Historical

Perspective

on

Pay:

The

Trends

so

far

5.1.1 The thrust of all the previous Pay Commissions has been to propose an improvement in the pay structure by way of ‘simplification and rationalisation.’ The most visible results of this exercise are evident in terms of reduction in number of pay scales as well as the

compression ratio. Traditionally, compression ratio has been taken as a ratio of maximum salary drawn by the Secretary to Government of India to

minimum salary drawn by the lowest functionary in the government. Table 1 below brings out the trend in pay structure in the government of India over

the years:

|

Central

P ay Commission (CPC) |

Minimum

Salary ( Rs.) |

Maximum

Salary ( Rs.) |

Compression

Ratio |

Number

of P ay Scales |

| I CPC (1946-47) | 55 | 2000 | 1: 36.4 | 150 ->30 |

| II CPC (1957-59) | 80 | 3000 | 1: 37.5 | 500-> 140 |

| III CPC (1972-73) | 196 | 3500 | 1: 17.9 | 500 -> 80 |

| IV CPC (1983-86) | 750 | 8000 | 1: 10.7 | 153 -> 36 |

| V CPC (1994-97) | 2550 | 26000 | 1: 10.2 | 51 -> 34 |

| VI CPC (2006-08) | 7000 | 80000 | 1: 11.4 | 35 -> 19 [4 PBs with 15 GPs+ 4 distinct scales] |

5.1.2 It can be seen from the table above that successive Pay Commissions have consciously tried to reduce the number of pay scales even though they

tended to increase during the intervening period between any two Pay Commissions. There were, however, no significant changes in the pay structure per

se until the IV CPC, when the concept of running pay scales was introduced in a limited way in respect of Defence forces. For others, individual pay

scales continued till the V CPC. It was the VI CPC which recommended running pay bands for both Civilians as well as Defence forces. This was coupled

with the introduction of the concept of Grade Pay as a level differentiator. Another new feature was the calculation of the annual increment on

percentage basis. Prior to VI CPC, the increment was a flat sum, depending on the pay scale. The effort at compression of levels was carried forward by

the VI CPC, which reduced the existing 35 levels to 19. Another radical measure was the doing away with ‘Group-D’as acategoryand placement of

‘Group-D’personnel in ‘Group-C’after appropriate training whenever necessary. Hence, it can be seen that the simplification process set in motion by

previous Pay Commissions acted as a precursor for progressive rationalisation by the subsequent Commissions.

Terms

of

Reference

with

regards

to

the

Pay

Structure

before

the

Seventh

CPC

5.1.3 One of the Terms of Reference (TOR) before this Commission is “to examine, review, evolve and recommendchanges that are desirable and feasible regarding the principles thatshould govern the emoluments structure including pay, allowances and otherfacilities and benefits in cash or kind having regard to rationalisation and simplification therein.”

5.1.4 Further, it is expected that the recommendations on the pay structure should ensure that the framework for an emoluments structure is linked with

“the need to attract the most suitable talent to government service,promote efficiency, accountability and responsibility in the work culture, andfoster excellence in the public governance system to respond to complexchallenges of modern administration and rapid political, social, economic and technological changes, with due regard to expectations of stakeholders.”

5.1.5 The Commission has endeavored to incorporate the above principles while devising the new pay structure. The approach of the Commission has been

to ensure that the emolument structure is in consonance with the nature of work, role and responsibilities and accountability involved at various

levels of the hierarchyin the Government of India. Thevalue that individual employees are expected to bring to the job, by way of relevant educational

qualifications, skill sets and experience are also important considerations. Internal equity, by way of salaries payable at comparable levels within

the organization, are also important considerations.

Existing

System

Until then the limited span of individual pay scales resulted in employees reaching the maximum of the scale and stagnating until their next regular

promotion. To alleviate the situation, often new posts were created even when no functional justification existed. This led to proliferation of levels

and unwarranted increase in financial liability. Frequent movement from one scale to another also led to problems in pay fixation of seniors who, in

some cases, ended up drawing lesser pay than their juniors.

5.1.7 At the time of constitution of the VI CPC there were about 35 standard pay scales in existence. Many of these pre revised scales were merged by

the VI CPC to arrive at 19 grades spread across four distinct Pay bands along with 4 distinct scales including one Apex scale (fixed) for

Secretary/equivalent and one scale for Cabinet Secretary/equivalent (fixed). The concept of Grade pay was intended as a fitment benefit but it also

served as a level determiner within a pay band.

5.1.8 Following implementation of the VI CPC recommendations, the pay structure in the Civilian set up consists of four pay bands with 15 levels of

grade pay, along with four standalone scales viz., the HAG scale, HAG+ scale, Apex scale (fixed) and the scale of Cabinet Secretary (fixed) as shown

below in Table 2:

Table

2

:

Present

Pay

Structure

(Civilian)*

|

Pay Band 1 (5200- 20200)

|

|||||

|

Grade Pay

|

1800

|

1900

|

2000

|

2400

|

2800

|

|

Pay Band 2 (9300-34800)

|

|||||

|

Grade Pay

|

4200

|

4600

|

4800

|

5400

|

|

|

Pay Band 3 (15600-39100)

|

|||||

|

Grade Pay

|

5400

|

6600

|

7600

|

||

|

Pay Band 4 (37400-67000)

|

|||||

|

Grade Pay

|

8700

|

8900

|

10000

|

||

|

HAG (67000-79000)

|

|||||

|

HAG+ (75500-80000)

|

|||||

|

Apex 80000 (fixed)

|

|||||

|

Cabinet Secretary 90000 (fixed)

|

|||||

For

the

Defence

Forces

the

structure

is

identical,

with

only

minor

variations

with

regard

to

certain

grade

pay

levels.

5.1.9 The pay structure as it stands today is fairly compact and manageable.

5.1.10 As has been mentioned earlier the VICPC introduced several new features in the overall structure for determination of pay and allowances. In the

course of implementation, while according approvals, the government, in some cases, departed from the recommendations of the Pay Commission.

5.1.11 Since the concept of running pay bands coupled with grade pays was novel, this Commission, at the outset, sought feedback from all stakeholders

regarding the existing pay structure before deciding whether to continue with the existing pay structure or to devise a new pay model.

Ke

y

Demands

Received

5.1.12 Consequent to receipt of feedback from various stakeholders as part of the response to the questionnaire circulated by the Commission as well as

memoranda submitted by various Association/Federations and during oral evidence, the major issues which have been brought to the notice of the

Commission in respect of the pay structure are discussed below seriatim:-

percent of the maximum of pre-revised pay scale. This was also meant to delineate the hierarchy in any cadre. The issue raised by various groups of

employees is that the methodology that was adopted in arriving at the grade pay values resulted in the difference in grade pay between adjacent levels

not being uniform. This in itself has caused resentment particularly at the lower levels. The quantum of difference between successive grade pays

varies within pay bands too. For example in PayBand-1, the difference between successive Grade pays is Rs.400 between GP 2000 and GP 2400 and

only Rs.100 between GP 1800 and GP 1900. A large number of stakeholders have represented that the benefit accruing from progression either through MACP

or from regular promotion was miniscule, especially in Pay Bands 1 and 2. As per the rules on pay fixation a promotion or financial upgrade by way of

MACP fetches one increment plus the difference of grade pay and a low differential in grade pay presently results in only a nominal increase in pay.

