NOTIFICATION

with the Comptroller and Auditor General in relation to persons serving in the Indian Audit and Accounts Department, the President hereby makes the

following rules, namely :-

(1)

These rules may be called the Central Civil Services (Revised Pay) Rules, 2016.

(2)

They shall be deemed to have come into force on the 1st day of January,

(1)

Save as otherwise provided by or under these rules, these rules shall apply to persons appointed to civil services and posts in connection with the

affairs of the Union whose pay is debitable to the Civil Estimates as also to persons serving in the Indian Audit and Accounts Department.

These rules shall not apply to –

(i)

persons appointed to the Central Civil Services and posts in Group ‘A’, ’B’ and ’C’, under the administrative control of the Administrator of

the Union Territory of Chandigarh;

(ii)

persons locally recruited for services in Diplomatic, Consular or other Indian establishments in foreign countries;

(iii)

persons not in whole-time employment;

(iv)

persons paid out of contingencies;

(v)

persons paid otherwise than on a monthly basis including those paid only on a piece rate basis;

(vi)

persons employed on contract except where the contract provides otherwise;

(vii)

persons re-employed in Government service after retirement;

(viii)

any other class or category of persons whom the President may, by order, specifically exclude from the operation of all or any of the

provisions contained in these rules.

3. Definitions —In these rules, unless the context otherwise requires,-

(i)

“existing basic pay” means pay drawn in the prescribed existing Pay Band and Grade Pay or Pay in the existing scale;

(ii)

“existing Pay Band and Grade Pay” in relation to a Government servant means the Pay Band and the Grade Pay applicable to the post held by the

Government servant as on the date immediately before the notification of these rules whether in a substantive capacity or in officiating capacity;

(iii)

“existing scale” in relation to a Government servant means the pay scale applicable to the post held by the Government servant as on the date

immediately before the notification of these rules in the Higher Administrative Grade, Higher Administrative Grade+, Apex scale and that applicable to

Cabinet Secretary whether in a substantive or officiating capacity;

(iv)

“existing pay structure ” in relation to a Government servant means the present system of Pay Band and Grade Pay or the Pay Scale applicable to the

post held by the Government servant as on the date immediately before the coming into force of these rules whether in a substantive or officiating

capacity.

1st day of January, 2016 was on deputation out of India or on leave or on foreign service, or who would have on that date officiated in one or more lower

posts but for his officiating in a higher post, shall mean such basic pay, Pay Band and Grade Pay or scale in relation to the post which he would have held

but for his being on deputation out of India or on leave or on foreign service or officiating in higher post, as the case may be;

(v)

“existing emoluments” mean the sum of (i) existing basic pay and (ii) existing dearness allowance at index average as on 1st day of January, 2006;

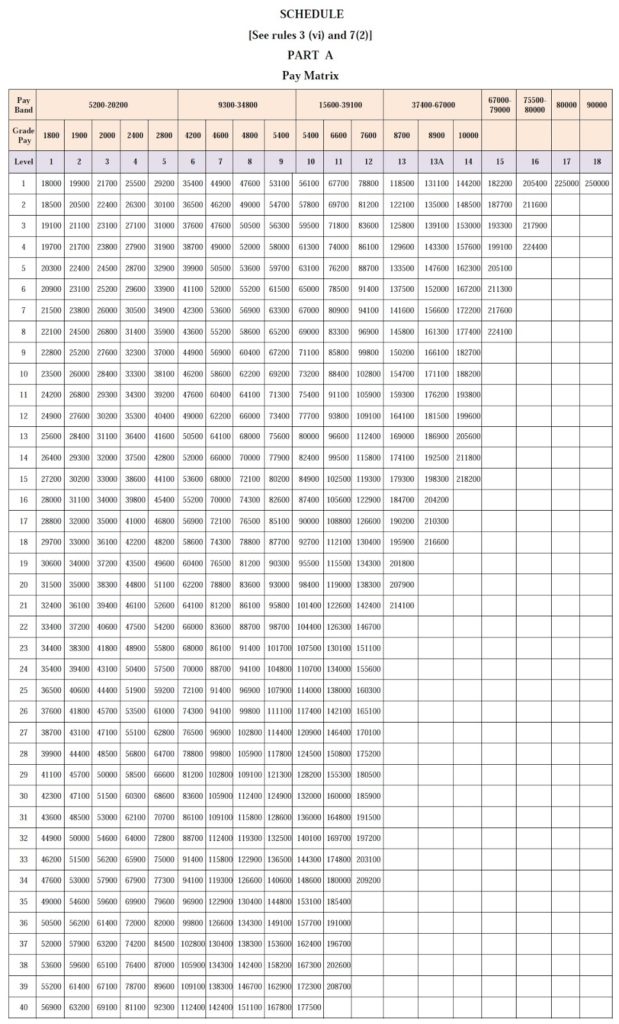

(vi)

