Integration of e-Awas system with PFMS for automatic posting of Licence fee deducted from salary of the allottees of GPRA in Delhi

File No.1-94011/3/2020-ITD-CGA

Government of India

Ministry of Finance

O/o The Controller General of Accounts :

Mahalekha Niyantrak Bhawan,

IT Division, New Delhi.

NO. 1-9401 1/4/2020-ITD-CGA/ 397

Dated:09/ 09/2020

Office Memorandum

Subject: Integration of e-Awas system with PFMS for automatic posting of Licence fee deducted from salary of the allottees of GPRA in Delhi- reg.

The undersigned is directed to forward herewith a copy of Directorate of Estates, M/o Housing and Urban Affairs’ O.M. No. 18011/1/2020-Pol. dated 01/09/2020 on the subject cited above for information and further necessary action.

2. All Pr.CCAs/CCAs/CAs(IC) are hereby requested to please direct PAOs/DDOs under their control, to comply with the instructions contained in the above-mentioned O.M. of

Directorate of Estates dated 01/09/2020.

3. It is further requested to please direct all Delhi-based PAOs under their control that they may obtain a certificate from DDOs along with salary bills for the month of Sept. 2020 to the effect that the DDOs have updated AAN, Address, City code etc in EIS module and verified the same from DDO module of GPRA.

Encl: As Above.

(V. Muthu Kumar)

Assistant Controller of Accounts, ITD

To:-

(i) All Pr. CCAs/CCAs/CAS(IC)

(ii) Jt, CGA(Admin), O/o CGA

(iii) Director (INGAF)

(iv) Joint CGA (PFMS) ce

Copy to:

(i) Sr. AOGTD) for uploading on CGA’s official website.

No. 18011/1/2020-Pol. III

Government of India

Ministry of Housing and Urban Affairs

Directorate of Estates

Nirman Bhawan, New Delhi

Dated: the 01.09.2020.

OFFICE MEMORANDUM

Subject : Introduction of integration of e-Awas system with PFMS for automatic posting of Licence Fee deducted from salary of the allottees of GPRA in Delhi- reg.

Directorate of Estates has introduced integration of e-Awas system with PFMS for automatic posting of Licence Fee deducted from salary of the allottees of GPRA, to strengthen the Licence Fee deductions and to curb unauthorised occupation even after transfer to ineligible office, Superannuation etc.. This will do away with the work of posting of licence fee schedule of their office manually on monthly basis by DDOs of eligible office who are preparing salary through PFMS.

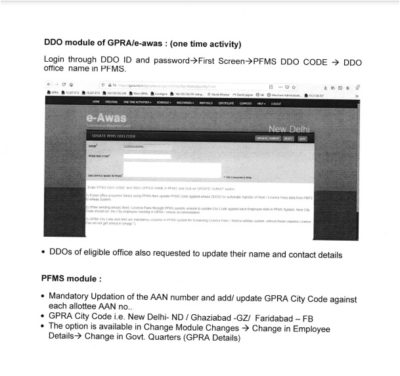

2. Drawing and Disbursing Officer (DDO) of office of the allottee has to login in DDO module of GPRA/e-Awas and fill up PFMS DDO code and office details as one time activity. DDO will have to complete the details of Allottee Account Number (AAN), residential address, rate of licence fee with water charges, if any and GRPA City Code i.e. New Delhi-ND/ Faridabad — FB/ Gaziabad- GZ in Government Accommodation module in PFMS for individual allottees. The information links in DDO module of GPRA/e-awas and PFMS Govt accommodation details as show in Annexure-A. It will be responsibility of DDOs/ allotttee to provide the correct details in the system for licence fee deduction.

3. Once the automatic deduction of licence fee of allottees start processing, the DDOs of concerned offices can view the deduction of licence fee deduction for allottees in their DDO module of GPRA/e-awas. DDOs of office of allottees are also requested to upto date the posting of licence fee schedule of their offices before Starting automatic deduction of licence fee. The option of posting of monthly licence fee through DDO module of GPRA/e-awas/e-awas will be discontinued.

4. The licence fee will only be accepted through automatic posting through PFMS system w.e.f. 1st September 2020, wherever salaries are distributed through PFMS. DDOs of all Ministries/Departments are requested to log in and fill the required details in the DDo module of e-Awas by 15th September,2o2o.

(M.C. Sonowal)

Deputy Director of Estates (Policy)

Tel.23062505

To,

1. All Ministries/ Department of Govt. of lndia

2. Deputy Director (Computer Cell), Dte. Of Estates, NirmnarBhawan, New Delhi

3. Tech. Director (NlC), Dte. Of Estates, NirmnaBhawan, New Delhi

COMMENTS