Revision of Flat rate of Licence Fee for GPRA throughout country: Directorate of Estates OM dt 19.07.2017 – Download the Images of scroll down and Download link of PDF is also available below the last image.

No. 18011/2/2015-Pol.III

Government of India

Ministry of Urban Development

Directorate of Estates

Nirman Bhawan, New Delhi

Dated:19 July, 2017

OFFICE MEMORANDUM

Subject: Revision of flat rate of licence fee for General Pool Residential Accommodation (GPRA) throughout the country.

In terms of the provisions of the Rule 74 of the “Central Government General Pool Residential Accommodation Rules. 2017, the Government has decided to revise the flat rates of licence fee recoverable for the residential accommodation available in General Pool and also in Departmental Pools of Ministries/Departments of the Government of India throughout the Country (except in respect of substandard/unclassified accommodation of Ministry of Defence, accommodation for service personnel of the Ministry of Defence and accommodation under the control of Ministry of Railways), as shown in the Annexure.

2 The revised rates of licence fee would be effective from 1st July, 2017. All Ministries/Departments are requested to take action to recover the revised licence fee in accordance with these orders in respect of accommodation under their control all over the country.

3 This issues with the concurrence of Integrated Finance Wing of the Ministry of Urban Development vide Note dated 6/7/2017.

Sd/-

(Swarnal Banerjee)

Deputy Director of Estates (Policy)

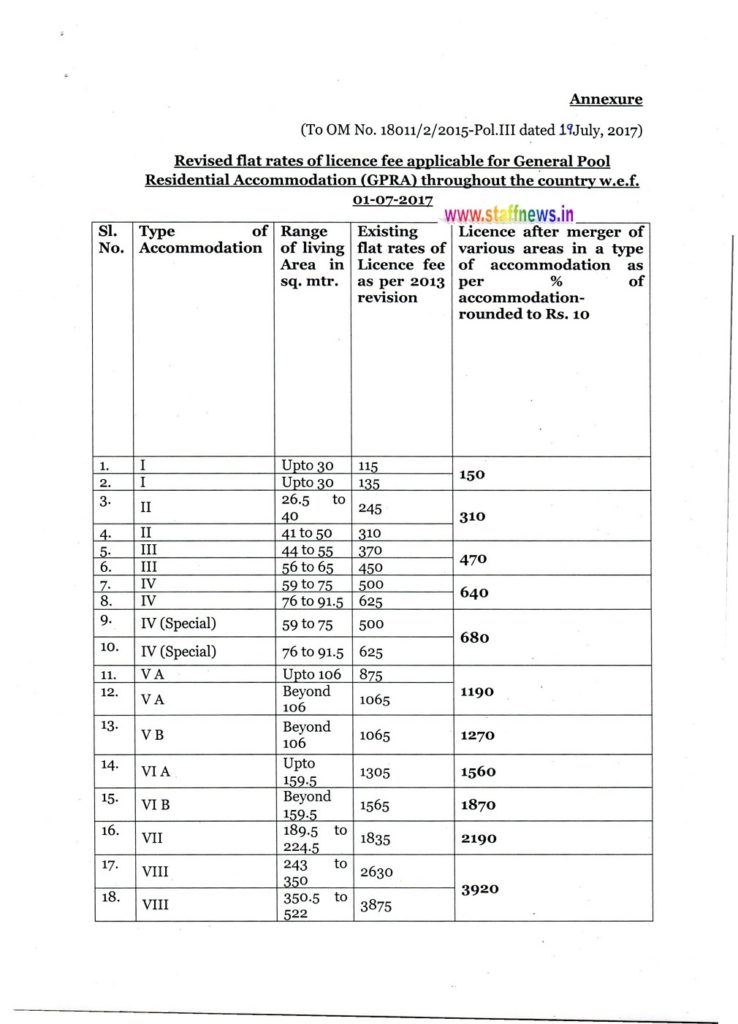

Annexure

(To OM No. 18011/2/2015-Pol.III dated 19 July, 2017)

Revised flat rates of licence fee applicable for General Pool Residential Accommodation (GPRA) throughout the country w.e.f. 01-07-2017

| Sl. No. | Type of Accommodation | Range | Existing flat rates of Licence fee as per 2013 revision | Licence after merger of various areas in a type of accommodation as per % of accommodation- rounded to Rs. 10 |

