7th CPC Pensionary Benefit w.e.f. 01.01.2016 for person retired on superannuation w.e.f. 31.12.2015 not admissible: High Court

| Matter : 7th CPC Pensionary Benefit w.e.f. 01.01.2016 for person retired on superannuation w.e.f. 31.12.2015 | ||||

| Order by | Case Number | Date of Judgment/Order | Party | VIEW |

| Hon’ble Prinicipal CAT, New Delhi | OA No. 571/2017 | 17/04/2018 | G.C. YADAV Vs. UNION OF INDIA & ORS |

Click to view |

| Hon’ble High Court, New Delhi | W.P.(C)–9062/2018 | 23/10/2018 | UNION OF INDIA & ORS Vs. G.C. YADAV |

Scroll below |

For CAT Order view: 7th CPC Pensionary Benefit w.e.f. 01.01.2016 for person retired on superannuation w.e.f. 31.12.2015: CAT Principal Bench, New Delhi Order

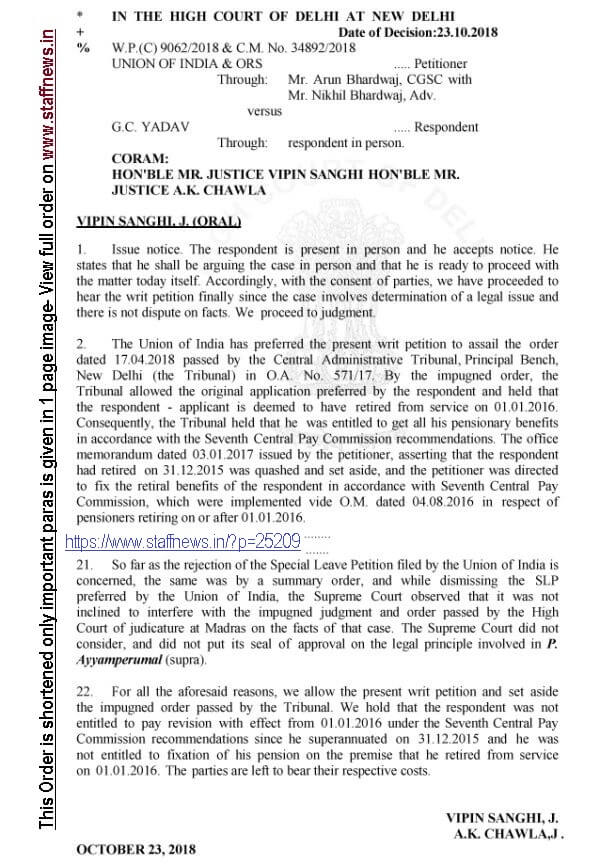

THE HIGH COURT OF DELHI AT NEW DELHI

Date of Decision:23.10.2018

W.P.(C) 9062/2018 & C.M. No. 34892/2018

UNION OF INDIA & ORS ….. Petitioner

Through: Mr. Arun Bhardwaj, CGSC with

Mr.Nikhil Bhardwaj, Adv.

versus

G.C. YADAV

….. Respondent

Through: respondent in person.

CORAM:

HON’BLE MR. JUSTICE VIPIN SANGHI

HON’BLE MR. JUSTICE A.K. CHAWLA

VIPIN SANGHI, J. (ORAL)

1. Issue notice. The respondent is present in person and he accepts notice. He states that he shall be arguing the case in person and that he is ready to proceed with the matter today itself. Accordingly, with the consent of parties, we have proceeded to hear the writ petition finally since the case involves determination of a legal issue and there is not dispute on facts. We proceed to judgment.

