Revised Consolidated Guidelines for Grant of Ex-gratia Finance Assistance from Customs and Central Excise Welfare fund

REVISED CONSOLIDATED GUIDELINES FOR GRANT OF EX-GRATIA FINANCIAL ASSISTANCE TO DEPARTMENTAL OFFICIALS/STAFF FROM THE CUSTOMS AND CENTRAL EXCISE WELFARE FUND IN CASE OF DEATH/PERMANENT DISABILITY OR INJURIES SUSTAINED IN PERFORMANCE OF DUTIES

A) Death attributable to performance of enforcement functions under the Customs/GST/NDPS Act or any other Act of the Government of India/State(s), including anti-smuggling, anti-evasion and anti narcotics duties, etc.: In case of death attributable to performance of enforcement functions under the Customs/GST/NDPS Act or any other Act of the Government of India/State(s), including anti-smuggling, anti-evasion and anti-narcotics duties, etc., ex-gratia financial assistance amounting to Rs.25 lakhs shall be paid to the survivors of the deceased departmental officials/ staff. An illustrative list of cases falling in this category is hereunder:

1) Death of departmental officials/ staff during the search and seizure operations against tax evaders, smugglers, drug traffickers, economic offenders etc. attributable to attacks during search and seizure operations including attacks by parties whose premises are searched, tax evaders, law offenders etc.

2) Death resulting from acts of violence or assault by economic offenders, smugglers, drug traffickers etc. committed against departmental officials/ staff:

(i) With an intention of obstructing or preventing the official/ staff from performing his/her official duties; or

(ii) Due to any act done or attempted to be done by the official/ staff in the lawful discharge of his/her duties; or

(iii) Attributable to the official position held by the official/ staff.

B) Death attributable to accidents or incidents of violence by terrorists, anti-social elements, etc. while on duty: In case of death of departmental officials/ staff attributable to accidents or incidents of violence by terrorists, anti-social elements, etc. occurring while on duty, ex-gratia financial assistance amounting to Rs.15 lakhs shall be paid to the survivors of the deceased official/ staff. An illustrative list of cases falling in this category is hereunder:

1) Death of officials/ staff as a result of accidents including the road accidents while proceeding to or returning from anti-smuggling/anti-evasion and anti-narcotics duties, or conduct of search and seizure operations against tax evaders, economic offenders, smugglers and drug traffickers, etc.

2) Death of officers/ staff as a result of an accident while travelling in a public, private or official vehicle or otherwise of an erstwhile Group ‘D’ employee, Dispatch Rider, Messenger, Notice Server, etc. deputed to distribute dak, deliver notices, etc. or of Departmental officials/ staff while performing field duties.

3) Death in an air crash/train accident/ accident to ship, river steamers etc. resulting in the death of the officials/ staff undertaking official journeys by these modes of travel while on duty.

4) Death of officials/ staff occurring due to fire accidents while he/she is on duty.

5) Departmental officials/ staff killed while on duty in incidents of terrorist violence in Jammu & Kashmir, North Eastern Region, Punjab, etc. other than in actual enforcement operations.

6) Death of departmental officials/ staff while on duty as an unwitting/unintended victims of bomb-blast s in public places, vehicles, indiscriminate shooting incidents occurring in public, etc. all of which are often resorted to by terrori sts, anti-social elements etc.

C) Death Attributable to a pandemic like corona virus disease (COVID-19) contracted while on duty:

1) In case of death of officials/staff attributable to infection of coronavirus contracted while on duty, an ex-gratia financial assistance amounting to Rs.7 lakhs shall be paid to the survivors of the deceased official/staff.

2) The primary cause of death of staff/official must be coronavirus disease (COVID-19). (Refer Point 3/ 3(a) & 7 of checklist) supported by a medical certificate.

3) A certificate given by the Commissioner of the Commissionerate or the ADO of the Directorate, countersigned by the Pr. Chief Commissioner or the Pr. Director General/Director General under whom the officer was working at the time of death would be accepted as proof of the officer /staff to having contracted the disease of corona virus (COVID-19) while on duty.