Consequently, there have been numerous demands for rationalisation of the grade pay structure.

successive pay bands is also not uniform and the variation is much more remarkable between Pay bands 3 and 4. This has led to significant differencein

benefits accruingon account of fixationof pay(and of pension) for persons in adjacent pay bands. As a result, there have been demands from some

quarters for going back to the system of individual pay scales and from some other to move towards an open ended pay structure.

Anyinconsistencyin the computation of grade payor in thespacingbetween paybands has adirect bearingon thequantumof fitment benefit. Therefore,

theseissues have also been raised by numerous stakeholders. It has been demanded by a majority of the stakeholders that there should be a single

fitment factor which should be uniformly applied for all employees.

Whilethe payof persons moving from alower pay band to a higher one on promotion would be regulated by the pay fixation formulation prescribed (pay was

fixed at the minimum of the pay band plus grade pay), the VICPC had recommended a separate entrypay for new recruits, takinginto account the length of

qualifying service prescribed by Department of Personnel and Training (DoPT) for movement from the first grade in the pay band to the grade in which

recruitment was being made. The resultant formulation was such that it led to many situations where direct recruits drew higher pay as compared to

personnel who reached that stage through promotion. Demands have been received from many staff associations and employees for removal of this

disparity.

has been underscored. As per the existing dispensation, upward movement in this scheme is through the grade pay hierarchy and the financial

benefit as a result of this progression is equivalent to one increment plus the difference in grade pay between the existing and next level. It has

been stated by employees that this amount is very meagre especially when the difference in grade pay is as low as Rs.100. Further, progression through

the MACP scheme can take place only when ten years have lapsed after the previous promotion/MACP upgrade, making the position even starker. Comparisons

are also made of the MACP introduced post VI CPC with the ACP scheme introduced post V CPC. In the case of earlier ACP scheme, although it was

available with lesser frequency i.e., after the passage of 12 and 24 years of service, the upgrade that was given was in the promotional

hierarchy. Therefore the monetary benefit to the employeewas sizeable as compared to that under the present MACP. Numerous demands have therefore been

received in the Commission to rationalize the progression of grade pay, to increase the frequency of administering MACP and to make the progression

follow the promotional instead of the grade pay hierarchy.

Pay

Structure

5.1.13 Although the VI CPC had mentioned that grade pay would be equivalent to 40 percent of the maximum of the pre-revised scale and that the grade

pay will constitute the actual fitment, yet the computation varied greatly. After the implementation of recommendations, the difference became more

pronounced in Pay Band 4 as compared to the other three pay bands. This resulted in varying fitment factors for various levels and promotional benefits

that were perceived to be rather differentiated. The same pattern was discernible in the pension fixation too.

5.1.14 After analysing the issues brought out by various stakeholders, this Commission is suggesting a new pay model that is expected to not only

address the existing problems but will also establish a rationalised system which is transparent and simple to use.

5.1.15 To begin with, the system of Pay Bands and Grade Pay has been dispensed with and the new functional levels being proposed have been arrived at

by merging the grade pay with the pay in the pay band. All of the existing levels have been subsumed in the new structure; no new level has been

introduced nor has any existing level been dispensed with.

lie. It is however difficult to ascertain the exact pay of an individual at any given point of time. Further, the way the pay progression would fan out

over a period of time was also not evident. Since various cadres are designed differently the relative pay progression also varies. The Commission

believes that any new entrant to a service would wish to be able to make a reasonable and informed assessment of how his/her career path would traverse

and how the emoluments will progress alongside. The new pay structure has been devised in the form of a pay matrix to provide complete transparency

regarding pay progression.

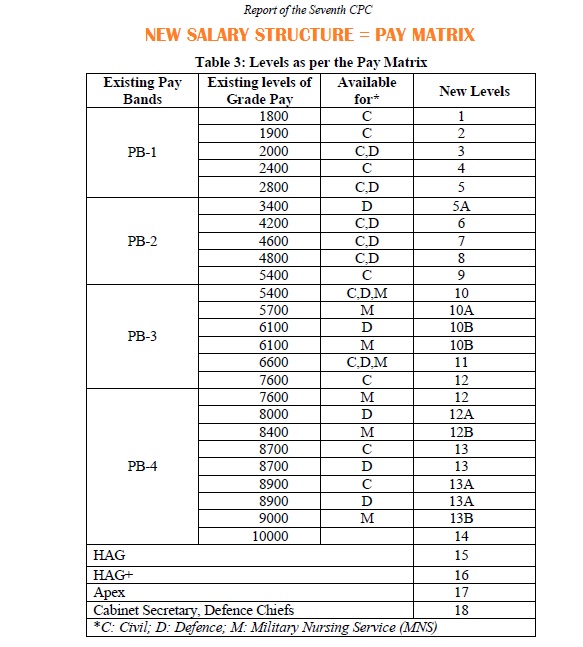

decades, generating greater competition for human resources and the need to attract and retain the best available talent in government services. The

nomenclature being used in the new pay matrix assigns levels in place of erstwhile grade pay and Table 3 below brings out the new dispensation for

various grades pay pertaining to Civil, Defence and MNS.

Table

3

:

Levels

as

per

the

Pay

Matrix

|

Existing

Pa y Bands |

Existing

levels of Grade Pay |

Available

for* |

New

Levels |

|

PB-1

|

1800

|

C

|

1

|

|

1900

|

C

|

2

|

|

|

2000

|

C,D

|

3

|

|

|

2400

|

C

|

4

|

|

|

2800

|

C,D

|

5

|

|

|

PB-2

|

3400

|

D

|

5A

|

|

4200

|

C,D

|

6

|

|

|

4600

|

C,D

|

7

|

|

|

4800

|

C,D

|

8

|

|

|

5400

|

C

|

9

|

|

|

PB-3

|

5400

|

C,D,M

|

10

|

|

5700

|

M

|

10A

|

|

|

6100

|

D

|

10B

|

|

|

6100

|

M

|

10B

|

|

|

6600

|

C,D,M

|

11

|

|

|

7600

|

C

|

12

|

|

|

PB-4

|

7600

|

M

|

12

|

|

8000

|

D

|

12A

|

|

|

8400

|

M

|

12B

|

|

|

8700

|

C

|

13

|

|

|

8700

|

D

|

13

|

|

|

8900

|

C

|

13A

|

|

|

8900

|

D

|

13A

|

|

|

9000

|

M

|

13B

|

|

|

10000

|

14

|

||

|

HAG

|

15

|

||

|

HAG+

|

16

|

||

|

Apex

|

17

|

||

|

Cabinet Secretary, Defence Chiefs

|

18

|

||

|

*C: Civil; D: Defence; M: Military Nursing Service (MNS)

|

|||

5.1.18 Prior to VI CPC, there were Pay Scales. The VI CPC had recommended running Pay Bands with Grade Pay as status determiner. The Seventh CPC is

recommending a Pay matrix with distinct Pay Levels. The Level would henceforth be the status determiner.

