Confederation of CGE&W strongly oppose Dearness Allowance and Dearness Relief freezing.

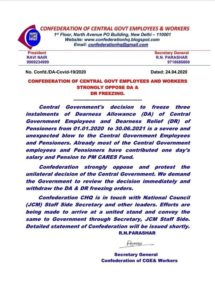

CONFEDERATION OF CENTRAL GOVT EMPLOYEES & WORKERS

1st Floor, North Avenue PO Building, New Delhi – 110001

No. Confd./DA-Covid-19/2020

Dated: 24.04.2020

CONFEDERATION OF CENTRAL GOVT EMPLOYEES AND WORKERS STRONGLY OPPOSE DA & DR FREEZING.

———————

Central Government’s decision to freeze three instalments of Dearness Allowance (DA) of Central Government Employees and Dearness Relief (DR) of Pensioners from 01.01.2020 to 30.06.2021 is a severe and unexpected blow to the Central Government Employees and Pensioners. Already most of the Central Government employees and Pensioners have contributed one day’s salary and Pension to PM CARES Fund.

Confederation strongly oppose and protest the unilateral decision of the Central Government. We demand the Government to review the decision immediately and withdraw the DA & DR freezing orders.

Confederation CHQ is in touch with National Council (JCM) Staff Side Secretary and other leaders. Efforts are being made to arrive at a united stand and convey the same to Government through Secretary, JCM Staff Side. Detailed statement of Confederation will be issued shortly.

R.N.PARASHAR

Secretary General

Confederation of CGE& Workers

COMMENTS

Sri Modi ji govt is anti to central govt employees . Never in past none of the govt stopped the employees and pensioners amount. But Sri Modi govt whants to privatise every thing . There is also a proposal that Sri Modi ji govt is going to central govt employees pension also This is leatest news from a reliable sources.

I am very much shocked about the embargo on DR for Pensioners .This is an unwanted ,unscientific decision.Those who are at the terminal period of life ,perhaps will not get the benefit .Besides in service employees are regularly paying I.Tax .They are in advantageous condition particularly group A & B officers whose salary cut will continue for one year.Irony of fate is that if Govt.gives full exemptions from IT for such donations there will be reduced IT Payment.Less income means lesser Income Tax.O.K. is not it going to hamper the Income Tax revenue of the same Govt?The cunning tactics have been applied here to save money from Pensioners only where more than 80% Income Tax calculations comes to NIL.This point may kindly be intimated while submitting the memorandum in future.

Thanks.