Settlement of PLI/RPLI death claim cases: Standard Operating Procedure (SOP) issued by Department of Posts dated 18.08.2020

DIRECTORATE OF POSTAL LIFE INSURANCE

Department of Posts,

Ministry of Communications,

Government of India

Chanakyapuri Post Office Complex, New Delhi-1 10021

No 25-04/SOP/2020-LI

Dated 18.08.02020

Sub: Standard Operating Procedure (SOP) for settlement of PLI/RPLI death claim cases.

As per the norms laid down in Citizen Charter, the death claims of PLI/RPLI are to be settled within 30 days in respect of normal claim cases and 90 days in respect of those cases involving investigation.

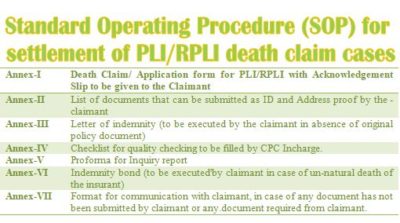

2. In this connection, kindly find enclosed a Standard Operating Procedure (SOP) for settlement of PLI/RPLI death claim cases along with following annexures:-

| Annex-I | Death Claim/ Application form for PLI/RPLI with Acknowledgement Slip to be given to the Claimant |

| Annex-II | List of documents that can be submitted as ID and Address proof by the – claimant |

| Annex-III | Letter of indemnity (to be executed by the claimant in absence of original policy document) |

| Annex-IV | Checklist for quality checking to be filled by CPC Incharge. |

| Annex-V | Proforma for Inquiry report |

| Annex-VI | Indemnity bond (to be executed’by claimant in case of un-natural death of the insurant) |

| Annex-VII | Format for communication with claimant, in case of any document has not been submitted by claimant or any.document required from claimant. |

3. This SOP may be widely disseminated across the’ Circles and all may be strictly instructed to follow the procedure laid down in SOP adhering to the timelines given in the SOP for carrying out different activities at various levels.

4, Necessary amendment required in Rule.39 of POLI Rules, 2011 in consequence of these instructions will be notified accordingly.

5. This issues with the approval competent authority.

(Hariom Sharma)

Deputy Divisional Manager-II

PLI DIRECTORATE NO. 25-04/SOP/2020-LI DATED 18.08.2020

Handling of PLI/RPLI Death Claim Cases

Standard Operating Procedure

Background

Life insurance is a vital protection coverage for the loved ones in the event of one’s untimely death. The most basic and important reason behind buying a Life Insurance Policy is to arrange for financial assistance for the loved ones. Bringing a new person under the coverage of Postal Life Insurance/ Rural Postal Life Insurance (PLI/RPLI) is just the beginning of our relationship with our customer. We need to be vigilant to ensure that the main aim of our customers for buying a PLI/RPLI policy is not lost sight of. Timely settlement of Death claim/ Maturity claim is one of the most important functions of any Insurance Business. PLI/RPLI is operating in significantly one of the most competitive insurance markets. As per the IRDAI’s (Insurance Regulatory and Development Authority of India) Annual Report, average number of days taken by major insurance players in settling the death claim is about 30 days. A commitment has also been made by the Department in its Citizen Charter, that death claim of PLI/RPLI would be settled within 30 days in respect of normal claim cases and 90 days in respect of cases involving Inquiry. However, it is observed that against the norm of 30 days, all India average number of days taken to settle a PLI death claim is 62 days. Similarly, the average number of days taken to settle a RPLI death claim is 64 days. In respect of death claim cases requiring inquiry, average number of days taken by majority of Circles to settle/reject the case is more than the prescribed 90 days. This has a negative effect on our business and consequently leads to downward business trends in PLI/RPLI business apart from having an adverse effect on our goodwill.

In order to expedite the process of settlement of death claim cases, it is decided that this specially designed Standard Operating Procedure (SOP) shall, henceforth, be followed by all concerned to facilitate our customers.

1. The period elapsed between date of acceptance of proposal and cause of death of the Insurant plays an important role in deciding the procedure for handling of the death claim cases. Death Claim cases of PLI/RPLI may be classified into following types:

1.1 Based on the period of the Insurance Policy: –

- Claims where Death occurs after completion of 3 years from the date of acceptance of proposal or date of revival of policy, whichever is later.

- Claims where death occurs before completion of 3 years from the date of acceptance of proposal or date of revival of policy, whichever is later.

1.2 Based on cause of Death of the Insurant

- Natural Death – All deaths except death by suicide, murder or accident.

- Un-natural Death – Death due to suicide, murder or accident.

