7th Pay Commission: Housing inflation index headed for cascading impact

In case of subsidised housing provided by the government, the rent charged for the dwelling is the HRA normally admissible to the employee along with a nominal license fee. (source: Illustration by CR Sasikumar)

The implementation of the Seventh Central Pay Commission (CPC) awards can have a significant bearing on the inflation trajectory through both direct and indirect channels, with the housing and transportation sectors projected to see the biggest impact of the potential increase in the spending capacity of government employees. The Reserve Bank of India has projected a direct impact of the latest pay commission recommendations on headline inflation to be around 150 basis points, while the indirect effects are estimated to be around 40 basis points. While the impact of the pay awards is likely to be seen over a period of two years, as was the experience the last time around, compared to the Sixth CPC awards, though, the central bank forecasts the increase in the housing index to be “more quick and continuous” and the indirect effects to be “smaller”.

A review of the cascading impact of the Sixth CPC awards offers an indication of the likely inflation impact this time around. The Sixth CPC awards were implemented in August 2008, with house rent allowance (HRA) awards coming into effect from September 2008.

On account of the methodology of collecting rental data in the Consumer Price Index-Industrial Workers (CPI-IW), the direct impact occurred with a lag during July 2009-January 2010, when the contribution of housing to the overall inflation was in excess of 25 per cent.

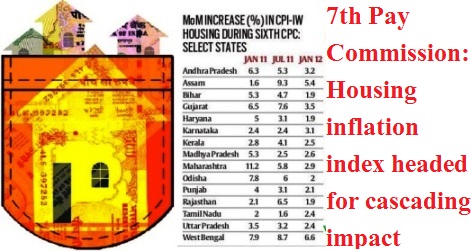

According to the RBI, the direct impact of the Sixth CPC awards on CPI-IW inflation was estimated at 2.5 percentage points in July 2009, which rose to around 4 percentage points by January 2010. Most of the state-wise housing indices showed significant increases by July 2010, indicating quick follow-through of central pay commission increases to state. As a result of the staggered increase in state government employees’ HRA, the rate of increase in housing index remained high till January 2012. Interestingly, the lesser developed states — Bihar, Odisha, Uttar Pradesh and Madhya Pradesh — recorded a sharply higher month-on-month percentage increase in the CPI-IW Housing index during this period (see chart).

The indirect impact of the Sixth CPC award on overall CPI-IW inflation worked out to around 60 basis points based on estimates derived from vector autoregression (VAR) and structural models, according to the RBI.

In case of subsidised housing provided by the government, the rent charged for the dwelling is the HRA normally admissible to the employee along with a nominal license fee. A hike in HRA results in an increase in imputed rent for government-provided accommodation. Such HRA awards, by their construct, seek to bring parity of housing allowances by the Government with the prevailing market rates. Thus, the direct effect on inflation comes through a higher housing index, according to the central bank.

The indirect effects stem from an increase in private consumption expenditures and through second-round increases in rental rates for housing in general, which could embed higher inflation expectations in the broader public perception.

The outgo of arrears under Seventh CPC awards, according to the RBI, would be substantially lower but HRA rates would automatically increase when the dearness allowance of the employees crosses threshold levels.

According to a December 2016 Credit Suisse report, the Seventh Pay Commission recommendations is projected to have a significant impact on the real estate cycle in small towns as more than 80 per cent of Central government employees reside in tier II, III cities. The report analysing the impact of the recommendations point out that as state governments and Central PSUs follow through the CPC proposals, almost 3.4 crore individuals (employees and pensioners) will witness increase in their incomes.

The Seventh Central Pay Commission had proposed a 23.55 per cent hike in salary, allowances and pension for 4.8 million government employees and 5.5 million pensioners. The recommended hike, contained in a 900-page report, is over 11 percentage points lower than the 35 per cent suggested by the Sixth pay commission. The basic salary hike recommended was 16 per cent, while that of housing rent allowance, other allowances and pensions were 138.71 per cent, 49.79 per cent and 23.63 per cent, respectively.

Since the basic pay has been revised upwards, the commission had recommended that HRA be paid at the rate of 24 per cent, 16 per cent and eight per cent of the new basic pay for Class ‘X’, ‘Y’ and ‘Z’ cities, respectively. The commission also recommended that the rate of HRA be revised to 27 per cent, 18 per cent and nine per cent, respectively, when dearness allowance crosses 50 per cent, and further revised to 30 per cent, 20 per cent and 10 per cent when dearness allowance crosses 100 per cent.

The financial impact of the Seventh CPC report is pegged at Rs 1.02 lakh crore during 2016-17. The total salary and pension bill of the government would work out to be Rs 5.36 lakh crore in the financial year, 23.55 per cent more than the Rs 4.33 lakh crore without factoring in the monetary implications of the pay commission. Of the total financial impact of Rs 1.02 lakh crore, Rs 73,650 crore will be borne by the general budget and Rs 28,450 crore by the Railway Budget.

Read at: Indian Express

Stay connected with us via Facebook, Google+ or Email Subscription.

Subscribe to Central Government Employee News & Tools by Email [Click Here]

Follow us: Twitter [click here] | Facebook [click here] | Google+ [click here]

Admin

COMMENTS

It is true that housing index will cascade. In most of tier2 towns, it is the doctors, bankers, government servant and professors/lecturers who are ready to pay huge for accommodation and thus increase the general level of the rent. In tier1 cities it includes MNC professionals too. If CG employees given a hefty HRA it will have an impact. Yet, this shows that they are in dire need of increased HRA as the rent is already exorbitant. A 2BHK flat in good areas cost over 10000 in a tier2 city. 3 BHK costs above 15000. So, HRA rate needs to be retained at 30, 20 and 15%.