D) Death not covered under (A), (B) or (C) above: In case of death of a departmental official/ staff which is not covered under (A), (B) or (C) above, ex-gratia financial assistance amounting to Rs.5 lakhs shall be paid to the survivors of the deceased official/ staff. Such cases include natural death, death of officials/ staff in accidents or incidents of violence by terrorists, anti-social elements, etc., otherwise than on duty.

E) Permanent injury or disability of departmental officials/ staff during the performance of his/her official duties: Ex-gratia financial assistance amounting to Rs.15 lakhs shall be paid to officials/ staff who sustain permanent injury or disability during the performance of their official duties.

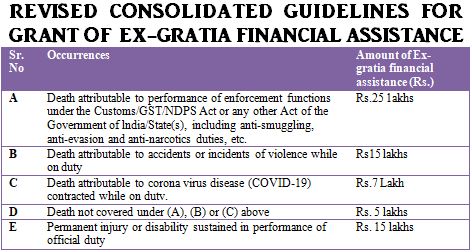

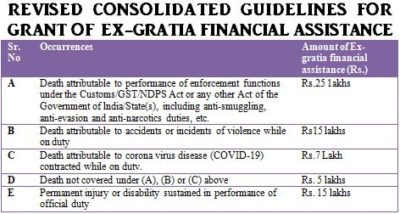

A summary of the Scheme for ex-gratia financial assistance from the Customs and Central Excise Welfare Fund is mentioned below:

| Sr. No | Occurrences | Amount of Ex- gratia financial assistance (Rs.) |

| A | Death attributable to performance of enforcement functions under the Customs/GST/NDPS Act or any other Act of the Government of lndia/State(s), including anti-smuggling, anti-evasion and anti-narcotics duties, etc. | Rs.25 lakhs |

| B | Death attributable to accidents or incidents of violence while on duty | Rs.15 lakhs |

| C | Death attributable to corona virus disease (COVID-19) contracted while on dutv. | Rs.7 Lakh |

| D | Death not covered under (A), (B) or (C) above | Rs.5 lakhs |

| E | Permanent injury or disability sustained in performance of official duty | Rs.15 lakhs |

*The Ex-Gratia Financial assistance from Welfare Fund as outlined above shall be paid in addition to any assistance which may be sanctioned from the Consolidated Fund of India in terms of Department of Pension & Pensioner’s O.M. No. 45/55/97-P&PW(C) dated 11.09.98 as amended from time to time

Note:

I.

i) The Commissioners/ADGs while forwarding proposals for financial assistance in this regard should critically examine the circumstances of death/ injury of the subject official/ staff and certify that the death is attributable to performance of enforcement functions under the Customs/GST/NDPS Act or any other Act of the Government of India/State(s), including anti-smuggling, anti-evasion and anti-narcotics duties, etc. categorized under (A) above or due to road accidents or incidents of violence while proceeding to or returning from anti-smuggling/ anti-evasion and anti-narcotics duties accidents or incidents of violence by terrorists, anti-social elements, etc. occurring while on duty, categorized under (B) above or the officer was working at the time of death would be accepted as proof of the officer/ staff to having contacted the disease of corona virus (COVID-19) while on duty categorized under (C) above or Permanent injury or disability sustained in performance of official duty as categorized under (E) above.

ii) The payment of ex-gratia financial assistance from the Customs and Central Excise Welfare Fund is not linked to the value of terminal benefits and immovable property of the deceased official/ staff. This delinking shall be applicable to all cases where death has occurred on or after 14.06.2011.

iii) The ex-gratia financial assistance from Welfare Fund as outlined above shall be paid in addition to any assistance which may be sanctioned from the Consolidated Fund of India in terms of Department of Pension & Pensioner’s O.M. No. 45/55/97-P&PW(C) dated 11.09.98 . The condition No. 12 contained in the Annexure to the afore-mentioned O.M., which provides that ex gratia assistance paid from different sources should not exceed Rs. 10 Lakhs in each individual case, has since been revised vide O.M. dated 16.03.2009 and the upper limit with respect to the aggregate of the relief/ex-gratia compensation from different sources in the government was raised to Rs. 20 lakhs. Subsequently, vide O.M. dated 12.07.2010 this upper limit also stands removed.

iv) In case of Category (C) of Table above, the primary cause of death of staff/officials must be coronavirus disease (COVID-19). (Refer point 3, 3(a) & 7 of checklist) supported by a medical certificate.

v) A certificate given by the Pr. Commissioner/Commissioner of the Commissionerate or the Pr. ADG/ADG of the Directorate, countersigned by the Pr. Chief Commissioner/Chief Commissioner or the Pr. Director General/Director General under whose jurisdiction the officer was working at the time of death would be accepted as proof of the officer /staff to having contracted the disease of corona virus (COVID-19) while on duty.