2. The Union of India has preferred the present writ petition to assail the order dated 17.04.2018 passed by the Central Administrative Tribunal,

Principal Bench, New Delhi (the Tribunal) in O.A. No. 571/17. By the impugned order, the Tribunal allowed the original application preferred by the respondent and held that the respondent – applicant is deemed to have retired from service on 01.01.2016. Consequently, the Tribunal held that he was entitled to get all his pensionary benefits in accordance with the Seventh Central Pay Commission recommendations. The office memorandum dated 03.01.2017 issued by the petitioner, asserting that the respondent had retired on 31.12.2015 was quashed and set aside, and the petitioner was directed to fix the retiral benefits of the respondent in accordance with Seventh Central Pay Commission, which were implemented vide O.M. dated 04.08.2016 in respect of pensioners retiring on or after 01.01.2016.

3. The date of birth of the respondent is 01.01.1956. Considering that the age of retirement/ superannuation is 60 years, he attained the said age on 31.12.2015. As per the petitioner, the subject of retirement is governed by FR 56 in chapter 9 of the FR/SR. The said chapter deals with retirements. FR 56 in so far as it is relevant, reads as follows:

“F.R. 56 (a) Except as otherwise provided in this rule, every Government servant shall retire from service on the afternoon of the last day of the month in which he attains the age of sixty years:

Provided that a Government servant whose date of birth is the first of a month shall retire from service on the afternoon of the last day of the preceding month on attaining the age of sixty years.” (emphasis supplied)

4. The submission of Mr. Bhardwaj, learned Central Government Standing Counsel is that since the date of birth of the respondent is 01.01.1956, by force of the first proviso to FR56 – which is quoted hereinabove, the respondent retired from service on the afternoon of the last day of the preceding month on attaining the age of 60 years i.e. on 31.12.2015.

5. Mr. Bhardwaj has argued that the respondent was not in service on 01.01.2016. His further submission is that pension is fixed on the basis of the last pay drawn, and the last pay drawn by the respondent was the pay that he was drawing on 31.12.2015. He further submits that the Seventh Central Pay Commission recommendations became effective – with effect from 01.01.2016 in respect of such of the employees who were in service on 01.01.2016. Thus, the respondent did not became entitled to pay revision till he superannuated on 31.12.2015.

6. Mr. Bhardwaj submits that while allowing the Original Application, the Tribunal has taken the aid of the Supreme Court in S. Banerjee V. Union of India, 1989 Supp (2) SCC 486. Mr. Bhardwaj submits that the said decision is not attracted in the present case, since in S. Banerjee (supra), the petitioner had retired on voluntarily retirement and he had sought voluntarily retirement with effect from 01.01.1986. The office order permitting the petitioner – S. Banerjee to voluntarily retire expressly stated that he was permitted “to retire voluntarily from the service of the Registry of the Supreme Court of India with effect from the forenoon of January 1, 1986”.

7. Thus, the Supreme Court concluded that it could not be said that the petitioner S. Banerjee retired on 31.12.1985. He continued to remain in service till the forenoon of 01.01.1986, and since the Fourth Central Pay Commission recommendations became effective from 01.01.1986, the petitioner S. Banerjee was held entitled to pay revision and fixation of pension on that basis, even though, on the day of retirement he was not entitled to draw any pay. Mr. Bhardwaj submits that, on the other hand, as far as the respondent is concerned, he retired on 31.12.2015. He has also referred to O.M. dated 03.01.2017 which contains reasons advanced by the petitioner while rejecting the representation of the respondent. The relevant extract from the said office memorandum reads as follows:

“2. In accordance with the orders issued by this Department on 4.8.2016 for revision of pension of past pensioners in implementation of the recommendations of 7th CPC, it has been mentioned that a pensioner/ family pensioner who become entitled to pension/ family pension w.e.f. 1.1.2016 consequent on retirement/ death of Government servant on 31.12.2015 would be covered by the orders applicable to the pre-2016 pensioners. Therefore, Shri Yadav retired on 31.12.2015 is to be treated as a pre- 2016 pensioner and his pension is required to be fixed under the provisions applicable to 6th CPC retirees and then revised w.e.f. 1.1.2016 in accordance with the OM No.38/37/16-P&PW(A) (ii), dated 4.8.2016.

