Revision of interest rates for Small Savings Schemes – Rollback of Fin Min Order Dtd 31 March 2021

Centre rolls back interest rate cut on small savings schemes, calls it oversight: The Economic Times

Synopsis

A day earlier, in a blow to savers, the government had cut interest rates on small savings schemes, such as post office deposits and public provident fund, by up to 110 basis points. The new rates were to be effective today.

Order on small savings interest rate cuts withdrawn: FM Nirmala Sitharaman

Interest rates of small savings schemes of GoI shall continue to be at the rates which existed in the last quarter of 2020-2021, ie, rates that prevailed as of March 2021.

Orders issued by oversight shall be withdrawn. @FinMinIndia @PIB_India— Nirmala Sitharaman (@nsitharaman) April 1, 2021

The finance ministry has withdrawn its decision to slash interest rates on small savings schemes like the Public Provident Fund and the National Savings Certificate (NSC), terming it an “oversight”, on Thursday. The rates on such schemes will continue to remain as they were during the January-March quarter, reversing the cut on interest rates of up to 110 basis points or 1.1 percentage points announced a day earlier.

“Interest rates of small savings schemes of GoI shall continue to be at the rates which existed in the last quarter of 2020-2021, ie, rates that prevailed as of March 2021. Orders issued by oversight shall be withdrawn,” finance minister Nirmala Sitharaman said in a Twitter update.

This would make the fourth consecutive quarter the government has maintained the rates on such schemes. According to the latest decision, PPF and NSC will continue to offer interest of 7.1% and 6.8% for the coming three months. The now withdrawn order would have made the effective rates from April 1, 6.4% and 5.9% for the PPF and NSC, respectively. The government had last cut interest rates a year ago by a sharper 140 basis points for the first quarter of 2020-21. The Senior Citizen Savings Scheme will now earn 7.4% compared to 6.5% if the cuts had gone through, while five-year recurring deposits will offer 5.8% interest instead of 5.3%.

Similarly, one-year to three-year time deposits, will continue with 5.5% interest as against the previously envisaged reduced rates down to 4.4% interest. Savings deposits will offer 4% interest, as they did in the previous quarters, instead of the reduced 3.5%. Interest on five-year time deposits will be maintained at 6.7%, compared to the 5.8% mentioned in yesterday’s order, while the Kisan Vikas Patra will offer 6.9% interest against 6.2%. The Sukanya Samriddhi Account scheme will now bear an interest of 7.6% from April 1, above the reduced 6.9% that would have been.

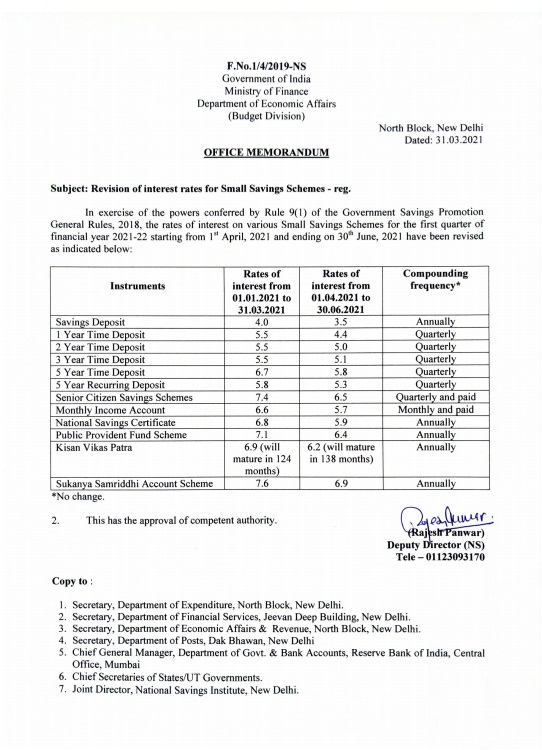

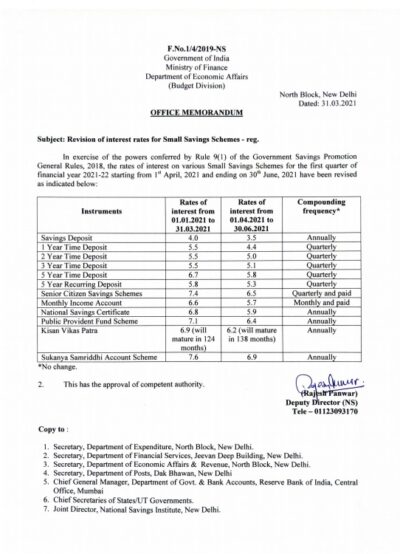

The issued order is:-

F.No.1/4/2019-NS

Government of India

Ministry of Finance

Department of Economic Affairs

(Budget Division)

North Block, New Delhi

Dated: 31.03.2021

OFFICE MEMORANDUM

Subject: Revision of interest rates for Small Savings Schemes – reg.

In exercise of the powers conferred by Rule 9(1) of the Government Savings Promotion General Rules, 2018, the rates of interest on various Small Savings Schemes for the first quarter of financial year 2021-22 starting from 1st April, 2021 and ending on 30th June, 2021 have been revised as indicated below:

| Instruments | Rates of interest from 01.01.2021 to 31.03.2021 |

Rates of interest from 01.04.2021 to 30.06.2021 |

Compounding frequency* |

| Savings Deposit | 4.0 | 3.5 | Annually |

| 1 Year Time Deposit | 5.5 | 4.4 | Quarterly |

| 2 Year Time Deposit | 5.5 | 5.0 | Quarterly |

| 3 Year Time Deposit | 5.5 | 5.1 | Quarterly |

| 5 Year Time Deposit | 6.7 | 5.8 | Quarterly |

| 5 Year Recurring Deposit | 5.8 | 5.3 | Quarterly |

| Senior Citizen Savings Schemes | 7.4 | 6.5 | Quarterly and paid |

| Monthly Income Account | 6.6 | 5.7 | Monthly and paid |

| National Savings Certificate | 6.8 | 5.9 | Annually |

| Public Provident Fund Scheme | 7.1 | 6.4 | Annually |

| Kisan Vikas Patra | 6.9 (will mature in 124 months) |

6.2 (will mature in 138 months) |

Annually |

| Sukanya Samriddhi Account Scheme | 7.6 | 6.9 | Annually |

*No change.

2. This has the approval of competent authority.

S/d,

(Rajesh Panwar)

Deputy Director (NS)

Tele – 01123093170

COMMENTS