7th CPC Allowance Order: Dress Allowance – w.e.f. 01.07.17 – once with salary in July – will go up by 25% each time DA rises by 50%, No uniform will provided henceforth

No.19051/1/2017-E.IV

Government of India

Ministry of Finance

Department of Expenditure

New Delhi, the 2nd August 2017

OFFICE MEMORANDUM

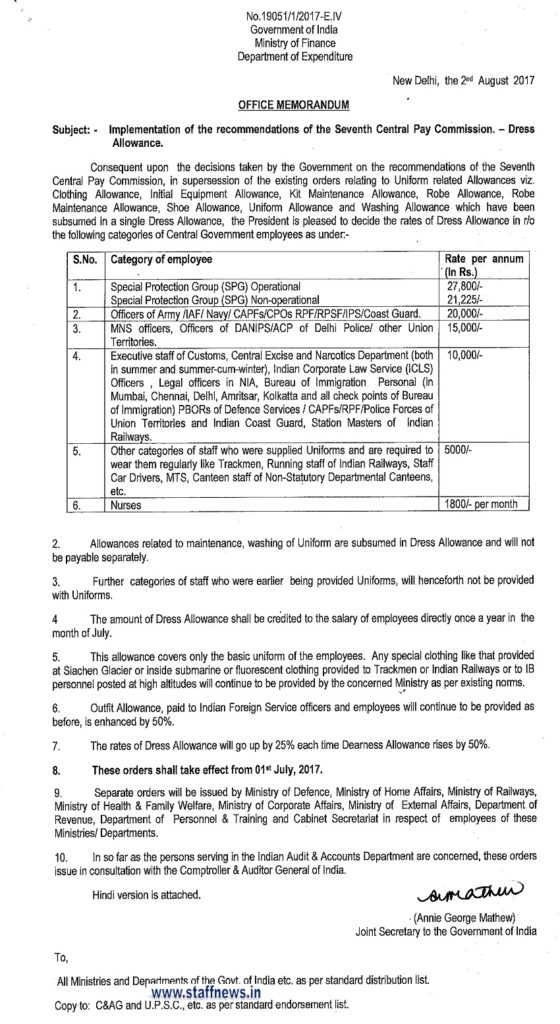

Subject: – Implementation of the recommendations of the Seventh Central Pay Commission. — Dress Allowance.

Consequent upon the decisions taken by the Government on the recommendations of the Seventh Central Pay Commission, in super session of the existing orders relating to Uniform related Allowances viz. Clothing Allowance, Initial Equipment Allowance, Kit Maintenance Allowance, Robe Allowance, Robe Maintenance Allowance, Shoe Allowance, Uniform Allowance and Washing Allowance which have been subsumed in a single Dress Allowance, the President is pleased to decide the rates of Dress Allowance in r/o the following categories of Central Government employees as under:-

| S.No. | Category of employee | Rate per annum (in Rs.) |

| 1. | Special Protection Group (SPG) Operational |

27,800/- |

| Special Protection Group (SPG) Non-operational |

21,225/- | |

| 2. | Officers of Army /IAF/ Navy/CAPFs/CPOs RPF/RPSF/IPS/Coast Guard. |

20,000/- |

| 3. | MNS officers, Officers of DANIPS/ACP of Delhi Police/other Union Territories. |

15,000/- |

| 4. | Executive staff of Customs, Central Excise and Narcotics Department (both in summer and summer-cum-winter), Indian Corporate Law Service (ICLS) Officers, Legal officers in NIA, Bureau of Immigration Personal (in Mumbai, Chennai, Delhi, Amritsar, Kolkatta and all check points of Bureau of Immigration) PBORs of Defence Services CAPFs/PF/Police Forces of Union Territories and Indian Coast Guard, Station Masters of Indian Railways. |

10,000/- |

| 5. | Other categories of staff who were supplied Uniforms and are required to wear them regularly like Trackmen, Running staff of Indian Railways, Staff Car Drivers, MTS, Canteen staff of Non-Statutory Departmental Canteens, etc. |

5,000/- |

| 6. | Nurses | 1,800/- per month |

2.Allowances related to maintenance, washing of Uniform are subsumed in. Dress Allowance and will not be payable separately.

3.Further categories of staff who were earlier being provided Uniforms, will henceforth not be provided with Uniforms.

4 The amount of Dress Allowance shall be credited to the salary of employees directly once a year in the month of July.

5.This allowance covers only the basic uniform of the employees. Any special clothing like that provided at Siachen Glacier or inside submarine or fluorescent clothing provided to Trackmen or Indian Railways or to IB personnel posted at high altitudes will continue to be provided by the concerned Ministry as per existing norms.

6.Outfit Allowance, paid to Indian Foreign Service officers and employees will continue to be provided as before, is enhanced by 50%.

7.The rates of Dress Allowance will go up by 25% each time Dearness Allowance rises by 50%.

8.These orders shall take effect from 01st July, 2017.

9. Separate orders will be issued by Ministry of Defence, Ministry of Home Affairs, Ministry of Railways, Ministry of Health & Family Welfare, Ministry of Corporate Affairs, Ministry of External Affairs, Department of Revenue, Department of Personnel & Training and Cabinet Secretariat in respect of employees of these

Ministries/ Departments.

10. In so far as the persons serving in the Indian Audit & Accounts Department are concerned, these orders

issue in consultation with the Comptroller & Auditor General of India.

Hindi version is attached.

sd/-

(Annie George Mathew):

Joint Secretary to the Government of India

Source: [www.doe.gov.in download pdf ]

COMMENTS

Dress Allowance Rs. 10000/- are also entitled for group "D" officers now they are claiming as Group "C" Non Gazetted & Non Ministerial executive officer. Because in the dress allowance order this category names are not mentioned. So, kindly inform to me with DOPT order

whether bill of uniform allowance is prepared or not

Dress allowance for f.y.2017-18 that was payable for month of July,2017,was paid on October,2017 and has been subsequently deducted from salary on Feb,2018 citing that the dress allowance is to be paid after one year is completed only. Can anyone tell what would be the proper rule?