Dearness Relief to Central Freedom Fighter Pensioners @ 26% w.e.f. 01.07.2021

F.No.45/08/2017-FF(P)

Government of India/Bharat Sarkar

Ministry of Home Affairs/Grih Mantralaya

Freedom Fighters & Rehabilitation Division

2nd Floor, NDCC-II Building,

Jai Singh Road, New Delhi – 110 001,

Dated, the 28th July, 2021.

To

The Pr. Chief Controller of Accounts(Home),

Ministry of Home Affairs,

MDCNS, New Delhi-110 OO1

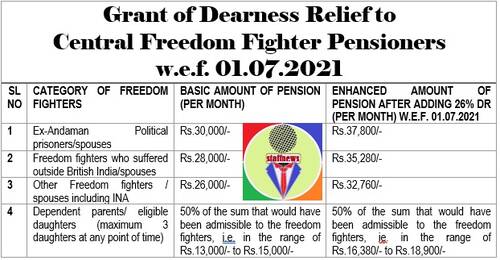

Subject: Grant of Dearness Relief to Central Freedom Fighter Pensioners w.e.f. 01.07.2021 – regarding

Sir,

I am directed to refer to this Ministry’s letter No.45/08/2017-FF(P) dated’5.11.2019 (copy enclosed) regarding 15% Dearness Relief to be paid to the freedom fighter pensioners w.e.f, 01.07.2019 and to say that recently Dearness Relief in respect of Central Government pensioners has been enhanced by 11% by the Government of India, Ministry of Personnel, Public Grievances & Pensions, Department of Pension & Pensioners’ Welfare, New Delhi’s O.M. No.42/07/2021- P&PW(D) dated 22.07.2021. Hence the Dearness Relief admissible to the Central Freedom Fighter/ spouse/ daughter pensioners shall be enhanced from the existing rate of 15% to 26% w.e.f, 01.07.2021. The revised amount of pension for various categories of pensioners after increase of 11% DR i.e. total 26% Dearness Relief will be as follows:

| SL NO |

CATEGORY OF FREEDOM FIGHTERS | BASIC AMOUNT OF PENSION (PER MONTH) | ENHANCED AMOUNT OF PENSION AFTER ADDING 26% DR (PER MONTH) W.E.F. 01.07.2021 |

| 1 | Ex-Andaman Political prisoners/spouses | Rs.30,000/- | Rs.37,800/- |

| 2 | Freedom fighters who suffered outside British India/spouses | Rs.28,000/- | Rs.35,280/- |

| 3 | Other Freedom fighters / spouses including INA | Rs.26,000/- | Rs.32,760/- |

| 4 | Dependent parents/ eligible daughters (maximum 3 daughters at any point of time) | 50% of the sum that would have been admissible to the freedom fighters, i.e. in the range of Rs.13,000/- to Rs.15,000/- | 50% of the sum that would have been admissible to the freedom fighters, ie. in the range of Rs.16,380/- to Rs.18,900/- |

2. Further, it is also clarified that as per Policy Guidelines dated 06.08.2014, TDS is not applicable in respect of Central Samman Pension.

3. This issues with the approval of Competent Authority.

Yours faithfully,

(Meenu Batra)

Director to the Government of India

Source: Click here to view/download the PDF (MHA) Click here to view/download the PDF

COMMENTS