Exercising Option for deduction of TDS under Old or New Rates of Income Tax for the F.Y. 2020-21

No.G-26028/4/2020-Cash

Government of India

Ministry of Road Transport &Highways

(Cash Section)

Transport Bhawan, 1, Parliament Street, New Delhi 110001

Dated 15th May, 2020

CIRCULAR

Subject : EXERCISING OPTION FOR DEDUCTION OF TDS UNDER OLD OR NEW RATES OF INCOME TAX FOR THE FY 2020-21

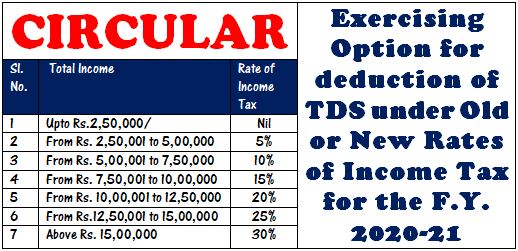

1. The new rates of the income tax have been introduced w.e.f. the financial year 2020-21 (assessment year 2021-22), wherein the total taxable income shall be computed without any exemption/ deduction such as Standard Deduction, HRA Exemption, loss from house property, deductions granted under the provisions of Chapter VI-A (except deduction under sub section (2) of Section 80CCD) etc. The new rates of income tax are as follows:

| SI. No. | Total Income | Rate of Income Tax |

| 1 | Upto Rs.2,50,000/ | Nil |

| 2 | From Rs. 2,50,001 to 5,00,000 | 5% |

| 3 | From Rs. 5,00,001 to 7,50,000 | 10% |

| 4 | From Rs. 7,50,001 to 10,00,000 | 15% |

| 5 | From Rs. 10,00,001 to 12,50,000 | 20% |

| 6 | From Rs.12,50,001 to 15,00,000 | 25% |

| 7 | Above Rs. 15,00,000 | 30% |

2. In addition to new rates, the income tax rates prevailing in the financial year 2019-20 will continue to exist in this financial year and the official has to choose between old rates and new rates for the purpose of monthly Income Tax recovery from pay and allowances. In the old tax rates, all the deductions and exemptions are allowed.

View: Ready Reckoner – Comparison of Income Tax for F.Y. 2020-21 under Existing & New Regime i.r.o. Normal, Senior & Super Senior Citizen

3. Therefore, all the officials are required to exercise their option, in writing or through email to cash.morth to choose between old or new income tax rates for the financial year 2020-21 (assessment year 2021-22) for the purpose of monthly Income Tax deduction from pay & allowances. This option should be forwarded to Cash Section latest by 31 May 2020. If no option is received by the prescribed date, it will be presumed that the official is opting for the old tax structure and Income Tax recoveries will be regulated accordingly.

4. it may also be noted that the option so exercised will be final and cannot be modified during the present financial year.

Sd/-

(Kiran Mala Kujur)

Under Secretary to the Govt. of India

All Officers/Officials of MoRTH

COMMENTS