Revision of pension w.e.f. 1.1.2006 of Pre-2006 pensioners who retired from the 5th CPC scale of Rs. 6500-10500/- DoP&PW O.M

No. 38/33/12-P&PW (A)

Government of India

Ministry of Personnel, PG & Pensions

Department of Pension & Pensioners’ Welfare

3rd Floor, Lok Nayak Bhawan

Khan Market, New Delhi-110 003

Dated the 4th January, 2019

OFFICE MEMORANDUM

Sub :- Revision of pension w.e.f. 1.1.2006 of Pre-2006 pensioners who

retired from the 5th CPC scale of Rs. 6500-10500/-.

The undersigned is directed to say that as per Para 4.2 of this

Department’s OM of even number dated 01.09.2008 relating to revision of pension of pro-2006

pensioners w.e.f. 1.1.2006, the revised pension w.e.f. 1.1.2006, in no case, shall be lower

than 50% of the sum of the minimum of pay in the pay band and the grade pay thereon

corresponding to the pre- revised pay scale From which the pensioner had retired.

Department’s OM of even number dated 01.09.2008 relating to revision of pension of pro-2006

pensioners w.e.f. 1.1.2006, the revised pension w.e.f. 1.1.2006, in no case, shall be lower

than 50% of the sum of the minimum of pay in the pay band and the grade pay thereon

corresponding to the pre- revised pay scale From which the pensioner had retired.

2. Instructions were issued vide this Department’s OM of even number dated

28.1.2013 for stepping up of pension of pre-2006 pensioners w.e.f. 24.9.2012 to 50%

of the sum of the minimum of pay in the pay hand and the grade pay thereon corresponding to

the pre-revised pay scale from which the pensioner had retired, as arrived at with

reference to the fitment tables annexed to Ministry of Finance, Department of Expenditure’s OM No.

1/1/2008-IC dated 30th August, 2008. A concordance table indicating the

revised pension/family pension of pre-2006 pensioners in terms of instructions contained in para 42 of OM

dated 1.9.2008 read with the OM dated 28.1.2013 was also annexed to the OM dated

28.1.2013. Subsequently, orders were issued vide this Department’s OM of even number

dated 30.7.2015 that the pension/family pension of all pre-2006 pensioners/family

pensioners may be revised in accordance with this Department’s OM No. 38/37/08-P&PW(A)

dated 28.1.2013 with effect from 1.1.2006 instead of 24.9.2012.

28.1.2013 for stepping up of pension of pre-2006 pensioners w.e.f. 24.9.2012 to 50%

of the sum of the minimum of pay in the pay hand and the grade pay thereon corresponding to

the pre-revised pay scale from which the pensioner had retired, as arrived at with

reference to the fitment tables annexed to Ministry of Finance, Department of Expenditure’s OM No.

1/1/2008-IC dated 30th August, 2008. A concordance table indicating the

revised pension/family pension of pre-2006 pensioners in terms of instructions contained in para 42 of OM

dated 1.9.2008 read with the OM dated 28.1.2013 was also annexed to the OM dated

28.1.2013. Subsequently, orders were issued vide this Department’s OM of even number

dated 30.7.2015 that the pension/family pension of all pre-2006 pensioners/family

pensioners may be revised in accordance with this Department’s OM No. 38/37/08-P&PW(A)

dated 28.1.2013 with effect from 1.1.2006 instead of 24.9.2012.

3. In the aforesaid OM dated 28.1.2013 of Department of Pension &

Pensioners’ Welfare, the grade pay corresponding to the pre-revised pay scale of Rs.

6500-10500 was shown as Rs. 4200/- and the minimum pension in terms of para 4.2 of the OM

dated 1.9.2008 was shown as Rs. 8145/- (50% of minimum pay of Rs. 16,290/- as per fitment

table for the pre-revised scale of pay of Rs. 6500-10500, annexed to Ministry of Finance,

Department of Expenditure’s OM No. 1/1/2008-IC dated 30th August, 2008).

Pensioners’ Welfare, the grade pay corresponding to the pre-revised pay scale of Rs.

6500-10500 was shown as Rs. 4200/- and the minimum pension in terms of para 4.2 of the OM

dated 1.9.2008 was shown as Rs. 8145/- (50% of minimum pay of Rs. 16,290/- as per fitment

table for the pre-revised scale of pay of Rs. 6500-10500, annexed to Ministry of Finance,

Department of Expenditure’s OM No. 1/1/2008-IC dated 30th August, 2008).

4. Order were issued vide Ministry of Finance, Department of Expenditure’s

OM No. 1.1.2008-IC dated 13.11.2009 that the posts which were in the pre-revised

scale of Rs. 6500-10500 as on 1.1.2006 and which were granted the normal replacement pay

structure of grade pay of Rs. 4200/- in the pay band PB-2, will be granted grade pay of Rs.

4600/- in the pay band PB-2 corresponding to the pre-revised scale of Rs. 7450-11,500 w.e.f.