II. The decision regarding grant of ex-gratia financial assistance from the Customs and Central Excise Welfare Fund shall be delinked from the appointment on compassionate grounds of a family member of the deceased official/ staff.

III. Time limit for submission of the proposal:

(i) A time limit of two years from the date of death of the official/ staff or the date when permanent injury or disability is sustained, as the case may be, has been prescribed for submission of a proposal for ex-gratia financial assistance.

(ii) An officer- PRO/ Welfare Officer/ any other officer who may be designated at the Commissionerate /Directorate level shall be entrusted the responsibility of ensuring that the request for ex-gratia financial assistance from the Welfare Fund along with its required accompanying documents is prepared in a timely manner by providing the much needed guidance to the survivors of the deceased or the official/ staff who sustained permanent injury or disability, as the case may be, who may otherwise be ignorant of the provisions of this Scheme. This is to ensure that inordinate delays in submission of requests for consideration of the Governing Body and subsequent disbursement of the ex-gratia financial assistance are done away with.

(iii) However, if for some reasons, a proposal for ex-gratia financial assistance could not be submitted in the prescribed time limit of two years even though the survivor(s) of the deceased or the official/ staff who sustained permanent injury or disability, as the case may be, deserve ex gratia financial assistance on merits, the same may be submitted for consideration of the Governing Body, providing adequate justification for non submission of the proposal within the prescribed time limit of two years.

(iv) The revised Scheme has come into effect from 21.08.2020.

Xxxx

CHECK LIST FOR PROPOSALS FOR EX-GRATIA FINANCIAL ASSISTANCE

Check that:

1. Application of beneficiary has been enclosed.

2. The date of death and age of the deceased official is mentioned.

3. Death certificate is enclosed. In case of death due to coronavirus disease (COVID-19), post mortem report or certificate of hospital , in which it should be mentioned that primary cause of death is corona virus disease (COVID-19) is enclosed.

3(a) A certificate given by the Commissioner of the Commissionerate or the ADG of the Directorate, countersigned by the Pr. Chief Commissioner or the Pr. Director General/Director General under whom the officer was working at the time of death would be accepted as proof of the officer /staff to having contracted the disease of corona virus (COVI0-19) while on duty.

4. In cases of death due to accident, or in mysterious circumstances, police investigation report is enclosed.

5. Following details of each of the surviving members of the family of deceased official are given: Name, Age, Relationship with the deceased official, in case of dependent children give their marital status, employed (mention earning/income) or studying (mention class/course).

6. In case if the surviving beneficiaries are minor chi ldren, details of their legal heir ship along with copy of Court Order, if any, have been given.

7. A certificate issued by the concerned Commissioner/ HOD after examining the circumstances of the death/ injury of the subject official as to whether the death is attributable to the actual performance of enforcement functions such as anti-smuggling I anti-evasion/ anti-narcotics duties., etc. categorized under (A) or accidents or incidents of violence by terrorists, anti-social elements, etc. while on duty, categorized under (B) or Permanent injury or disability sustained in performance of official duty as categorized under (D) has been enclosed.

8. Proposal has been submitted within the prescribed time limit of 2 years from the date of death of the official/ staff or the date when permanent injury or disability was sustained by the official/ staff.

9. In case of proposal submitted after the prescribed period of 2 years, reasons for delayed submission of the proposal giving full justification has been enclosed.

10. Proposal has been recommended by the Advisory Committee headed by Commissioner/HOD. The Advisory Committee should be headed by the Commissioner/HoD and should have at least one representative each from Group- ‘A’ to ‘C’ category of officials, including one official from uniformed Group ‘C’ category (erstwhile Group-D officials). The decisions arrived at by the Advisory Committee should be forwarded, as minutes of meeting, to the Governing Body with fu ll details/justifications for further consideration and Sanction.

xxxx

COMMENTS