Pradhan Mantri Sneh Bandhan Scheme – An insurance focused Deposit Scheme o be launched with effect from 1st August 2015

Indian Banks Association

No.RB/PMSBY/1092

July 20,2015

Chief Executives of all Member Banks

Dear Sirs/Madam,

Pradhan Mantri Sneh Bandhan Scheme – An insurance focused Deposit Scheme

Please find enclosed a Scheme called Pradhan Mantri Sneh Bandhan Scheme received from the Department of Financial Services to be launched with effect from 1st August 2015. This gift product is designed keeping in view the ensuing Raksha Bandhan festival in mind. However, the product is relevant for other festivals, social occasions and family celebrations also. Essentially the gifter buys the gift instrument (typically a bankers’ cheque or Gift Card), and gives to a sister or a relative as a gift on the given occasion. The giftee presents the instrument to the bank to be deposited in her existing account or a new account to be opened. The bank can open a Zero balance BSBDA account, if need be. The three variations of the gift instrument are as under:

1. Instrument for Rs. 201. This will facilitate premium payment for Pradhan Mantri Suraksha Bima Yoj ana over a period of several years.

2. Instrument for Rs.351. This will facilitate one year premium payment for Pradhan Mantri Suraksha Bima Yoj ana and Pradhan Mantri J eevan Jyoti Bima Yoj ana.

3. Instrument for Rs.5001. This will facilitate premium payment for both PMJ J BY and PMSBY over a period of several years.

It is envisaged that in respect of product 1 and 3 above, the interest on fixed deposit created will meet premium payment of the insurance product(s). In the illustration given in the Scheme, it is envisaged that the premium for initial 2 years will be retained in the savings account and the balance amount kept in fixed deposit for 5 to 10 years. Banks could however, examine alternate approaches to optimize the process and to ensure availability of balance in the account for meeting premium payment every year on the designated date. (example: after deducting the 1st year premium, the balance could be kept in short term deposit maturing on 31St May 2016. On that day, after retaining amount required for premium payment on 1st June 2016 the remaining amount could be placed in longer term deposits with annual interest getting credited to the savings account on 31st May every year which will facilitate premium payment on 1st June).

Banks may ensure the giftee is eligible for enrolment in the insurance schemes concerned and necessary enrolment forms are got filled up. In the event, the giftee is already covered for the current year under the said insurance schemes, the amount may be utilized for premium payment in subsequent years. This is for your information and necessary action.

Yours faithfully,

K Unnikrishnan

Deputy Chief Executive

Encl: as above

DFS Letter to IBA:-

F. No. 7/81/2015~BOA

Government of india

Ministry of Finance

Department of Financial Services

New Deihi, dated the 17th July, 2015

To,

The Chief Executive

Indian Banks Association

Mumbai

Sub: Draft Scheme of Pradhan Mantri Suraksha BimaYojna, Pradhan Mantri Jeevan Jyoti BimaYojana and Atal Pension Yojana.

Sir,

I am directed to say that Prime Minister has recently launched three social security schemes, viz. Pradhan Mantri Suraksha Bima Yojana, Pradhan Mantri Jeevan Jyoti BimaYojana and Atal Pension Yojana.

2. A group of bankers comprising of State Bank of india (SBl), Punjab National Bank (PNB), Bank of Baroda (BOB) etc was convened to discuss and formulate some standard products to cover premium of these schemes.

3. The group has forwarded the draft scheme which is being forwarded to lBA to circuiate amongst member banks ensuring that these products are available from August 13th 2015 before the festival of Raksha Bandhan.

4, This may be given TOP PRIORITY,

Yours faithfully,

Encl.-As above

(Tirth Ram)

Under Secretary to the Government of India

PRADHAN MANTRI SNEH BANDHAN YOJANA

(PROPOSED NAME)

Hon’ble Prime Minister earlier announced two schemes of Govt. of India i.e Pradhan Mantri Suraksha Bima Yojana (PMSBY) and Pradhan Mantri Jeewan Jyoti Bima Yojana (PMJJBY).

On the occasion of Raksha Bandhan, three specially designed gift products are now being announced by Hon’ble Prime Minister, which will be purchased from the Banks on payment of specified amount, for gifting the same as detailed below. However, the scheme will be available at all the times.

