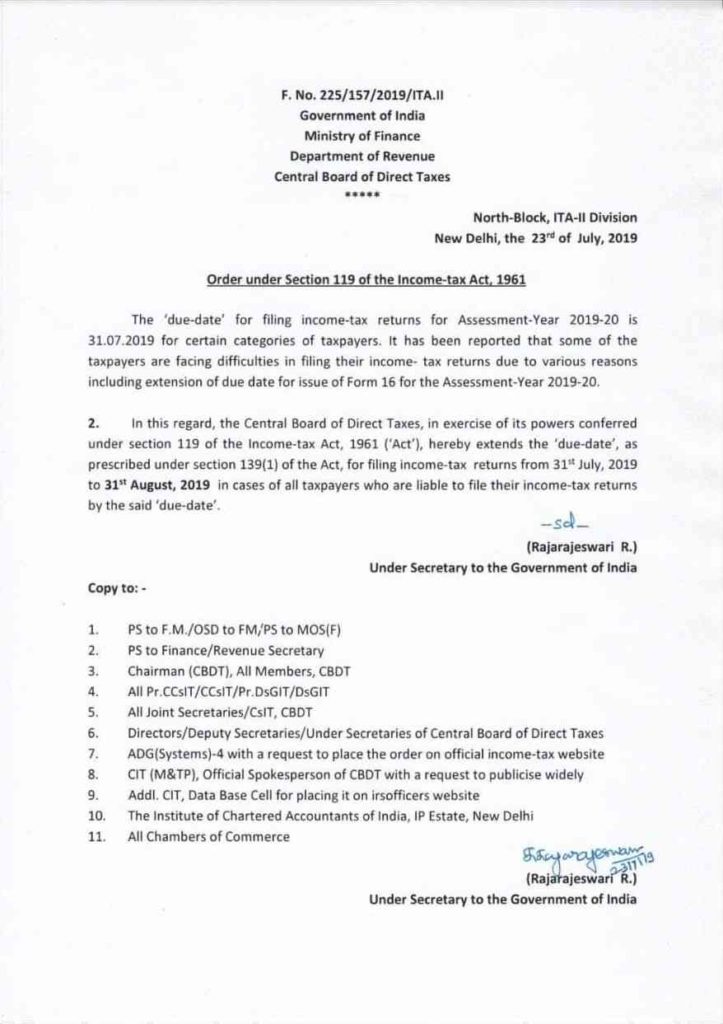

Order under Section 119 of the Income-tax Act, 1961

2. In this regard, the Central Board of Direct Taxes, in exercise of its powers conferred under section 119 of the Income-tax Act, 1961 (‘Act’), hereby extends the ‘due-date’, as prescribed under section 139(1) of the Act, for filing income-tax returns from 31st July, 2019 to 31st August, 2019 in cases of all taxpayers who are liable to file their income-tax returns by the said ‘due-date’.

Copy to: –

1. PS to F.M./OSD to FM/PS to MOS(F)

2. PS to Finance/Revenue Secretary

3. Chairman (CBDT), All Members, CBDT

4. All Pr.CCsIT/CCsIT/Pr.DsGIT/DsGIT |

5. All Joint Secretaries/CsIT, CBDT

6. Directors/Deputy Secretaries/Under Secretaries of Central Board of Direct Taxes

7. ADG(Systems)-4 with a request to place the order on official income-tax website

8. CIT (M&TP), Official Spokesperson of CBDT with a request to publicise widely

9. Addl. CIT, Data Base Cell for placing it on irsofficers website

10. The Institute of Chartered Accountants of India, IP Estate, New Delhi

11. All Chambers of Commerce

COMMENTS