Calculation of taxable interest relating to contribution in a provident fund w.e.f F.Y 2021-22: CGA, FinMin

No. TA-3-07001/7/2021-TA-III-Part(1)/cs8084/70

Ministry of Finance

Department of Expenditure

Office of Controller General of Accounts

Mahalekha Niyantrak Bhawan

E-Block, GPO Complex, INA,

New Delhi

Dated: 25.02.2022

Office Memorandum

Subject: Calculation of taxable interest relating to contribution in a provident fund, exceeding specified limit w.e.f F.Y 2021-22 -reg.

In pursuance of the notification issued by Department of Revenue (CBDT) dated 31st August, 2021, the interest relating to contribution in a provident fund or recognized provided fund, exceeding specified limit of Rs. five lakh in case of employee where GPF is applicable shall be part of taxable income of the subscriber w.ef. Financial year 2021-22 onwards.

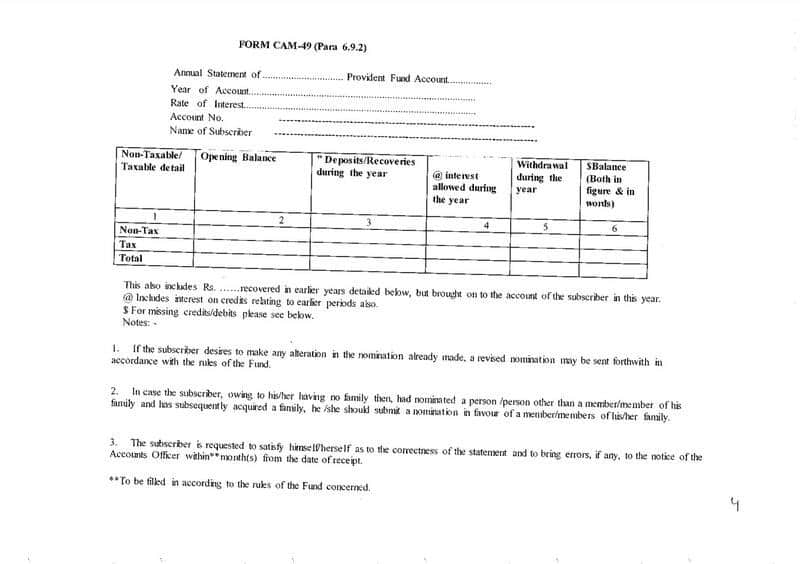

2. In view of the aforesaid decision, the respective GPF ledger folio maintained as per CAM-47 & the Annual GPF statement in form CAM-49 respectively with required changes to this effect needs to prepare by PAOs in respective nodal offices in the revised format enclosed with retrospective effect from 01.04.2021 onwards. The same are also made available to ITD for development in PFMS. The necessary amendments in chapter 6 of the Civil Account Manual (CAM) will be issued separately.

3. All the Pr.CCAs/CCAs/CAS(IC) in the Ministries/Departments are required to instruct nodal offices under their control to prepare GPF ledger & Annual statement to be issued to subscribers in the format enclosed.

Encl: As above.

(Ashish Kumar Singh)

Dy. Controller General of Accounts

To,

All Pr. CCAs/CCAs/CAs (IC) of the Ministries/ Deptts. concerned.

Copy to:

- PPS to CGA.

- PPS to Additional CGA/Jt.CGA

Source : Click here to view/download PDF

COMMENTS