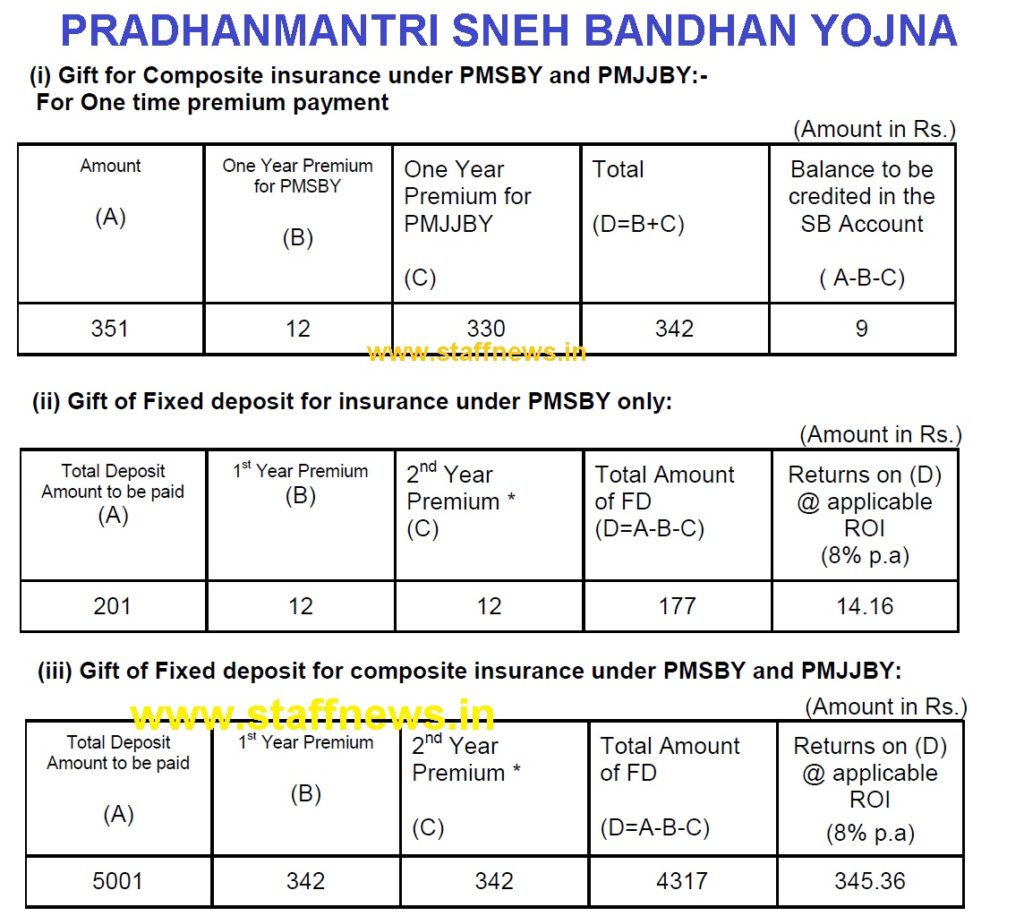

(i) Gift for Composite insurance under PMSBY and PMJJBY:-

For One time premium payment

(Amount in Rs.)

| Amount |

One Year Premium for PMSBY |

One Year Premium for PMJJBY |

Total |

Balance to be credited in the SB Account |

(A) |

(B)

|

(C) |

(D=B+C) |

(A-B-C) |

| 351 |

12 |

330 |

342 |

9 |

An individual may gift an amount of Rs. 351/- on Raksha Bandhan towards funding of the recipients one time insurance premium for PMSBY and PMJJBY (Rs. 12/- + Rs. 330/- i.e Rs. 342/-), with the balance amount of Rs. 9/- to be credited to the savings bank account of the insured. Subsequent insurance premia will have to be deposited by the insurer for continuing the insurance cover.

(ii) Gift of Fixed deposit for insurance under PMSBY only:

(Amount in Rs.)

| Total Deposit Amount to be paid |

1st Year Premium |

2nd Year Premium * |

Total Amount of FD |

Returns on (D) @ applicable ROI

(8% p.a)

|

(A) |

(B)

|

(C) |

(D=A-B-C) |

| 201 |

12 |

12 |

177 |

14.16 |

To be parked in SB account of the insurer till the date of next premium.

An individual may invest an amount of Rs. 201/- any time during the year for gifting from which:-

(a) Rs. 12/- will be immediately paid to the insurance company as first years’ premium.

(b) Rs.12/- will be parked separately in a SB account of the insurer towards payment of second years’ premium.

(c) Balance amount of Rs. 177/- will be invested in a TD (Term Deposit) for ten years at the then prevalent interest rate (8% pa) for earning annual interest income of Rs. 14.16 which will be sufficient for annual insurance premiums, at the current rate, up to the date of the Term Deposit.

(iii) Gift of Fixed deposit for composite insurance under PMSBY and PMJJBY:

(Amount in Rs.)

| Total Deposit Amount to be paid |

1st Year Premium |

2nd Year Premium * |

Total Amount of FD |

Returns on (D) @ applicable ROI (8% p.a)

|

(A) |

(B)

|

(C) |

(D=A-B-C) |

| 5001 |

342 |

342 |

4317 |

345.36 |

To be parked in SB account of the insurer till the date of next premium

An individual may invest an amount of Rs. 5001/- any time during the year for gifting from which:-

(a) Rs. 342/- will be immediately paid to the insurance company as first years’ premium.

(b) Rs.342/- will be parked separately in a SB account of the insurer towards payment of second years’ premium.

(c) Balance amount of Rs. 4317/- will be invested in a TD (Term Deposit) for Five or Ten years at the then prevalent interest rate (8% pa) for earning annual interest income of Rs.345.36 which will be sufficient for annual insurance premiums, at the current rate, up to the date of the Term Deposit.

TERMS AND CONDITIONS:

1. Maintenance of desired insurance schemes’ premium will be the responsibility of the customer/ insured.

2. Prevailing rate of interest will be paid on the term / fixed deposits.

3. Extant guidelines related to deduction of tax at source will be applicable on the term / fixed deposit accounts.

Source: www.iba.org.in

Stay connected with us via Facebook, Google+ or Email Subscription.

Subscribe to Central Government Employee News & Tools by Email [Click Here]

Follow us: Twitter [click here] | Facebook [click here] | Google+ [click here]

Admin

COMMENTS