3. As regards the judgment in the case of S. Benerjee, referred to in the representation of Shri Yadav as well as in the letter from DoPT, it may be mentioned that Shri Benerjee retired voluntarily w.e.f. 1.1.1986. In his case, Hon’ble Supreme Court noted the contention of the UoI that in view of the proviso of Rule 5(2) of CCS (Pension) Rules,

Shri Benerjee is not entitled to the salary for the day of his retirement and, therefore, he was not entitled to the benefits of 4th CPC which were available to those who retired on or after 1.1.1986. Hon’ble Supreme Court observed that since Shri Benerjee retired voluntarily w.e.f. 1.1.1986, he could not be said to have retired on December 1985 and, therefore, the fact that he did not draw any salary for day of which he actually retired has no bearing on the question to the date of retirement.

4. In the case of Shri Yadav, he actually retired on 31.12.15 and was not in service on 1.1.16. Judgment of Hon’ble Supreme Court in the case of Shri S. Benerjee has no relevance in his case. In fact Rule 5(2) of CCS (Pension) Rules has already been amended and as per the amended rule date of voluntary retirement is treated as the last working day. Therefore, those who retired voluntarily on 1.1.2016 would be eligible for pay and pension benefits of 7th CPC as a post 1.1.2016 retiree.

5. Since Shri Yadav retired on superannuation on 31.12.15, he is to be treated as a pre-2016 pensioner and is accordingly entitled to the benefit in revision of pension under the OM No.38/37/46-P&PW(A) (ii) dated 4.8.16.”

8. On the other hand, the respondent, who appears in person, submits that he attained the age of 60 years at 12:00 mid night on 31.12.2015 i.e. on the night of 31.12.2015 and 01.01.2016. He submits that the respondent became a retiree only on 01.01.2016, and in terms of the office memorandum dated 04.08.2016, he was entitled to be treated as a 2016 retiree. Consequently, his pension should have been fixed on the basis of the pay fixation under the Seventh Central Pay Commission recommendations which became effective from 01.01.2016. He also places reliance on a decision of the Madras High Court in P. Ayyamperumal V. The Registrar (CAT) and Ors., in W.P. No.15732/2017 decided on 15.09.2017. In this case, the issue was with regard to the grant of the annual increment to the employee, which fell due on 1st July. He retired on superannuation on 30th June. The Division Bench of the High Court held that the petitioner had completed full years service as on 30.06.2013, and the increment fell due on 01.07.2013 on which date he was not in service. The Division Bench allowed the said petition and held that the petitioner was entitled to fixation of his pension on the basis of the increment which fell due on 01.07.2013. The Special Leave Petition against the said decision of the Madras High Court preferred by the Union of India before the Supreme Court vide SLP (C) No. 22283/2018, was dismissed on 23.07.2018.

9. The respondent submits that the decision of the Madras High Court in P.Ayyamperumal (supra) has attained finality and the said decision be followed by this Court.

10. Having heard the learned counsel for the petitioner, Mr. Bhardwaj; perused the record and the relevant rules, and; having considered the submissions advanced by the respondent and the decisions relied upon by him, we are of the considered view that the respondent could not be considered to have superannuated/ retired on 01.01.2016, and he could not be treated as post 2016 pensioner. We are of the view that the impugned order passed by the Tribunal cannot be sustained and is liable to be set aside.

11. Firstly, we may observe that since the date of birth of the respondent is 01.01.1956, he attained the age of 60 years i.e. the age of superannuation on 31.12.2015. The respondent appears to be reeling under the impression that he attained the age of 60 years only on 01.01.2016, which is not correct. On 01.01.2016, the respondent entered into the 61st year of his life, having completed his 60 years on 31.12.2015.