1.12006.

OM No. 1.1.2008-IC dated 13.11.2009 that the posts which were in the pre-revised

scale of Rs. 6500-10500 as on 1.1.2006 and which were granted the normal replacement pay

structure of grade pay of Rs. 4200/- in the pay band PB-2, will be granted grade pay of Rs.

4600/- in the pay band PB-2 corresponding to the pre-revised scale of Rs. 7450-11,500 w.e.f.

1.12006.

5. Representations have been received in this Department for extending the

benefit of grade pay of Rs. 4600 for revision of pension/family pension, w.e.f. 1.1.2006, in

respect of Pre-2006 pensioners who retired/died in the 5th CPC scale of Rs.

6500-10500/- or equivalent pay scale in the earlier Pay Commission periods. The matter regarding the amount of minimum

pension/family pension in terms of para 4.2 of the O.M. dated 1.9.2008 in their case has

been re-examined in the light of the orders issued by Ministry of Finance (Department of

Expenditure) vide their OM No. 1/1/08-IC dated 13.11.2009 and decisions of courts in certain cases. It has

been observed that pay of all serving employees in the pro-revised pay scale of Rs. 6500-10500/-

has been fixed w.e.f. 1.1.2006 in the grade pay of Rs. 4600/-. Therefore, the grade pay of Rs.

4600/- can be considered as the grade pay corresponding to the pre revised pay scale of Rs.

6500-10500/-.

benefit of grade pay of Rs. 4600 for revision of pension/family pension, w.e.f. 1.1.2006, in

respect of Pre-2006 pensioners who retired/died in the 5th CPC scale of Rs.

6500-10500/- or equivalent pay scale in the earlier Pay Commission periods. The matter regarding the amount of minimum

pension/family pension in terms of para 4.2 of the O.M. dated 1.9.2008 in their case has

been re-examined in the light of the orders issued by Ministry of Finance (Department of

Expenditure) vide their OM No. 1/1/08-IC dated 13.11.2009 and decisions of courts in certain cases. It has

been observed that pay of all serving employees in the pro-revised pay scale of Rs. 6500-10500/-

has been fixed w.e.f. 1.1.2006 in the grade pay of Rs. 4600/-. Therefore, the grade pay of Rs.

4600/- can be considered as the grade pay corresponding to the pre revised pay scale of Rs.

6500-10500/-.

6. Accordingly, it has been decided that, for the purpose of revision of

pension/family pension w.e.f. 1.1.2006 under para 4.2 of the OM. dated 1.9.2008, the Grade Pay of

Rs. 4600/- may be considered as the corresponding Grade pay in the case of pre-2006

pensioners who retired/died in the 5th CPC scale of Rs. 6500-l0500/- or equivalent pay scale in

the earlier Pay Commission periods,

pension/family pension w.e.f. 1.1.2006 under para 4.2 of the OM. dated 1.9.2008, the Grade Pay of

Rs. 4600/- may be considered as the corresponding Grade pay in the case of pre-2006

pensioners who retired/died in the 5th CPC scale of Rs. 6500-l0500/- or equivalent pay scale in

the earlier Pay Commission periods,

7. In accordance with the provisions of Rule 7 of the CCS (Revised Pay)

Rules, 2008, the pay corresponding to the pay of Rs. 6500/- in the pro-revised pay scale of Rs.

6500-10500/- would be Rs. l2090/- in the PB-2. After adding the grade pay of Rs. 4600/-, the pay

in the Pay Band + Grade Pay corresponding to the pay of Rs. 6500/- in the pre-revised pay

scale of Rs. 6500-10500 would be Rs. l6690/- (12090+4600). Accordingly, the revised pension w.e.f.

1.1.2006 in terms of para 4.2 of OM dated 1.9.2008, for the pre-2006 pensioners who retired from

the pay scale of Rs. 6500-l0500/- in the 5th CPC or equivalent pay scales in the

earlier Pay Commissions would be Rs. 8345/-. Accordingly the entries at serial number 13 in the annexure of this

Department’s OM No. 38/37/08-P&PW(A) dated 28.1.2013 may be substituted by the entries

shown in the statement annexed to this O.M.

Rules, 2008, the pay corresponding to the pay of Rs. 6500/- in the pro-revised pay scale of Rs.

6500-10500/- would be Rs. l2090/- in the PB-2. After adding the grade pay of Rs. 4600/-, the pay

in the Pay Band + Grade Pay corresponding to the pay of Rs. 6500/- in the pre-revised pay

scale of Rs. 6500-10500 would be Rs. l6690/- (12090+4600). Accordingly, the revised pension w.e.f.

1.1.2006 in terms of para 4.2 of OM dated 1.9.2008, for the pre-2006 pensioners who retired from

the pay scale of Rs. 6500-l0500/- in the 5th CPC or equivalent pay scales in the

earlier Pay Commissions would be Rs. 8345/-. Accordingly the entries at serial number 13 in the annexure of this

Department’s OM No. 38/37/08-P&PW(A) dated 28.1.2013 may be substituted by the entries

shown in the statement annexed to this O.M.

