Revision of Form A – Application for Disability Pension and Form B – Application for extraordinary Family Pension: Review of CCS(Extra Ordinary Pension) Form – Pensioners Portal Orders

NOTIFICATION

1. (1) These rules may be called the Central Civil Services (Extraordinary Pension) Amendment Rules, 2015.

(2) They shall come into force on the date of their publication in the Official Gazette.

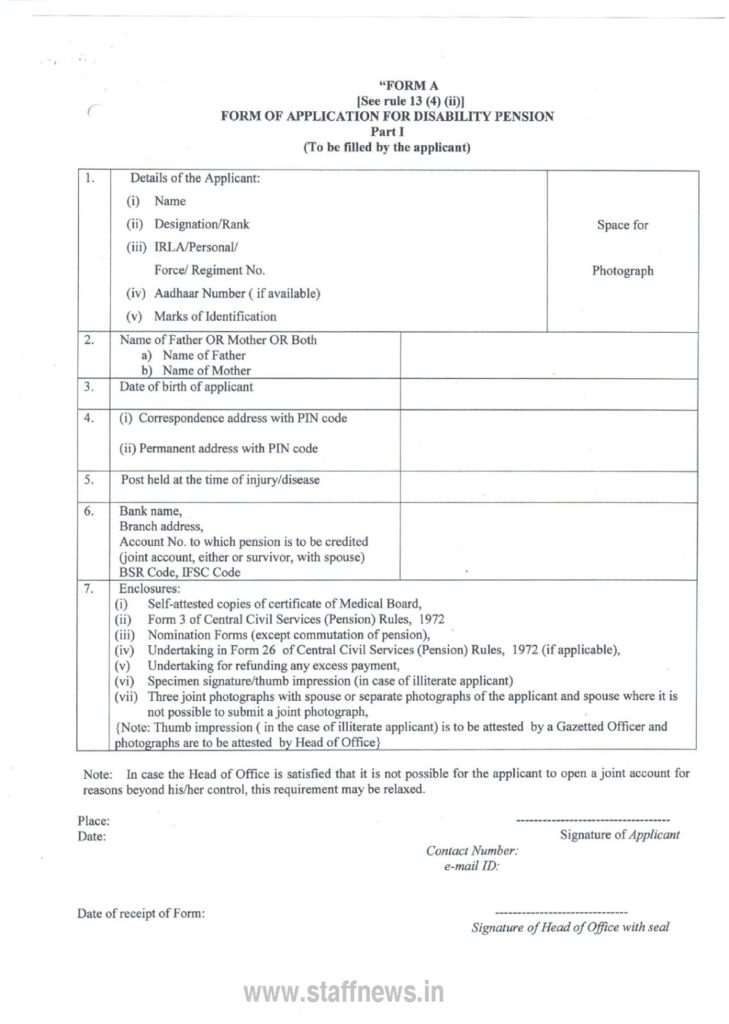

2. In the Central Civil Services (Extraordinary Pension) Rule, 1939, in Schedule IV, for Form A and Form B, the following Forms shall respectively be substituted, namely:-

| 1. |

Details of the Applicant:

|

Space for

Photograph |

|

|

(i)

Name |

|||

|

(ii)

Designation/Rank |

|||

|

(iii) IRLA/Personal/

Force/ Regiment No. |

|||

|

(iv) Aadhaar

Number ( if available) |

|||

|

(v)

Marks of Identification |

|||

| 2. |

Name

of Father OR Mother OR Both |

|

|

|

a)

Name of Father |

|||

|

b)

Name of Mother |

|||

| 3. |

Date

of birth of applicant |

||

| 4. |

(i)

Correspondence address with PIN code |

||

|

(ii)

Permanent address with PIN code |

|||

| 5. |

Post

held at the time of injury/disease |

||

| 6. |

Bank

name, |

||

|

Branch

address, |

|||

|

Account No. to which pension is to be credited

(joint account, either or survivor, with spouse) BSR Code, IFSC Code |

|||

| 7. |

Enclosures:

(i) Self-attested copies of certificate of Medical Board, (ii) Form 3 of Central Civil Services (Pension) Rules, 1972 iii) Nomination Forms (except commutation of pension), (iv) Undertaking in Form 26 of Central Civil Services (Pension) Rules, 1972 (if applicable), (v) Undertaking for refunding any excess payment, (vi) Specimen signature/thumb impression (in case of illiterate applicant) (vii) Three joint photographs with spouse or separate photographs of the applicant and spouse where it is not possible to submit a joint photograph, {Note: Thumb impression ( in the case of illiterate applicant) is to be attested by a Gazetted Officer and photo ars are to be attested b Head of Office} |

||

(Note: In case the Head of Office is satisfied that it is not possible for the applicant to open a joint account for

reasons beyond his/her control, this requirement may be relaxed.

| Place: Date: |

———————-

Signature of Applicant |

|

Contact Number: _______________________

e-mail ID: __________________ |

|

| Date of receipt of Form: |

———————————

Signature of Head of Office with seal |

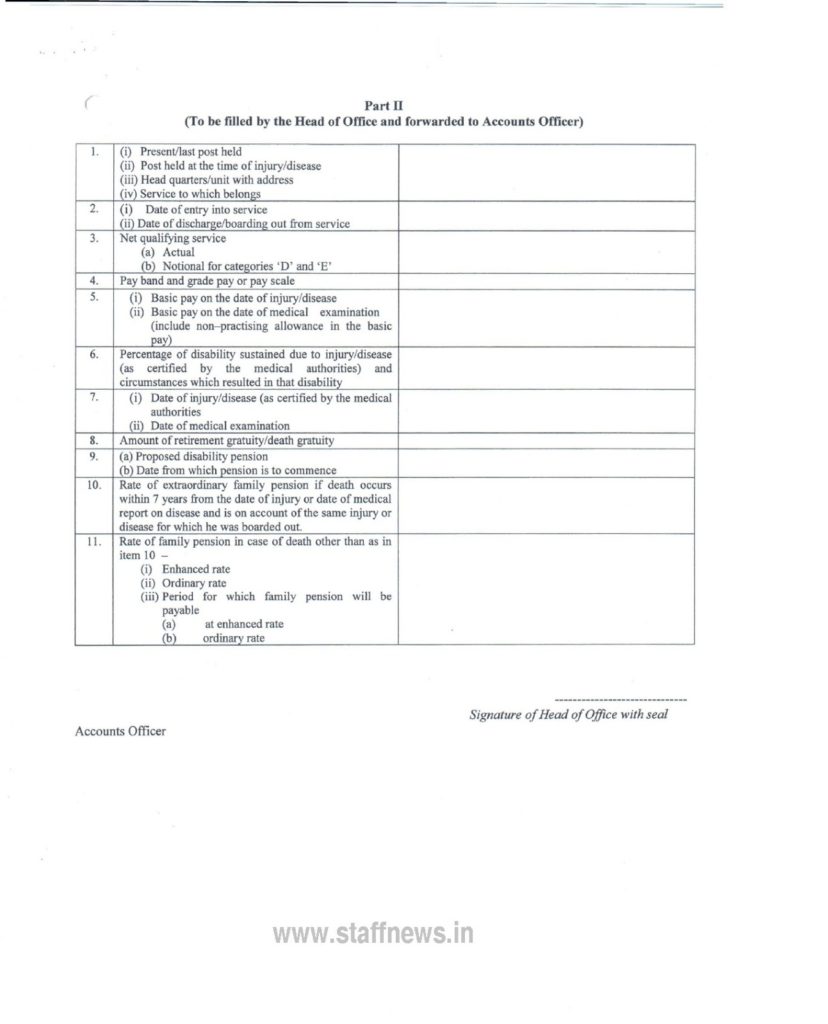

| 1. |

(i)

|

Present/last post held

|

||

|

(ii)

|

Post held at the time of injury/disease

|

|||

|

(iii)

|

Head quarters/unit with address

|

|||

|

(iv)

|

Service to which belongs

|

|||

| 2. |

(i)

|

Date of entry into service

|

||

|

(ii)

|

Date of discharge/boarding out from service

|

|||

| 3. |

Net qualifying service

|

|||

|

|

(a) Actual

|

|||

|

|

(b) Notional for categories ‘D’ and ‘E’

|

|||

| 5. |

(i)

|

Basic pay on the date of injury/disease

|

||

|

(ii)