| 1. | I | Upto 30 | 115 | 150 |

| 2. | I | Upto 30 | 135 | |

| 3. | II | 26.5 to 40 | 245 | 310 |

| 4. | II | 41 to 50 | 310 | |

| 5. | III | 44 to 55 | 370 | 470 |

| 6. | III | 56 to 65 | 450 | |

| 7. | IV | 59 to 75 | 500 | 640 |

| 8. | IV | 76 to 91.5 | 625 | |

| 9. | IV (Special) | 59 to 75 | 500 | 680 |

| 10. | Iv (Special) | 76 to 91.5 | 625 | |

| 11. | V A | Upto 106 | 875 | 1190 |

| 12. | V A | Beyond 106 | 1065 | |

| 13. | V B | Beyond 106 | 1065 | 1270 |

| 14. | VI A | Upto 159.5 | 1305 | 1560 |

| 15 | VI B | Beyond 159.5 | 1565 | 1870 |

| 16 | VII | 189.5 to 224.5 | 1835 | 2190 |

| 17 | VIII | 243 to350 | 2630 | 3920 |

| 18 | VIII | 350.5 to 522 | 3875 |

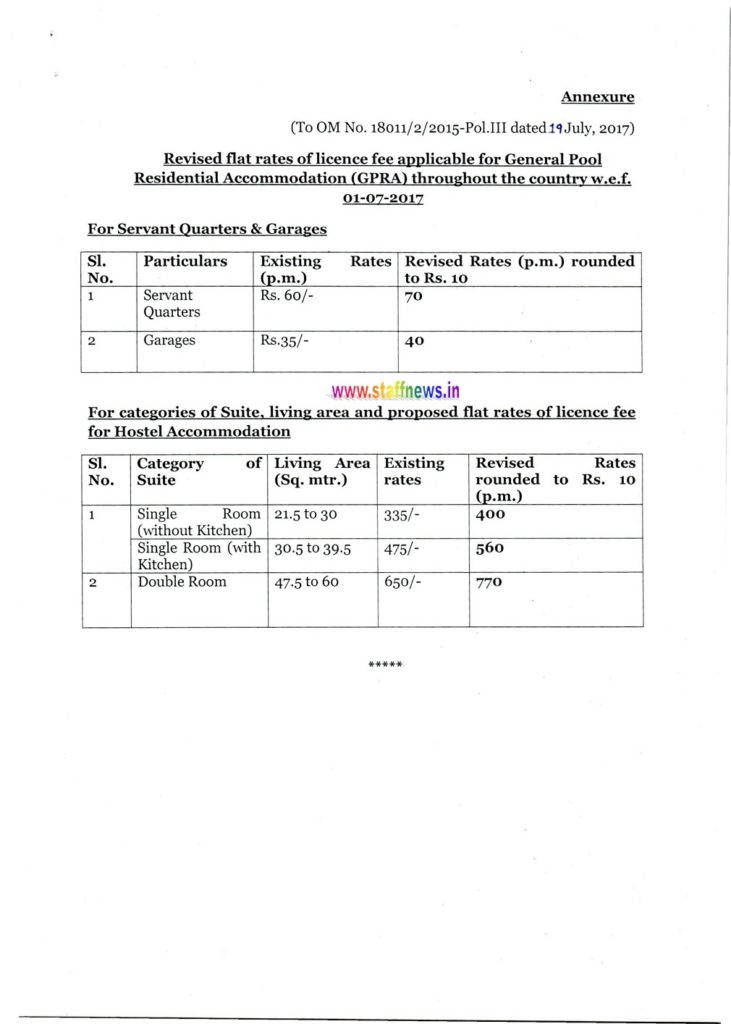

For Servant Quarters & Garages

| Sl. No. | Particulars | Existing Rates (p.m.) | Revised Rates rounded to Rs. 10 (p.m.) |

| 1 | Servant Quarters | Rs. 60/- | 70 |

| 2 | Garages | Rs.35/- | 40 |

For categories of Suite, living area and proposed flat rates of licence fee for Hostel Accommodation

| Sl. No. | Category ofSuite | Living Area (Sq. mtr.) | Existing rates | Revised Rates rounded to Rs.10 (p.m.) |

| 1 | Single Room(without Kitchen) | 21.5 to 30 | 335/- | 400 |

| Single Room (with Kitchen) | 30.5 to 39.5 | 475/- | 560 | |

| 2 | Double Room | 47.5 to 6o | 650/- | 770 |

COMMENTS

INCREMENT:

In order to set right this genuine anomaly, the Government of Tamilnadu has issued an order vide GO No. 311 dated 31.12.2014. As per that order, a Government servant whose increment falls due on the day following superannuation, on completion of one full year of service which are countable for increment under Fundamental Rules may be sanctioned with one notional increment at the prescribed eligible rate, purely for the purpose of pensionery benefits and not for any other purpose.

When Tamil Nadu Govt. could resolve the issue “granting increment” for those Govt Servants served total one year, at least notional increment for the purpose of pensionery benefits, why the Central Govt. (Model Employer) hesitating to implement the same. Hence, Govt. of India also shall sanction the same to their employees who worked for total one year, it should be resolved with out any further loss of time.

jvsrkrishna

9441903448

jvsrkrishna@gmail.com