7th pay commission as regards beyond options pension revision 01.01.2016 – BPS

Both the options recommended by the 7th Commission as regards pension revision vide their para 10.1.67 have been accepted subject to feasibility of their implementation. Option 2 is to be implemented immediately.

In case option one is finally accepted for which ‘Bharat Pensioners Samaj’ is fighting tooth & nail, the pensioner will have the option to choose whichever is more beneficial to him/her

The objection of DOPW &MOD against option 1 is that records may not be available to implement. It is a very poor & illogical argument to deprive pensioners of their legitimate right. Service record of an employee is permanent in nature & cannot be destroyed without specific permission under specific circumstances. In case for any reason if anyone’s service record is missing it can always be reconstructed with the help of PPO, various other records with the departments & with the employee/pensioner. In 100% cases PPOs are available, in 95% cases all other records too are available. Pensioners too are having authentic records required for the purpose.

|

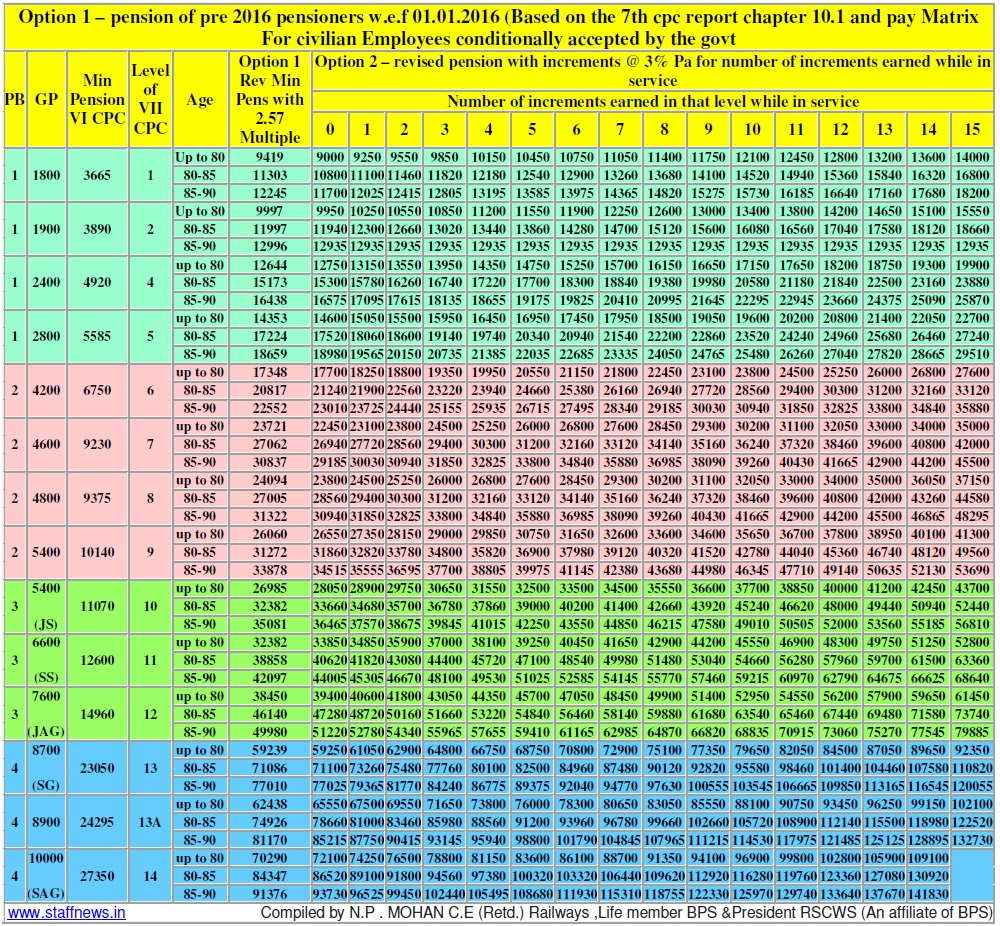

| 7th CPC Pension Table [Click for larger view] |

Option 1 – pension of pre 2016 pensioners w.e.f 01.01.2016 (Based on the 7th cpc report chapter 10.1 and pay Matrix