5.1.19 Since the existing pay bands cover specific groups of employees such as PB-1 for Group `C’ employees, PB-2 for Group `B’ employees and PB-3

onwards for Group `A’ employees, any promotion from one pay band to another is akin to movement from one group to the other. These are significant

jumps in the career hierarchy in the Government of India. Rationalisation has been done to ensure that the quantum of jump, in financial terms, between

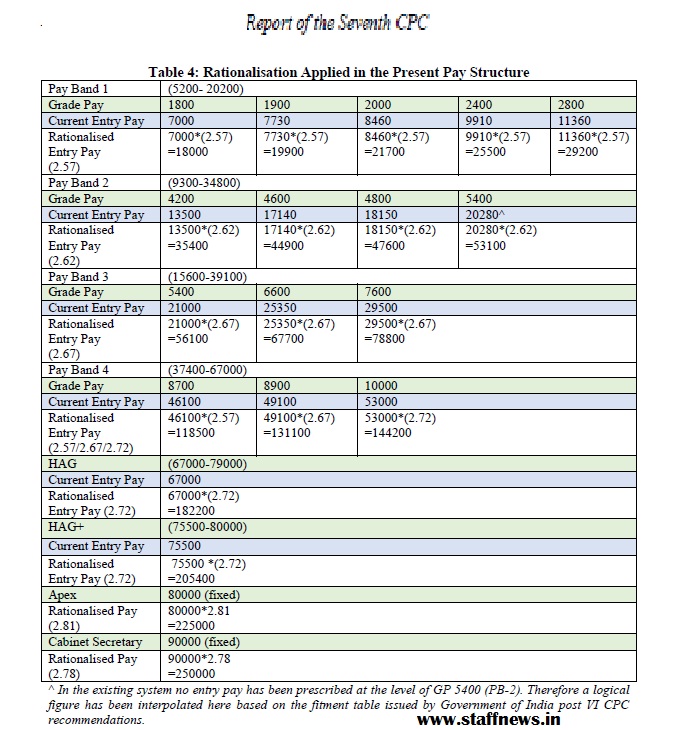

these pay bands is reasonable. This has been achieved by applying‘index of rationalisation’ from PB-2 onwards on the premise that with enhancement of

levels from Pay Band 1 to 2, 2 to 3 and onwards, the role, responsibility and accountability increases at each step in the hierarchy. The proposed pay

structure reflects the same principle. Hence, the existing entry pay at each level corresponding to successive grades payin each payband, from PB-2

onwards, has been enhanced by an ‘index of rationalisation’ as shown below in Table 4:

| Pay Band 1 |

(5200- 20200) |

||||

| Grade Pay | 1800 | 1900 | 2000 | 2400 | 2800 |

| Current Entry Pay | 7000 | 7730 | 8460 | 9910 | 11360 |

| Rationalised Entry Pay (2.57) | 7000*(2.57) =18000 | 7730*(2.57) =19900 | 8460*(2.57) =21700 | 9910*(2.57) =25500 | 11360*(2.57) =29200 |

| Pay Band 2 |

(9300-34800) |

||||

| Grade Pay | 4200 | 4600 | 4800 | 5400 | |

| Current Entry Pay | 13500 | 17140 | 18150 | 20280^ | |

| Rationalised Entry Pay (2.62) | 13500*(2.62) =35400 | 17140*(2.62) =44900 | 18150*(2.62) =47600 | 20280*(2.62) =53100 | |

| Pay Band 3 |

(15600-39100) |

||||

| Grade Pay | 5400 | 6600 | 7600 | ||

| Current Entry Pay | 21000 | 25350 | 29500 | ||

| Rationalised Entry Pay (2.67) | 21000*(2.67) =56100 | 25350*(2.67) =67700 | 29500*(2.67) =78800 | ||

| Pay Band 4 |

(37400-67000) |

||||

| Grade Pay | 8700 | 8900 | 10000 | ||

| Current Entry Pay | 46100 | 49100 | 53000 | ||

| Rationalised Entry Pay (2.57/2.67/2.72) | 46100*(2.57) =118500 | 49100*(2.67) =131100 | 53000*(2.72) =144200 | ||

| HAG |

(67000-79000) |

||||

| Current Entry Pay | 67000 | ||||

| Rationalised Entry Pay (2.72) | 67000*(2.72) =182200 | ||||

| HAG+ |

(75500-80000) |

||||

| Current Entry Pay | 75500 | ||||

| Rationalised Entry Pay (2.72) | 75500 *(2.72) =205400 | ||||

| Apex |

80000 (fixed) |

||||

| Rationalised Pay (2.81) | 80000*2.81 =225000 | ||||

| Cabinet Secretary |

90000 (fixed) |

||||

| Rationalised Pay (2.78) | 90000*2.78 =250000 | ||||

8700 and GP 10000 witness a slight departure.

at this level has been moderated.

accountability. Further, the levels of SAG and above are those which are involved in policy formulation.