2. Manner of Submission of Claim by Claimant

The Claim Application (Annex-I) along with the required documents can be submitted by the Claimant (Nominee(s) or Legal Heir(s) as the case may be) at any Post Office including Branch Post Offices or CPC.

3. Action at Claim receiving Office

3.1 The Claimant shall submit Claim Application (Annex-I) along with required documents at any Post Office or CPC. The BPM/SPM/Postmaster or CPC in-charge of the Office concerned, where the claim is submitted, shall scrutinise the Claim Application to ensure that the requisite details are duly filled in and the relevant documents are attached and the same is mentioned thereon. If required, the official concerned shall help the Claimant in filling up the Claim Application correctly by guiding and explaining the requirements.

3.2 All the ORIGINAL documents are required to be produced while submitting the Claim Application and the same will be returned to the Claimant after having been compared with the copies thereof being submitted along with the Claim Application. However, original Policy Bond shall be retained/submitted along with the Claim Application. Letter of Indemnity (Annex-III) and Indemnity Bond (Annex-VI) shall also be submitted in original.

3.3 The following documents are required to be submitted along with the Claim Application:

| Sl. | List of Documents | Unnatural Death | Natural Death |

| 1 | Claim Application form | Yes | Yes |

| 2 | Original Policy Bond or Letter of Indemnity* (Format at Annex- III) | Yes | Yes |

| 3 | Self-Attested copy of Death Certificate (issued by Local Administration/Registrar of local board/village panchayat/Medical Practitioner or Certificate from Doctor who last attended the Insurant clearly mentioning reason of death) |

Yes |

Yes |

| 4 | Self-Attested copy of ID and Address proof of the Claimant (list of Documents acceptable as ID and Address proof is given in Annex-II) with the details of mobile number, e-Mail ID and his/her relationship with insurant |

Yes |

Yes |

| 5 | Cancelled Cheque for Bank mandate | Yes | Yes |

| 6 | Self-Attested copy of Legal Documents in support of his/her claim (Letter of Administration or Succession Certificate or Probate of Will), if nomination is not available) |

Yes |

Yes |

| 7 | Self-Attested copy of FIR | Yes | No |

| 8 | Self-Attested copy of Post-mortem report | Yes | No |

| 9 | Indemnity Bond* (Annex-VI) from Claimant | Yes | No |

| 10 | Document of Credit ** (if Pay Policy) | Yes | Yes |

| 11 | Premium Receipt Book *** (If Cash Policy) | Yes | Yes |

Note (*): Letter of Indemnity and Indemnity Bond, if any, must be Notarised from Public Notary on non-judicial stamp paper of value as prescribed in the State concerned.

Note (**) In case, premia payment is not updated in Pay Policies, a certificate from the Employer about deduction of premia and details/copy of premia schedule sent to India Post.

Note (***) In case, premia payment is not updated in Cash Policies, Premium receipt Book is mandatory for updation of Premia paid by Insurant on McCamish Software.

3.4 Wherever a self-attested copy of a document is submitted, the official accepting the same will compare it with the ORIGINALS and shall put his/her signature in token of having verified the copies with their originals.

3.5 The Office concerned will give an Acknowledgement (Part of Annex-I) for receipt of Claim Application to the Claimant.

3.6 Action at Branch Post Office (BO)– In case the Claim Application is received at BO, the BPM shall forward the Claim Application along with all the enclosures to its Account Office through Account Bag on the same day duly entered in their Daily Account/Daily Transaction report (DTR) after Indexing it in the RICT device, if possible.

3.7 Action at Sub Post Office (SO)– The Claim Application may be received at SO either directly or through BO. In both the cases, Indexing of the Claim Application shall be done at the SO itself (in cases Indexing not already done at BO for Application received at BO). After Indexing, the Claim Application shall be sent to the HO (CPC) concerned (with which the office is mapped with) on the same day through Account Bag duly entered in their Daily Account/Daily Transaction report (DTR).

3.8 Action at HO (CPC) – The Claim Application may be received at CPC either directly or through SO/BO. Indexing of the Claim Application shall be done before further processing (if Indexing not already done at SO/BO for Application received at SO/BO).

4. All Post Offices shall maintain a Register in the following format for the Claim Application received-

Name of the Office ____________

| Sl.