8. As provided in this Department’s OM dated 28.1.2013, in case the

consolidated pension/family pension calculated as per para 4.1. of this Department’s OM

No. 38/37/08-P&PW(A) dated 1.9.2008 is higher than the pension/Family pension

calculated in the manner indicated above, the same (higher consolidated pension/family pension) will

continue to be treated as basic pension/family pension.

consolidated pension/family pension calculated as per para 4.1. of this Department’s OM

No. 38/37/08-P&PW(A) dated 1.9.2008 is higher than the pension/Family pension

calculated in the manner indicated above, the same (higher consolidated pension/family pension) will

continue to be treated as basic pension/family pension.

9. In their application to the persons belonging to the India Audit and

Accounts Department, these orders are issued in consultation with the comptroller and Auditor

General of India. 10. All the Ministries/Departments are requested to bring the contents of

these orders to the notice of Controller of Accounts/Pay and Accounts Officers and Attached and

subordinate Offices under them. They are also requested to revise the pension of the affected

pre-2006 pensioners in accordance with the instructions contained in this O.M. on a top priority

basis.

Accounts Department, these orders are issued in consultation with the comptroller and Auditor

General of India. 10. All the Ministries/Departments are requested to bring the contents of

these orders to the notice of Controller of Accounts/Pay and Accounts Officers and Attached and

subordinate Offices under them. They are also requested to revise the pension of the affected

pre-2006 pensioners in accordance with the instructions contained in this O.M. on a top priority

basis.

11. Hindi version will follow.

(Harjit Singh)

Director

To

All Ministries/Departments of Government of India as per mailing list.

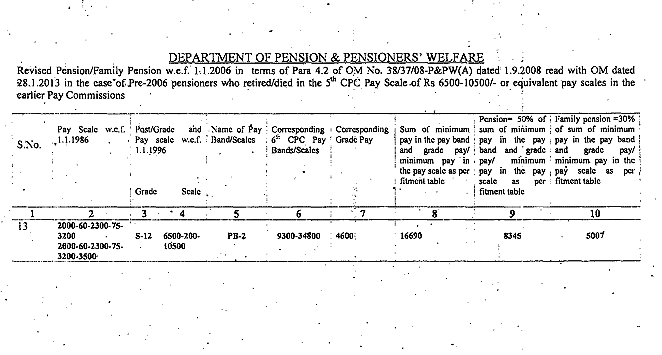

DEPARTMENT OF PENSION & PENSIONERS’ WELFARE

Revised Pension/Family Pension w.e.f. 1.1.2006 in terms of Para 4.2 of OM

No. 38/37/08-P&PW(A) dated 1.9.2008 read with OM dated 28.1.2013 in the

case of Pre-2006 pensioners who retired/died in the 5th CPC Pay

Scale of Rs 6500-10500/- or equivalent pay scales in the earlier Pay

Commissions

No. 38/37/08-P&PW(A) dated 1.9.2008 read with OM dated 28.1.2013 in the

case of Pre-2006 pensioners who retired/died in the 5th CPC Pay

Scale of Rs 6500-10500/- or equivalent pay scales in the earlier Pay

Commissions

|

S.No

|

Pay Scale w.e.f.

1.1.1986 |

Post/Grade and Pay scale w.e.f. 1.1.1996

Grade Scale

|

Name of Pay Band/ Scales

|

Corres-ponding

6th CPC Pay Bands/ Scales |

Corres-ponding Grade Pay

|

Sum of minimum

pay in the pay band and grade pay/ minimum pay in the pay scale as per fitment table |

Pension=50% of sum of minimum pay in the pay band and grade

pay/ minimum pay in the pay scale as per fitment table |

Family pension = 30% of sum of minimum pay in the pay band

and grade pay/minimum pay in the pay scale as per fitment table |

|

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

| 13 | 2000-60-2300 -75-3200 2000-60-2300-75 -3200-3500 |

S-12 | 6500- 200- 10500 |

PB – 2 | 9300-34800 | 4600 | 16690 | 8345 | 5007 |

Source: Click to view/download pdf

http://documents.doptcirculars.nic.in/D3/D03ppw/PPWA_04012019aed87.pdf

COMMENTS

Concerdance Table with your pay scales of pre-2006 matching with your basic last basic pay.

Please intimate is there any ready reckoner/calculator/tables for pensioners who retired from service before 2006

It is available in the CONCORDANCE TABLES in last basic pay with the scale of pay of you as per the available tables of pension as on 1/1/2016 for CENTRAL GOVERNMENT PENSIONERS.

Any body knows how can I calculate the pension those who alrady in 4600 grade pay, will they get Revision or not. Pl to cononvey the details,

50% of your last basic pay including Grade Pay or 50% of basic pay as per 7th CPC MATRIX LEVEL.