7th CPC – Instructions on Notional Fixation for revision of pension of pre-2016 pensioners/ family pensioners

Office of the Controller General of Defence Accounts

No. AT/II/ 2701/ Orders

Dated: 07 June 2017

To

All PCsDA/CsDA/PCA(Fys)/CFA(Fys)

Subject: Implementation of Government’s decision on the recommendations of the 7th CPC- Revision of pension of pre-2016 pensioners/ family pensioners, etc.

Copy of Ministry of Personnel, PG & Pensions, Department of Pension & Pensioners’ Welfare OM No 38/37/2016-P&PW (A) dated 12-05-2017 containing Central Government decision for revision of pension of pre-2016 pensioners/family pensioners in accordance with first formulation recommended by the 7th CPC is forwarded herewith for information and necessary action.

2. As per para 4 of DOPP&W ibid OM, the pension/family pension w.e.f. 01-01-2016 in respect of all pensioners/family pensioners, who retired/died prior to 01-01-2016, may be revised by notionally fixing their pay in the pay matrix recommended by the 7th CPC in the level corresponding to the pay in the pay scale/pay band an grade pay at which they retired/ died. This will be done by notional pay fixation under each intervening Pay Commission based on the formula for revision of pay. While fixing pay on notional basis, the pay fixation formulae approved by the Government and other relevant instructions on the subject in force at the relevant time shall be strictly followed. As per first formulation recommended by 7th CPC and accepted by the Government the revised pension/family pension w.e.f. 01-01-2016 shall be calculated based on this notionally revised pay.

3. In this regard reference is also invited to DOPP&W OM No 45/86/97-P&PW (A) (iii) dated 10-02-1998 issuing instructions for revision of pension/family pension in respect of Government servants who retired/ died before 01-01-1986, by notional fixation of their pay in the scale of pay introduced w.e.f. 01-01-1986. For the purpose of calculation of notional pay w.e.f. 01-01-2016 of those Government servants who retired or died before 01-01-1986, the pay scale and notional pay as on 01-01-1986, as arrived at in terms of the instructions issued vide DOPP&W OM No 45/86/97-P&PW (A) (iii) dated 10-02-1998, will be treated as the pay scale and the pay of the concerned Government servant as on 01-01-1986. In the case of those Government servants who retired or died on or after 01-01-1986 but before 01-01-2016, the actual pay and the pay scale from which they retired or died would be taken into consideration for the purpose of calculation of the notional pay as on 01-01-2016 in accordance with para 2 above.

4. For the purpose of revision of pension /family pension as elaborated above in terms of Department of Pension & Pensioners’ Welfare OM No 38/37/2016-P&PW (A) dated 12-05-2017, revised LPC-cum-data sheet audited by the last Pay & Accounts Office of the concerned Government servant would have to be forwarded to PCDA (P) Allahabad by the concerned unit/formation. Accordingly, any subsidiary instructions to meet the audit requirements in connection with the submission of requisite documents for the approval of revised LPC may please be issued to the units and formations through Command/Area Headquarters. The implementation instructions in this regard are also being finalized by PCDA (P) and will be circulated to all Heads of Offices shortly.

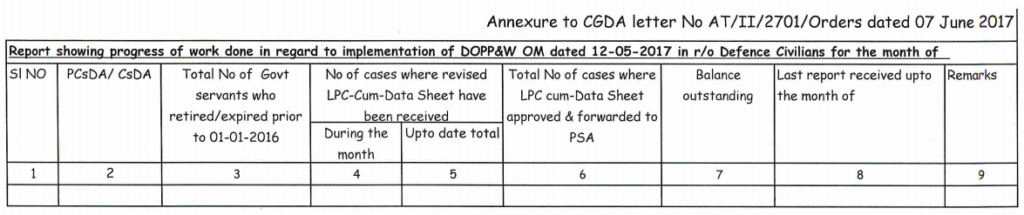

5. To have an effective monitoring of the notional revision of pay as on 01-01-2016 in terms of DOPP&W OM No 38/37/2016-P&PW (A) dated 12-05-2017 and approval of revised LPC-cum-datasheet for forwarding to PCDA (P) Allahabad, it is requested that a monthly report in the format enclosed may please be forwarded to HQrs Office. The first report on this account showing the position as on 30-06-2017 may please be submitted to reach HQrs office by 07th July 2017.

Please acknowledge receipt.

This issues with the approval of Addl CGDA (P&W).

sd/-

(Puskal Upadhyay)

Jt CGDA (P&W)

Source: www.cgda.nic.in

[http://cgda.nic.in/audit/circulars/AT_II_8617.pdf]

COMMENTS

Any pensioner who retiired as SE, CPWD (and equivalent post in CE Services)at any time has to be fixed in Matrix Table 13 for his pension as this post carries the scale of Rs. 14300/- to Rs. 18300/- in terms of 5th CPC. He has in addition to get the advantage of increments earned in the POST.

GS Oberoi, President, AIAROSI, Noida (UP).

The Full Parity implies that a pensioner must get pension according to the Matrix Table applicable to the upgrade scale.

The Last Pay Drawn and the Scale of Pay at the time of retirement cannot be used for determination of pension as on 1.1.2016, if pensioner's POST was upgraded after his retirement.

Any Third option for pensioners must NOT result in less pension than Full pension admissible under Option 1 recommended by the 7th CPC. The Sacrosanct Principle of Full Parity recommended and already accepted by the Gov't, w.e.f. 1.1.2016, through their Resolution of August 2016 must be fully honoured. BPS and other Pensioners' Associations should bring this matter to the personal notice of Hon'ble PM to avoid getting Justice through courts. The community of Pensioners is feeling completely let down by the Gov't.

GS Oberoi, President, All India Association of Retired Officers of Survey of India(AIAROSI), Noida(UP). Affiliated to BPS No. A-3345.

I had given my comments, sometime back. When will these appear?

Gurbaksh Singh Oberoi, Noida(UP).