Ceilings in respect of office expenditure on hospitality after abolition of Sumptuary Allowance & Entertainment Allowance by 7th CPC

F .No. 13024/01/2016-Trg. Ref

Ministry of Personnel, Public Grievances and Pensions

Department of Personnel and Training

Training Division

Block-4, Old JNU Campus

New Mehrauli Road, New Delhi-67

Dated: October 24th, 2017

OFFICE MEMORANDUM

Subject- Ceilings in respect of Office Expenditure on hospitality – reg.

Consequent upon acceptance of the recommendations of the 7th Central Pay Commission (CPC) by the Government, Sumptuary allowance and Entertainment allowance have been abolished with effect from 30.06.2017. As per Resolution of the Government dated 06.07.2017, such expenditure on hospitality should be treated as office expenditure and the Ministry of Finance was to lay down the ceilings for various levels. Ministry of Finance, Department of Expenditure vide their OM No.11-1/2016/E.II B (7th CPC)Pt.III(C) dated 22nd September, 2017 has conveyed the ceiling of office expenditure on hospitality.

2. The ceiling of office expenditure on hospitality with regard to training establishments will be in accordance with D/o Expenditure’s OM dated 22nd September, 2017 (copy enclosed).

3. The prescribed ceilings will be effective from 22nd September, 2017.

sd/-

(Biswajit Banerjee)

Under Secretary to the Government of India

No.11-1/2016/E.II B(7th CPC)/Pt.III(C)

GOVERNMENT OF INDIA

MINISTRY OF FINANCE

Department of Expenditure

(7th CPC matters)

North Block, New Delhi

Dated: 22.09.2017

OFFICE MEMORANDUM

Subject: Ceilings in respect of Office Expenditure on hospitality- regarding.

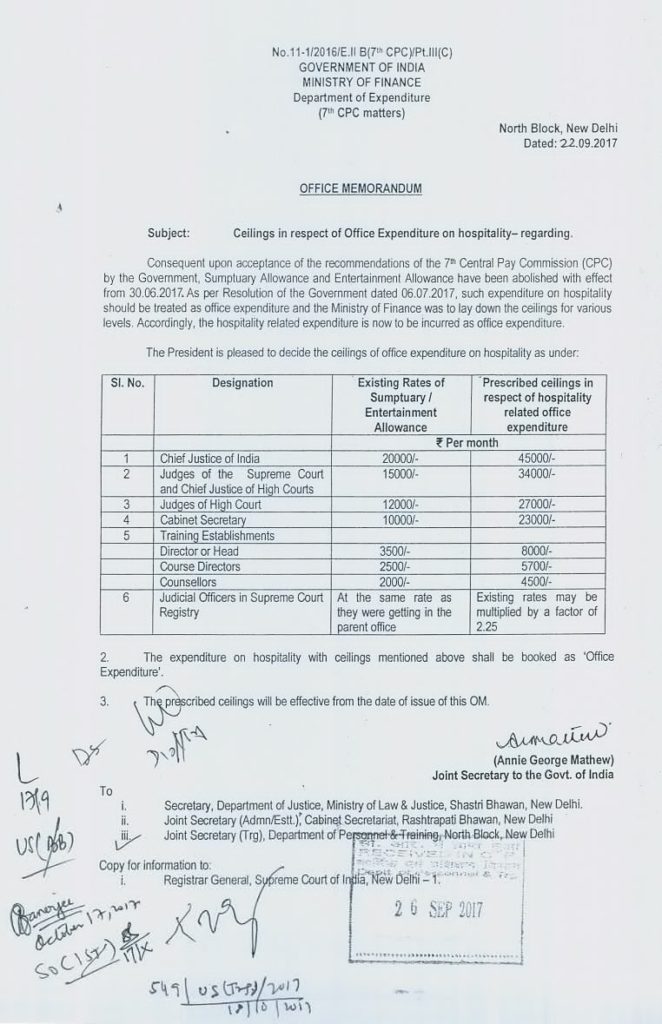

Consequent upon acceptance of the recommendations of the 7th Central Pay Commission (CPC) by the Government, Sumptuary Allowance and Entertainment Allowance have been abolished with effect from 30.06.2017. As per Resolution of the Government dated 06.07.2017, such expenditure on hospitality should be treated as office expenditure and the Ministry of Finance was to lay down the ceilings for various levels. Accordingly, the hospitality related expenditure is now to be incurred as office expenditure.

The President is pleased to decide the ceilings of office expenditure on hospitality as under:

| Sl. No. | Designation | Existing Rates of Sumptuary/ Entertainment Allowance |

Prescribed ceilings in respect of hospitality related office expenditure |

| ₹ Per month | |||

| 1 | Chief Justice of India | 20000/- | 45000/- |

| 2 | Judges of the Supreme Court and Chief Justice of High Courts |

15000/- | 34000/- |

| 3 | Judges of High Court | 12000/- | 27000/- |

| 4 | Cabinet Secretary | 10000/- | 23000/- |

| 5 | Training Establishments | ||

| Director or Head | 3500/- | 8000/- | |

| Course Directors | 2500/- | 5700/- | |

| Counsellors | 2000/- | 4500/- | |

| 6 | Judicial Officers in Supreme Court Registry | At the same rate as they were getting in the parent office |

Existing rates may be multiplied by a factor of 2.25 |

2. The expenditure on hospitality with ceilings mentioned above shall be booked as “Office Expenditure’.

3. Prescribed ceilings will be effective from the date of issue of this OM.

Sd/-

(Annie George Mathew)

Joint Secretary to the Govt. of India

COMMENTS