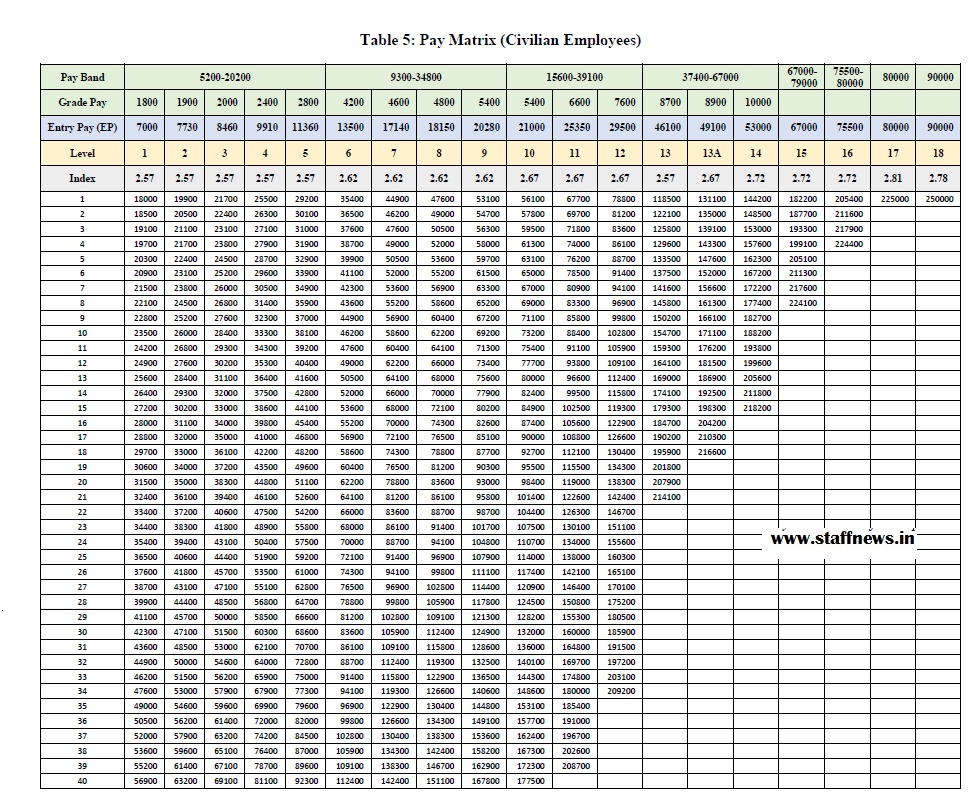

rationalised entry pay so arrived has been used in devising the new pay matrix.

for each level denotes ‘pay progression’ within that level. These indicate the steps of annual financial progression of three percent

within each level. The starting point of the matrix is the minimum pay which has been arrived based on 15th ILC norms or the Aykroyd formula. This has

already been explained in Chapter 4.2.

annual basis, based on annual increments till the time of their next promotion.

made out that an employee who does not have any promotional prospects in his cadre will be able to traverse through at least three levels solely by means of assured financial progression or MACP, assuming a career span of 30 years or more.

5:

Pay

Matrix

(Civilian

Employees)

