Implementation of 7th Pay Commission: Method of Pay Fixation & Drawal of Arrears – Instructions by CGDA

Office of the Controller General of Defence Accounts

Ulan Batar Road, Palam, Delhi Cantt-110010

No. AT/II/2701/Orders

Dated: 10 Aug 2016

To

All PCsDA/CsDA/PCA (Fys)/CFA (Fys)

Subject: Government Notification of 7th Central Pay Commission Recommendations – CCS (RP) Rules, 2016.

Copies of MoF, Department of Expenditure Resolution dated 25-07-2016 containing Central Govt. decision on the 7th CPC Report, the CCS (RP) Rules 2016 notified vide GSR No 721 (E) dated 25-07-2016 (MoF, Department of Expenditure F. No 1-2/2016-IC dated 25-07-2016) and MoF, Department of Expenditure No 1-5/2016-IC dated 29-07-2016 are available on the of website of the Ministry of Finance (http://finmin/nic.in) and may be downloaded for information and necessary action. CDS (RP) Rules 2016 is under issue by the Ministry of Defence and will be circulated on receipt.

2. As per Rule 6 of the CCS (RP) Rules 2016, Govt servants are required to exercise their option for drawal of pay in the revised pay structure in the format prescribed in the Rules. PCsDA/CsDA are requested to advise the units/formations to obtain option under the relevant rules from the employees before the salary bill for August 2016 in the revised pay structure is submitted.

3. The method of fixation of pay in the revised pay structure has been explained in para 7 of MoF OM No 1-2/2016-IC dated 25-07-2016 and the same may be referred for fixation in the revised pay structure as on 01-01-2016.

4. In cases of up gradation of posts, fixation of pay will be done as prescribed in Rule 7 (2) of CCS (RP) Rules 2016.

5. As per Para 2 of the MoF (Department of Expenditure) OM dated 29-07-2016 appropriate necessary action to fix the pay of the employees covered under CCS (RP) Rules 2016 needs to be carried out; for this purpose the statement of fixation of pay in revised pay structure as per CCS (RP) Rules 2016 is to be prepared in triplicate. Further as per Para 7 of MoF ibid OM the arrears accruing on account of revised pay w.e.f 01.01.2016 is to be paid cash in one installment along with payment of Salary for the month of August, 2016, after making necessary adjustment on account of GPF and NPS with reference to the revised basic pay.

6. As per para 8 of MoF (Department of Expenditure) OM dated 29-07-2016 arrear claims may be paid without pre-check of the fixation of pay in the revised scales of pay. The facility for making payment of arrear claims without pre-Check will not, however, be available in respect of those Govt servants who have relinquished service on account of dismissal, resignation, discharge, retirement etc., after the date of implementation of pay Commissions recommendations but before the preparation and drawal of the arrears clam as well as in respect of employees who had expired prior to exercising option for the drawal of pay in the revised scale. The statement of fixation of pay in the prescribed proformae is subject to post audit. However, DDOs should obtain undertaking in writing from every employee as prescribed as per the ‘Form of Option’ under Rule 6 (2) of the CCS (RP) Rules 2016 at the time of exercise option under Rule 6 (1) thereof.

7. Further while authorizing the arrears, Income Tax on arrears ad due may also be deducted and credited to Government in accordance with the instructions on the subject.

8. The fixation of pay in respect of Defence Civilians transferred from one audit area to another on or after 1.1.2016 will be initiated by the Units/formations in which the individual is serving at present and should be dealt with by the PCsDA/CsDA, in whose audit jurisdiction they are located. As far as the payment of arrears is concerned, the procedure laid down in MoF (Department of Economic Affairs) OM No F.10 (49)/B/73 dated 7.1.1974 (reproduced in CPRO 61/74) ( Copy enclosed as Annexure ‘A’ for ready reference) should be followed.

9. Any subsidiary instructions to meet the audit requirements in connection with the submission of pay Fixation proformae, arrears claims etc may please be issued to the units and formations through command/area headquarters.

