SB Order No. 17/2020: Introduction of common/modified forms to be used in National Savings Schemes for CBS and non CBS Post Offices

SB Order No. 17/2020

F. No 25-08/2012-FS (CBS)

Govt. of India

Ministry of Communication

Department of Posts

(F.S. Division)

Dak Bhawan, New Delhi-110001

Dated: 15.04.2020

To,

All Head of Circles/Regions

Subject : Introduction of common/modified forms to be used in National Savings Schemes for CBS and non CBS Post Offices – Regarding.

Sir/Madam,

The Ministry of Finance (Department of Economic Affairs) had notified separate forms for each Small Savings Scheme through revised Schemes Rules 2019 vide Notification Nos. 914(E), 915(E), 916(E), 917(E), 918(E), 919(E), 920 (E), 921(E) and 922(E), dated 12.12.2019.

2. (i) This office has been receiving various references from Field Units and other stakeholders citing difficulties in use of separate forms for each Savings Scheme as well as serious issues in printing/procurement and ensuring availability of all these forms in all the Post Offices (including EDBOs) doing POSB operations. The issue was examined and deliberated in detail by this office in consultation with NSI and since this is a purely operational issue, the competent authority has decided to allow use of the following common forms by the all Post Offices, instead of separate form for each scheme:-

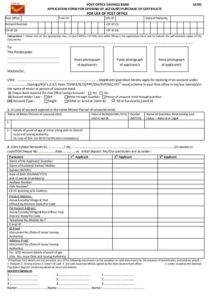

- Application form for Opening of Account/Purchase of Certificate (AOF)

- Pay-in Slip (SB-103)

- Application form for Closure of Account on Maturity. (SB-7A)

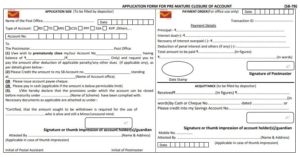

- Application form for Premature Closure of Account. (SB-7B)

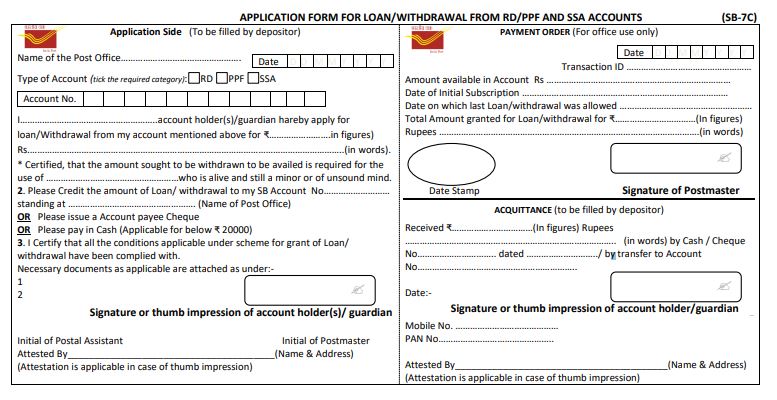

- Application form for Loan/withdrawal from RD/PPF and SSA Accounts (SB-7C)

- Application form for extension of RD/TD/PPF/SCSS Accounts.

(ii) Additional form (Annexure-I) prescribed for PPF/SCSS vide SB Order 06/2015 dated 09.06.2015 shall be discontinued.

(iii) For normal withdrawal from Post Office Savings/NSS-87 Accounts and withdrawal of periodical interest from TD/MIS/SCSS accounts, existing withdrawal form (SB-7) shall continue to be used.

(iv) While using AOF, non-CBS post offices may ignore SOL/CIF ID related fields (as they would not be there) till the Post Office is migrated to CBS.

(v) While opening of new accounts, a separate form (Annexure II) (prescribed vide SB Order 06.2015 dated 09.06.2015) should also be taken by CBS Post Offices from new customers/depositor (not having CBS account in Post Offices/not updated their KYC in existing account(s)).

(vi) In case, any depositor submits any of the notified forms in revised schemes rules 2019, that form may also be accepted.

3. It 1s requested to circulate this SB Order alongwith copy of Forms enclosed to all concerned for information and necessary action. The same may also be placed on the notice boards of the Post Offices in public area.

4. This issues with the approval of Competent Authority.

Yours Faithfully,

Sd/-

(Devendra Sharma)

Assistant Director (SB)

Enclosed:-

1. Application form for Opening of Account/Purchase of Certificate (AOF)

2. Pay-in Slip (SB-103)

3, Application form for Closure of Account on Maturity. (SB-7A)

4. Application form for Premature Closure of Account. (SB-7B)

5. Application form for Loan/withdrawal from RD/PPF and SSA Accounts (SB-7C)

6. Application form for extension of RD/TD/PPF/SCSS Accounts.

1. Application form for Opening of Account/Purchase of Certificate (AOF)

Declaration & Nomination Form

Declaration & Nomination Form

2. Pay-in Slip (SB-103)

3, Application form for Closure of Account on Maturity. (SB-7A)

4. Application form for Premature Closure of Account. (SB-7B)

5. Application form for Loan/withdrawal from RD/PPF and SSA Accounts (SB-7C)

6. Application form for extension of RD/TD/PPF/SCSS Accounts.

To,

The Postmaster

…………………………………………………

Sir,

1. I/We … … … … … … … … … … … … … … … … … … … … … … … … is/are depositor of Account Number … … … … … … … … … … under … … … … … … … … … … ( Recurring Deposit/National Savings Time Deposit Scheme for 1/2/3/5 years/ Public Provident Fund/ Sr. Citizen Savings Scheme) in your office. The said account was opened on … … … … … … … … … … and has/will mature on … … … … … … … … … … for payment.

2. I/We hereby request for extension of the account for a further period of … … … … … year(s) in case of RD and TD/Block period of 5years in case of PPF/Block period of 3 years in case of SCSS, as per applicable scheme provisions from the date of maturity of the above said account.

3. I/We have understood the terms and conditions applicable to the account during the period of extension under the said scheme as amended from time to time and shall abide by them.

4. I/We hereby declare that I/We, and the minor( in case of minor account) continues to be Resident Citizen of India at the time of commencement of the extension period.

Place:

Date:

Signature of the account holder(s)/guardian

(Name and address)

For the use of Post Office

The account no … … … … … … … … … … which was opened on … … … … … … … … … … with Rs. … … … … … (Rupees … … … … … … … … … … … … … … … under … … … … … … … … … … … … … … … (Name of scheme) and matured on … … … … … has been extended for a period of … … … … … years with effect from … … … … … to … … … … … under scheme provisions.

Necessary entries have been made in the records and pass book/deposit receipt/ statement of account.

Place:

Date:

Signature of Postmaster

Seal

Source: Click here to view/download the PDF

[http://utilities.cept.gov.in/dop/pdfbind.ashx?id=4455]

COMMENTS