|

Pay

Band |

5

200-20200 |

||||

|

Grade

Pay |

1

800 |

1

900 |

2

000 |

2

400 |

2

800 |

|

E

ntry Pay (EP) |

7

000 |

7

730 |

8

460 |

9

910 |

1

1360 |

|

Le

vel |

1

|

2

|

3

|

4

|

5

|

|

Index

|

2

. 5 7 |

2

. 5 7 |

2

. 5 7 |

2

. 5 7 |

2

. 5 7 |

|

1

|

18000

|

19900

|

21700

|

25500

|

29200

|

|

2

|

18500

|

20500

|

22400

|

26300

|

30100

|

|

3

|

19100

|

21100

|

23100

|

27100

|

31000

|

|

4

|

19700

|

21700

|

23800

|

27900

|

31900

|

|

5

|

20300

|

22400

|

24500

|

28700

|

32900

|

|

6

|

20900

|

23100

|

25200

|

29600

|

33900

|

|

7

|

21500

|

23800

|

26000

|

30500

|

34900

|

|

8

|

22100

|

24500

|

26800

|

31400

|

35900

|

|

9

|

22800

|

25200

|

27600

|

32300

|

37000

|

|

10

|

23500

|

26000

|

28400

|

33300

|

38100

|

|

11

|

24200

|

26800

|

29300

|

34300

|

39200

|

|

12

|

24900

|

27600

|

30200

|

35300

|

40400

|

|

13

|

25600

|

28400

|

31100

|

36400

|

41600

|

|

14

|

26400

|

29300

|

32000

|

37500

|

42800

|

|

15

|

27200

|

30200

|

33000

|

38600

|

44100

|

|

16

|

28000

|

31100

|

34000

|

39800

|

45400

|

|

17

|

28800

|

32000

|

35000

|

41000

|

46800

|

|

18

|

29700

|

33000

|

36100

|

42200

|

48200

|

|

19

|

30600

|

34000

|

37200

|

43500

|

49600

|

|

20

|

31500

|

35000

|

38300

|

44800

|

51100

|

|

21

|

32400

|

36100

|

39400

|

46100

|

52600

|

|

22

|

33400

|

37200

|

40600

|

47500

|

54200

|

|

23

|

34400

|

38300

|

41800

|

48900

|

55800

|

|

24

|

35400

|

39400

|

43100

|

50400

|

57500

|

|

25

|

36500

|

40600

|

44400

|

51900

|

59200

|

|

26

|

37600

|

41800

|

45700

|

53500

|

61000

|

|

27

|

38700

|

43100

|

47100

|

55100

|

62800

|

|

28

|

39900

|

44400

|

48500

|

56800

|

64700

|

|

29

|

41100

|

45700

|

50000

|

58500

|

66600

|

|

30

|

42300

|

47100

|

51500

|

60300

|

68600

|

|

31

|

43600

|

48500

|

53000

|

62100

|

70700

|

|

32

|

44900

|

50000

|

54600

|

64000

|

72800

|

|

33

|

46200

|

51500

|

56200

|

65900

|

75000

|

|

34

|

47600

|

53000

|

57900

|

67900

|

77300

|

|

35

|

49000

|

54600

|

59600

|

69900

|

79600

|

|

36

|

50500

|

56200

|

61400

|

72000

|

82000

|

|

37

|

52000

|

57900

|

63200

|

74200

|

84500

|

|

38

|

53600

|

59600

|

65100

|

76400

|

87000

|

|

39

|

55200

|

61400

|

67100

|

78700

|

89600

|

|

40

|

56900

|

63200

|

69100

|

81100

|

92300

|

|

Pay

Band |

9

300-34800 |

|||

|

Grade

Pay |

4

200 |

4

600 |

4

800 |

5

400 |

|

E

ntry Pay (EP) |

1

3500 |

1

7140 |

1

8150 |

2

0280 |

|

Le

vel |

6

|

7

|

8

|

9

|

|

Index

|

2

. 6 2 |

2

. 6 2 |

2

. 6 2 |

2

. 6 2 |

|

1

|

35400

|

44900

|

47600

|

53100

|

|

2

|

36500

|

46200

|

49000

|

54700

|

|

3

|

37600

|

47600

|

50500

|

56300

|

|

4

|

38700

|

49000

|

52000

|

58000

|

|

5

|

39900

|

50500

|

53600

|

59700

|

|

6

|

41100

|

52000

|

55200

|

61500

|

|

7

|

42300

|

53600

|

56900

|

63300

|

|

8

|

43600

|

55200

|

58600

|

65200

|

|

9

|

44900

|

56900

|

60400

|

67200

|

|

10

|

46200

|

58600

|

62200

|

69200

|

|

11

|

47600

|

60400

|

64100

|

71300

|

|

12

|

49000

|

62200

|

66000

|

73400

|

|

13

|

50500

|

64100

|

68000

|

75600

|

|

14

|

52000

|

66000

|

70000

|

77900

|

|

15

|

53600

|

68000

|

72100

|

80200

|

|

16

|

55200

|

70000

|

74300

|

82600

|

|

17

|

56900

|

72100

|

76500

|

85100

|

|

18

|

58600

|

74300

|

78800

|

87700

|

|

19

|

60400

|

76500

|

81200

|

90300

|

|

20

|

62200

|

78800

|

83600

|

93000

|

|

21

|

64100

|

81200

|

86100

|

95800

|

|

22

|

66000

|

83600

|

88700

|

98700

|

|

23

|

68000

|

86100

|

91400

|

101700

|

|

24

|

70000

|

88700

|

94100

|

104800

|

|

25

|

72100

|

91400

|

96900

|

107900

|

|

26

|

74300

|

94100

|

99800

|

111100

|

|

27

|

76500

|

96900

|

102800

|

114400

|

|

28

|

78800

|

99800

|

105900

|

117800

|

|

29

|

81200

|

102800

|

109100

|

121300

|

|

30

|

83600

|

105900

|

112400

|

124900

|

|

31

|

86100

|

109100

|

115800

|

128600

|

|

32

|

88700

|

112400

|

119300

|

132500

|

|

33

|

91400

|

115800

|

122900

|

136500

|

|

34

|

94100

|

119300

|

126600

|

140600

|

|

35

|

96900

|

122900

|

130400

|

144800

|

|

36

|

99800

|

126600

|

134300

|

149100

|

|

37

|

102800

|

130400

|

138300

|

153600

|

|

38

|

105900

|

134300

|

142400

|

158200

|

|

39

|

109100

|

138300

|

146700

|

162900

|

|

40

|

112400

|

142400

|

151100

|

167800

|

|

Pay

Band |

15600-39100

|

||

|

Grade

Pay |

5

400 |

6

600 |

7

600 |

|

E

ntry Pay (EP) |

2

1000 |

2

5350 |

2

9500 |

|

Le

vel |

1

0 |

1

1 |

1

2 |

|

Index

|

2

. 6 7 |

2

. 6 7 |

2

. 6 7 |

|

1

|

56100

|

67700

|

78800

|

|

2

|

57800

|

69700

|

81200

|

|

3

|

59500

|

71800

|

83600

|

|

4

|

61300

|

74000

|

86100

|

|

5

|

63100

|

76200

|

88700

|

|

6

|

65000

|

78500

|

91400

|

|

7

|

67000

|

80900

|

94100

|

|

8

|

69000

|

83300

|

96900

|

|

9

|

71100

|

85800

|

99800

|

|

10

|

73200

|

88400

|

102800

|

|

11

|

75400

|

91100

|

105900

|

|

12

|

77700

|

93800

|

109100

|

|

13

|

80000

|

96600

|

112400

|

|

14

|

82400

|

99500

|

115800

|

|

15

|

84900

|

102500

|

119300

|

|

16

|

87400

|

105600

|

122900

|

|

17

|

90000

|

108800

|

126600

|

|

18

|

92700

|

112100

|

130400

|

|

19

|

95500

|

115500

|

134300

|

|

20

|

98400

|

119000

|

138300

|

|

21

|

101400

|

122600

|

142400

|

|

22

|

104400

|

126300

|

146700

|

|

23

|

107500

|

130100

|

151100

|

|

24

|

110700

|

134000

|

155600

|

|

25

|

114000

|

138000

|

160300

|

|

26

|

117400

|

142100

|

165100

|

|

27

|

120900

|

146400

|

170100

|

|

28

|

124500

|

150800

|

175200

|

|

29

|

128200

|

155300

|

180500

|

|

30

|

132000

|

160000

|

185900

|

|

31

|

136000

|

164800

|

191500

|

|

32

|

140100

|

169700

|

197200

|

|

33

|

144300

|

174800

|

203100

|

|

34

|

148600

|

180000

|

209200

|

|

35

|

153100

|

185400

|

|

|

36

|

157700

|

191000

|

|

|

37

|

162400

|

196700

|

|

|

38

|

167300

|

202600

|

|

|

39

|

172300

|

208700

|

|

|

40

|

177500

|

||

|

Pay

Band |

3

7400-67000 |

||

|

Grade

Pay |

8

700 |

8

900 |

1

0000 |

|

E

ntry Pay (EP) |

4

6100 |

4

9100 |

5

3000 |

|

Le

vel |

13

|

13A

|

14

|

|

Index

|

2

. 5 7 |

2

. 6 7 |

2

. 7 2 |

|

1

|

118500

|

131100

|

144200

|

|

2

|

122100

|

135000

|

148500

|

|

3

|

125800

|

139100

|

153000

|

|

4

|

129600

|

143300

|

157600

|

|

5

|

133500

|

147600

|

162300

|

|

6

|

137500

|

152000

|

167200

|

|

7

|

141600

|

156600

|

172200

|

|

8

|

145800

|

161300

|

177400

|

|

9

|

150200

|

166100

|

182700

|

|

10

|

154700

|

171100

|

188200

|

|

11

|

159300

|

176200

|

193800

|

|

12

|

164100

|

181500

|

199600

|

|

13

|

169000

|

186900

|

205600

|

|

14

|

174100

|

192500

|

211800

|

|

15

|

179300

|

198300

|

218200

|

|

16

|

184700

|

204200

|

|

|

17

|

190200

|

210300

|

|

|

18

|

195900

|

216600

|

|

|

19

|

201800

|

||

|

20

|

207900

|

||

|

21

|

214100

|

||

|

Pay

Band |

6

7000-79000 |

7

5500-80000 |

8

0000 |

9

0000 |

|

Grade

Pay |

||||

|

E

ntry Pay (EP) |

6

7000 |

7

5500 |

8

0000 |

9

0000 |

|

Le

vel |

15

|

16

|

17

|

18

|

|

Index

|

2

. 7 2 |

2

. 7 2 |

2

. 8 1 |

2

. 7 8 |

|

1

|

182200

|

205400

|

225000

|

250000

|

|

2

|

187700

|

211600

|

||

|

3

|

193300

|

217900

|

||

|

4

|

199100

|

224400

|

||

|

5

|

205100

|

|||

|

6

|

211300

|

|||

|

7

|

217600

|

|||

|

8

|

224100

|

|||

|

9

|

Minimum

Pay

approach. They have proposed that the minimum wage for a single worker be based on the norms set by the 15th Indian Labour Conference, with certain

additions to the same. The minimum pay as suggested in the memorandum is Rs.26,000, which is around 3.7 times the existing minimum salary of Rs.7,000.

While the broad approach is similar, the specifics do vary and the Commission has, based on need-based minimum wage for a single worker with family as

defined in the Aykroyd formula, computed the minimum payat Rs.18,000. Details on the computation of minimum payhave been brought out in Chapter 4.2.

