Report of Seventh Central Pay Commission

Chapter

9.1 – Advances

9.1.1 Two types of advances are granted to government employees: Interest-free and Interest-bearing.

Interest-free

Advances

9.1.2 Presently 12 interest-free advances are permissible. Their details are as follows:

Table

1

:

Interest-free

Advances

1

:

Interest-free

Advances

|

S.No.

|

Name

|

Amount

|

Eligibility

|

Remarks

|

|

1

|

Bicycle Advance | Rs.4500 | GP<=2800 | Recoverable in max 30 monthly installments |

|

2

|

Warm Clothing Advance | Rs.4500 | All Group C employees posted at a hill station either on first appointment or on transfer, for a period of not less than one year | Recoverable in max 12 monthly installments |

|

3

|

Advance of Pay on Transfer | 1 month’s pay OR2 months’ pay in case of transfer due to shift of HQ as a result of government policy | All employees transferred from one station to another in public interest | Recoverable in max 3 monthly installments |

|

4

|

Advance of TA on Tour/ Transfer/ Retirement | An amount sufficient to cover the officials’ personal travelling expenses for a month or six weeks in case of prolonged tours | All cases where TA is admissible | The advance shall be adjusted immediately after completion of tour |

|

5

|

Advance of TA to the family of a deceased government employee | Limited to 3/4th of probable expenses admissible under the rules | Same as for retirement/transfer | |

|

6

|

Advance of LTC | Up to 90% of the fare | All eligible Central Government Employees | |

|

7

|

Advance of Leave Salary | An amount not exceeding the net amount of leave salary including allowances for the first 30 days of leave after deduction of PF, House Rent, Income Tax, Recovery of Advances, etc. |

All officials proceeding on leave for a period not less than 30 days | Adjusted against the monthly salary bills |

|

8

|

Advance in connection with medical treatment | 90% of the package deal for specific major illnesses.Rs.10,000 for indoor treatment or outdoor treatment of 3 months or less for cancer.Rs.36,000 for treatment of TB where duration is more than 3 months |

All Central Government employees except Railway employees | |

|

9

|

Festival Advance |

Rs.4500

|

GP<=4800 | Recoverable in max 10 monthly installments |

|

10

|

Advance in the event of natural calamity like flood, drought, cyclone, etc. |

Rs.7500

|

All non-Gazetted employees | Recoverable in max 12 monthly installments |

|

11

|

Advance for training in Hindi through Correspondence Course |

Rs.450

|

For those Central Government employees who undergo training through correspondence course conducted by the Central Hindi Directorate | |

|

12

|

Advance for Law Suits |

Rs.500

|

All Central Government employees | Recoverable in max 24 monthly installments |

9.1.3 There is a general demand from the JCM-Staff Side to increase all interest-free advances to three times their present value.

Analysis

and

Recommendations

and

Recommendations

9.1.4 As can be seen from the table above, the amount of most of the advances is quite low. With the increased salary packages provided after successive

Pay Commissions, these advances have lost their relevance. Hence, to do away with outdated provisions and thereby save on the costs involved in

administering these advances, it is recommended that all Interest-free advances should be abolished.

Pay Commissions, these advances have lost their relevance. Hence, to do away with outdated provisions and thereby save on the costs involved in

administering these advances, it is recommended that all Interest-free advances should be abolished.

Interest-bearing

Advances

9.1.5 The following four Interest-bearing advances are presently admissible:

Table

2

:

Interest-bearing Advances

2

:

Interest-bearing Advances

| S.No. |

Name |

Amount |

Eligibility |

Remarks |

| 1 | Motor Car Advance | Rs.1,80,000 on first occasion and Rs.1,60,000 subsequently OR 8 months’ Basic Pay OR anticipated price of car, whichever is least | Pay in the pay band of Rs.19,530 or more, excluding GP | Recoverable in max 200 monthly installments |

| 2 | Motorcycle/ Scooter/ Moped Advance | Rs.30,000 on first occasion and Rs.24,000 subsequently OR 4 months’ Basic Pay OR anticipated price of Motorcycle/ Scooter/Moped, whichever is least Rs.20,000 OR anticipated price of Moped only, whichever is less if pay<8560 |

Pay in the pay band of Rs.8,560 or more, excluding GP | Recoverable in max 70 monthly installments |

| 3 | Advance for purchase of Personal Computer | Rs.80,000 on first occasion and Rs.75,000 subsequently OR anticipated price of PC, whichever is less | Pay in the pay band of Rs.19,530 or more, excluding GP | Recoverable in max 150 monthly installments |

| 4 | House Building Advance (HBA) | 34 months’ Basic Pay OR Rs.7,50,000 OR Cost of House OR repaying capacity, whichever is the least for new construction/purchase of new house/flat. For a new house, the cost ceiling limit shall be 134 times the pay in the pay band subject to a minimum of Rs.7.50 lakh and a maximum of Rs.30.00 lakh relaxable up to a maximum of 25% of the revised maximum cost ceiling of Rs.30.00 lakh. The maximum limit for grant of HBA for enlargement of existing house shall be 34 months’ of pay in the pay band subject to a maximum of Rs.1.80 lakh or cost of the enlargement or repaying capacity, whichever is the least. |

All permanent officials or officials with at least 10 years of continuous service | Recovery of principal in max 180 monthly instalments and Recovery of interest in max 60 installments subsequently |

Analysis

and

Recommendations

and

Recommendations

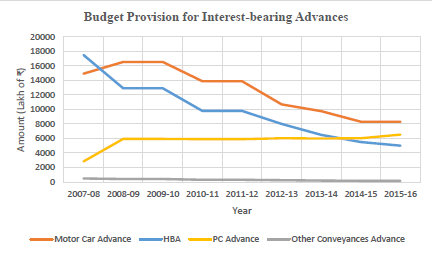

9.1.6 The present position is that meagre funds are allotted for these advances and only a few manage to avail this facility. In fact, budget provision for

all of them, except Advance for purchase of Personal Computer, has been reducing over the years, as can be seen from the graph below 35:

all of them, except Advance for purchase of Personal Computer, has been reducing over the years, as can be seen from the graph below 35:

9.1.7 Regarding Motor Car Advance and Motor Cycle/Scooter/Moped Advance, we are of the view that quite a few schemes for purchase of vehicles are available

in the market from time to time. The employees should avail of these schemes and both these advances should be abolished.

in the market from time to time. The employees should avail of these schemes and both these advances should be abolished.

9.1.8 Regarding other interest-bearing advances, the following is recommended:

|

S.

No. |

Name

of Advance |

Recommended

Ceiling |

Recommendations

|

|

1

|

P C Advance |

Rs.50,000 or actual price of PC, whichever is lower |

May be allowed maximum five times in the entire service. |

|

2

|

HBA |

34 times Basic Pa y ORRs.25 lakh OR anticipated price of house, whichever is least |

The requirement o f m inimum 1 0 y ears o f continuous service to avail of HBA should be reduced to 5 years.If both spouses are government servants, HBA should be admissible to both separately. Existing employees who have already taken Home Loans from banks and other financial institutions should be allowed to migrate to this scheme. |

———————————-

35 Source: Detailed Demands for Grants, Ministry of Finance.

Stay connected with us via Facebook, Google+ or Email Subscription.

COMMENTS

Could anyone can clarify that who is eligible for computer advance of 50000/- as per the 7th CPC recommendation?