For civilian Employees conditionally accepted by the govt

PB1

|

PB

|

1

|

1

|

1

|

1

|

||||||||||

|

GP

|

1800

|

1900

|

2400

|

2800

|

||||||||||

|

Min Pension VI CPC

|

3665

|

3890

|

4920

|

5585

|

||||||||||

|

Level of VII CPC

|

1

|

2

|

4

|

5

|

||||||||||

|

Age

|

Up to 80

|

80-85

|

85-90

|

Up to 80

|

80-85

|

85-90

|

up to 80

|

80-85

|

85-90

|

up to 80

|

80-85

|

85-90

|

||

|

Option 1 Rev Min Pens with 2.57 Multiple

|

9419

|

11303

|

12245

|

9997

|

11997

|

12996

|

12644

|

15173

|

16438

|

14353

|

17224

|

18659

|

||

|

Option 2 – revised pension with increments @ 3% Pa for number of increments earned while in service

|

Number of increments earned in that level while in service

|

0

|

9000

|

10800

|

11700

|

9950

|

11940

|

12935

|

12750

|

15300

|

16575

|

14600

|

17520

|

18980

|

|

1

|

9250

|

11100

|

12025

|

10250

|

12300

|

12935

|

13150

|

15780

|

17095

|

15050

|

18060

|

19565

|

||

|

2

|

9550

|

11460

|

12415

|

10550

|

12660

|

12935

|

13550

|

16260

|

17615

|

15500

|

18600

|

20150

|

||

|

3

|

9850

|

11820

|

12805

|

10850

|

13020

|

12935

|

13950

|

16740

|

18135

|

15950

|

19140

|

20735

|

||

|

4

|

10150

|

12180

|

13195

|

11200

|

13440

|

12935

|

14350

|

17220

|

18655

|

16450

|

19740

|

21385

|

||

|

5

|

10450

|

12540

|

13585

|

11550

|

13860

|

12935

|

14750

|

17700

|

19175

|

16950

|

20340

|

22035

|

||

|

6

|

10750

|

12900

|

13975

|

11900

|

14280

|

12935

|

15250

|

18300

|

19825

|

17450

|

20940

|

22685

|

||

|

7

|

11050

|

13260

|

14365

|

12250

|

14700

|

12935

|

15700

|

18840

|

20410

|

17950

|

21540

|

23335

|

||

|

8

|

11400

|

13680

|

14820

|

12600

|

15120

|

12935

|

16150

|

19380

|

20995

|

18500

|

22200

|

24050

|

||

|

9

|

11750

|

14100

|

15275

|

13000

|

15600

|

12935

|

16650

|

19980

|

21645

|

19050

|

22860

|

24765

|

||

|

10

|

12100

|

14520

|

15730

|

13400

|

16080

|

12935

|

17150

|

20580

|

22295

|

19600

|

23520

|

25480

|

||

|

11

|

12450

|

14940

|

16185

|

13800

|

16560

|

12935

|

17650

|

21180

|

22945

|

20200

|

24240

|

26260

|

||

|

12

|

12800

|

15360

|

16640

|

14200

|

17040

|

12935

|

18200

|

21840

|

23660

|

20800

|

24960

|

27040

|

||

|

13

|

13200

|

15840

|

17160

|

14650

|

17580

|

12935

|

18750

|

22500

|

24375

|

21400

|

25680

|

27820

|

||

|

14

|

13600

|

16320

|

17680

|

15100

|

18120

|

12935

|

19300

|

23160

|

25090

|

22050

|

26460

|

28665

|

||

|

15

|

14000

|

16800

|

18200

|

15550

|

18660

|

12935

|

19900

|

23880

|

25870

|

22700

|

27240

|

29510

|

||

PB-2

|

PB

|

2

|

