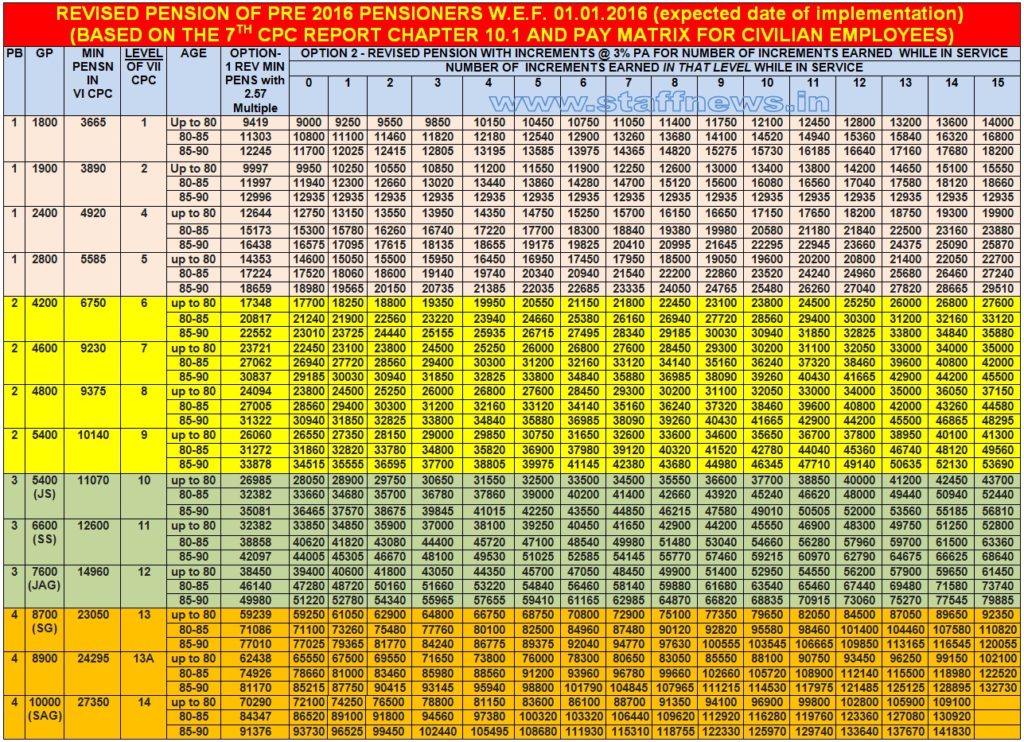

REVISED PENSION TABLE OF PRE 2016 PENSIONERS W.E.F. 01.01.2016 (expected date of implementation)

(BASED ON THE 7TH CPC REPORT CHAPTER 10.1 Pension and Related Benefits of Civilian Employees AND 5.1 Pay Structure (Civilian Employees) PAY MATRIX FOR CIVILIAN EMPLOYEES)

| PB & GP |

PB-1 & GP 1800

|

||||

| MIN PENSION IN 6th CPC |

3665

|

||||

| LEVEL OF VII CPC |

1

|

||||

|

New Pension in 7th CPC

|

|||||

|

AGE

|

Up to 80

|

80-85

|

85-90

|

||

| OPTION 1 REV MIN PENS with 2.57 Multiple |

9419

|

11303

|

12245

|

||

| OPTION 2 – REVISED PENSION WITH INCREMENTS @ 3% PA FOR NUMBER OF INCREMENTS EARNED WHILE IN SERVICE | NUMBER OF INCREMENTS EARNED IN THAT LEVEL WHILE IN SERVICE | 0 |

