Standard Operating Procedure for handling / payment of accounts / certificates non-migrated to Finacle CBS: SB Order No. 18/2023 dated 13.09.2023

SB Order No. 18/2023

No. CBS-25/96/2021-FS-DOP

Government of India

Ministry of Communications

Department of Posts

(Financial Services Division)

Dak Bhawan, New Delhi – 110001

Dated: 13.09.2023

To

All Head of Circles / Regions

Subject: Standard Operating Procedure for handling / payment of accounts / certificates non-migrated to Finacle CBS – Reg.

Madam / Sir,

Various references have been received in this office regarding streamlining of the procedure for processing payments against POSB accounts and certificates which were left out during migration to Finacle CBS due to various reasons.

2. After CBS & CSI GL integration which was implemented in September 2019, ideally there should not have been any manual voucher posting in the F & A Module of CSI for accounting of POSB transactions. However, in order to account the POSB related transactions which are handled out of Finacle CBS, due to multiple reasons, voucher posting in F&A Module of CSI is being resorted to.

3. In order to streamline the handling and payment of such non migrated POSB accounts and certificates and also to restrict voucher posting in F&A module of CSI in respect of POSB receipts and payments, it has been decided that payment of any such non-migrated account(s) and certificate(s) shall be done in Finacle. This will result into appropriate accounting of all the POSB transactions in Finacle and will strengthen the checking mechanism. It will also lead to reduction of inconvenience to customers.

4. Accordingly, Standard Operating Procedure (SOP) to handle all such non-migrated POSB account(s) / certificate(s) in Finacle has been prepared and is attached for information, guidance and necessary action.

5. Circles should ensure that direct manual voucher postings in respect of POSB payment transactions in F&A module of CSI are not done by the post offices.

6. It is requested to circulate it to all concerned for information, guidance, and necessary actions.

7. This is issued with the approval of the Competent Authority

Yours faithfully

(T C VIJAYAN)

Assistant Director (SB-I)

Standard Operating Procedure for handling maturity / closure payment of non migrated POSB Accounts / Savings Certificates

Introduction

(i). POSB operations in post offices were earlier performed through Sanchay Post application, which was a stand-alone application. Migration of post offices from Sanchay post to CBS were commenced in end of the year 2013. At the time of migration of post offices ‘Checklist for Go Live’ was prepared by CEPT and shared with the Circles for readiness of offices for migration. As prescribed in para (II) (1) of ‘Check List for Go Live’, “Scheme-wise, account-wise balances agreement had to be completed before migration and balances in Finacle after migration were to be tallied with the agreed balances (certified). However, it is understood that due to various reasons, balances before migration and after migration were not tallied at the time of migration and some of the accounts / certificates were left out for migration into CBS. Till now, Payment of all such accounts / certificates are handled by·the Post Offices / Divisions manually out of system.

(ii). Various references have been received in Directorate from Circles for providing a standard operating procedure for handling/payment of such non-migrated accounts / certificates. The CBS and CSI systems were integrated in the month of September 2019 for automatic flow of transaction amount from CBS system to CSI system. But, whenever any non-migrated account / certificate is closed out of CBS system, it requires the manual correction in Long Book and the post offices need to enter such transactions in F&A Module of CSI, which creates differences in POSB receipts and payments available in CBS and CSI systems and such transactions require proper checking.

(iii). In order to overcome the issues mentioned in para (ii) above, it has been decided to make necessary provision in Finacle to enable the post offices to enter all POSB transactions in Finacle and to avoid manual entry of POSB transactions in F & A Module of CSL According, changes have been made in Finacle CBS system and the following Standard Operating Procedure is being prescribed for handling of maturity including post maturity and closure including premature closure payment of non migrated POSB accounts / Savings Certificates of the schemes mentioned in the table in para (2)(a) below.