“Pay Matrix” means Matrix specified in Part A of the Schedule, with Levels of pay arranged in vertical cells as assigned to corresponding existing Pay

Band and Grade Pay or scale;

(vii)

“Level” in the Pay Matrix shall mean the Level corresponding to the existing Pay Band and Grade Pay or scale specified in Part A of the Schedule;

(viii)

“pay in the Level” means pay drawn in the appropriate Cell of the Level as specified in Part A of the Schedule;

(ix)

“revised pay structure” in relation to a post means the Pay Matrix and the Levels specified therein corresponding to the existing Pay Band and Grade

Pay or scale of the post unless a different revised Level is notified separately for that post;

(x)

“basic pay” in the revised pay structure means the pay drawn in the prescribed Level in the Pay Matrix;

(xi)

“revised emoluments” means the pay in the Level of a Government servant in the revised pay structure; and

(xii)

“Schedule” means a schedule appended to these rules.

4.

Level of posts.– The Level of posts shall be determined in accordance with the various Levels as assigned to the corresponding existing Pay Band and

Grade Pay or scale as specified in the Pay Matrix.

5.

Drawal of pay in the revised pay structure.– Save as otherwise provided in these rules, a Government servant shall draw pay in the Level in the revised

pay structure applicable to the post to which he is appointed:

subsequent increment in the existing pay structure or until he vacates his post or ceases to draw pay in the existing pay structure:

notification of these rules on account of promotion or upgradation, the Government servant may elect to switch over to the revised pay structure from the

date of such promotion or upgradation, as the case may be.

Band and Grade Pay or scale.

another post on or after the 1st day of January, 2016, and he shall be allowed pay only in the revised pay structure.

in an officiating capacity on a regular basis for the purpose of regulation of pay in that pay structure under Fundamental Rule 22, or under any other rule

or order applicable to that post, his substantive pay shall be substantive pay which he would have drawn had he retained the existing pay structure in

respect of the permanent post on which he holds a lien or would have held a lien had his lien not been suspended or the pay of the officiating post which

has acquired the character of substantive pay in accordance with any order for the time being in force, whichever is higher.

6. Exercise of option – 7th CPC Revised Pay Rules, 2016 [click to view]

7. Fixation of pay with illustration in 7th CPC – Revised Pay Rules, 2016 [click to view]

8. Fixation of pay of employees appointed by direct recruitment on or after 1st day of January, 2016. [click to view]

9. Increments in Pay Matrix. [click to view]

10. Date of next increment in revised pay structure. [click to view]

Revision of pay from a date subsequent to 1st day of January, 2016.—Where a Government servant who continues to draw his pay in the existing pay structure is brought over to the revised pay structure from a date later than 1st day of January, 2016, his pay in the revised pay structure shall be fixed in the manner prescribed in accordance with clause (A) of sub-rule (1) of rule

7.

Pay protection to officers on Central deputation under Central Staffing Scheme.—If the pay of the officers posted on deputation to the Central Government under Central Staffing Scheme, after fixation in the revised pay structure either under these rules or as per the instructions regulating such fixation of pay on the post to which they are appointed on deputation, happens to be lower than the pay these officers would have been entitled to, had they been in their parent cadre and would have drawn that pay but for the Central deputation, such difference in the pay shall be protected in the form of Personal Pay with effect from the date of notification of these

rules.

13.

Fixation of pay on promotion on or after 1st day of January, 2016. [Click to view]

14. Mode of payment of arrears of pay. [Click to view]

15. Overriding effect of rules.—The provisions of the Fundamental Rules, the Central Civil Services (Revision of Pay) Rules, 1947, the Central Civil Services (Revised Pay) Rules, 1960, the Central Civil Services (Revised Pay) Rules, 1973, the Central Civil Services (Revised Pay) Rules, 1986, the Central Civil Services (Revised Pay) Rules, 1997 and the Central Civil Services (Revised Pay) Rules, 2008 shall not save as otherwise provided in these rules, apply to cases where pay is regulated under these rules, to the extent they are inconsistent with these

16 Power to relax.—Where the President is satisfied that the operation of all or any of the provisions of these rules causes undue hardship in any particular case, he may, by order, dispense with or relax the requirements of that rule to such extent and subject to such conditions as he may consider necessary for dealing with the case in a just and equitable

17. Interpretation. —If any question arises relating to the interpretation of any of the provisions of these rules, it shall be referred to the Central Government for decision.

