Provisions related to TDS on withdrawal from Employees Provident Fund Scheme, 1952

(FORM No. 19)

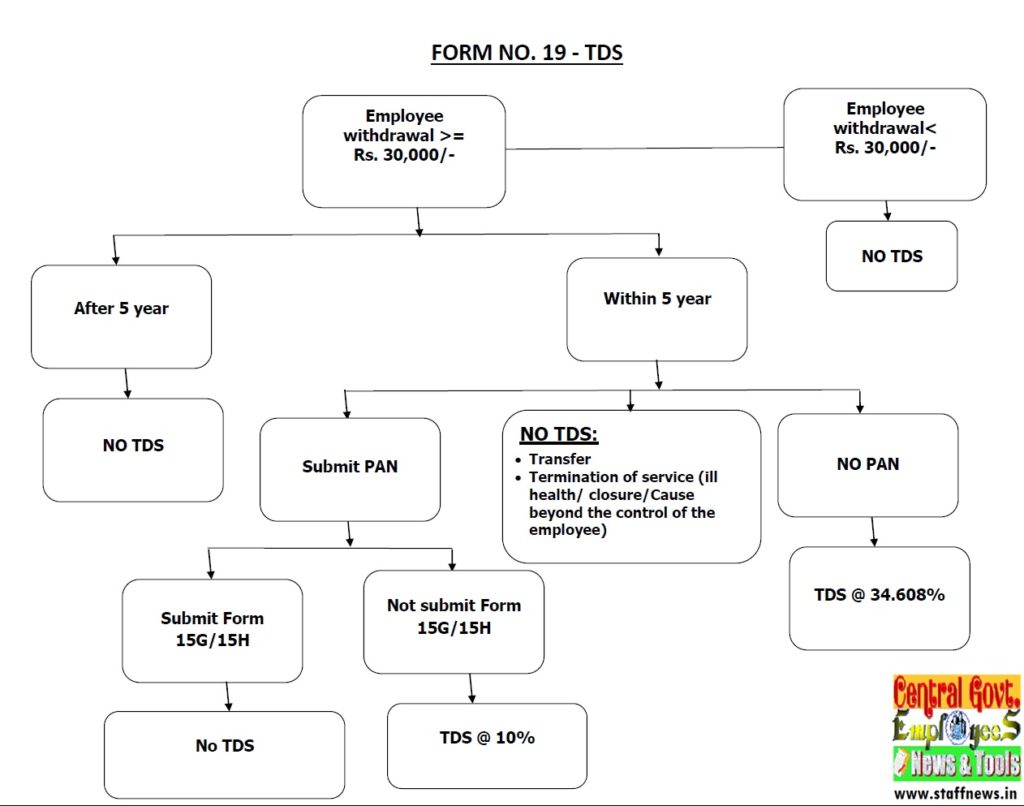

No TDS in respect of the following cases:-

- Transfer of PF from one account to another PF account.

- Termination of service due to Ill health of member /discontinuation of Business by employer/completion of project/other cause beyond the control of member.

- If employee withdraws PF after a period of five year.

- If PF payment is less than Rs. 30,000/- but the member has rendered service of less than 5 years.

- If employee withdraws amount more than or equal to Rs. 30,000/-, with service less than 5 years but submits Form 15G/15H along with their PAN

TDS will be deducted in respect of the following cases:

- If employee withdraws amount more than or equal to Rs. 30000/-, with service less than 5 years, then

a) TDS will be deducted @ 10% if Form-15G/15H is not submitted provided PAN is submitted.

b) TDS will be deducted @ maximum marginal rate (i:e. 34.608%) if employee fails to submit PAN.

Notes:

- TDS is deductible at the time of payment.

- TDS will be deducted under Section 192A of Income Tax Act, 1961.

- Form 15H is for senior citizens (60 years & above) and Form 15G is for individuals having no taxable income. Form 15G & 15H are self declarations and may be accepted as such in duplicate.

- Members must quote PAN in Form No.- 15G / 15H and in Form No. 19.

Source: EPFO

http://epfindia.gov.in/site_docs/PDFs/Updates/TDS_FlowChart_Instructions_Eng.pdf

Stay connected with us via Facebook, Google+ or Email Subscription.

Subscribe to Central Government Employee News & Tools by Email [Click Here]

Follow us: Twitter [click here] | Facebook [click here] | Google+ [click here]

Admin

COMMENTS