7th CPC TA Rules – Reimbursement of Taxes/GST on the prescribed entitlement of Hotel accommodation/Guest House: DoE Order with example

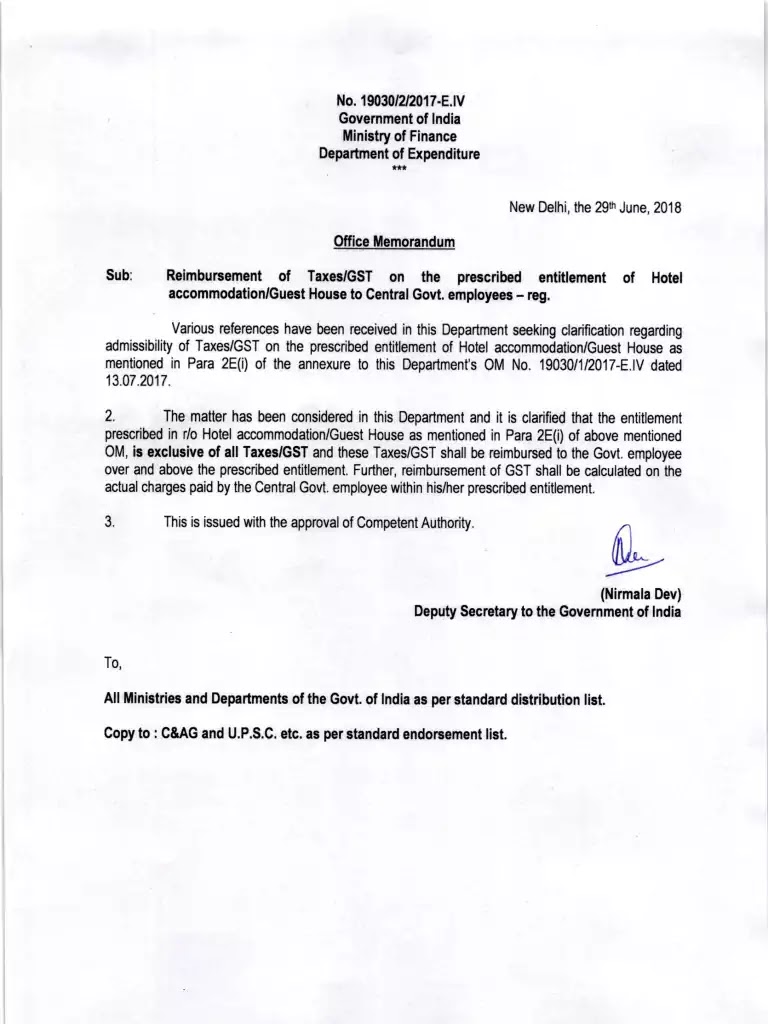

No. 19030/2/2017-E.IV

Government of India

Ministry of Finance

Department of Expenditure

New Delhi, the 29th June, 2018

Office Memorandum

Sub: Reimbursement of Taxes/GST on the prescribed entitlement of Hotel

accommodation/Guest House to Central Govt. employees – reg.

Various references have been received in this Department seeking

clarification regarding admissibility of Taxes/GST on the prescribed

entitlement of Hotel accommodation/Guest House as mentioned in Para 2E(i)

of the annexure to this Department’s OM No. 19030/1/2017-E.IV dated

13.07.2017.

2. The matter has been considered in this Department and it is clarified

that the entitlement prescribed in r/o Hotel accommodation/Guest House as

mentioned in Para 2E(i) of above mentioned OM, is exclusive of all

Taxes/GST and these Taxes/GST shall be reimbursed to the Govt. employee

over and above the prescribed entitlement. Further, reimbursement of GST

shall be calculated on the actual charges paid by the Central Govt.

employee within his/her prescribed entitlement.

that the entitlement prescribed in r/o Hotel accommodation/Guest House as

mentioned in Para 2E(i) of above mentioned OM, is exclusive of all

Taxes/GST and these Taxes/GST shall be reimbursed to the Govt. employee

over and above the prescribed entitlement. Further, reimbursement of GST

shall be calculated on the actual charges paid by the Central Govt.

employee within his/her prescribed entitlement.

3. This is issued with the approval of Competent Authority.

Sd/-

(Nirmala Dev)

Deputy Secretary to the Government of India

Check entitlement: 7th CPC TA Rules: Entitlement for Journeys on Tour or Training

Illustrations:-

Example 1: Hotel Bill Paid for 2 days Rs.1500/- + (GST 12% + 12%) Rs. 360 = Total Rs. 1860 by an official of Level 6 [entitlement Rs.750/- per day].

Reimbursement will be – Rs.1500/- and Rs. 360/- (Full reimbursement)

Example 1: Hotel Bill Paid for 2 days Rs.1500/- + (GST 12% + 12%) Rs. 360 = Total Rs. 1860 by an official of Level 6 [entitlement Rs.750/- per day].

Reimbursement will be – Rs.1500/- and Rs. 360/- (Full reimbursement)

Example 2: Hotel Bill Paid for 2 days Rs.10,000/- + (GST 12% + 12%) Rs. 2400 = Total Rs.12,400 by an official of Level 12 [entitlement Rs.4,500/- per day]

Reimbursement will be – Rs. 9,000/- + Rs. 2,160 = Total Rs. Rs.11,160

{reimbursement of GST shall be calculated on the actual charges paid by the Central Govt. employee within his/her prescribed entitlement.}

Source : Click here to download/view the PDF

[https://doe.gov.in/sites/default/files/DoE%20OM%20dated%2029.06.2018%20Eng.pdf]

COMMENTS