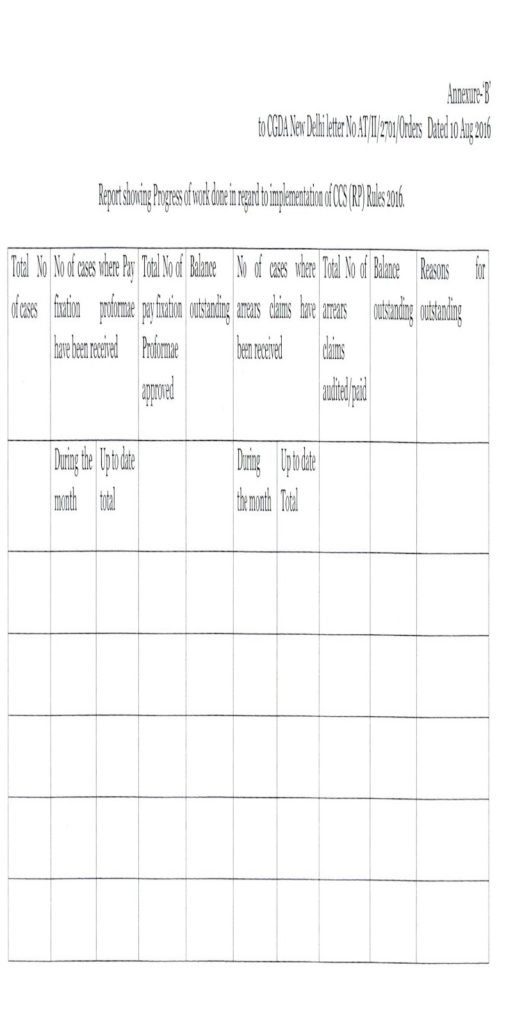

10. It is also of equal importance to ensure the completion of post audit within a period of 3 months so that provisional payments in the revised scales are not made for unduly long period. This fact of completion of post-audit and adjustment of any overpayments as a result thereof may also be endorsed on the relevant pay bills/arrear claims. The work relating to post audit of fixation of pay/ arrear claims should be monitored at PCsDA/CsDA level by instituting suitable reporting system for watching the progress of work. It is requested that a Monthly Report in a proformae at Annexure “B” to this letter showing the progress of work related to post audit of fixation of pay and payment of arrears claims both in respect of industrial and Non-industrial employee may please be furnished to Headquarters office so as to reach by 15th of every month. Suitable instructions to the sub-offices may be issued by the PCsDA/CsDA for obtaining progress of work in this regard, to be included in their report to HQrs office. The first report on this account showing the position as on 31-08-2016 may be submitted to reach HQrs office by 15th September 2016. It should be ensured that all out efforts are made at all levels to ensure prompt clearance to avoid complaints in this regard.

11. According to Rule 17 of CCS (RP) Rules 2016 if any question arises relating to the interpretation of any of the provisions of these Rules, the same should be referred to the Central Government for decision. Therefore, any point for clarification should be carefully examined in PCSDA/CsDA level. It is enjoined upon all the functionaries that references on this account should be attended to on a top priority basis. The Administrative Authorities may please be kept informed of such references to HQrs office. In the meanwhile the case should be regulated as the Rule stands.

Please acknowledge receipt.

(Vinod Anand)

Sr.ACGDA (P&W)

Annexure-B

APPendix to CPRO 61/74

Copy of Govt of India, MoD OM No.1(1)74/D (Civ-I) dated 18.4.1974.

PROCEEDURE FOR PAYMENT OF ARREARS OF PAY AND ALLOWANCES ETC OF A GOVT SERVANT TRANSFERRED FROM ONE DIVISION/OFFICE/DEPARTMENT TO ANOTHER IN RESPECT OF WHOM A LAST PAY CERTIFICATE HAS BEEN ISSUED – REGARDING.

The undersigned is directed to state that it has been brought to the notice of this Ministry that the practice obtaining for the payment of arrears of pay and allowances etc of a Govt servant transferred from one Division/Office/Department to another and in respect of whom a last pay certificate has been issued varies from office to office and that no uniform procedure is being followed in this regard. The questioon of evolving a uniform procedure has been under consideration of this Ministry for some time past. It has now been decided in consultation with the comptroller and Auditor General of India that the following procedure may be adopted by all the offices in the matter of drawing the arrears claims of the Government servants who are working under their control.

2. The drawing and disbursing officer of the office in which the Government Servant is currently working may prepare a “Due and Drawn Statement” in respect of arrears of pay and allowances of such a Government servant and send it to his earlier office(s)/Parent office as the case may be for verification of the claim. The latter office may check these statements make entries in their record (i.e. in the office copies of the bills) and return to the concerned drawing officer with a certificate that the arrears relating to the Government servant have been noted in the relevant office copies of the bills. On receipt of the “Due and Drawn Statement” duly vetted by the earlier/parent office, the drawing and disbursing officer may prepare the arrears bills of the Government servant in the proper form, record the necessary certificate as required under the rules and draw the bills from the treasury and disburse the arrears to him on proper acquittance. The expenditure in this behalf may be debited to the budget provision of his office.

3. In the case of Govt servants working in Civil Deptts/Railways/P&T and other Government servants transferred to Deptts paid from Defence services Estimates and vice-versa, the procedure referred to in Para 2 above is further modified to the extent that while accepting the “Due and Drawn Statement” of arrear claims, the concerned office should also accept the debit thereof, record the classification and return it to the Drawing and Disbursing Officer of the office in which the Govt servant is currently working for drawal of arrears and payment to him.

4. This OM issues with the concurrence of Ministry of Finance (Defence) vide their UO No 972/PB of 1974.

(Based on the Ministry of Finance, Department of Economic Affairs OM No F 10(49)/E/73 dated 7 January 1974.

Annexure – B

to CGDA New Delhi letter No At/II/2701/Orders Dated 10 Aug 2016

Report showing progress of work done in regard to implementation of CCS(RP) Rules 2016 (Click on image)

Source/View/Download: Click here www.cgda.nic.in

COMMENTS

I retired from Railways after 38 years of service in the scale of 2000-3200 attained after the 30 years of service, but while emerging scales of two lower scales into our scale, this scale was not considered to be upgraded in the next higher scale, resulting in GP of Rs. 4200 till today along with the other juniors emerged getting GP of 4200. Is it not High-handedness on the part of 6th Pay Commission ignoring the deserved elderly persons?

I am working in Ministry of Defence (DGQA)Orgh. as PA and after complition of 30 yrs service I got GP 4800 in the yr 2009 but i have not consider next GP 5400 but Min. of Fin. (Deptt of Expd.) issued the OM11-5/2016-JC dt.29-7-16 & 1 Aug 16 Signed by Gurdeep Singh, Under Secretary that After completion of 4 years Service Next GP will be consider at the time of fixation pl.forward the same DGQA Deptt. Hastings, Kolkata