Fitment

beginning of PB-1 viz., Rs.5,200 + GP 1800, which prevailed on 01.01.2006, the date of implementation of the VI CPC recommendations. Hence the starting

point now proposed is 2.57 times of what was prevailing on 01.01.2006. This fitment factor of 2.57 is being proposed to be applied uniformly for all employees. It includes a factor of 2.25 on

account of DA neutralisation, assuming that the rate of Dearness Allowance would be 125 percent at the time of implementation of the new pay. Accordingly,

the actual raise/fitment being recommended is 14.29 percent.

Pay

Fixation

in

the

New

Pay

Structure

of 2.57. The figure so arrived at is to be located in the new pay matrix, in the level that corresponds tothe employee’s grade pay on the date of implementation, except in cases where the Commission has recommended a change in the existing grade pay

. If the identical figure is not available in the given level, the next higher figure closest to it would be the new pay of the concerned employee. A

couple of examples are detailed below to make the process amply clear.

5.1.29 The pay in the new pay matrix is to be fixed in the following manner:

Step

1

: Identify Basic Pay (Pay in the pay band plus Grade Pay) drawn by an employee as on the date of implementation. This figure is ‘A’.

Step

2

: Multiply ‘A’ with 2.57, round-off to the nearest rupee, and obtain result ‘B’.

Step

3

: The figure so arrived at, i.e., ‘B’ or the next higher figure closest to it in the Level assigned to his/her grade pay, will be the new pay in the new

pay matrix. In case the value of ‘B’ is less than the starting pay of the Level, then the pay will be equal to the starting pay of that level.

Example I

multiplying Rs.55,040 with 2.57, a figure of Rs.1,41,452.80 is arrived at. This is rounded off to Rs.1,41,453.

Levels being proposed.

iii. In the column for level 13, the figure closest to Rs.1,41,453 is Rs.1,41,600.

iv. Hence the pay of employee H will be fixed at Rs.1,41,600 in level 13 in the new pay matrix as shown below:

Table

6

:

Pay

Fixation

| GP 8700 |

GP 8900 |

GP 10000 |

| Level 13 |

Level 13A |

Level 14 |

| 118500 | 131100 | 144200 |

| 122100 | 135000 | 148500 |

| 125800 | 139100 | 153000 |

| 129600 | 143300 | 157600 |

| 133500 | 147600 | 162300 |

| 137500 | 152000 | 167200 |

| 141600 | 156600 | 172200 |

| 145800 | 161300 | 177400 |

| 150200 | 166100 | 182700 |

5.1.30 As part of its recommendations if Commission has recommended any upgradation or downgrade in the level of a particular post, the person would be

placed in the level corresponding to the newly recommended grade pay.

Example II

level the pay fixation would have been as explained in Example I above. After multiplying by 2.57, the amount fetched viz., Rs.62,194 would have been

located in Level 6 and T’s pay would have been fixed in Level 6 at Rs.62,200.

ii. However, assuming that the Commission has recommended that the post occupied by T should be placed one level higher in GP 4600. T’s basic pay would

then be Rs.24,600 (20000 + 4600). Multiplying this by 2.57 would fetch Rs.63,222.

iii. This value would have to be located in the matrix in Level 7 (the upgraded level of T).

iv. In the column for Level 7 Rs.63,222 lies between 62200 and 64100. Accordingly, the pay of T will be fixed in Level 7 at Rs.64,100.

Entry

Pay

into the same level from below. In the existing system, the entry pay for new or direct recruits takes into consideration the weightage given to qualifying

service prescribed by DoPT, whereas for those reaching the grade through promotion from lower grade, the entry pay is fixed at the minimum of the pay band

plus grade pay corresponding to the new grade. The entry pay therefore varies, and is different for those entering a level directly and those getting

promoted into it. There have been demands for a uniform entry pay for all.

5.1.32 In the new pay matrix, it is proposed that direct recruits start at the minimum pay corresponding to the level to which recruitment is made, which

will be the first cell of each level. For example a person entering service as a direct recruit at level 3 will get a pay of Rs.21,700, at level 8 of

Rs.47,600, at level 10 of Rs.56,100 and so on.

previous level. For instance, if a person who was drawing Rs.26,000 in level 3 gets a promotion to level 4, his pay fixation will be as shown in Table 7:

Table

7

:

Entry

Pay

| L3 | L4 | L5 | L6 | L7 | L8 |

| 21700 | 25500 | 29200 | 35400 | 44900 | 47600 |

| 22400 | 26300 | 30100 | 36500 | 46200 | 49000 |

| 23100 | 27100 | 31000 | 37600 | 47600 | 50500 |

| 23800 | 27900 | 31900 | 38700 | 49000 | 52000 |

| 24500 | 28700 | 32900 | 39900 | 50500 | 53600 |

| 25200 | 29600 | 33900 | 41100 | 52000 | 55200 |

| 26000 | 30500 | 34900 | 42300 | 53600 | 56900 |

| 26800 | 31400 | 35900 | 43600 | 55200 | 58600 |

| 27600 | 32300 | 37000 | 44900 | 56900 | 60400 |

| 28400 | 33300 | 38100 | 46200 | 58600 | 62200 |

| 29300 | 34300 | 39200 | 47600 | 60400 | 64100 |

| 30200 | 35300 | 4 0400 |

49000 | 62200 | 66000 |

| 31100 | 36400 | 41600 | 50500 | 64100 | 68000 |

Step

1:

After grant of one increment in level 3 the pay increases to Rs.26,800 in level 3 itself.

Step

2:

Locate the equal or next higher amount in level 4 which in this case will be Rs.27,100. Hence the new pay on promotion from level level 3 to level 4 will

be fixed at Rs.27,100.

5.1.35 To take another example, if a person drawing Basic Pay of, say, Rs.40,400 in level L5 is promoted to L7, the steps to arriving at his pay on

promotion will be to first add one increment within level L5 to arrive at Rs.41,600, and then fix the pay at Rs.44,900 in level L7 as Rs.44,900 is the

nearest, next higher figure to Rs.41,600 in the column of figures for level L7.

5.1.36 Although the rationalisation has been done with utmost care to ensure minimum bunching at most levels, however if situation does arise whenever more

than two stages are bunched together, one additional increment equal to 3 percent may be given for every two stages bunched, and pay fixed in the

subsequent cell in the pay matrix.

5.1.37 For instance, if two persons drawing pay of Rs.53,000 and Rs.54,590 in the GP 10000 are to be fitted in the new pay matrix, the person drawing pay

of Rs.53,000 on multiplication by a factor of 2.57 will expect a pay corresponding to Rs.1,36,210 and the person drawing pay of Rs.54,590 on multiplication

by a factor of 2.57 will expect a pay corresponding to Rs.1,40,296. Revised pay of both should ideally be fixed in the first cell of level 15 in the pay of

Rs.1,44,200 but to avoid bunching the person drawing pay of Rs.54,590 will get fixed in second cell of level 15 in the pay of Rs.1,48,500.