2. Changes done in Finacle CBS

(i). Two Office accounts have been created (One for payment of Principal Amount and another one for payment of Interest Amount) for all POSB schemes mentioned below. Details of office accounts are listed below.

| SCHEME | ACCOUNT NAME | GL HEAD | Office accounts |

| PO Savings Account | NON MIGRATED SB PRINCIPAL | 30001 | SOLID+MXSBP |

| INTEREST ON NON MIGRATED SB ACCOUNT | 37001 | SOLID+MXSBI | |

| Recurring Deposit | NON MIGRATED RD PRINCIPAL | 30010 | SOL ID+MXRDP |

| INTEREST ON NON MIGRATED RD ACCOUNT | 37009 | SOL ID+MXRDI | |

| Monthly Income Account | NON MIGRATED MIS PRINCIPAL | 30016 | SOL ID+MXMIP |

| INTEREST ON NON MIGRATED MIS ACCOUNT | 37015 | SOL ID+MXMII | |

| Senior Citizen Savings Scheme | NON MIGRATED SCSS PRINCIPAL | 30020 | SOL ID+MXSCP |

| INTEREST ON NON MIGRATED SCSS ACCOUNT | 37017 | SOL ID+MXSCI | |

| Public Provident Fund | NON MIGRATED PPF PRINCIPAL | 33001 | SOL ID+MXPPP |

| INTEREST ON NON MIGRATED PPF ACCOUNT | 37026 | SOL ID+MXPPI | |

| Sukanya Samruddhi Account | NON MIGRATED SSA PRINCIPAL | 30042 | SOL ID+MXSSP |

| INTEREST ON NON MIGRATED SSA ACCOUNT | 37077 | SOL ID+MXSSI | |

| Time Deposit Account 1 Year | NON MIGRATED TD 1 YEAR PRINCIPAL | 30011 | SOL ID+MXTI1P |

| INTEREST ON NON MIGRATED TD 1 YEAR ACCOUNT | 37010 | SOL ID+MXTI1I | |

| Time Deposit Account 2 Years | NON MIGRATED TD 2 YEAR PRINCIPAL | 30012 | SOL ID+MXT2P |

| INTEREST ON NON MIGRATED TD 2 YEAR ACCOUNT | 37011 | SOL ID+MXT2I | |

| Time Deposit Account 3 Years | NON MIGRATED TD 3 YEAR PRINCIPAL | 30013 | SOL ID+MXT3P |

| INTEREST ON NON MIGRATED TD 3 YEAR ACCOUNT | 37012 | SOL ID+MXT3I | |

| Time DepositAccount 5 Years | NON MIGRATED TD 5 YEAR PRINCIPAL | 30014 | SOL ID+MXTSP |

| INTEREST ON NON MIGRATEDTD 5 YEAR ACCOUNT | 37013 | SOL ID+MXT5I | |

| Kisan Vikas Patra (Issued up to22.09.2014) | NON MIGRATED KVP (PRE-2014) PRINCIPAL | 32002 | SOL ID+MXKVP |

| INTEREST ON NON MIGRATEDKVP (PRE-2014) | 71002 | SOL ID+MXKVI | |

| Kisan Vikas Patra (Issued from 23.09.2014 to30.06.2016) | NON MIGRATED KVP (PRE-2016) PRINCIPAL | 32027 | SOL ID+MXKNP |

| INTEREST ON NON MIGRATED KVP (PRE-2016) | 71004 | SOL ID+MXKNI | |

| Kisan Vikas Patra (Issued after30.06.2016) | NON MIGRATED KVP16PRINCIPAL | 32027 | SOL ID+MXKPP |

| INTEREST ON NON MIGRATEDKVP16 | 71004 | SOL ID+MXKPI | |

| National Savings Certificates VIII Issue (Issued before01.07.2016) | NON MIGRATED NSC8(PRE-2016) PRINCIPAL | 32001 | SOL ID+MXNSP |

| INTEREST ON NON MIGRATEDNSC8 (PRE-2016) | 71001 | SOL ID+MXNSI | |

| National Savings Certificates VIII Issued (Issued after 30.06.2016) | NON MIGRATED NSC16PRINCIPAL | 32001 | SOL ID+MXNPP |

| INTEREST ON NON MIGRATEDNSC16 | 71001 | SOL ID+MXNPI | |

| National Savings Certificates IX Issue | NON MIGRATED NSC9 ISSUEPRINCIPAL | 32003 | SOL ID+MXNXP |

| INTEREST ON NON MIGRATEDNSC9 | 71003 | SOL ID+tMXNXI | |

| NSS-87 | NON MIGRATED NSS-87 PRINCIPAL | 30021 | SOL ID+MXN8P |

| INTEREST ON NON MIGRATED NSS-87 ACCOUNT | 70021 | SOL ID+MXN8I | |

| NSS-92 | NON MIGRATED NSS-92PRINCIPAL | 30022 | SOL ID+MXN9OP |

| INTEREST ON NON MIGRATEDNSS-92 ACCOUNT | 70020 | SOL ID+MXNOI |

(ii) The above office accounts are being created only in Head Post Offices (HO) SOLs and they are accessible by the official having the Supervisor role at HO.