|

Basic pay on the date of medical

examination (include non-practising allowance in the basic pay) |

|||

| 6. |

Percentage of disability sustained due to injury/disease

(as certified by the medical authorities) and circumstances which resulted in that disability |

|||

| 7. |

(i)

|

Date of injury/disease (as certified by the

medical authorities |

||

|

(ii)

|

Date of medical examination

|

|||

| 8. |

Amount of retiremet gratuity/death gratuity

|

|||

| 9. |

(a)

|

Proposed disability pension

|

||

|

(b)

|

Date from which pension is to commence

|

|||

| 10. |

Rate of extraordinary family pension if

death occurs within 7 years from the date of injury or date of medical report on disease and is on account of the same injury or disease for which he was boarded out. |

|||

| 11. |

Rate of family pension in case of death

other than as in item 10 |

|||

|

|

(i) Enhanced rate

|

|||

|

|

(ii) Ordinary rate

|

|||

|

|

(iii) Period for which family pension will

be payable |

|||

|

|

|

(a) at enhanced rate

|

||

|

|

|

(b) ordinary rate

|

||

Accounts Officer

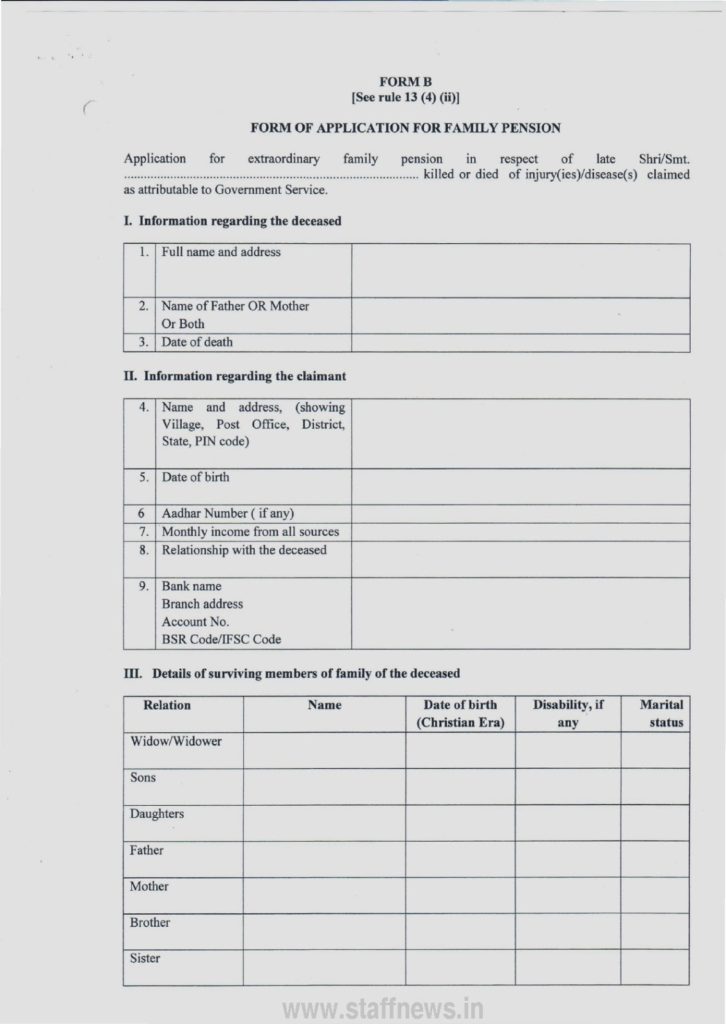

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ __ _ _ _ _ _ _ killed or died of injury(ies)/disease(s) claimed

as attributable to Government Service.

I. Information regarding the deceased

|

1.

|

Full name and address

|

|

|

2.

|

Name of Father OR Mother

Or Both |

|

|

3.

|

Date of death

|

|

II. Information regarding the claimant

|

4.

|

Name and address, (showing

Village, Post Office, District, State, PIN code) |

|

|

5.

|

Date of birth

|

|

|

6.

|

Aadhaar Number (if any)

|

|

|

7.

|

Monthly income from all

sources |

|

|

8.

|

Relationship with the

deceased |

|

|

9.