2

|

2

|

2

|

||||||||||

|

GP

|

4200

|

4600

|

4800

|

5400

|

||||||||||

|

Min Pension VI CPC

|

6750

|

9230

|

9375

|

10140

|

||||||||||

|

Level of VII CPC

|

6

|

7

|

8

|

9

|

||||||||||

|

Age

|

up to 80

|

80-85

|

85-90

|

up to 80

|

80-85

|

85-90

|

up to 80

|

80-85

|

85-90

|

up to 80

|

80-85

|

85-90

|

||

|

Option 1 Rev Min Pens with 2.57 Multiple

|

17348

|

20817

|

22552

|

23721

|

27062

|

30837

|

24094

|

27005

|

31322

|

26060

|

31272

|

33878

|

||

|

Option 2 – revised pension with increments @ 3% Pa for number of increments earned while in service

|

Number of increments earned in that level while in service

|

0

|

17700

|

21240

|

23010

|

22450

|

26940

|

29185

|

23800

|

28560

|

30940

|

26550

|

31860

|

34515

|

|

1

|

18250

|

21900

|

23725

|

23100

|

27720

|

30030

|

24500

|

29400

|

31850

|

27350

|

32820

|

35555

|

||

|

2

|

18800

|

22560

|

24440

|

23800

|

28560

|

30940

|

25250

|

30300

|

32825

|

28150

|

33780

|

36595

|

||

|

3

|

19350

|

23220

|

25155

|

24500

|

29400

|

31850

|

26000

|

31200

|

33800

|

29000

|

34800

|

37700

|

||

|

4

|

19950

|

23940

|

25935

|

25250

|

30300

|

32825

|

26800

|

32160

|

34840

|

29850

|

35820

|

38805

|

||

|

5

|

20550

|

24660

|

26715

|

26000

|

31200

|

33800

|

27600

|

33120

|

35880

|

30750

|

36900

|

39975

|

||

|

6

|

21150

|

25380

|

27495

|

26800

|

32160

|

34840

|

28450

|

34140

|

36985

|

31650

|

37980

|

41145

|

||

|

7

|

21800

|

26160

|

28340

|

27600

|

33120

|

35880

|

29300

|

35160

|

38090

|

32600

|

39120

|

42380

|

||

|

8

|

22450

|

26940

|

29185

|

28450

|

34140

|

36985

|

30200

|

36240

|

39260

|

33600

|

40320

|

43680

|

||

|

9

|

23100

|

27720

|

30030

|

29300

|

35160

|

38090

|

31100

|

37320

|

40430

|

34600

|

41520

|

44980

|

||

|

10

|

23800

|

28560

|

30940

|

30200

|

36240

|

39260

|

32050

|

38460

|

41665

|

35650

|

42780

|

46345

|

||

|

11

|

24500

|

29400

|

31850

|

31100

|

37320

|

40430

|

33000

|

39600

|

42900

|

36700

|

44040

|

47710

|

||

|

12

|

25250

|

30300

|

32825

|

32050

|

38460

|

41665

|

34000

|

40800

|

44200

|

37800

|

45360

|

49140

|

||

|

13

|

26000

|

31200

|

33800

|

33000

|

39600

|

42900

|

35000

|

42000

|

45500

|

38950

|

46740

|

50635

|

||

|

14

|

26800

|

32160

|

34840

|

34000

|

40800

|

44200

|

36050

|

43260

|

46865

|

40100

|

48120

|

52130

|

||

|

15

|

27600

|

33120

|

35880

|

35000

|

42000

|

45500

|

37150

|

44580

|

48295

|

41300

|

49560

|

53690

|

||

PB-3

|

PB

|

3

|

3

|

3

|

||||||||

|

GP

|

5400 (JS)

|

6600 (SS)

|

7600 (JAG)