Annual

I

ncrement

Span

of

Each

Level

stagnation takes place. However, level 12 and beyond, the span of successive levels has been reduced so that the maximum at each level is lower than the

maximum pay at the subsequent level. This has been done as a result of capping of maximum pay at HAG+ (level 16) at a lower stage as compared to the Apex

pay at level 17. Since Apex pay at level 17 is fixed at Rs.2,25,000, a person residing in the previous level (level 16) should not draw equivalent or more

than the apex pay, the maximum pay has been restricted to Rs.2,24,400. Similarly the process has been followed until level 11 keeping in mind the maximum

pay drawn by the person in the next higher level. Accordingly, the span of levels beyond level 11 progressively reduces from 39 years at level 11 to 4

years at level 16. It is important to note that the end-points of any column do not signify the end points of any traditional pay

scale. Hence in any kind of calculation which attempts to work with the “maximum pay of a particular pay scale” it would be inappropriate, even incorrect,

to pick the last figure of the column to be so. As has been stated earlier in this paragraph the column spans have been kept at 40 to cater to persons who

may enter a particular level at any stage and may have resided in the level for a fair length of time. The end-points of the column, representing the

possible highest and lowest pay in that level, may not be treated as the maximum and minimum of any closed pay scale, as used to prevail prior to the implementation of the VI CPC.

Compression

Ratio

Government of India is not appropriate. The comparison should be like to like while calculating the compression ratio. Accordingly, the lowest pay at

entrylevel of Group `C’ should be compared with the entry pay of Group `A’ to arrive at the compression ratio. This Commission has recommended a minimum

pay of Rs.18,000 at entry level in Group `C’ and Rs.56,100 as entry pay at Group `A’ level. The compression ratio is thus arrived at 1: 3.12 which signifies that a Group `A’ officer entering the government on direct recruitment basis

gets roughly three times the pay drawn by a Group `C’ level functionary at their entry level.

5.1.41 Similarly comparisons can be made between maximum pay (Rs.56,800) of any employee who has joined in level 1 and rendered 35 years of service and

received pay progression solely by way of MACP with the maximum pay of Rs.2,25,000 drawn by Group `A’ officer at Apex level (level 17), thecompression ratio works out to be 1:3.96.Sincethe maximum paydrawn for different officials will depend

on their age of entry, promotional prospects in their services/cadres and individual performance, the minimum pay at entry level is considered a better

comparator.

Date

of

Effect

5.1.42 The various associations of the JCM-Staff Side have demanded that the recommendations of this Commission should be implemented w.e.f. 01.01.2014.

Their argument is that there has been substantial erosion in the value of wages owing to non-merger of DA, which has crossed the 100 percent mark in

January 2014. They have also demanded wage revision after every five years, instead of the present decennial exercise.

5.1.43However, itis to benoted that this Commission was constituted in year 2014, wellbefore the completion of ten years since the implementation of the VI

CPC recommendations, which were made effective on 01.01.2006. As a result, its recommendations would be available for consideration before the ten year

period gets over on 01.01.2016. The Commission does not agree with the demand of early implementation of revised pay structure and recommends that the date of effect should be 01.01.2016.

Modified

Assured

Career

Progression

(MACP)

Commission feels that the inherent issues in the existing pay structure owing to which there was widespread resentment have been set right by way of

rationalisation of pay levels, abolition of pay band and grade pay and introduction of a matrix based open pay structure. Hence, there is no justification for increasing the frequency of MACP and it will continue to be

administered at 10, 20 and 30 years as before. In the new Pay matrix, the employees will move to the immediate next level in the hierarchy. Fixation of pay

will follow the same principle as that for a regular promotion in the pay matrix. MACP will continue to be applicable to all employees up to HAG level

except members of Organised Group `A’ Services where initial promotions up to NFSG are time bound and hence assured.

performance appraisal for MACP as well as for regular promotion. The Commission recommends that this benchmark,in the interest of improving performance level, be enhanced from ‘Good’ to ‘Very Good.’ In addition, introduction of more stringent criteria such as clearing of departmental examinations or mandatory

training before grant of MACP can also be considered by the government.

Withholding

Annual

Increments

of

Non-performers

after

20

Years

grant of MACP, although subject to the employee attaining the laid down threshold of performance, is taken for granted. This Commission believes that

employees who do not meet the laid down performance criterion should not be allowed to earn future annual increments. The Commission is therefore proposing

withholding of annual increments in the case of those employees who are not able to meet the benchmark either for MACP or a regular promotion within the

first 20 years of their service. This will act as a deterrent for complacent and inefficient employees. However, since this is not apenalty, thenorms for

penal action in disciplinarycasesinvolving withholdingincrements will not be applicable in such cases. This will be treated as an “efficiency bar”.

Additionally, for such employees there could be an option to leave service on similar terms and conditions as prescribed for voluntary retirement.

Benefits

of

Migrating

to

a

New

System

composite level.

PB-4 has been set right by the process of normalisation. This will also help address the demands for upgradation of grade pay received in the Commission

solely on grounds of disparity between various pay bands.

any person on the date of implementation is to be multiplied by a factor of 2.57 and the figure so obtained will be matched for the closest figure in the level pertaining to his/her existing grade pay and fixed there.

MACP as well as on regular promotion. This will enable him/her to visualise the career path across levels and span of service.

bands. It will also depict the exact amount payable to a person in relation to number of years spent in service in each level.

of India.

personnel entering and retiring at various levels, promotional trends of various cadres, financial outgo at various levels, and so on. Hence, it can act as

a powerful tool to bring in financial management reforms.

Authority that should review the pay structure based on job roles evaluation, remuneration prevailing in the market for comparable job profiles, general

workingof the economy, etc. within a given budgetaryoutlay. With this, the pay structure could be revised periodically, at more regular intervals, say

annually, without putting an undue burden on the public exchequer every ten years, as is the casenow. Such aperiodic reviewmayhavemanypossible fallouts:

impact of revision of wages could be easily absorbed in each year’s budget and quicker remediation of anomalies would take place, leading to greater

employee satisfaction. In the backdrop of annual revisions, the present system of biannual revision of DA could also be dispensed with.