9000

|

10800

|

11700

|

| 1 |

9250

|

11100

|

12025

|

||

| 2 |

9550

|

11460

|

12415

|

||

| 3 |

9850

|

11820

|

12805

|

||

| 4 |

10150

|

12180

|

13195

|

||

| 5 |

10450

|

12540

|

13585

|

||

| 6 |

10750

|

12900

|

13975

|

||

| 7 |

11050

|

13260

|

14365

|

||

| 8 |

11400

|

13680

|

14820

|

||

| 9 |

11750

|

14100

|

15275

|

||

| 10 |

12100

|

14520

|

15730

|

||

| 11 |

12450

|

14940

|

16185

|

||

| 12 |

12800

|

15360

|

16640

|

||

| 13 |

13200

|

15840

|

17160

|

||

| 14 |

13600

|

16320

|

17680

|

||

| 15 |

14000

|

16800

|

18200

|

||

| PB & GP |

PB-1 & GP 1900

|

||||

| MIN PENSION IN 6th CPC |

3890

|

||||

| LEVEL OF VII CPC |

2

|

||||

|

New Pension in 7th CPC

|

|||||

|

AGE

|

Up to 80

|

80-85

|

85-90

|

||

| OPTION 1 REV MIN PENS with 2.57 Multiple |

9997

|

11997

|

12996

|

||

| OPTION 2 – REVISED PENSION WITH INCREMENTS @ 3% PA FOR NUMBER OF INCREMENTS EARNED WHILE IN SERVICE | NUMBER OF INCREMENTS EARNED IN THAT LEVEL WHILE IN SERVICE | 0 |

9950

|

11940

|

12935

|

| 1 |

10250

|

12300

|

13325

|

||

| 2 |

10550

|

12660

|

13715

|

||

| 3 |

10850

|

13020

|

14105

|

||

| 4 |

11200

|

13440

|

14560

|

||

| 5 |

11550

|

13860

|

15015

|

||

| 6 |

11900

|

14280

|

15470

|

||

| 7 |

12250

|

14700

|

15925

|

||

| 8 |

12600

|

15120

|

16380

|

||

| 9 |

13000

|

15600

|

16900

|

||

| 10 |

13400

|

16080

|

17420

|

||

| 11 |

13800

|

16560

|

17940

|

||

| 12 |

14200

|

17040

|

18460

|

||

| 13 |

14650

|

17580

|

19045

|

||

| 14 |

15100

|

18120

|

19630

|

||

| 15 |

15550

|

18660

|

20215

|

||

| PB & GP |

PB-1 & GP 2400

|

||||

| MIN PENSION IN 6th CPC |

4920

|

||||

| LEVEL OF VII CPC |

4

|

||||

|

New Pension in 7th CPC

|

|||||

|

AGE

|

up to 80

|

80-85

|

85-90

|

||

| OPTION 1 REV MIN PENS with 2.57 Multiple |

12644

|

15173

|

16438

|

||

| OPTION 2 – REVISED PENSION WITH INCREMENTS @ 3% PA FOR NUMBER OF INCREMENTS EARNED WHILE IN SERVICE | NUMBER OF INCREMENTS EARNED IN THAT LEVEL WHILE IN SERVICE | 0 |

12750

|

15300

|

16575

|

| 1 |

13150

|

15780

|

17095

|

||

| 2 |

13550

|

16260

|

17615

|

||

| 3 |

13950

|

16740

|

18135

|

||

| 4 |

14350

|

17220

|

18655

|

||

| 5 |

14750

|

17700

|

19175

|

||

| 6 |

15250

|

18300

|

19825

|

||

| 7 |

15700

|

18840

|

20410

|

||

| 8 |

16150

|

19380

|

20995

|

||

| 9 |

16650

|

19980

|

21645

|

||

| 10 |

17150

|

20580

|

22295

|

||

| 11 |

17650

|

21180

|

22945

|

||

| 12 |

18200

|

21840

|

23660

|

||

| 13 |

18750

|

22500

|

24375

|

||

| 14 |

19300

|

23160

|

25090

|

||

| 15 |

19900

|

23880

|

25870

|

||

| PB & GP |

PB-1 & GP-2800

|

||||

| MIN PENSION IN 6th CPC |

5585

|

||||

| LEVEL OF VII CPC |

5

|

||||

|

New Pension in 7th CPC

|

|||||

|

AGE

|

up to 80

|

80-85

|

85-90

|

||

| OPTION 1 REV MIN PENS with 2.57 Multiple |

14353

|

17224

|

18659

|

||

| OPTION 2 – REVISED PENSION WITH INCREMENTS @ 3% PA FOR NUMBER OF INCREMENTS EARNED WHILE IN SERVICE | NUMBER OF INCREMENTS EARNED IN THAT LEVEL WHILE IN SERVICE | 0 |

