Revision of interest rates for Small Savings Schemes for 1st Quarter of 2016-17 i.e. w.e.f. Apr-2016 to Jun-2016

F.No. 1/04/2016-NSJI

Government of India

Ministry of Finance

Department of Economic Affairs

(Budget Division)

North Block, New Delhi

Dated: 18th March, 2016

OFFICE MEMORANDUM

Subject: Revision of interest rates for Small Savings Schemes.

The undersigned is directed to refer to this Department’s GM of even number dated 16th February, 2016, vide which the various decisions taken by the Government regarding interest fixation for small savings schemes were communicated to all concerned.

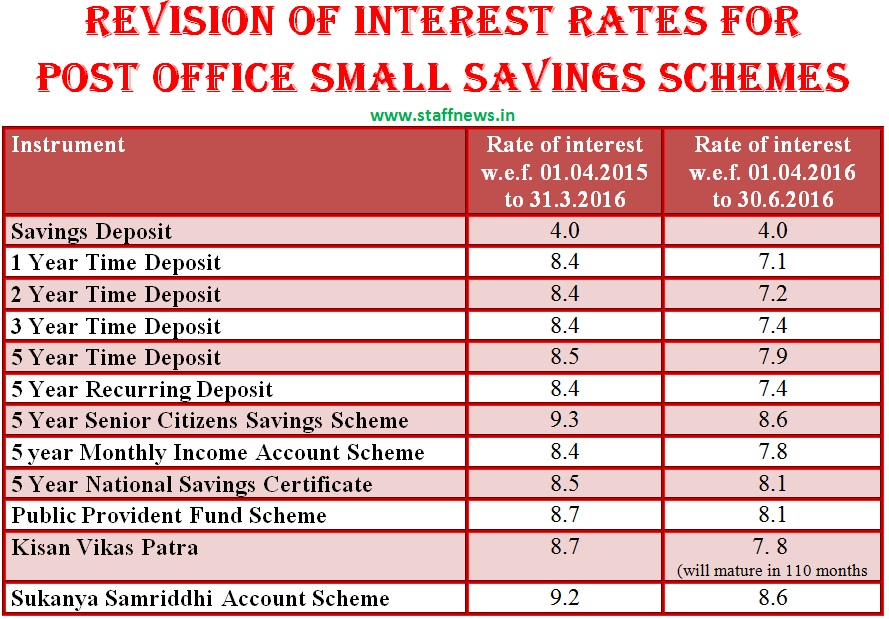

2. On the basis of the decisions of the Government, interest rates for small savings schemes are to be notified on quarterly basis. Accordingly, the rates of interest on various small savings schemes for the first quarter of financial year 2016-17, on the basis of the interest compounding/payment built-in in the schemes, shall be as under:

| Instrument | Rate of interest w.e.f. 01.04.2015 to 31.3.2016 | Rate of interest w.e.f. 01.04.2016 to 30.6.2016 |

| Savings Deposit | 4.0 | 4.0 |

| 1 Year Time Deposit | 8.4 | 7.1 |

| 2 Year Time Deposit | 8.4 | 7.2 |

| 3 Year Time Deposit | 8.4 | 7.4 |

| 5 Year Time Deposit | 8.5 | 7.9 |

| 5 Year Recurring Deposit | 8.4 | 7.4 |

| 5 Year Senior Citizens Savings Scheme | 9.3 | 8.6 |

| 5 year Monthly Income Account Scheme | 8.4 | 7.8 |

| 5 Year National Savings Certificate | 8.5 | 8.1 |

| Public Provident Fund Scheme | 8.7 | 8.1 |

| Kisan Vikas Patra | 8.7 | 7. 8 (will mature in 110 months |

| Sukanya Samriddhi Account Scheme | 9.2 | 8.6 |

3. The necessary notifications will be notified separately.

4. This has the approval of Secretary (Economic Affairs).

(Anil Kumar)

Under Secretary to the Government of India

Source: www.finmin.nic.in

[http://finmin.nic.in/the_ministry/dept_eco_affairs/budget/ombudget0001.pdf]

Stay connected with us via Facebook, Google+ or Email Subscription.

Subscribe to Central Government Employee News & Tools by Email [Click Here]

Follow us: Twitter [click here] | Facebook [click here] | Google+ [click here]

Admin

COMMENTS

The ministry has forgotten to tax the interst component by charging swachabharath,and service tax we are still Lucky.Next budget they may propose such taxes and make the Interest paid will become Zero.Let us be happy for this year.

The minimum interest rate for savings bank account should be atleast 5% more than the inflation rate. For Term deposit, SCSS, and other savings should fetch more interest than savings bank account. Let the Govt. decide, whether it want or discourage savings.

BJP is cutting short the the very source of income of the sr.citizen in the country whose strength in the country is not small.Shading away heir responsibility is really a social guilt

IT IS ONLY RIDICULOUS TO HAVE CUT THE INTEREST RATE ON SENIOR CITIZEN SCHEMES.THAT IS THEIR MAIN SOURCE OF SURVIVAL.DOES THE BJP WANT THEM TO BEG WHEN THE GOVT HAS TOTALLY FAILED TO CURTAIL COST OF LIVING? IN ONE BREATH THEY MAKE LEGISLATION S TO ENFORCE THEIR LIABILITY ON THEIR CHILDREN.IN OTHER BREATH THEY WANT TO SHADE AWAY THEIR OWN LIABILITY TOWARDS THE SR.CITIZENS.HAS BLOWING HOOT AND COLD SIMULTANEOUSLY BECOME THE CHARACTERISTIC OF BJP? BJP WILL NOT BE PARDONED BY THE SR CITIZENS IN THE NEXT ELECTIONS.mIND WELL THEIR POPULATION IS NOT SMALL.