(iii). Transactions done in these office accounts except KVP & NSC (VIII Issue & IX Issue) issued up to 30.06.2016, will be reflected in Long Book Detailed report and Long Book Consolidation report.

(iv). Transactions carried out in respect of certificates issued before 01.07.2016, will be reflected in the Discharge Journal of KVP and NSC.

Note: At present, there are 810 SOLs (Service Outlets) which are HOs as on date and if any HO is down-graded to SO, Divisional Office concerned should ensure that the above listed office accounts are disabled to prevent only such further transactions. Request for disabling the accounts may be sent to CEPT.

3. Operating Procedure

(i). The accounts / certificates which remained non-migrated to Finacle are to be closed only at Head Post Offices.

(ii). The transactions are to be done by 2 supervisors at HO concerned for accounts belonging to HO and the sub post offices in account with the HO.

(iii). When any account / certificate holder attends the post office for closure / maturity payment of his account / certificate and if the account / certificate is not found or is found as ‘Closed / Deleted’ in Finacle CBS, all the documents namely Account Closure Form / Claim Form, Passbook / Certificates (s) and other documents as prescribed in various procedures in POSB CBS Manual (Corrected up to 31.12.2021) should be accepted from the Depositor(s) / Claimant(s). A receipt in SB-28 or NC-11 shall be issued to the Depositor / Claimant for the passbook or certificates issued before 01.07.2016 respectively. The post office concerned shall follow the following procedure besides following all the procedures prescribed in POSB CBS Manual (Corrected up to 31.12.2021) in respect of closure of account / encashment of certificate / settlement of claims.

(A). Procedure at HO where the account / certificate stands

(1). (a). The designated PA should check and verify that the account / certificate is not closed or transferred out from the office records namely Account Opening Form (AOF) / SB-3 or Application for purchase of Savings Certificates, Manual Ledger or Ledger maintained in Sanchay Post, Specimen Signature (SS) Book and Long book(s) and ascertain that this account is live.

Note: – Designated PA/SPM concerned shall obtain fresh KYC documents from the account holder(s) and verify with the original. These KYC documents shall be attached with the case history sheet. Ifthe KYC documents of the depositor(s)/claimant(s) are already available with the post office, CIF ID of the depositor(s)/claimant(s) may be noted on the case history sheet and there should be no need to obtain fresh KYC documents if there is no change in the KYC details.

(b). In case of certificates (KVP/NSC) issued before 01.07.2016, Designated PA should check and verify that the certificate is not in the negative list or discharged or transferred out from the office records namely Application for purchase of Certificates, Register of Duplicate Certificate, discharge journals or the information available in CC BRIDGE application at HO.

