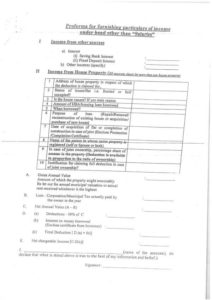

Income-Tax deduction at source from salaries during the financial year 2019 – 20 – Information regarding – Proforma

TIME BOUND

F.NO. G.27036/1/2011-Cash-I

Directorate General of Health Services

(Cash-I Section)

CIRCULAR

Nirman Bhawan,New Delhi

Dated the 6th September, 2019

Subject: Income-Tax deduction at source from salaries during the financial year 2019 – 20 (U/S 192 of the Income Tax Act, 1961) -information regarding.

Cash Section, Dte.GHS is required to work out income tax liability in respect of all the officials and recover remaining Income-Tax from salary in remaining months of the current financial year(2018-19).

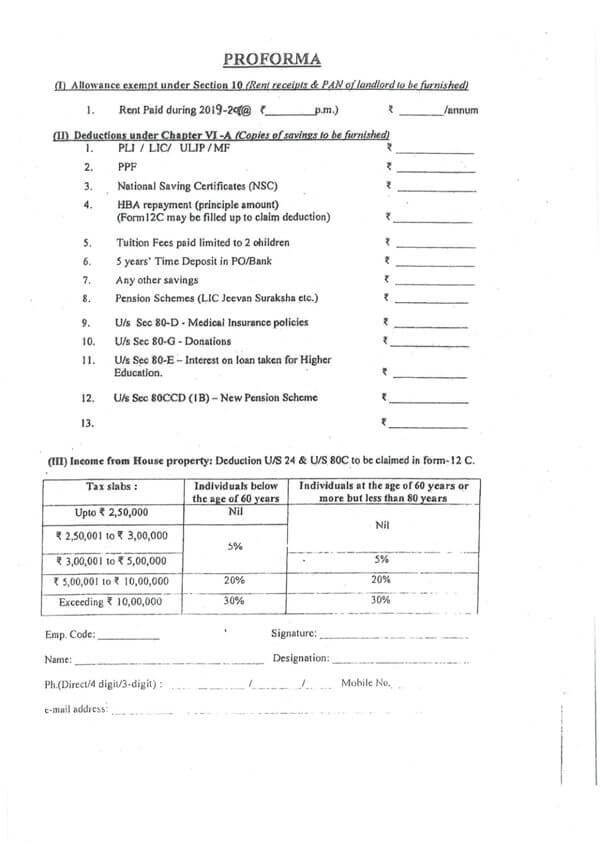

All the Officers/Staff, in Dte. GHS are, therefore , requested to intimate savings (other than GPF/NPS contribution,CGEGIS & CGHS) as per proforma enclosed so that income tax liability can be worked out and recovered in the remaining months of current financial year on an average basis. In case of non-receipt of information by 16th September 2019, it will be presumed that there is no savings besides GPF/NPS contribution,CGEGIS & CGHS and income tax will be deducted accordingly on an average basis.

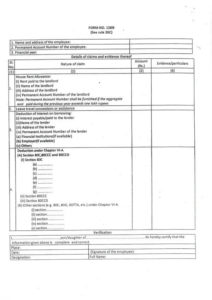

If staying in rented accommodation ,proper rent receipt from the landlord may be provided. Further, if annual rent paid by the employee exceeds Rs. 1,00,000/- per annum, it is mandatory to furnish i n Form 1288 (available in proforma), the name, address, and PAN of the landlord(s).

Officers who are drawing Annual Allowance are requested to submit a certificate to the effect that the annual allowance drawn by them for the year 2019-20 has been utilized for the purpose for which it was given.

Self attested copies of documents in respect of savings intimated may also be provided.

(Johnson)

Section Officer & DDO

Directorate General of Health Services

Source: Click here to view/download the PDF

Source: Click here to view/download the PDF

[https://dghs.gov.in/WriteReadData/Orders/201909060243178254260incometaxform.pdf]

COMMENTS