|

Bank Name

Branch Address Account No. BRS Code/IFSC Code |

|

III. Details of surviving members of family of the deceased

| Relation | Name | Date of birth (Christian Era) |

Disability, if any | Marital status |

|

Widow/Widower

|

||||

|

Sons

|

||||

|

Daughters

|

||||

|

Father

|

||||

|

Mother

|

||||

|

Brother

|

||||

|

Sister

|

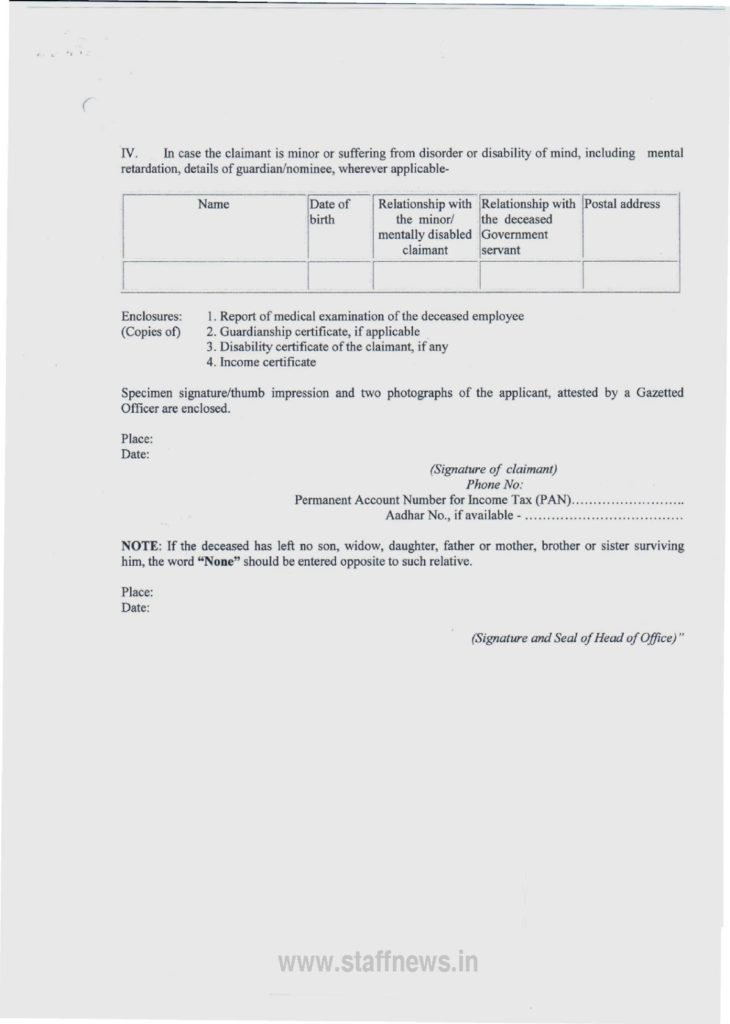

IV. In case the claimant is minor or suffering from disorder or disability of mind, including mental

retardation, details of guardian/nominee, wherever applicable-

|

Name

|

Date of birth | Relationship with the minor/ mentally disabled claimant |

Relationship with the deceased Government servant |

Postal address |

| Enclosures: (Copies of): |

1. Report of medical examination of the deceased employee 2. Guardianship certificate, if applicable 3. Disability certificate of the claimant, if any 4. Income certificate |

Specimen signature/thumb impression and two photographs of the applicant, attested by a Gazetted

Officer are enclosed.

| Place: Date: |

(Signature of claimant) _______________________

Phone No: ______________ Permanent Account Number for Income Tax (PAN)_______________ Aadhar No., if available _______________ |

him, the word “None” should be entered opposite to such relative.

Place:

Date:

the 7th August, 1987 were published by the Ministry of Personnel, Public Grievances and

Pensions, Department of Pension and Pensioners Welfare and the said rules were

further amended vide

1. S.O. No.1487(E) dated the 30th December, 2003

2. S.O. No.410(E) dated the 15th February 2011

3. G.S.R No. 96 dated the 20th December, 2013.

Source: Pensioners Portal

[http://documents.doptcirculars.nic.in/D3/D03ppw/PPWF_050515_eng.pdf]

Stay connected with us via Facebook, Google+ or Email Subscription.

Subscribe to Central Government Employee News & Tools by Email [Click Here]

Follow us: Twitter [click here] | Facebook [click here] | Google+ [click here]

COMMENTS