Revision of pension of Pre -1996/Pre-2006 pensioners – Inclusion of Non-Practicing Allowance (NPA) for revision of pension of retired medical officers w.e.f 1.1.1996/ w.e.f 1.1.2006: Formula of Calculation by PCDA(P) Circular No. C-145

OFFICE OF THE PR. CONTROLLER OF DEFENCE ACCOUNTS (PENSIONS)

DRAUPADI GHAT, ALLAHABAD- 211014

Important Circular No: C-145

No:-GI/C/0198/Vol- V/Tech

O/o the Pr.C.D.A. (Pensions)

Draupadighat Allahabad -211014

Dated: – 11/09/2015

Subject: Revision of pension of Pre -1996/Pre-2006 pensioners – Inclusion of Non-Practicing Allowance (NPA) for revision of pension of retired medical officers w.e.f 1.1.1996/ w.e.f 1.1.2006.

Reference: This office Important Circulars No. 57 dt. 17.09.2008, 62 dt. 12.11.2008, 102 dt. 11.02.2013 & C-144 dt. 14.08.2015.

(Available on this office website: http://pcdapension.nic.in )

On the subject matter in its judgment dated 27.11.2013 in Civil Appeal No. 10640 – 46/2013 and other connected matters, Hon’ble Supreme Court has directed to recalculate the pension payable to the Applicants (i.e. pre -1996 retired medical officers) by adding the element of NPA. The Review Petitions filed by the Government against the above mentioned judgment have been dismissed by Hon’ble Supreme Court on 31.7.14.

(2) In view of above, GOI, Ministry of P, PG and pension, Dept of P&PW have issued orders under(2) their OM No. 38/31/11 P&PW (A)(Vol. IV) dated 14.10.2014 & 21.10.2014 (copy enclosed) that “In case of pre -1996 retired medical officers, NPA @ 25% shall be added to the minimum of the revised scale of pay as on 1.1.1996 corresponding to the pre 1996 pay scales from which the pensioners had retired, in cases where consolidated pension/family pension was to be stepped up to 50% / 30% respectively of the minimum of revised pay –scale in terms of OM No. 45/10/98-P&PW (A) dated 17.12.1998 read with OM No. 45/86/97-P &PW (A)(Pt.) dated 11.5.2001, subject to condition that after revision of above terms pension does not exceed Rs15,000/- w.e.f. 1.1. 1996.”

(3) All other conditions as given in OM No. 45/10/98-P&PW (A) dated 17.12.1998 read with OM No. 45/86/97-P &PW (A)(Pt.) dated 11.5.2001 , shall remain unchanged.

(4) Further, GOI, Ministry of P, PG and pension, Dept of P&PW has extended the above said benefits to Pre- 2006 under their OM No. 38/ 31/ 11 P&PW (A)(Vol. IV) dated 18th February, 2015 (copy enclosed) and directed that “For revision of pension/family pension in case of Pre-2006 retired medical officers w.e.f 01.01.2006, in terms of OM No. 38/37/08-P&PW (A) dated 28.01.2013 and dated 30.07.2015, NPA @25% would be required to be added to the minimum of the pay in the revised pay band plus grade pay (or minimum of pay in revised pay scale in the case of HAG and above) corresponding to the pre-revised pay scale from which they retired as arrived at with reference to the fitment table annexed to the Department of Min of Fin, Deptt of Expenditure OM No. 1/1/2008 – IC dated 30-08-2008, subject to condition that the basic pay plus NPA does not exceed Rs. 85,000/-.”

(5) All other conditions as given in OM No. 38/37/ 08-P&PW (A) dated 1.9.2008 as amended from timeto time shall remain unchanged.

(6) Formula to calculate the above benefits in r/ o Pre-1996 & Pre-2006 retired medical officer is given as Annexure – I & II respectively. How ever, where, the PDAs are in doubt in regulating the payment of revised pension/family pension under these orders, the cases with full details of pensioner/ family pensioners and PPO No, etc. may be referred to Audit Section of this office for advice and further action.

(Upinderbir Singh)

D C D A (P)