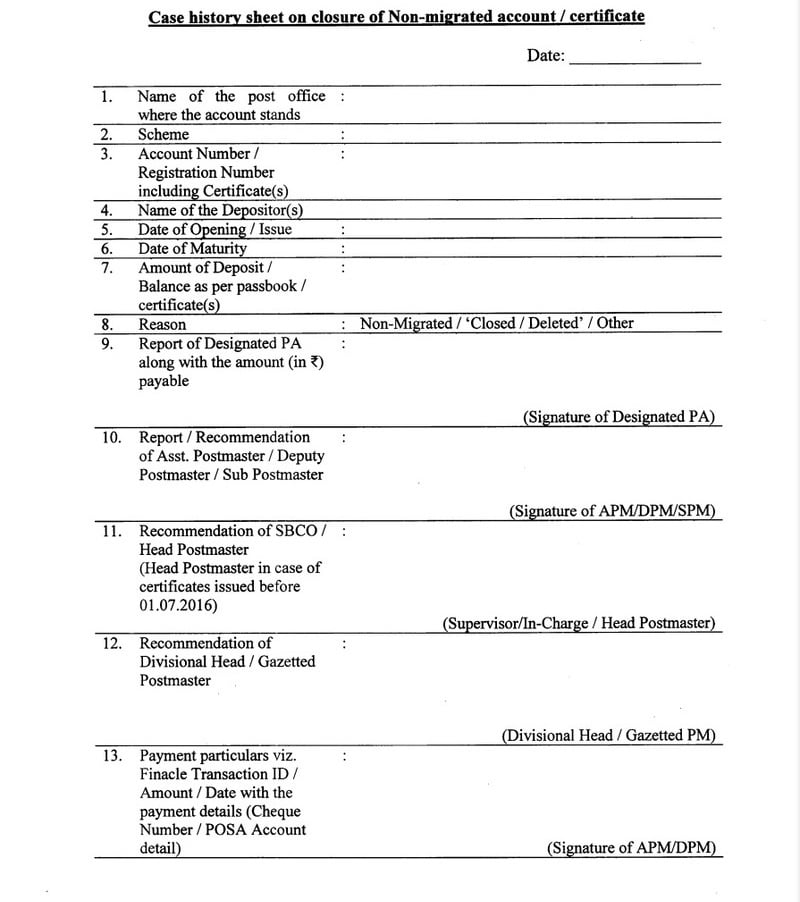

(c). The designated PA after verification of records, shall prepare the case history sheet on closure of non-migrated account / certificate in the format prescribed (proforma is attached) and will pass the remarks along with the amount payable under his / her signature. Then, designated PA will transfer the case along with the passbook / certificate, office record which has been referred and case history sheet to the Asst. Postmaster (APM) or Deputy Postmaster (DPM) with his / her remarks / report.

(2). (a). After verification by designated PA, APM/DPM shall verify the records to ensure the genuineness of the remarks of the designated PA. APM/DPM shall then make his/her report / recommendation in the case history sheet.

(b). APMIDPM shall forward the case with necessary report / recommendation, in the case history sheet as follows:-

| In case of Accounts / Certificates issued after 30.06.2016 | In case of Certificates issued before 01.07.2016 |

| Send the case to the Supervisor / In- Charge SBCO for checking the genuineness of the live status of the account I certificate. | Send the case to Head of the Class-I HO in case of Class – I HO or to the Head Postmaster for forwarding the case to Divisional Head, in case of other than Class -I HO. |

(3). Supervisor / In-Charge SBCO should thoroughly check the records in SBCO and HO and verify the details of the account/certificates and the amount payable along with the interest. Then, he/she should send the case for sanction of payment, as follows.

| In case of Gazetted HO | Other than Gazetted HO |

| Send to Gazetted Postmaster | Send to the Divisional Head |

(4). In case of Gazetted HO, the Chief Postmaster / Dy. Chief Postmaster / Senior Postmaster / Asst. Director will recommend the case after thorough examination and no · need to issue separate sanction order for payment.

(5). (a). Divisional Head in turn shall examine the cases received from Supervisor / In-Charge SBCO and shall make recommendation in the case history sheet. If the case is recommended, Divisional Head shall issue sanction order for payment of the account/ certificate.

(b). In case of certificates (KVP/NSC) issued before 01.07.2016, Divisional Head / Head of Class-I HO shall examine the cases received from Head Postmaster / APM / DPM and consult the register of transfer of certificates to ensure that the certificate(s) is not transferred out or paid in the office other than office of issue. If the original application for purchase of certificates is not available in the office of issue, NO-DISCHARGE Certificate may be obtained from Postal Account Office. After confirming the live status of the certificates and amount payable, the Divisional Head shall issue sanction order for payment.

(6). On receipt of the sanction order for payment from Divisional Head or Recommendation of Gazetted Postmaster, the payment should be processed in Finacle. All payments should be made either through Account Payee Cheque or through credit in Post Office Savings Account (POSA) of account holder(s)/claimant. In case POSA stands at other post office (SOL), then the payment above 50,000/-, shall be made only by Account Payee cheque. No cash payment should be made and there is no facility for credit in other bank savings account.

(7). Process in Finacle

(a). APM/DPM will initiate the payment in Finacle by using HTM menu by using office account of respective scheme as below: –

| Debit | Credit |

| (i). · Withdrawal from Principal Amount office account of respective scheme (Listed in Para(2)(i))

(ii). Withdrawal from Interest Amount office account of respective scheme (Listed in Para(2)(i)) |

PO Savings Account of Account holder or Postmaster’s cheque account (SOL ID+0340) |

(b). The following fields should be entered in HTM menu.

(i). In case of Certificates issued before 01.07.2016

| Field(s) | Detail to be entered |

| Ref.No | Date of Issue of NSC/KVP certificate |

| Remarks 1 | Registration Number of certificate |

| Transaction particular | Certificate Number & Division office sanction order number |

| Postmaster cheque in favour of | Name of account holder (both for SB credit and credit in SOLID+0340) |

Note: If above fields are not entered, Certificate number, date of issue, registration number details will not reflect in Discharge Journal.

