Subject : Amendment in Central Civil Services (Conduct) Rules, 1964 regarding acceptance of gifts by Government servants.

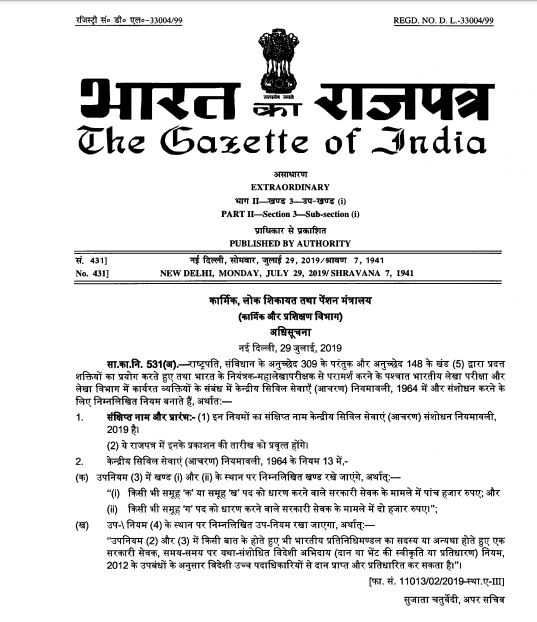

| Before Amendment | After Amendment |

|

Sub rule(3) of Rule 13

In any other case, a Government servant shall not accept any gift without the sanction of the Government, if the value exceeds – (i) rupees one thousand five hundred in the case of Government servants holding any Group ‘A’ or Group ‘B’ post; and (ii) rupees five hundred in the case of Government servant holding any Group `C’ or Group ‘D’ posts. |

Sub rule(3) of Rule 13

In any other case, a Government servant shall not accept any gift without the sanction of the Government, if the value exceeds – (i) rupees five thousand in the case of Government servants holding any Group ‘A’ or Group ‘B’ post; and (ii) rupees two thousand in the case of Government servant holding any Group `C’ post. |

|

Sub rule(4) of Rule 13

Notwithstanding anything contained in sub rule (2) and (3), a Government servant, being a member of India delegation or otherwise, may receive and retain gifts from foreign dignitaries, if the market value of gifts received on one occasion does not exceed rupees one thousand. In all other cases, the acceptance and retention of such gift shall be regulated by the instructions issued by the Government in this regard from time to time. |

Sub rule(4) of Rule 13

Notwithstanding anything contained in sub rule (2) and (3), a Government servant, being a member of the Indian delegation or otherwise, may receive and retain gifts from foreign dignitaries in accordance with the provisions of The Foreign Contribution (Acceptance or Retention of Gifts or Presentation) Rules, 2012, as amended from time to time. |

3. Hindi version will follow.

(2) They shall come into force on the date of its publication in the Official Gazette.

2. In the Central Civil Services (Conduct) Rules, 1964, in rule 13,-

(a) in sub-rule (3), for clauses (i) and (ii), the following clauses shall be substituted, namely:-

“(i) rupees five thousand in the case of a Government servant holding any Group ‘A’ or Group ‘B’ post; and

(ii) rupees two thousand in the case of a Government servant holding any Group ‘C’ post.”;

(b) for sub-rule (4), the following sub-rule shall be substituted, namely:-

- S.O. 482, dated the 14th February,1970:

- S.O. 3643, dated the 4th November,1972;

- S.O. 83, dated the 13th January, 1973;

- S.O. 846, dated the 28th February, 1976;

- S.O.2563, dated the l7th July, 1976;

- S.O. 2691, dated the 24th July,1976;

- S.O. 4663, dated the 11th December, 1976;

- S.O. 2859, dated the 17th September,l977;

- S.O. 2859, dated the 30th September, 1978;

- S.O. 3, dated the 6th January, 1979;

- S.O. 1270, dated the 10thMay, 1980;

- S.O. 4812, dated the 19th October, 1985;

- S.O. 935, dated the 8th March, 1986;

- S.O. I 124, dated the 22nd March,1986;

- S.O. 3159, dated the 20th September, 1986;

- S.O. 3280, dated the 27th September, 1986;

- S.O. 1965, dated the 8th August, 1987;

- S.O. 1454, dated the 14th May, 1988;

- S.O. 2582, dated the 6th October, 1990;

- S.O. 3132, dated the 26th December,1992;

- c.S.R. 355, dated the 29th July, 1995;

- G.S.R. 367, dated the 31st August, 1996;

- G.S.R. 49, dated the 7th March, 1998;

- G.S.R. 342, dated the 23rd October, 1999;

- C.S.R. 458, dated the 27th December, 2003;

- G.S.R. 376, dated the 22nd October, 2005;

- G.S.R. 8, dated the 31st January, 2009;

- G.S.R. 370 (E), dated the 9th May, 2011;

- G.S.R. 149 (E), dated the 4th March,2014;

- G.S.R. 823 (E), dated the 19th November,2014; and

- G.S.R. 845 (E), dated the 27th November,2014.

Source:

Click here for Signed Copy

[https://dopt.gov.in/sites/default/files/11013_02_2009EsttAIII_06082019_English.pdf]

COMMENTS