Family Pension – Division of pensionary benefits like gratuity, GPF, CGEGIS, leave encashment, besides arrears of salary and dependent pension, between the widow and parents: Interpretation/ clarifications/ advice given by Department of Pension & PW to MHA

Compilation of rule based interpretation/clarifications/advice given by Department of Pension & PW to Ministries/Departments during 01.01.2023 to 31.01.2023

I. Subject: Invalid Pension

II. Subject : Qualifying Service and counting of past service

III. Subject : Voluntary Retirement

IV. Subject: Revision of Pension due to detection of wrong fixation of pay and Recovery of Government dues and provisions of Waiving off

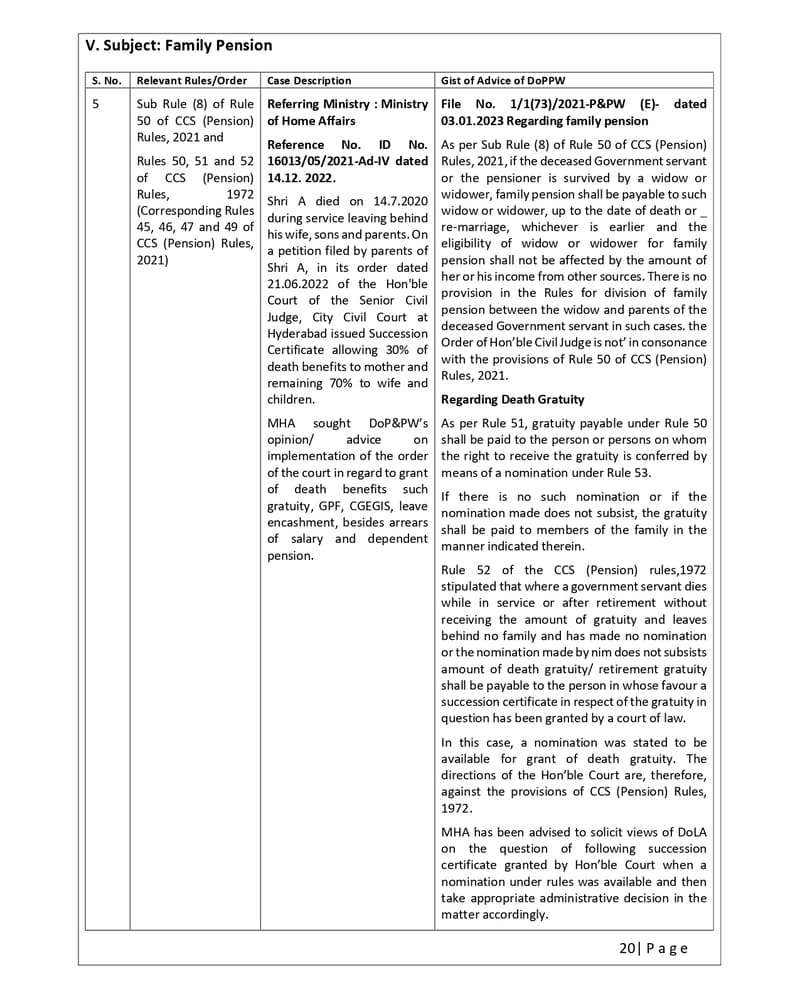

V. Subject: Family Pension (i)

Relevant Rules/Order:

Sub Rule (8) of Rule 50 of CCS (Pension) Rules, 2021 and

Rules 50, 51 and 52 of CCS (Pension) Rules, 1972 (Corresponding Rules 45, 46, 47 and 49 of CCS (Pension) Rules, 2021)

Case Description:

Referring Ministry : Ministry of Home Affairs

Reference No. ID No. 16013/05/2021-Ad-IV dated 14.12. 2022.

Shri A died on 14.7.2020 during service leaving behind his wife, sons and parents. On a petition filed by parents of Shri A, in its order dated 21.06.2022 of the Hon’ble Court of the Senior Civil Judge, City Civil Court at Hyderabad issued Succession Certificate allowing 30% of death benefits to mother and remaining 70% to wife and children.

MHA sought DoP&PW’s opinion/ advice on implementation of the order of the court in regard to grant of death benefits such gratuity, GPF, CGEGIS, leave encashment, besides arrears of salary and dependent pension.

Gist of Advice of DoPPW

File No. 1/1(73)/2021-P&PW (E)- dated 03.01.2023 Regarding family pension

As per Sub Rule (8) of Rule 50 of CCS (Pension) Rules, 2021, if the deceased Government servant or the pensioner is survived by a widow or widower, family pension shall be payable to such widow or widower, up to the date of death or re-marriage, whichever is earlier and the eligibility of widow or widower for family pension shall not be affected by the amount of her or his income from other sources. There is no provision in the Rules for division of family pension between the widow and parents of the deceased Government servant in such cases. the Order of Hon’ble Civil Judge is not’ in consonance with the provisions of Rule 50 of CCS (Pension) Rules, 2021.

Regarding Death Gratuity

As per Rule 51, gratuity payable under Rule 50 shall be paid to the person or persons on whom the right to receive the gratuity is conferred by means of a nomination under Rule 53.

If there is no such nomination or if the nomination made does not subsist, the gratuity shall be paid to members of the family in the manner indicated therein.

Rule 52 of the CCS (Pension) rules,1972 stipulated that where a government servant dies while in service or after retirement without receiving the amount of gratuity and leaves behind no family and has made no nomination or the nomination made by him does not subsists amount of death gratuity/ retirement gratuity shall be payable to the person in whose favour a succession certificate in respect of the gratuity in question has been granted by a court of law.

In this case, a nomination was stated to be available for grant of death gratuity. The directions of the Hon’ble Court are, therefore, against the provisions of CCS (Pension) Rules, 1972.

MHA has been advised to solicit views of DoLA on the question of following succession certificate granted by Hon’ble Court when a nomination under rules was available and then take appropriate administrative decision in the matter accordingly.

COMMENTS

Son is Disability before death of father having CDMO Proof is eligible for pension or not