(ii). In case of Accounts and Certificates issued after 30.06.2016

| Field(s) | Detail to be entered |

| Transaction particulars | Account Number & Division office sanction order number |

Note: If transaction particulars are not entered, same will not reflect in Long Book.

(c). APM/DPM shall note down the transaction particulars on account closure form and handover to another APM/DPM who has the Supervisory role in Finacle or the Postmaster for verification.

(7). After verification by another APM/DPM/Postmaster, the APM/DPM will note down the maturity amount in the case history sheet and pass the warrant of payment in account / certificate.

(8). The designated PA will maintain a register in the following format and make entries. Designated PA shall put up the register to APM/DPM also.

REGISTER OF PAYMENTS OF NON-MIGRATED ACCOUNTS / CERTIFICATES

| SI. No. | Date of Receipt of the case | Name of the Post Office where | account / certificate stands | Scheme | Account Number / Registration | Number / Certificate Number | Name of the Depositor(s) | Amount of Deposit in 2 | Total amount of Payment in | Sanction Order Detail | Date of payment | Cheque / POSA Account Detail | Initials of the Designated PA | Initials of the APM/DPM |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | (10) | (11) | (12) | (13) | (14) | (15) |

(9). After effecting payment, necessary remarks in office records mentioned in the previous paragraphs should be passed by the Designated PA and counter-signed by the APM/DPM.

(10). Account Closure Form and Discharged Certificates should be disposed as prescribed in relevant rules in POSB CBS Manual (Corrected up to 31.12.2021).

(11). All the case history sheets along with the copy of the sanction order for payment should be maintained in a separate guard file.

(12). The designated PA or APM or DPM shall hand over the cheque to the depositor(s)/claimant(s) in case of payment through cheque and the acknowledgment in token of having received the cheque by the depositor(s)/claimant(s), shall be obtained at the bottom of the case history sheet.

(B). Procedure at Sub Post Office where the account / certificate stands

(1). Designated PA should follow the procedure mentioned in para 3(iii)(A) above. Designated PA shall transfer the case to the Sub Postmaster (SPM).

(2). (a). After verification by Designated PA, SPM should also verify the records to ensure the genuineness of the remarks of the Designated PA. SPM will then make his report / recommendation in the case history sheet. Then, SPM shall forward the case to the Head Postmaster of Account HO.

(3). At, HO the procedure prescribed in para 3 (A) above shall be followed.

(4). After processing the payment in Finacle at HO, if the payment is through cheque, APM/DPM will arrange for issue of cheque and forward the cheque to the SPM. Further, APM/DPM shall forward a copy of the case history sheet to the SO concerned.

(5). On receipt of case history sheet, necessary remarks in office records mentioned inthe previous paragraphs should be passed by the Designated PA and counter-signed by the SPM.

(6). All the case history sheets along with the copy of the sanction order for payment should be maintained in a separate guard file.

(7). The designated PA or SPM shall hand over the cheque to the depositor(s)/claimant(s) in case of payment through cheque and the acknowledgment in token of having received the cheque by the depositor( s)/claimant( s), shall be obtained at the bottom of the case history sheet.

(C). Procedure at Post Office other than the office where the account / certificate stands

(1). On receipt of all the documents, Postmaster shall forward the case along with all documents to the post office where account / certificate stands by Service Insured Post on the day of its receipt.

(2). Postmaster where the account / certificate stands shall then follow the procedure as mentioned in para (A) or (B) above.

(3). Ifthe payment is preferred by cheque, Postmaster where the account / certificate stands shall forward the cheque to the office where the request for closure of account / certificate has been submitted by the Depositor / Claimant. Further, Postmaster shall forward a copy of the case history.sheet also.

(4). Postmaster at the office where the request has been received will hand over the cheque and make necessary entries in the register of payment of non-migrated accounts / certificates.

(5). The designated PA or APM or DPM or SPM shall hand over the cheque to the

. depositor(s)/claimant(s) in case of payment through cheque and the acknowledgment in token of having received the cheque by the depositor( s)/claimant( s), shall be obtained at the bottom of the case history sheet.

(D). Procedure at Branch Post Office

(1). The Branch Postmaster (BPM) shall follow the procedure prescribed in Rule 70 of POSB CBS Manual (Corrected up to 31.12.2021). Accordingly, BPM shall forward the account closure request to Account Office and Account Office in tum shall follow the procedure prescribed in the above paragraphs, if the account / certificate is not found in Finacle CBS.

