Revision of Pension due to detection of wrong fixation of pay and Recovery of Government dues and provisions of Waiving off: Interpretation/ clarifications/ advice given by Department of Pension & PW to MSDE

Compilation of rule based interpretation/clarifications/advice given by Department of Pension & PW to Ministries/Departments during 01.01.2023 to 31.01.2023

II. Subject : Qualifying Service and counting of past service

III. Subject : Voluntary Retirement

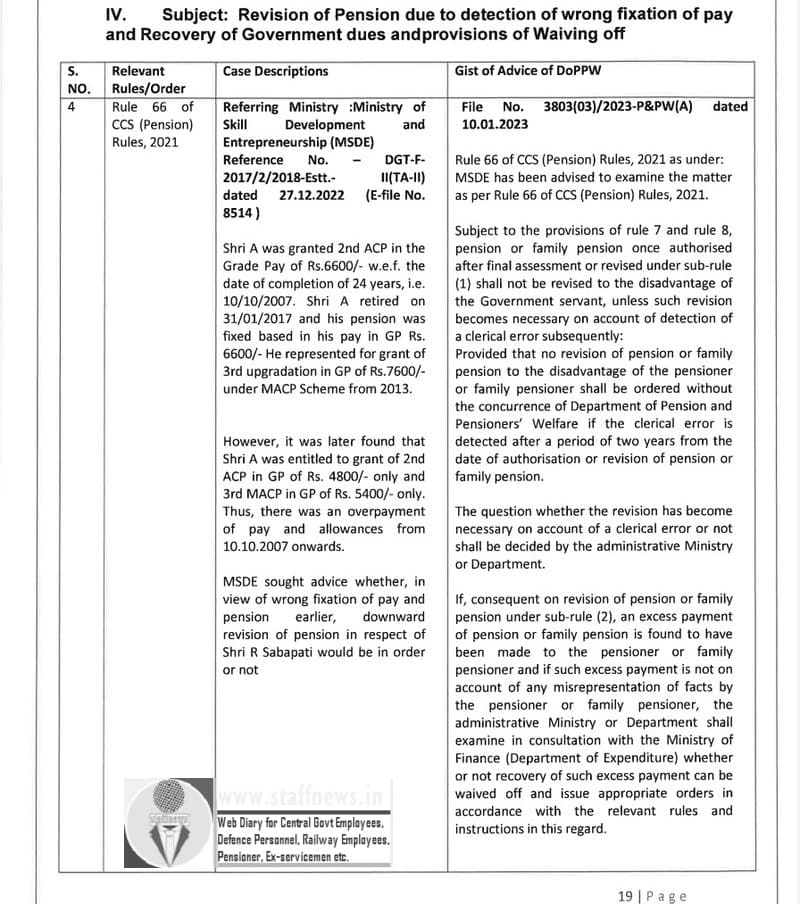

IV. Subject: Revision of Pension due to detection of wrong fixation of pay and Recovery of Government dues and provisions of Waiving off

Relevant Rules/Order:

Rule 66. of CCS (Pension) Rules, 2021

Case Description

Referring Ministry :Ministry of Skill Development and Entrepreneurship (MSDE) Reference No. — ODGT-F-2017/2/2018-Estt.- 11(TA-II) dated 27.12.2022 (E-file No. 8514)

Shri A was granted 2nd ACP in the Grade Pay of Rs.6600/- w.e.f. the date of completion of 24 years, i.e. 10/10/2007. Shri A retired on 31/01/2017 and his pension was fixed based in his pay in GP Rs. 6600/- He represented for grant of 3rd upgradation in GP of Rs.7600/- under MACP Scheme from 2013.

However, it was later found that Shri A was entitled to grant of 2nd ACP in GP of Rs. 4800/- only and 3rd MACP in GP of Rs. 5400/- only. Thus, there was an overpayment of pay and allowances from 10.10.2007 onwards.

MSDE sought advice whether, in view of wrong fixation of pay and pension earlier, downward revision of pension in respect of Shri R Sabapati would be in order or not

Gist of Advice of DoPPW

File No. 3803(03)/2023-P&PW(A) dated 10.01.2023

Rule 66 of CCS (Pension) Rules, 2021 as under:

MSDE has been advised to examine the matter as per Rule 66 of CCS (Pension) Rules, 2021.

Subject to the provisions of rule 7 and rule 8, pension or family pension once authorised after final assessment or revised under sub-rule (1) shall not be revised to the disadvantage of the Government servant, unless such revision becomes necessary on account of detection of a clerical error subsequently:

Provided that no revision of pension or family pension to the disadvantage of the pensioner or family pensioner shall be ordered without the concurrence of Department of Pension and Pensioners’ Welfare if the clerical error is detected after a period of two years from the date of authorisation or revision of pension or family pension.

The question whether the revision has become necessary on account of a clerical error or not shall be decided by the administrative Ministry or Department.

If, consequent on revision of pension or family pension under sub-rule (2), an excess payment of pension or family pension is found to have been made to the pensioner or family pensioner and if such excess payment is not on account of any misrepresentation of facts by the pensioner or family pensioner, the administrative Ministry or Department. shall examine in consultation with the Ministry of Finance (Department of Expenditure) whether or not recovery of such excess payment can be waived off and issue appropriate orders in accordance with the relevant rules and instructions in this regard.

COMMENTS

Okay sir,we are worked in Npcil under Development of Atomic energy.we are absorbed from DAE.TO NUCLEAR POWER CORPORATION LTD.Npcil formed as government enterprises on 17th September 1987.during that time DAE staffs are called as Deputationist.

After 7years the Deputationist received from Npcil offer for absorb as Npcil ABSORBEES on 17th September 1994.Some of deputation employees given the option form to Npcil and received from DAE service benefits,as follows.1) received prorata pension as per their service 4TH PAY COMMISSION 2) Received gratuity as per their services.

After that we are serving as Npcil ABSORBEES, upto till the retirement date.(ex: October 2009) during the Npcil service the mangement not considering the employees retirement benefits.

THR NPCIL FORMED 1987,TILL DATE (36 YEARS) LEFT.Mangment said that pension scheme not finalized.and draging more than 30years

And chited Npcil ABSORBEES and new recruits from those who are appointed as Npcil employees from 17th September 1987.

In this juncture now retired from Npcil employees and NPCIL ABSORBEES are getting old age more are less age ’80’.some of employees are expired due to old age and Sickness.

Hence I request from my own interest kindly Conway our humble request to Npcil and DAE management to finilesed Npcil pension scheme implementation as soon as possible.

To avoid Deluders.

Thanks and regards

Rajasekaran ANNAMALAI

Rtd from Npcil MAPS, Kalpakkam, chennai.600059.

Mob 9171083369.

Mail/rajavelu1949[at]gmail.com