No. |

Date of Receipt | Name of Insurant | Policy Number | Sum Assured | Type of Policy | Service Request No. | Date of

dispatch to CPC |

Sign of

Official |

5. Processing of Claim Application

5.1 Action at CPC on receipt of claim cases

All the Claim Applications so received shall be entered in a Register maintained for this purpose in the following format:

| Sl | Service Request No. and date | Date of Receipt in CPC | Received from (Claimant

/name of office) |

Name of Insurant | Policy Number | Sum Assured | Type of Policy | Inquiry Required (Yes/No) | Sanction Amount and Date | Mode & Date of payment | Remarks | Sign of Official |

5.1.1 In case any required document is found not submitted, a written communication (Annex-VII) will be sent immediately by the CPC through Registered AD to the Claimant requesting to submit the requisite document(s) within 15 days.

5.1.2 In case of non-receipt of requisite document(s) within 15 days, a reminder shall be sent to the Claimant through Registered AD intimating that if required document(s) are not submitted within next 7 days, the case will be closed.

5.1.3 In case required document(s) are still not received after expiry of the extended period, the claim application along with other document(s), so submitted, shall be returned to the Claimant through Registered AD. Remarks to this effect shall be made in the Register maintained for this purpose (as prescribed in para 5.1 above).

5.1.4 The CPC shall check to ensure that entries of all the documents are made correctly while Indexing, Scanning and Data Entry of the death claim application along with all the enclosed documents.

5.1.5 Once the Claim Application is found to be complete in all respects including receipt of required documents, the CPC in-charge will check the category of claim i.e. whether claims pertain to category (i) where Death occurred after completion of 3 years from the date of acceptance of proposal or date of revival of policy, whichever is later or (ii) where death occurred before completion of 3 years from the date of acceptance of proposal or date of revival of policy, whichever is later, and shall take time bound action accordingly.

5.2 Death occurs beyond 3 years from the date of acceptance of proposal or date of revival of policy, whichever is later

5.2.1 As per the Insurance market regulator in India (IRDAI) the insurer has only 3 years window for calling a policy in question on the ground of misrepresentation or suppression of a material fact not amounting to fraud, from the date of issuance of Policy or date of commencement of risk or date of revival of policy or date of rider of the policy, whichever is later. It is regardless of whether claim has arisen or not and when it is intimated. Once this period of 3 years is over, the policy cannot be called in question. Accordingly, if a death claim in respect of policy arises after 3 years from the date of acceptance of proposal or date of revival of policy, whichever is later, there is no need of Inquiry.

5.2.2 Therefore, all PLI/RPLI death claims which are presented after 3 years from the date of acceptance of proposals or date of revival of policy, whichever is later, there is no need for carrying out any Inquiry in the matter.

5.2.3 CPC will send all the documents including the death claim application duly signed on checklist (Annex IV) with full name (of CPC incharge), Designation, and date to Approving Authority, under whose jurisdiction the CPC lies, for approval. The case shall also be submitted in McCamish, simultaneously.

5.3 Death occurs within 3 years from the date of acceptance of proposal or date of revival of policy, whichever is later

5.3.1 Where death of insurant occurs within 3 years from the date of acceptance of proposal or date of revival of policy, whichever is later, the CPC shall submit all the documents including the death claim application duly signed on checklist (Annex-IV) with full name (of CPC incharge), designation and date to Approving Authority, under whose jurisdiction the CPC lies, for death claim inquiry and The case shall also be submitted in McCamish, simultaneously.

6. Action by Approving Authority

6.1 In case Claim Application does not require Inquiry: –

6.1.1 The Approving Authority shall go through the Claim Application and shall approve/reject the case after scrutiny by making appropriate remarks on checklist (Annex IV). A copy of Annex IV is retained by office of the Approving Authority. Original checklist and all the enclosed documents are returned to CPC concerned for further action.

6.2 In case Claim Application requires Inquiry: –

6.2.1 The Approving Authority shall send the case to the Inquiry Officer concerned if the place of Inquiry (which would be primarily decided based on the place of death) lies within jurisdiction of the Approving Authority.

6.2.2 In case the place of Inquiry is beyond jurisdiction of the Approving Authority, the case shall be sent to the Division concerned (under whose jurisdiction place of inquiry lies) for Inquiry through McCamish.

6.2.3 On receipt of Inquiry report from the Inquiry Officer, the Approving Authority concerned shall either approve or reject the case.

6.2.4 Approving Authority shall maintain details of Inquiry cases in the following format:

| Sl. | Service Request No. and date | Date of

receipt in O/o Approving Authority |

Policy No. | Date of sendin g case for Inquiry | Name &

designation of Inquiry Officer (in case place of Inquiry lies within jurisdiction of Approving Authority) |

Name of the Division to which case sent for Inquiry (in case place of Inquiry lies outside the

jurisdiction of Approving Authority) |

Date of receipt of Inquiry Report | Date of Approval/ Rejection of the

Claim |

6.2.5 In case of rejection, the reasons for rejection shall be stated in writing.

6.2.6 The Approving Authority concerned should ensure returning the checklist (Annexure – IV) to the CPC duly signed along with his/her name, designation and date on the checklist, after approval/rejection for further processing.