4. Other Instructions

1. (a). In case of closure of MIS and SCSS accounts, if any deduction (due to premature closure of account) arises, the deduction amount should be credited in the following office accounts.

MIS Deduction … SOLID+0185

SCSS Deduction … SOLID+0188

(b). In case of closure of NSS-87 or SCSS accounts, if any deduction towards TDS arises, in such cases, the following office accounts should be credited.

TDS on NSS-87 … TDS on SCSS

SOLID+0041 … SOLID+0293

(c). Since the above office accounts are system-only accounts, a request may be sent to CEPT through email for allowing credit in the office account concerned through CPC, before processing in Finacle.

Note: The transactions stated in sub para (1) above will not appear in Long Book and TDS reports.

2. Non-migrated accounts/certificates or certificates / accounts marked as ‘Closed / Deleted’ should be closed by following the above procedure strictly. No manual voucher posting should be done directly in F & A Module of CSI in respect of POSB Transactions. No manual corrections/modifications are to be made in the Long Book/Discharge journal except in case of exceptional scenarios with approval of Divisional Head.

3. Payments should be settled within 10-15 days in the cases where the request for closure is accepted at the office where the account / certificate stands and within maximum of 30 days in case request is accepted in offices other than where the account / certificate stands.

4. The above said procedure may be followed in .the cases, where payment to the Depositor(s) / Claimant(s) arises due to wrong balance migration in CBS and due to the variation in the maturity amount due to wrong date of opening of account, wrong date of transaction etc in CBS.

5. Role of SBCO & PA handling Cash Certificate Returns at HO:

(a). SBCO of concerned HO shall verify the manual payment voucher entries available in long book detailed report with sanction order of Divisional Head / Orders of Head of Gazetted HO.

(b). PA handling Cash Certificate Returns at HO shall verify the details of the certificates discharged with the details in discharge journal and the sanction order of Divisional Head.

6. Role of Inspecting / Visiting Officers

(a). All the officers during the visits should ensure that the Post Offices follows the above prescribed procedure for closure of non-migrated accounts / certificates. During visits / inspections, it should be ensured that the payments are settled within time prescribed.

(b). During the annual inspection, the Inspecting Officers should check four cases and report observations in the Inspection Report.

5. Illustration for making entries in HTM

(a). For example, a KVP certificate of Dn 10,000/- (Serial No. 3CDxxxx77) issued on 03.12.2014 in the name of Jansibhen is closed on 31.07.2023 at Rajkot HO (SOL ID

– 36000100) and the payment is preferred on transfer to Post Office Savings Account Number (166099XXXX), · as per the above procedure which was sanctioned vide Sanction Memo No. SB-10/52/2023-Non-Mig dated 28.07.2023, the entries shall be as follows.

Principal Payment 10,000

Interest Payment 10,000 + 259 (PMI) = 10,259/-

| Debit | Credit | ||

| (i). A/C ID – 36000100MXKNP –

(ii).A/C ID – 36000100MXKNI – |

10,000/-

10,259/- |

A/C ID -166099XXXX – | 20,259/- |

| Field(s) | Detail to be entered |

| Ref.No | 03.12.2014 (Maximum 20 Characters) |

| Remarks 1 | 1566 (Maximum 30 Characters) |

| Transaction particulars | 3CDxxxx77 (SB-10/52/2023-Non Mig dated 28.07 .23) (Maximum 50 Characters) |

| Postmaster cheque in favour of | Jansibhen |

(b). For example, one MIS account with the deposit of 30,000/- (Account No. 12534) opened in the name of Rajesh is matured on 30.07.2016 and closed on 31.07.2023 at Madurai HO (SOL ID – 62500100) and the payment is preferred by cheque, as per the above procedure which was sanctioned vide Sanction Memo No. CBS-17/15/2023-Non-Migration dated 31.07.2023, the entries shall be as follows:-

Principal Payment … 30,000

Interest Payment … 8,400 (PMI)

| Debit | Credit | ||

| (i). A/C ID – 62500100MXMIP – | 30,000/- | AIC ID – 62500100340 – | 38,400/- |

| (ii).A/C ID – 625001OOMXMII – | 8,400/- | ||

| Field(s) | Detail to be entered |

| Transaction particulars | 12534 & CBS-17/15/2023-Non-Mig dated 31.07.2023 |

* Assume that all the monthly interest payments have already been paid to the depositor.

COMMENTS