12. The issue of retirement in respect of Central Government servants is covered by FR 56. We have already quoted the relevant extract from the said rule. The first proviso to FR 56 (a) is clearly attracted in the facts of the present case, since the date of birth of the respondent falls on the first day of the month i.e. on 01.01.1956. Consequently, by virtue of the first proviso to Rule 56 (a), respondent retired from service on the afternoon of the last day of the preceding month on attaining the age of 60 years. In the case of the respondent, that was the afternoon of 31.12.2015. Even if the expression “afternoon” is construed broadly, it could only extend to midnight of 31.12.2015 and the same would not cross the said deadline. As at the beginning of 01.01.2016 i.e. from 00.00 hrs of 01.01.2016, the respondent ceased to be a serving employee, having superannuated on 31.12.2015. At no point of time on 01.01.2016, the respondent could be said to be in active service. At no point of time, in the year 2016 the respondent worked in a post, the pay or emoluments of which were fixed on the basis of the recommendations of the Seventh Central Pay Commission. He was not entitled to receive any pay on or from 01.01.2016. Thus, the question of revision of his pay, premised on the recommendations of the Seventh Central Pay Commission did not arise. The said recommendations became effective from 01.01.2016 in respect of employees who were in service on 01.01.2016 – which the respondent was not.

13. We agree with the submission of Mr. Bhardwaj that the Tribunal has erred in placing reliance on the judgment in S. Banerjee (supra) in the facts of the present case. The material difference in the facts of S. Banerjee (supra) and the facts of the present case is that in S. Banerjee (supra), the petitioner – S. Banerjee sought voluntary retirement from a particular date i.e. 01.01.1986. It is open to an employee seeking voluntary retirement to choose the date of his voluntary retirement, unlike in the case of a superannuating Government servant whose date of retirement is determined by FR 56.

14. The Supreme Court took note of the fact in S. Banerjee (supra) that the petitioner was permitted to voluntarily retire from service from the forenoon of January 1, 1986. Thus, it could not be said that S. Banerjee had retired at any point of time on 31.12.1985. He continued to remain in service till the forenoon of 1st January, 1986. Before his retirement on the forenoon of 01.01.1986, the Fourth Central Pay Commission recommendations were implemented with effect from 01.01.1986. Thus, there was an overlap and before S. Banerjee retired, the revised pay scales under the Fourth Central Pay Commission Report came into effect. This is not the position in the present case.

15. The Supreme Court referred to Rule 5(2) of the Central Civil Service (Pension) Rules, 1972 which, inter alia provides that the day on which the Government Servant retires, or is retired or discharged, or is allowed to resign from service, shall be treated as his last working day and that in the case of a Government Servant who retires prematurely or voluntarily under clauses (j) to (m) of Rule 56 or Rule 48, or Rule 48 (a) of the Fundamental Rules, the date of retirement shall be treated as a non working day. The Supreme Court observed that even in the case of the petitioner S. Banerjee, the date of retirement was January 1, 1986 and he was not entitled to pay for January 1, 1986 – since the same was to be treated as a non working day. However, that had no bearing on the question as to the date of retirement.