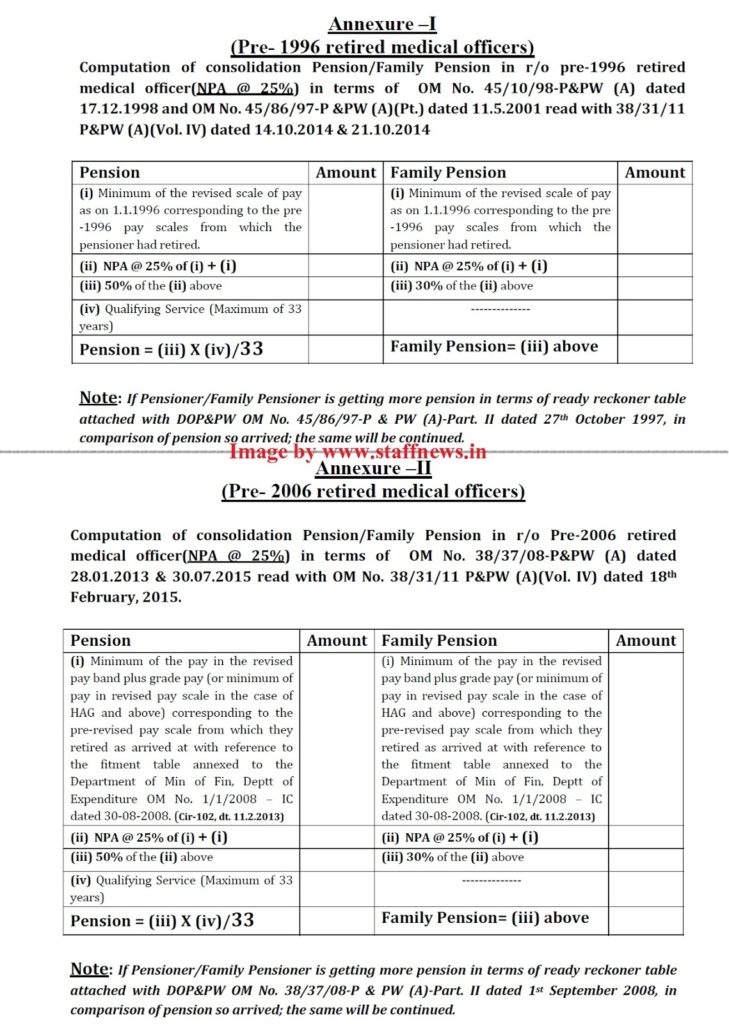

Annexure -I

(Pre- 1996 retired medical officers)

Computation of consolidation Pension/Family Pension in r/o pre-1996 retired

medical officer (NPA @ 25%) in terms of OM No. 45/ 10/98-P&PW (A) dated

17.12.1998 and OM No. 45/86/97-P &PW (A)(Pt.) dated 11.5.2001 read with 38/31/11

P&PW (A) (Vol. IV) dated 14.10.2014 & 21.10.2014

medical officer (NPA @ 25%) in terms of OM No. 45/ 10/98-P&PW (A) dated

17.12.1998 and OM No. 45/86/97-P &PW (A)(Pt.) dated 11.5.2001 read with 38/31/11

P&PW (A) (Vol. IV) dated 14.10.2014 & 21.10.2014

| Pension | Amount | Family Pension | Amount |

| (i) Minimum of the revised scale of pay as on 1.1.1996 corresponding to the pre-1996 pay scales from which the pensioner had retired. |

(i) Minimum of the revised scale of pay as on 1.1.1996 corresponding to the pre-1996 pay scales from which the pensioner had retired. | ||

| (ii) NPA @ 25% of (i) + (i) | (ii) NPA @ 25% of (i) + (i) | ||

| (iii) 50% of the (ii) above | (iii) 30% of the (ii) above | ||

| (iv) Qualifying Service (Maximum of 33 years) |

—-

|

||

| Pension = (iii) x (iv) /33 | Family Pension: (iii) above |

Note: If Pensioner/Family Pensioner is getting more pension in terms of ready reckoner table

attached with DOP&PW oM No. 45/86/97-P & PW (A)-Part. II dated 27th October 1997, in

comparison of pension so arrived; the same will be continued.

attached with DOP&PW oM No. 45/86/97-P & PW (A)-Part. II dated 27th October 1997, in

comparison of pension so arrived; the same will be continued.

Annexure -II

(Pre- 2006 retired medical officers)

Computation of consolidation Pension/Family Pension in r/o Pre-2006 retired

medical officer(NPA @ 25%) in terms of OM No. 38/37/08-P&PW (A) dated

28.01.2013 & 30.07.2015 read with OM No. 38/31/11 P&PW (A)(Vol. IV) dated 18th

February, 2015.

medical officer(NPA @ 25%) in terms of OM No. 38/37/08-P&PW (A) dated

28.01.2013 & 30.07.2015 read with OM No. 38/31/11 P&PW (A)(Vol. IV) dated 18th

February, 2015.

| Pension | Amount | Family Pension | Amount |

| (i) Minimum of the pay in the revised pay band plus grade pay (or minimum of pay in revised pay scale in the case of HAG and above) corresponding to the pre-revised pay scale from which they retired as arrived at with reference to the fitment table annexed to the Department of Min of Fin, Deptt of Expenditure OM No. 1/ 1/2008 – IC dated 30-08-2008. (Cir- 102, dt. 11.2.2013) |

(i) Minimum of the pay in the revised pay band plus grade pay (or minimum of pay in revised pay scale in the case of HAG and above) corresponding to the pre-revised pay scale from which they retired as arrived at with reference to the fitment table annexed to the Department of Min of Fin, Deptt of

Expenditure OM No. 1/1/2008 – IC dated 30-08-2008.(Cir-102, dt. 11.2.2013)

|

||

|

(ii) NPA @ 25% of (i) + (i)

|

(ii) NPA @ 25% of (i) + (i)

|

||

| (iii) 50% of the (ii) above | (ii) 30% of the (ii) above | ||

| (iv) Qualifying Service( Maximum of 33 years) |

—-

|

||

| Pension: (iii) x (iv)/33 | Family Pension: (iii) above |

Note: If Pensioner/Family Pensioner is getting more pension in terms of ready reckoner table

attached with DOP&PW OM No. 38/37/08-P & PW (A)-Part. II dated 13‘ September 2008, in

comparison of pension so arrived; the same will be continued.

attached with DOP&PW OM No. 38/37/08-P & PW (A)-Part. II dated 13‘ September 2008, in

comparison of pension so arrived; the same will be continued.

Enclosures [click on OM No. to view]:-

Dept of P&PW OM No. 38/31/11 P&PW (A)(Vol. IV) dated 14.10.2014 &

Dept of P&PW OM No. 38/31/11 P&PW (A)(Vol. IV) dated 21.10.2014

Source: http://pcdapension.nic.in/6cpc/Circular-c145.pdf

Stay connected with us via Facebook, Google+ or Email Subscription.

Subscribe to Central Government Employee News & Tools by Email [Click Here]

Follow us: Twitter [click here] | Facebook [click here] | Google+ [click here]

Admin

COMMENTS

Govt should think of giving non practicing allowance to professionals such as Advocates as Judges and other posts where professional experience is needed.Further promotions should be there to get honest and best talented persons