|

||||||||

|

Min Pension VI CPC

|

11070

|

12600

|

14960

|

||||||||

|

Level of VII CPC

|

10

|

11

|

12

|

||||||||

|

Age

|

up to 80

|

80-85

|

85-90

|

up to 80

|

80-85

|

85-90

|

up to 80

|

80-85

|

85-90

|

||

|

Option 1 Rev Min Pens with 2.57 Multiple

|

26985

|

32382

|

35081

|

32382

|

38858

|

42097

|

38450

|

46140

|

49980

|

||

|

Option 2 – revised pension with increments @ 3% Pa for number of increments earned while in service

|

Number of increments earned in that level while in service

|

0

|

28050

|

33660

|

36465

|

33850

|

40620

|

44005

|

39400

|

47280

|

51220

|

|

1

|

28900

|

34680

|

37570

|

34850

|

41820

|

45305

|

40600

|

48720

|

52780

|

||

|

2

|

29750

|

35700

|

38675

|

35900

|

43080

|

46670

|

41800

|

50160

|

54340

|

||

|

3

|

30650

|

36780

|

39845

|

37000

|

44400

|

48100

|

43050

|

51660

|

55965

|

||

|

4

|

31550

|

37860

|

41015

|

38100

|

45720

|

49530

|

44350

|

53220

|

57655

|

||

|

5

|

32500

|

39000

|

42250

|

39250

|

47100

|

51025

|

45700

|

54840

|

59410

|

||

|

6

|

33500

|

40200

|

43550

|

40450

|

48540

|

52585

|

47050

|

56460

|

61165

|

||

|

7

|

34500

|

41400

|

44850

|

41650

|

49980

|

54145

|

48450

|

58140

|

62985

|

||

|

8

|

35550

|

42660

|

46215

|

42900

|

51480

|

55770

|

49900

|

59880

|

64870

|

||

|

9

|

36600

|

43920

|

47580

|

44200

|

53040

|

57460

|

51400

|

61680

|

66820

|

||

|

10

|

37700

|

45240

|

49010

|

45550

|

54660

|

59215

|

52950

|

63540

|

68835

|

||

|

11

|

38850

|

46620

|

50505

|

46900

|

56280

|

60970

|

54550

|

65460

|

70915

|

||

|

12

|

40000

|

48000

|

52000

|

48300

|

57960

|

62790

|

56200

|

67440

|

73060

|

||

|

13

|

41200

|

49440

|

53560

|

49750

|

59700

|

64675

|

57900

|

69480

|

75270

|

||

|

14

|

42450

|

50940

|

55185

|

51250

|

61500

|

66625

|

59650

|

71580

|

77545

|

||

|

15

|

43700

|

52440

|

56810

|

52800

|

63360

|

68640

|

61450

|

73740

|

79885

|

||

PB-4

|

PB

|

4

|

4

|

4

|

||||||||

|

GP

|

8700 (SG)

|

8900

|

10000 (SAG)

|

||||||||

|

Min Pension VI CPC

|

23050

|

24295

|

27350

|

||||||||

|

Level of VII CPC

|

13

|

13A

|

14

|

||||||||

|

Age

|

up to 80

|

80-85

|

85-90

|

up to 80

|

80-85

|

85-90

|

up to 80

|

80-85

|

85-90

|

||

|

Option 1 Rev Min Pens with 2.57 Multiple

|

59239

|

71086

|

77010

|

62438

|

74926

|

81170

|

70290

|

84347

|

91376

|

||

|

Option 2 – revised pension with increments @ 3% Pa for number of increments earned while in service