PART A

Pay Matrix

7th CPC Pay Matrix Level 6 to 9 – 6th CPC PB2 – Revised Pay Rules, 2016 Schedule Part A

7th CPC Pay Matrix Level 10 to 12 – 6th CPC PB3 – Revised Pay Rules, 2016 Schedule Part A

7th CPC Pay Matrix Level 13, 13A & 14 – 6th CPC PB4 – Revised Pay Rules, 2016 Schedule Part A

7th CPC Pay Matrix Level 15 to 18 – 6th CPC HAG – Revised Pay Rules, 2016 Schedule Part A

7th CPC Upgraded levels for Medical, Paramedical & Common Categories

7th CPC Upgraded Levels for Certain Posts in Ministries, Deptt & UT

Memorandum Explanatory to the Central Civil Services (Revised Pay) Rules, 2016

Source-http://www.finmin.nic.in/7cpc/7thCPC_revisedpayrules25072016.pdf

COMMENTS

hello, i was appointed as accountant on 26.05.2016. from what date i will get increment (01.01.2017 or 01.07.2017). I clear the departmental confirmatory exam on 10.06.2017. will i get arrear also.? plzz guide

what is the relevant FR applicable in the case of a cntral government employee tranferring to a lower grade pay from a higher grade pay on account of selection in competitive exam. Will his pay be protected in this case. DOes any body have any idea? FR 15 was relevant for the 6th pay commissione regime. But what rule will be applicable in 7th pay commission.

My macp for grade pay from 2800 to 4200/- granted wef 12/7/16 could I elect to go with existing structure according to rule5 para 3 of CCS RP 2016 on the basis of date of notification I E 25/7/16.

I would like to ask. . For anyone getting a promotion next year. Say in april 17. . . . Will he or she be allowed to file option if thier yearly increment is in july. . . . If they r allowed. . . . . Then why r employees promoted this year between 2nd jan n 30th june not allowed to file option

But all websites and all zonal accounts offices claim that if we file an option to fixation as on 1st jan. . For fixation under 7th cpc. . . Then we will have our next increment as on 1st jan 17

Or they r asking us to file option 2. So that the 7th cpc fixation is done from 1st july 16. . . And since we opt for continuing in 6th cpc. . We will not get arrears. . Though we will get higher basic. . . .

My contention is that we should be allowed to file TWO OPTION FORMS THE FIRST BEING FOR FIXATION AS ON 1ST JAN 16 FOR FIXATION IN 7TH CPC. . AND 2ND FOR FIXATION OF OUR FINANCIAL UPGRADATION FROM APRIL 25TH TO 1ST JULY 16. . . .

we ARE not allowed to file another option form. . .in my case i have had a financial upgradtion on 25th april. Whereby increasing my GRADE PAY FROM. 4800 TO 5400. . . TO FILE ANOTHER OPTION FORM. that my financial upgradation be done after 1st july increment. . . . .

ACTUALLY THE TERM. OPTION AND FIXATION SHOULD NOT HAVE BEEN USED FOR FIXATION FOR 7TH CPC. . WHICH IS CREATING ALL THE CONFUSION. . . . . PLS CHECK OTHER WEBSITE RESPONSES SINCE ALL SAY THAT WE SHOULD FOREGO ARREARS N TAKE HIGHER BASIC. . . . . . BUT IF SOMEONE NEXT YEAR IS GONNA GET PROMOTION THEN HE OR SHE WILL B ALLOWED TO FILE OPTION WHEREAS WE ARE NOT BEING ALLOWED. . . N NO CLARIFICATION ALSO ISSUED. . . . PLS DO ANSWER

first increment will be on 1.7.16.

His next date of increment will be 01.07.2017

Whether an employee whose pay has been fixed in the revised pay structure on 1st January, 2016 will get an increment on 1st July, 2016 since his date of increment in the old pay structure was 1st July?