14600

|

17520

|

18980

|

| 1 |

15050

|

18060

|

19565

|

||

| 2 |

15500

|

18600

|

20150

|

||

| 3 |

15950

|

19140

|

20735

|

||

| 4 |

16450

|

19740

|

21385

|

||

| 5 |

16950

|

20340

|

22035

|

||

| 6 |

17450

|

20940

|

22685

|

||

| 7 |

17950

|

21540

|

23335

|

||

| 8 |

18500

|

22200

|

24050

|

||

| 9 |

19050

|

22860

|

24765

|

||

| 10 |

19600

|

23520

|

25480

|

||

| 11 |

20200

|

24240

|

26260

|

||

| 12 |

20800

|

24960

|

27040

|

||

| 13 |

21400

|

25680

|

27820

|

||

| 14 |

22050

|

26460

|

28665

|

||

| 15 |

22700

|

27240

|

29510

|

||

| PB & GP |

PB-2 & GP-4200

|

||||

| MIN PENSION IN 6th CPC |

6750

|

||||

| LEVEL OF VII CPC |

6

|

||||

|

New Pension in 7th CPC

|

|||||

|

AGE

|

up to 80

|

80-85

|

85-90

|

||

| OPTION 1 REV MIN PENS with 2.57 Multiple |

17348

|

20817

|

22552

|

||

| OPTION 2 – REVISED PENSION WITH INCREMENTS @ 3% PA FOR NUMBER OF INCREMENTS EARNED WHILE IN SERVICE | NUMBER OF INCREMENTS EARNED IN THAT LEVEL WHILE IN SERVICE | 0 |

17700

|

21240

|

23010

|

| 1 |

18250

|

21900

|

23725

|

||

| 2 |

18800

|

22560

|

24440

|

||

| 3 |

19350

|

23220

|

25155

|

||

| 4 |

19950

|

23940

|

25935

|

||

| 5 |

20550

|

24660

|

26715

|

||

| 6 |

21150

|

25380

|

27495

|

||

| 7 |

21800

|

26160

|

28340

|

||

| 8 |

22450

|

26940

|

29185

|

||

| 9 |

23100

|

27720

|

30030

|

||

| 10 |

23800

|

28560

|

30940

|

||

| 11 |

24500

|

29400

|

31850

|

||

| 12 |

25250

|

30300

|

32825

|

||

| 13 |

26000

|

31200

|

33800

|

||

| 14 |

26800

|

32160

|

34840

|

||

| 15 |

27600

|

33120

|

35880

|

||

| PB & GP |

PB-2 & GP-4600

|

||||

| MIN PENSION IN 6th CPC |

9230

|

||||

| LEVEL OF VII CPC |

7

|

||||

|

New Pension in 7th CPC

|

|||||

|

AGE

|

up to 80

|

80-85

|

85-90

|

||

| OPTION 1 REV MIN PENS with 2.57 Multiple |

23721

|

27062

|

30837

|

||

| OPTION 2 – REVISED PENSION WITH INCREMENTS @ 3% PA FOR NUMBER OF INCREMENTS EARNED WHILE IN SERVICE | NUMBER OF INCREMENTS EARNED IN THAT LEVEL WHILE IN SERVICE | 0 |

22450

|

26940

|

29185

|

| 1 |

23100

|

27720

|

30030

|

||

| 2 |

23800

|

28560

|

30940

|

||

| 3 |

24500

|

29400

|

31850

|

||

| 4 |

25250

|

30300

|

32825

|

||

| 5 |

26000

|

31200

|

33800

|

||

| 6 |

26800

|

32160

|

34840

|

||

| 7 |

27600

|

33120

|

35880

|

||

| 8 |

28450

|

34140

|

36985

|

||

| 9 |

29300

|

35160

|

38090

|

||

| 10 |

30200

|

36240

|

39260

|

||

| 11 |

31100

|

37320

|

40430

|

||

| 12 |

32050

|

38460

|

41665

|

||

| 13 |

33000

|

39600

|

42900

|

||

| 14 |

34000

|

40800

|

44200

|

||

| 15 |

35000

|

42000

|

45500

|

||

| PB & GP |

PB-2 & GP-4800

|

||||

| MIN PENSION IN 6th CPC |

9375

|

||||

| LEVEL OF VII CPC |

8

|

||||

|

New Pension in 7th CPC

|

|||||

|

AGE

|

up to 80

|

80-85

|

85-90

|

||

| OPTION 1 REV MIN PENS with 2.57 Multiple |

24094

|

27005

|

31322

|

||

| OPTION 2 – REVISED PENSION WITH INCREMENTS @ 3% PA FOR NUMBER OF INCREMENTS EARNED WHILE IN SERVICE | NUMBER OF INCREMENTS EARNED IN THAT LEVEL WHILE IN SERVICE | 0 |

