Grant of Fixed Medical Allowance – Undertaking is required to be submitted once every year alongwith other certificate

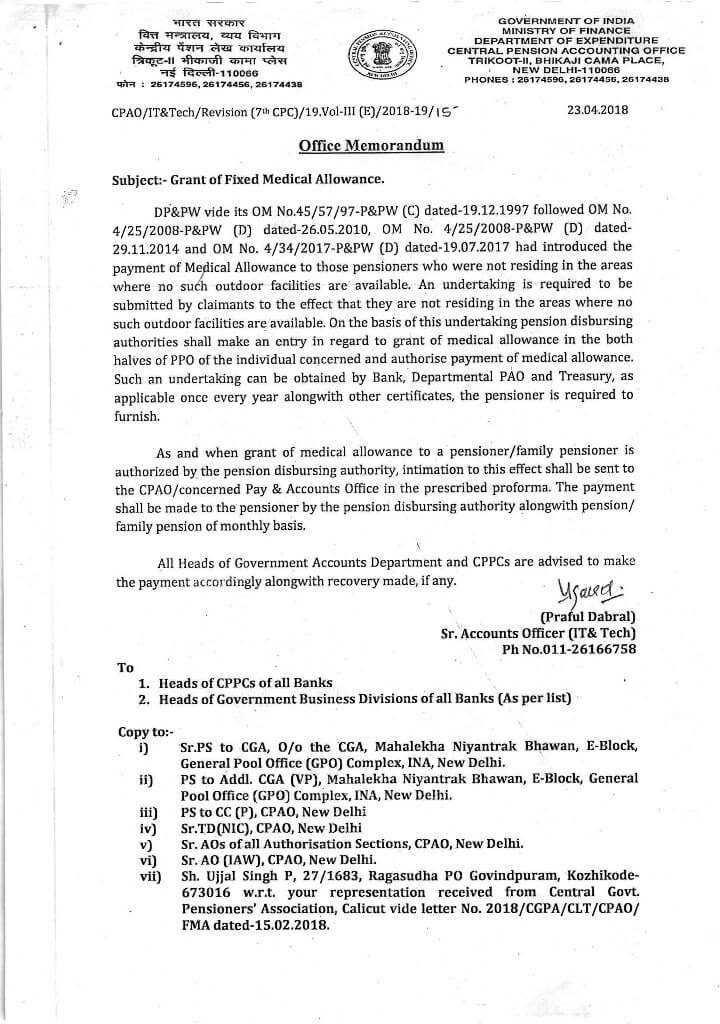

GOVERNMENT OF INDIA

MINISTRY OF FINANCE

DEPARTMENT OF EXPENDITURE

CENTRAL PENSION ACCOUNTING OFFICE

TRIKOOT-II, BHIKAJI CAMA PLACE,

NEW DELHI-110066

CPAO/IT&Tech/Revision (7th CPC)/19.Vol-III (B)/2018-19/15

23.04.2018

Office Memorandum

Subject:- Grant of Fixed Medical Allowance.

DOP&PW vide its OM No.45/57/97-P&PW(C) dated-19.12.1997 followed OM No. 4/25/2008-P&PW (D) dated-26.05.2010, OM No. 4/25/2008-P&PW (D) dated 29.11.2014 and OM No. 4/34/2017-P&PW (D) dated-19.07.2017 had introduced the payment of Medical Allowance to those pensioners who were not residing in the areas where no such outdoor facilities are available. An undertaking is required to be submitted by claimants to the effect that they are not residing in the areas where no such outdoor facilities are available. On the basis of this undertaking pension disbursing authorities shall make an entry in regard to grant of medical allowance in the both halves of PPO of the individual concerned and authorise payment of medical allowance. Such an undertaking can be obtained by Bank,Departmental PAO and Treasury, as applicable once every year alongwith other certificates, the pensioner is required to furnish.

As and when grant of medical allowance to a pensioner/family pensioner is authorized by the pension disbursing authority, intimation to this effect shall be sent to the CPAO/concerned Pay & Accounts Office in the prescribed proforma. The payment shall be made to the pensioner by the pension disbursing authority alongwith pension/ family pension of monthly basis.

All Heads of Government Accounts Department and CPPCs are advised to make the payment accordingly alongwith recovery made, if any.

(Praful Dabral)

Sr. Accounts Officer (lT& Tech)

[http://cpao.nic.in/pdf/Grant_fixed_Medical_allowance.pdf]

COMMENTS

Choosing medical service is right to life under Art 21 of the Constitution.Denaying Fixed Medical Allowance(FMA) to those who are residing with in 2.5 km from a departmental medical services, though it is not availed but go to such medical services a person has confidence. A person should not closed for alternative toThe departmental medical service only because he resides within 2.5 kms from such a departmental facility. This ruling is only an executive fiat not supported by any statute, while in catena of cases Hon’ble SC and HCs held that any executive fiat be supported by a statute. Further there is no certifying Authority to confirm whether a person is residing or not within 2.5 kms from such facility and further it may vary from time to time due road rules pf. One way etc. As such this being ultra votes Art 14 and 21 of the Constitution, allyhose who do not opt for departmental medical services irrespective of the distance of their residence, be not be deneyed FMA is paid to those who is residing beyond 2.5 kms and such aged pensioners be paid FMA to uphold the basic law of Justice,equity and fair play