|

Number of increments earned in that level while in service

|

0

|

59250

|

71100

|

77025

|

65550

|

78660

|

85215

|

72100

|

86520

|

93730

|

|

1

|

61050

|

73260

|

79365

|

67500

|

81000

|

87750

|

74250

|

89100

|

96525

|

||

|

2

|

62900

|

75480

|

81770

|

69550

|

83460

|

90415

|

76500

|

91800

|

99450

|

||

|

3

|

64800

|

77760

|

84240

|

71650

|

85980

|

93145

|

78800

|

94560

|

102440

|

||

|

4

|

66750

|

80100

|

86775

|

73800

|

88560

|

95940

|

81150

|

97380

|

105495

|

||

|

5

|

68750

|

82500

|

89375

|

76000

|

91200

|

98800

|

83600

|

100320

|

108680

|

||

|

6

|

70800

|

84960

|

92040

|

78300

|

93960

|

101790

|

86100

|

103320

|

111930

|

||

|

7

|

72900

|

87480

|

94770

|

80650

|

96780

|

104845

|

88700

|

106440

|

115310

|

||

|

8

|

75100

|

90120

|

97630

|

83050

|

99660

|

107965

|

91350

|

109620

|

118755

|

||

|

9

|

77350

|

92820

|

100555

|

85550

|

102660

|

111215

|

94100

|

112920

|

122330

|

||

|

10

|

79650

|

95580

|

103545

|

88100

|

105720

|

114530

|

96900

|

116280

|

125970

|

||

|

11

|

82050

|

98460

|

106665

|

90750

|

108900

|

117975

|

99800

|

119760

|

129740

|

||

|

12

|

84500

|

101400

|

109850

|

93450

|

112140

|

121485

|

102800

|

123360

|

133640

|

||

|

13

|

87050

|

104460

|

113165

|

96250

|

115500

|

125125

|

105900

|

127080

|

137670

|

||

|

14

|

89650

|

107580

|

116545

|

99150

|

118980

|

128895

|

109100

|

130920

|

141830

|

||

|

15

|

92350

|

110820

|

120055

|

102100

|

122520

|

132730

|

|||||

NOTE: Based on the recommendations of 7th CPC vide Para 10.1.67 of its Report, an ALL-IN ONE table for pension has been prepared from where the likely pension can be determined easily.

The table covers all the 5th CPC scales from S 4 to S 29 (except S 6) grouped in 4 PBs after 6th CPC.

These have been assigned Levels 1 to 14 in the matrix table by 7th CPC.

The table also gives pension for pensioners falling in 3 age groups i.e. upto 80 years and with additional pension @ 20% and 30% after the age of 80 and 85 respectively.

Since the pension as per option 2 may take time, the pension as per option 1 (with a factor of 2.57) may be paid in the first instance as an interim measure.

Pension as per option-1 is to be calculated on the basis of pension as fixed after 6th CPC. This being different for pensioners retiring from the same scale, the figures in the table under option -1 are according to the minimum revised basic pension as per DOP OM dated 30-7-2015. The Pension is to be finally fixed at the higher of the two Options.

In some levels like levels 6, 10, 11, 12, 13 and 14, there is no common min revised pension as per 6th CPC (differing with each scale though GP is same). The table can accommodate only one figure. Therefore, in such cases lowest of the figure has been taken as representative of the respective level.

Compiled by N.P . MOHAN C.E (Retd.) Railways ,Life member BPS &President RSCWS (An affiliate of BPS)

Option 2

Revised basic pension of as on 01.01.2016 = Existing basic pension as on 01.01.2016 X 2.57 = Revised basic pension + Nil DR as on 01.01.2016 Option 2 is to be implemented immediately

In case option one is finally accepted for which BPS is fighting tooth & nail the pensioner will have the option to choose whichever is more beneficial to him/her

Sd/

S.C.Maheshwari

Secy General Bharat Pensioners Samaj

Source: BPS

COMMENTS

Sir my father expired 2017 26years service nbsub eme core now my mother getting how much will revised he retires 2oo1 my kirankumarvalluri99999[at]gmail.com my no9390569886

How many pension pre1996honyltinarmy

In every where the two option has been mentioned. Both the option are clear cut. When government is well know about the fact and ready to give maximum benefit to their pensioner, why the question of option is raised? It will be better if it is implemented in one final step providing maximum benefit to central govt. employee as per rule.

It is option 1 that is pension basic * 2.57 which will be implemented and not Option 2 with increments.This is stated wrongly in the desciption.