23800

|

28560

|

30940

|

| 1 |

24500

|

29400

|

31850

|

||

| 2 |

25250

|

30300

|

32825

|

||

| 3 |

26000

|

31200

|

33800

|

||

| 4 |

26800

|

32160

|

34840

|

||

| 5 |

27600

|

33120

|

35880

|

||

| 6 |

28450

|

34140

|

36985

|

||

| 7 |

29300

|

35160

|

38090

|

||

| 8 |

30200

|

36240

|

39260

|

||

| 9 |

31100

|

37320

|

40430

|

||

| 10 |

32050

|

38460

|

41665

|

||

| 11 |

33000

|

39600

|

42900

|

||

| 12 |

34000

|

40800

|

44200

|

||

| 13 |

35000

|

42000

|

45500

|

||

| 14 |

36050

|

43260

|

46865

|

||

| 15 |

37150

|

44580

|

48295

|

||

| PB & GP |

PB-2 & GP-5400

|

||||

| MIN PENSION IN 6th CPC |

10140

|

||||

| LEVEL OF VII CPC |

9

|

||||

|

New Pension in 7th CPC

|

|||||

|

AGE

|

up to 80

|

80-85

|

85-90

|

||

| OPTION 1 REV MIN PENS with 2.57 Multiple |

26060

|

31272

|

33878

|

||

| OPTION 2 – REVISED PENSION WITH INCREMENTS @ 3% PA FOR NUMBER OF INCREMENTS EARNED WHILE IN SERVICE | NUMBER OF INCREMENTS EARNED IN THAT LEVEL WHILE IN SERVICE | 0 |

26550

|

31860

|

34515

|

| 1 |

27350

|

32820

|

35555

|

||

| 2 |

28150

|

33780

|

36595

|

||

| 3 |

29000

|

34800

|

37700

|

||

| 4 |

29850

|

35820

|

38805

|

||

| 5 |

30750

|

36900

|

39975

|

||

| 6 |

31650

|

37980

|

41145

|

||

| 7 |

32600

|

39120

|

42380

|

||

| 8 |

33600

|

40320

|

43680

|

||

| 9 |

34600

|

41520

|

44980

|

||

| 10 |

35650

|

42780

|

46345

|

||

| 11 |

36700

|

44040

|

47710

|

||

| 12 |

37800

|

45360

|

49140

|

||

| 13 |

38950

|

46740

|

50635

|

||

| 14 |

40100

|

48120

|

52130

|

||

| 15 |

41300

|

49560

|

53690

|

||

| PB & GP |

PB-3 & GP-5400

|

||||

| MIN PENSION IN 6th CPC |

11070

|

||||

| LEVEL OF VII CPC |

10

|

||||

|

New Pension in 7th CPC

|

|||||

|

AGE

|

up to 80

|

80-85

|

85-90

|

||

| OPTION 1 REV MIN PENS with 2.57 Multiple |

26985

|

32382

|

35081

|

||

| OPTION 2 – REVISED PENSION WITH INCREMENTS @ 3% PA FOR NUMBER OF INCREMENTS EARNED WHILE IN SERVICE | NUMBER OF INCREMENTS EARNED IN THAT LEVEL WHILE IN SERVICE | 0 |

