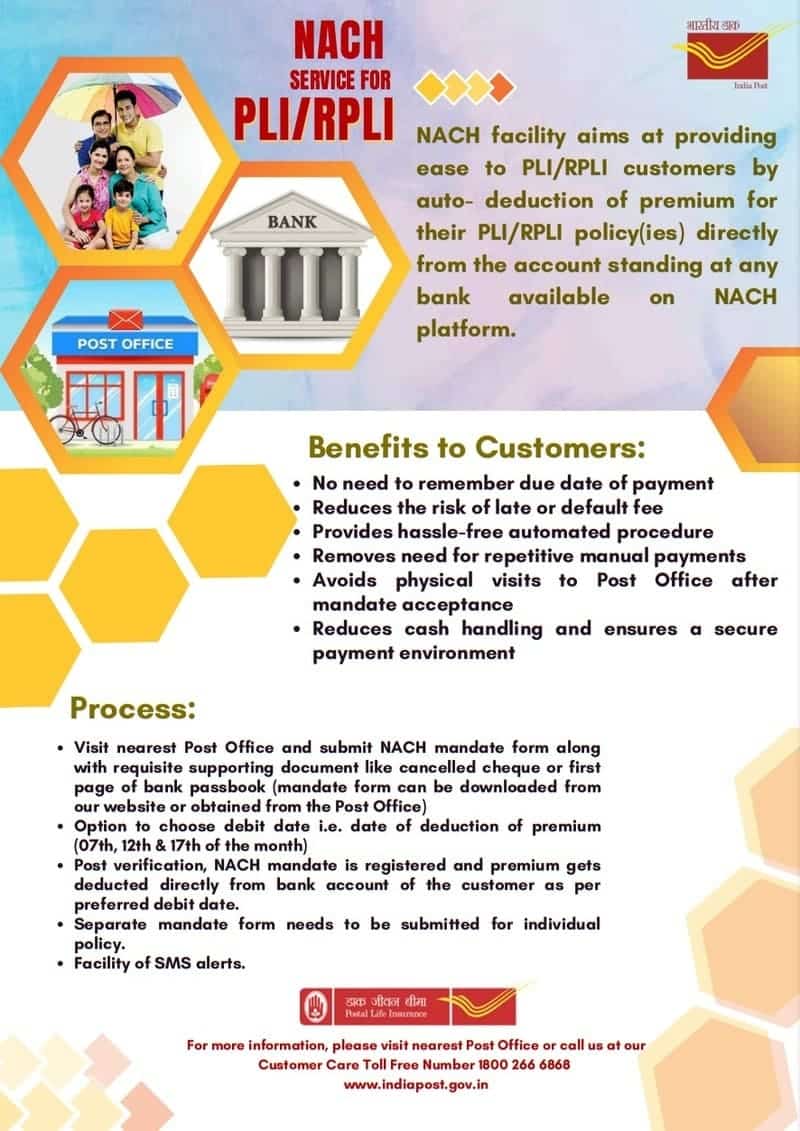

NACH service for PLI/RPLI

NACH facility aims at providing ease to PLI/RPLI customers by auto- deduction of premium for their PLI/RPLI policy(ies) directly from the account standing at any bank available on NACH platform.

POST OFFICE Benefits to Customers:

- No need to remember due date of payment

- Reduces the risk of late or default fee

- Provides hassle-free automated procedure

- Removes need for repetitive manual payments

- Avoids physical visits to Post Office after mandate acceptance

- Reduces cash handling and ensures a secure payment environment

Process:

- Visit nearest Post Office and submit NACH mandate form along with requisite supporting document like cancelled cheque or first page of bank passbook (mandate form can be downloaded from our website or obtained from the Post Office)

- Option to choose debit date i.e. date of deduction of premium (07th, 12th & 17th of the month)

- Post verification, NACH mandate is registered and premium gets deducted directly from bank account of the customer as per preferred debit date.

- Separate mandate form needs to be submitted for individual policy.

- Facility of SMS alerts.

COMMENTS