7. Manner of Inquiry

7.1 The Inquiry Officer shall be nominated by the Approving Authority or the Divisional Head, as the case may be.

7.2 Any Inspector Posts/Assistant Superintendent of Posts/PRI (P)/Marketing Executive etc. may be nominated as Inquiry Officer. He/she may obtain assistance of any postal official for the purpose, if considered necessary.

7.3 While inquiring into the death claim, the Inquiry officer must check, if the insured has died due to any disease and if so, whether the insurant was aware of that disease prior to taking the policy.

7.4 Inquiry officer should clearly mention this fact along with supporting document(s) in his report that insurant was aware of the disease prior to taking the policy and insurant has suppressed the material fact about the disease at the time of taking the policy. In case, no such supporting document is available with investigating officer in support of his claim, he should clearly mention it in his report that no document(s) to this effect are available.

7.5 In case of unnatural death, the Inquiry officer shall inquire with the Hospital/Doctor and Police Station concerned to verify the genuineness of the Post-mortem report, FIR etc. Additionally, he/she shall inquire about any update/amendment in the Post-mortem/FIR and shall obtain a copy of such update/amendment, if any.

7.6 Inquiry officer is required to submit his/her report (Annexure V) complete in all respect within 21 days (15 days for Inquiry into the case and 6 days for preparation and submission of report).

8. Action at CPC on receipt of Approval/Rejection of the Claim from Approving Authority

8.1 In case of Approval

- Shall generate Sanction Letter

- Shall send a copy of Sanction Letter to Postmaster for crediting the sanctioned amount into the Account details submitted by the Claimant in the Claim Application. One copy of Sanction Letter shall be sent to the Claimant through Registered AD.

- In case of account details not given by the Claimant or any technical problem arising due to incomplete/wrong information about the account, a Crossed Cheque shall be drawn by the Postmaster. The Crossed Cheque along with the Sanction Letter shall be sent to the claimant through Registered AD.

8.2 In case of Rejection

- If claim is rejected, CPC shall send Rejection Letter (generated through McCamish) to the Claimant through Registered AD by the next working day giving him/her the reasons of rejection.

9. Time limit prescribed (in working days)

9.1 In case No Inquiry is required

| Sl. | Activity | Time Limit (Max.) |

| i. | Receipt and forwarding of Claim Application by BO | 1 day |

| ii. | Receipt, Indexing and forwarding of Claim Application by SO | 1 day |

| iii. | Indexing and Scanning (ECMS) in CPC | 2 days |

| iv. | Data Entry in CPC | 1 day |

| v. | Quality Checking in CPC | 1 day |

| vi. | Approval | 3 days |

| vii. | Sanction Letter generation in CPC | 1 day |

| viii. | Sanction amount transfer through Bank mandate by Postmaster | 2 day |

| ix. | Drawing Cheque of the Sanction amount by Postmaster, in case account details not provided | 1 day |

| x. | Dispatch of Sanction Letter with/without Crossed Cheque | 1 day |

| Total No. of Days | 14 days | |

9.2 In case Inquiry is required

| Sl. | Activity | Time Limit (Max.) |

| i. | Receipt and forwarding of Claim Application by BO | 1 day |

| ii. | Receipt, Indexing and forwarding of Claim Application by SO | 1 day |

| iii. | Indexing and Scanning (ECMS) in CPC | 2 days |

| iv. | Data Entry in CPC | 1 day |

| v. | Quality Checking in CPC | 1 day |

| vi. | Claim Inquiry | 21 days |

| vii. | Approval | 15 days |

| viii. | Sanction/Rejection Letter generation in CPC | 1 day |

| ix. | Sanction amount transfer through Bank mandate by Postmaster | 2 days |

| x. | Drawing of Cheque for the Sanction amount by Postmaster, in case account details not provided | 1 day |

| xi. | Dispatch of Sanction Letter with/without Crossed Cheque | 1 day |

| Total No. of Days | 47 days | |

Read more: Click here to view/download the PDF

COMMENTS

నాకు ఒక జాతీయ జెండా కావలి iam Vivek S/o Krishna H.NO:12-15-212 near by HDFC Bank 5street manikeshwari Nagar ou campus pincode:500007 Telangana P:No. 8297898626