28050

|

33660

|

36465

|

| 1 |

28900

|

34680

|

37570

|

||

| 2 |

29750

|

35700

|

38675

|

||

| 3 |

30650

|

36780

|

39845

|

||

| 4 |

31550

|

37860

|

41015

|

||

| 5 |

32500

|

39000

|

42250

|

||

| 6 |

33500

|

40200

|

43550

|

||

| 7 |

34500

|

41400

|

44850

|

||

| 8 |

35550

|

42660

|

46215

|

||

| 9 |

36600

|

43920

|

47580

|

||

| 10 |

37700

|

45240

|

49010

|

||

| 11 |

38850

|

46620

|

50505

|

||

| 12 |

40000

|

48000

|

52000

|

||

| 13 |

41200

|

49440

|

53560

|

||

| 14 |

42450

|

50940

|

55185

|

||

| 15 |

43700

|

52440

|

56810

|

||

| PB & GP |

PB-3 & GP-6600

|

||||

| MIN PENSION IN 6th CPC |

12600

|

||||

| LEVEL OF VII CPC |

11

|

||||

|

New Pension in 7th CPC

|

|||||

|

AGE

|

up to 80

|

80-85

|

85-90

|

||

| OPTION 1 REV MIN PENS with 2.57 Multiple |

32382

|

38858

|

42097

|

||

| OPTION 2 – REVISED PENSION WITH INCREMENTS @ 3% PA FOR NUMBER OF INCREMENTS EARNED WHILE IN SERVICE | NUMBER OF INCREMENTS EARNED IN THAT LEVEL WHILE IN SERVICE | 0 |

33850

|

40620

|

44005

|

| 1 |

34850

|

41820

|

45305

|

||

| 2 |

35900

|

43080

|

46670

|

||

| 3 |

37000

|

44400

|

48100

|

||

| 4 |

38100

|

45720

|

49530

|

||

| 5 |

39250

|

47100

|

51025

|

||

| 6 |

40450

|

48540

|

52585

|

||

| 7 |

41650

|

49980

|

54145

|

||

| 8 |

42900

|

51480

|

55770

|

||

| 9 |

44200

|

53040

|

57460

|

||

| 10 |

45550

|

54660

|

59215

|

||

| 11 |

46900

|

56280

|

60970

|

||

| 12 |

48300

|

57960

|

62790

|

||

| 13 |

49750

|

59700

|

64675

|

||

| 14 |

51250

|

61500

|

66625

|

||

| 15 |

52800

|

63360

|

68640

|

||

| PB & GP |

PB-3 & GP-7600

|

||||

| MIN PENSION IN 6th CPC |

14960

|

||||

| LEVEL OF VII CPC |

12

|

||||

|

New Pension in 7th CPC

|

|||||

|

AGE

|

up to 80

|

80-85

|

85-90

|

||

| OPTION 1 REV MIN PENS with 2.57 Multiple |

38450

|

46140

|

49980

|

||

| OPTION 2 – REVISED PENSION WITH INCREMENTS @ 3% PA FOR NUMBER OF INCREMENTS EARNED WHILE IN SERVICE | NUMBER OF INCREMENTS EARNED IN THAT LEVEL WHILE IN SERVICE | 0 |

39400

|

47280

|

51220

|

| 1 |

40600

|

48720

|

52780

|

||

| 2 |

41800

|

50160

|

54340

|

||

| 3 |

43050

|

51660

|

55965

|

||

| 4 |

44350

|

53220

|

57655

|

||

| 5 |

45700

|

54840

|

59410

|

||

| 6 |

47050

|

56460

|

61165

|

||

| 7 |

48450

|

58140

|

62985

|

||

| 8 |

49900

|

59880

|

64870

|

||

| 9 |

51400

|

61680

|

66820

|

||

| 10 |

52950

|

63540

|

68835

|

||

| 11 |

54550

|

65460

|

70915

|

||

| 12 |

56200

|

67440

|

73060

|

||

| 13 |

57900

|

69480

|

75270

|

||

| 14 |

59650

|

71580

|

77545

|

||

| 15 |

61450

|

73740

|

79885

|

||

| PB & GP |

PB-4 & GP-8700

|

||||

| MIN PENSION IN 6th CPC |

23050

|

||||

| LEVEL OF VII CPC |

13

|

||||

|

New Pension in 7th CPC

|

|||||

|

AGE

|

up to 80

|

80-85

|

85-90

|

||

| OPTION 1 REV MIN PENS with 2.57 Multiple |

59239

|

71086

|

77010

|

||

| OPTION 2 – REVISED PENSION WITH INCREMENTS @ 3% PA FOR NUMBER OF INCREMENTS EARNED WHILE IN SERVICE | NUMBER OF INCREMENTS EARNED IN THAT LEVEL WHILE IN SERVICE | 0 |