Some

Additional

Illustrative

Examples

in

Respect

of

Pay

Fixation

in

the

New

Pay

Matrix

| Ms. ABC is presently drawing a Basic Pay of Rs.12,560 in GP 2400. For Normal Fitment, her Basic Pay will first be multiplied by a factor of 2.57 and then rounded-off to the nearest Rupee. In this case 12560 x 2.57 = 32,279.20, which will be rounded-off to Rs.32,279. She will then be placed in the Pay Matrix in the Level corresponding to GP 2400 (Level 4 in this case) in a cell either equal to or next higher to Rs.32,279. In this case, her salary will be fixed at Rs.32,300. |

Pay Band |

5200-20200 | ||||||

| Grade Pay |

1800 | 1900 | 2000 | 2400 | 2800 | |||

|

Entry

Pay (EP) |

7000 | 7730 | 8460 | 9910 | 11360 | |||

| Levels | 1 | 2 | 3 | 4 | 5 | |||

| Index | 2.57 | 2.57 | 2.57 | 2.57 | 2.57 | |||

| 1 | 18000 | 19900 | 21700 | 25500 | 29200 | |||

| 2 | 18500 | 20500 | 22400 | 26300 | 30100 | |||

| 3 | 19100 | 21100 | 23100 | 27100 | 31000 | |||

| 4 | 19700 | 21700 | 23800 | 27900 | 31900 | |||

| 5 | 20300 | 22400 | 24500 | 28700 | 32900 | |||

| 6 | 20900 | 23100 | 25200 | 29600 | 33900 | |||

| 7 | 21500 | 23800 | 26000 | 30500 | 34900 | |||

| 8 | 22100 | 24500 | 26800 | 31400 | 35900 | |||

| 9 | 22800 | 25200 | 27600 | 32300 | 37000 | |||

| 10 | 23500 | 26000 | 28400 | 33300 | 38100 | |||

| 11 | 24200 | 26800 | 29300 | 34300 | 39200 | |||

5.1.51 Upgraded by Seventh CPC

| Suppose, Ms. ABC, who is presently drawing a Basic Pay of Rs.12,560 in GP 2400 (10160+2400), is upgraded to GP 2800 as a result of Seventh CPC’s recommendations. Then the fitment will be in two steps:1. The new basic pay will be computed using the upgraded grade pay. The pay arrived will be as follows:Basic Pay: 10160+2800=12,960.2. Then this value will be multiplied by a factorof2.57 and then rounded-offto the nearest Rupee. In this case 12960 x 2.57 = 33,307.20, which will be rounded-off to Rs.33,307.She will thenbeplaced inthe PayMatrix in the Level correspondingto her upgraded Grade Pay, i.e. GP 2800 (Level 5 in this case)in acell eitherequal to or next higher to Rs.33,307. In this case, her salary will be fixed at Rs.33,900. |

Pay Band |

5200-20200 | ||||||

| Grade Pay |

1800 | 1900 | 2000 | 2400 | 2800 | |||

|

Entry

Pay (EP) |

7000 | 7730 | 8460 | 9910 | 11360 | |||

| Levels | 1 | 2 | 3 | 4 | 5 | |||

| Index | 2.57 | 2.57 | 2.57 | 2.57 | 2.57 | |||

| 1 | 18000 | 19900 | 21700 | 25500 | 29200 | |||

| 2 | 18500 | 20500 | 22400 | 26300 | 30100 | |||

| 3 | 19100 | 21100 | 23100 | 27100 | 31000 | |||

| 4 | 19700 | 21700 | 23800 | 27900 | 31900 | |||

| 5 | 20300 | 22400 | 24500 | 28700 | 32900 | |||

| 6 | 20900 | 23100 | 25200 | 29600 | 33900 | |||

| 7 | 21500 | 23800 | 26000 | 30500 | 34900 | |||

5.1.52 Promotion/MACP

| Suppose, Ms. ABC, who, after having been fixed in the Pay Matrix, is drawing a Basic Pay of Rs.28,700 in Level 4. She is upgraded to Level 5 (either regular promotion or through MACP). Then her salary will be fixed in the following manner: 1. She will first be given one increment in her current Level 4 (to Rs.29,600 in this case). 2. Then she will be placed in the Level 5 at a Level equal to or next higher compared to Rs.29,600, which comes to Rs.30,100 in this case. |

Pay Band |

5200-20200 | ||||||

| Grade Pay |

1800 | 1900 | 2000 | 2400 | 2800 | |||

|

Entry

Pay (EP) |

7000 | 7730 | 8460 | 9910 | 11360 | |||

| Levels | 1 | 2 | 3 | 4 | 5 | |||

| Index | 2.57 | 2.57 | 2.57 | 2.57 | 2.57 | |||

| 1 | 18000 | 19900 | 21700 | 25500 | 29200 | |||

| 2 | 18500 | 20500 | 22400 | 26300 | 30100 | |||

| 3 | 19100 | 21100 | 23100 | 27100 | 31000 | |||

| 4 | 19700 | 21700 | 23800 | 27900 | 31900 | |||

| 5 | 20300 | 22400 | 24500 | 28700 | 32900 | |||

| 6 | 20900 | 23100 | 25200 | 29600 | 33900 | |||

| 7 | 21500 | 23800 | 26000 | 30500 | 34900 | |||

5.1.53 Annual Increment

|

Suppose, Ms. ABC, who, after having been fixed in the Pay Matrix, is drawing a Basic Pay of Rs.32,300 in Level 4. When she gets an annual

increment on 1st of July, she will just move one stage down in the same Level. Hence, after increment, her pay will be Rs.33,300. |

Pay

Band |

5200-20200

|

||||||

|

Grade

Pay |

1800

|

1900

|

2000

|

2400

|

2800

|

|||

|

Entry

Pay (EP) |

7000

|

7730

|

8460

|

9910

|

11360

|

|||

|

Levels

|

1

|

2

|

3

|

4

|

5

|

|||

|

Index

|

2.57

|

2.57

|

2.57

|

2.57

|

2.57

|

|||

|

1

|

18000

|

19900

|

21700

|

25500

|

29200

|

|||

|

2

|

18500

|

20500

|

22400

|

26300

|

30100

|

|||

|

3

|

19100

|

21100

|

23100

|

27100

|

31000

|

|||

|

4

|

19700

|

21700

|

23800

|

27900

|

31900

|

|||

|

5

|

20300

|

22400

|

24500

|

28700

|

32900

|

|||

|

6

|

20900

|

23100

|

25200

|

29600

|

33900

|

|||

|

7

|

21500

|

23800

|

26000

|

30500

|

34900

|

|||

|

8

|

22100

|

24500

|

26800

|

31400

|

35900

|

|||

|

9

|

22800

|

25200

|

27600

|

32300

|

37000

|

|||

|

↓

|

||||||||

|

10

|

23500

|

26000

|

28400

|

33300

|

38100

|

|||

|

11

|

24200

|

26800

|

29300

|

34300

|

39200

|

|||

Click here to view Seventh Pay Commission Full Report

Stay connected with us via Facebook, Google+ or Email Subscription.

Subscribe to Central Government Employee News & Tools by Email [Click Here]

Follow us: Twitter [click here] | Facebook [click here] | Google+ [click here]

Admin

COMMENTS

Sir, I am getting 4404 as basic pension from VI pay commission. I retired at 4590 in the time scale of 3050—4590, after rendering 23 years of serviceHow much I get in option 2 if the VII pay commission implements.

Where is TABLE – 12A …?

This pay commission actually disappointed to civilian employees and it is the worst pay commission than earlier pay commission and 6cpc anomalies not yet resolved so far.

10% increase in pension at the age of 65 instead of 80.