16. Paragraph 6 of the judgment in S. Banerjee (supra) reads as follows;

“6. Under para 17.3, the benefits recommended will be available to employees retiring during the period, 1-1-1986 to 30-9-1986. So the employees retiring on 1-1-1986 will be entitled to the benefit under para 17.3. The question that arises for our consideration is whether the petitioner has retired on 1-1-1986. We have already extracted the order of this Court dated 6-12-1985 whereby the petitioner was permitted to retire voluntarily from the service of the Registry of the Supreme Court with effect from the forenoon of 1-1-1986. It is true that in view of the proviso to Rule 5(2) of the Rules, the petitioner will not be entitled to any salary for the day on which he actually retired. But, in our opinion, that has no bearing on the question as to the date of retirement. Can it be said that the petitioner retired on 31- 12-1985 ? The answer must be in the negative. Indeed, Mr Anil Dev Singh, learned counsel appearing on behalf of the respondents, frankly conceded that the petitioner could not be said to have retired on 31-12-1985. It is also not the case of the respondents that the petitioner had retired from the service of this Court on 31-12-1985. Then it must be held that the petitioner had retired with effect from 1-1-1986 and that is also the order of this Court dated 6-12-1985. It may be that the petitioner had retired with effect from the forenoon of 1-1-1986 as per the said order of this Court, that is to say, as soon as 1-1-1986 had commenced the petitioner retired. But, nevertheless, it has to be said that the petitioner had retired on 1-1-1986 and not on 31-12-1985. In the circumstances, the petitioner comes within the purview of para 17.3 of the recommendations of the Pay Commission”

17. As noticed hereinabove, in the present case, by virtue of the 1st proviso to Rule 56 (a) of the FR, the respondent retired on the afternoon of 31.12.2015. He did not see the light of the day – as a serving Government servant on 01.01.2016. Thus, the decision in S. Banerjee (supra) was clearly not attracted in the facts of the present case.

18. Reliance placed by the respondent on the judgment of the Madras High Court in P. Ayyamperumal (supra) is of no avail. Pertinently, that case did not relate to fixation of the date of retirement – which is the central issue in the present case. A perusal of the order passed in P. Ayyamperumal (supra) shows that the Division Bench accepted the position that the petitioner had completed one full year’s service on 30.06.2013. However, the increment fell due on 01.07.2013 – on which date he was not in service. The Division Bench followed its earlier decision in State of Tamil Nadu, rep. by its Secretary to Government, Finance Department and Others v. M. Balasubramaniam CDJ 2012 MHC 6525 wherein the Madras High Court had allowed the petition filed by the employee by observing that the employee had completed one full year of service between 01.04.2002 to 31.03.2003, which entitled him to the benefit of increment. The increment accrued to him for the work done during the preceding period of one year.

19. On that premise, the Division Bench in P. Ayyamperumal (supra) held that the petitioner was entitled to one notional increment for the period 01.07.2012 to 30.06.2013. The said increment was directed to be taken into account on the date of his superannuation i.e. 01.07.2013.

20. Firstly, in our view, the said decision in P. Ayyamperumal (supra) was rendered in a materially different fact situation. The issue determined by the Court was not with regard to the date of retirement/ superannuation. In fact, on that aspect, the finding returned by the Madras High Court goes contrary to the submission of the respondent that he retired on 01.01.216, and not 31.12.2015. Secondly, the relief was granted to the petitioner by the Madras High Court since the increment which fell due on 01.07.2013 had been earned by the petitioner by working for the full year i.e. 01.07.2012 to 30.06.2013. The same cannot be said about the revision of pay upon implementation of the Central Pay Commission recommendations. Thirdly, the decision of the Madras High Court has only persuasive value and in the fact of the present case, we do not think that the ratio of the said decision is attracted.

21. So far as the rejection of the Special Leave Petition filed by the Union of India is concerned, the same was by a summary order, and while dismissing the SLP preferred by the Union of India, the Supreme Court observed that it was not inclined to interfere with the impugned judgment and order passed by the High Court of judicature at Madras on the facts of that case. The Supreme Court did not consider, and did not put its seal of approval on the legal principle involved in P. Ayyamperumal (supra).

22. For all the aforesaid reasons, we allow the present writ petition and set aside the impugned order passed by the Tribunal. We hold that the respondent was not entitled to pay revision with effect from 01.01.2016 under the Seventh Central Pay Commission recommendations since he superannuated on 31.12.2015 and he was not entitled to fixation of his pension on the premise that he retired from service on 01.01.2016. The parties are left to bear their respective costs.

VIPIN SANGHI, J.

A.K. CHAWLA,J .

OCTOBER 23, 2018

COMMENTS