59250

|

71100

|

77025

|

| 1 |

61050

|

73260

|

79365

|

||

| 2 |

62900

|

75480

|

81770

|

||

| 3 |

64800

|

77760

|

84240

|

||

| 4 |

66750

|

80100

|

86775

|

||

| 5 |

68750

|

82500

|

89375

|

||

| 6 |

70800

|

84960

|

92040

|

||

| 7 |

72900

|

87480

|

94770

|

||

| 8 |

75100

|

90120

|

97630

|

||

| 9 |

77350

|

92820

|

100555

|

||

| 10 |

79650

|

95580

|

103545

|

||

| 11 |

82050

|

98460

|

106665

|

||

| 12 |

84500

|

101400

|

109850

|

||

| 13 |

87050

|

104460

|

113165

|

||

| 14 |

89650

|

107580

|

116545

|

||

| 15 |

92350

|

110820

|

120055

|

||

| PB & GP |

PB-4 & GP-8900

|

||||

| MIN PENSION IN 6th CPC |

24295

|

||||

| LEVEL OF VII CPC |

13A

|

||||

|

New Pension in 7th CPC

|

|||||

|

AGE

|

up to 80

|

80-85

|

85-90

|

||

| OPTION 1 REV MIN PENS with 2.57 Multiple |

62438

|

74926

|

81170

|

||

| OPTION 2 – REVISED PENSION WITH INCREMENTS @ 3% PA FOR NUMBER OF INCREMENTS EARNED WHILE IN SERVICE | NUMBER OF INCREMENTS EARNED IN THAT LEVEL WHILE IN SERVICE | 0 |

65550

|

78660

|

85215

|

| 1 |

67500

|

81000

|

87750

|

||

| 2 |

69550

|

83460

|

90415

|

||

| 3 |

71650

|

85980

|

93145

|

||

| 4 |

73800

|

88560

|

95940

|

||

| 5 |

76000

|

91200

|

98800

|

||

| 6 |

78300

|

93960

|

101790

|

||

| 7 |

80650

|

96780

|

104845

|

||

| 8 |

83050

|

99660

|

107965

|

||

| 9 |

85550

|

102660

|

111215

|

||

| 10 |

88100

|

105720

|

114530

|

||

| 11 |

90750

|

108900

|

117975

|

||

| 12 |

93450

|

112140

|

121485

|

||

| 13 |

96250

|

115500

|

125125

|

||

| 14 |

99150

|

118980

|

128895

|

||

| 15 |

102100

|

122520

|

132730

|

||

| PB & GP |

PB-4 & GP-10000

|

||||

| MIN PENSION IN 6th CPC |

27350

|

||||

| LEVEL OF VII CPC |

14

|

||||

|

New Pension in 7th CPC

|

|||||

|

AGE

|

up to 80

|

80-85

|

85-90

|

||

| OPTION 1 REV MIN PENS with 2.57 Multiple |

70290

|

84347

|

91376

|

||

| OPTION 2 – REVISED PENSION WITH INCREMENTS @ 3% PA FOR NUMBER OF INCREMENTS EARNED WHILE IN SERVICE | NUMBER OF INCREMENTS EARNED IN THAT LEVEL WHILE IN SERVICE | 0 |

72100

|

86520

|

93730

|

| 1 |

74250

|

89100

|

96525

|

||

| 2 |

76500

|

91800

|

99450

|

||

| 3 |

78800

|

94560

|

102440

|

||

| 4 |

81150

|

97380

|

105495

|

||

| 5 |

83600

|

100320

|

108680

|

||

| 6 |

86100

|

103320

|

111930

|

||

| 7 |

88700

|

106440

|

115310

|

||

| 8 |

91350

|

109620

|

118755

|

||

| 9 |

94100

|

112920

|

122330

|

||

| 10 |

96900

|

116280

|

125970

|

||

| 11 |

99800

|

119760

|

129740

|

||

| 12 |

102800

|

123360

|

133640

|

||

| 13 |

105900

|

127080

|

137670

|

||

| 14 |

109100

|

130920

|

141830

|

||

| 15 | |||||

NOTE: Based on the recommendations of 7th CPC vide Para 10.1.67 of its Report, an ALL-IN ONE table for pension has been prepared from where the likely pension can be determined easily.

· The table covers all the 5th CPC scales from S 4 to S 29 (except S 6) grouped in 4 PBs after 6th CPC. These have been assigned Levels 1 to 14 in the matrix table by 7th CPC.

· The table also gives pension for pensioners falling in 3 age groups i.e. upto 80 years and with additional pension @ 20% and 30% after the age of 80 and 85 respectively.

· Since the pension as per option 2 may take time, the pension as per option 1 (with a factor of 2.57) may be paid in the first instance as an interim measure.

· Pension as per option-1 is to be calculated on the basis of pension as fixed after 6th CPC. This being different for pensioners retiring from the same scale, the figures in the table under option -1 are according to the minimum revised basic pension as per DOP OM dated 30-7-2015. The Pension is to be finally fixed at the higher of the two Options.

· In some levels like levels 6, 10, 11, 12, 13 and 14, there is no common min revised pension as per 6th CPC (differing with each scale though GP is same). The table can accommodate only one figure. Therefore, in such cases lowest of the figure has been taken as representative of the respective level.

Compiled by N.P . MOHAN C.E (Retd.) Railways & President RSCWS

Source: http://scm-bps.blogspot.in/2015/12/revised-pension-of-pre-2016-pensioners_6.html

Stay connected with us via Facebook, Google+ or Email Subscription.

Subscribe to Central Government Employee News & Tools by Email [Click Here]

Follow us: Twitter [click here] | Facebook [click here] | Google+ [click here]

Admin

COMMENTS

Please show tables of all grades

S Ramamurthy Retd as defence civilian pensioner

I retired from Ordnance Factories. Min of Defence on 31.10.1992 as Deputy General Manager from Cordite Factory Aruvankadu.At the time of retirement I was drawing my basicpay as 4950 in the PayScale of 4500-5700 with 3 increments to my credit.Asper chapter 10.1 of 7th CPC my basic pension comes to Rs 64800 as on 1.1.2016 following option 2.applying 3 increments while in service .But my parent Factory where from I retired have fixed my basic pension as on 1.1.2016 atRs 61550 stating option 2 as envisaged has not the approval of Govt.of India.

All my efforts to get this amendment has not borne any fruit even when I put my grievances through PGPORTAL AND POMOPGPORTAL.

Can anybody throw any light on the applicability of option 2 of 7th CPC which provides weightageto those who earned increments in the scale while in service.The purpose of publishing notifications concerning chapter 10.1 of 7th CPC and connected concordant table is not quite clear when Govt.of India have not accepted this provision recommend by 7th CPC.

This is a very good work done for pensioners knowledge. Buy Why for civilian pensioners revised pension tables of various grades are prepared up to 15 increments only? I think these tables should be prepared for more number of increments. Initially they were prepared by experts for more than 15 increments.Those who earned more than 15 increments on last post retired for them these tables if prepared, will be very useful. I retired with 21 increments on my last post.Thank you

Let the author to publish the methodology for calculate the pension option-3 as suggested

by the pension dept recently is highly appreciable.

When option one and option two is crystal clear for the 7th pay commission for the fixation of pension, why Govt. is not fixing it in one step? The higher side of the calculation should be directly implemented.It will save the time.

my special famaly pension after o.r.o.p is 15479 i dont know about basic pension what is my pension after VIIth pay commision and what is the arrier

my special family pension after o.r.o.p is 15479 i dont know about my basic pension

i request you that what is my current pension after VIIth pay commision and

what is my arrier

The table is with reference to the minimum basic pension of VI CPC and the figures relate to the number of increments earned in that level. Suppose there is a person with a higher basic level with say N increments, then the pension under VII CPC should be

basic pension x 2.57 x 1.03 n times where N is the number increments. But here in spite of higher basic pension, the retiree with N increments will get what a person of 12600 with N increments will get. is this not a grand anomaly. Is this not visible to the VII CPC. The idea of government is to buy time by teasing the retirees.

I was allowed ACP in the pre revised grade of 7500-19400 from 1999. Thereafter promoted in this grade in march, 2003. Later with implementation of 6th cpc and on completion of four years service the grade pay was revied to 5400 with PB2 grade 9300-34800 from march, 2007. Now in the said post I earned 15 increments upto my retirement in july,2013. Now on fixation of my pension whether my 15 increments will be considered or 7 increments which I earned after upgradation to GP of 5400.

Vijay Kumar

May i know what about a person who retired TWICE in 1965 & then in 1979 with combination of services just to get minimum 4920 wef JAN,2006 where as his counter part getting 5585 where as his 2nd post was higher than 1st one , in last CPC it became reversed and hence less pension

By this he may get even more lesser JAY HIND both pensions under MOD ,CGDA

Dear Mr. Balakrishnan, first you do not confuse others and your self by writing BP in place of basic pension. BP indicate generally basic pay. There is no provision for pension commutation while on implementing pay commission.

Scientists explore too much towards their benefits not in their areas of interest.Hence the scientist expect revised commutation after his retirement.

I retired as a Scientist in the pay scale 37400 – 67000 with a Grade pay of 8900. My present BP is 27200. I know my future pension would be Rs 69904. I would like to know if there is a commutation for this increase. If so how to calculate.

As per my understanding; Only existing amount of commutation will be deducted from likely future pension.

If existing commutation amount is say Rs. 10880 (40% of BP 27200 ) then likely future pension will be Rs. 69904 – 10880 = 59024. MCN

It is unbecoming of an officer retired at such a high salary and pension to talk about commutation of revised pension on account subsequent pay commission award.Commutation is done only once at the retirement and it will not be applicable if you delay your option at the time of retirement !!!

Sri.JKR has to see this case where two employees in the scale 3000-4500, when both are at 4375, one retires before VCPC,and the other continues and retires at 12925/- of the VCPC. As per the fixation process envisaged in the 7CPC, the first one who retired at 4375, gets much higher pension than the person retiring later at 12925- and this appears to be an anomaly, and at this stage, no clarity is available and it would have been better had the 7CPC given some examples which are little complicated like this.

Another issue needs to be clarified in regard to re-fixation of pension based on option !is the confusion arising out of the refixation of pay consequent upon the implementation of the recommendations of the VCPC, where some increments earned in the retiring grade, have been lost in the process of re-fixation in the VCPC scales, thereby causing the no. of increments earned in the retiring level appearing to be far less than the actually earned ones, thereby reducing the index no. in the matrix.

Interpretation Of JK RAGHUNATHAN is correct What Mr. Ramana thinks about the no of increments from one p c to another PC For the same pay scale is genuine as the pay scales of 4 CPC and 5 CPC as the rate of increment is differant the no of increments earned also varies for equal pay and pay scale It is observed as the employee goes from one CPC to another CPC he loses some increments The older retiree gets more than the new retiree .

This can be observed practically by taking an example give by & 7 CPC of a retiree retired in 4 cpc drawing Rs 4000 If he had retired in 5 cpc regime he would have got less pension as the number of increments he had earned would be less than 4 CPC

As the case cited above is a genuine one, whether it would be possible for the implementing authorities to do justice by taking into account the total no. of increments earned in the retiring grade by taking the total no. of increments earned both in the 4th and 5 th CPC regimes for purpose of determining the new pension under option 1 of the 7CPC.

The option provided for refixation of pension based on the no. of increments earned in the retiring level needs some clarification.What is the meaning of the no. of increments in the retiring level? In a case where the pensioner has got promoted to the retiring level and his basic pay is higher than the minimum pay in the retiring level to the extent of few say 4 or 5 increments,(i.e., at a higher index within the retiring level) and he retires after getting some 2 or 3 increments in the retiring level, how the total no of increments in the retiring level is arrived t for the purpose fo re-fixation of pension needs to be clarified. Or the actual no of increments earned in the retiring level alone, is to be taken into account for the re-fixation of pension.

The Number of STAGES from the Minimum Pay (Starting Pay) of the Retiring Pay

Scale UP TO the LAST PAY DRAWN DETERMINES the Number of Increments Earned for the Purpose of Calculation of NOTIONAL PAY and NOT the ACTUAL INCREMENTS DRAWN in the Retiring Pay Scale. This method gives Maximum Benefit to the Pensioners in respect of Fixation of Revised Pension as per Formulation 1 in Para 10.1.67,Sub para(i) of 7th CPC Report

With Regards,

JK RAGHUNATHAN

Flawless work by the author.

good effort,pl.let me havethe last table with mimimum pension as 23750

thanks