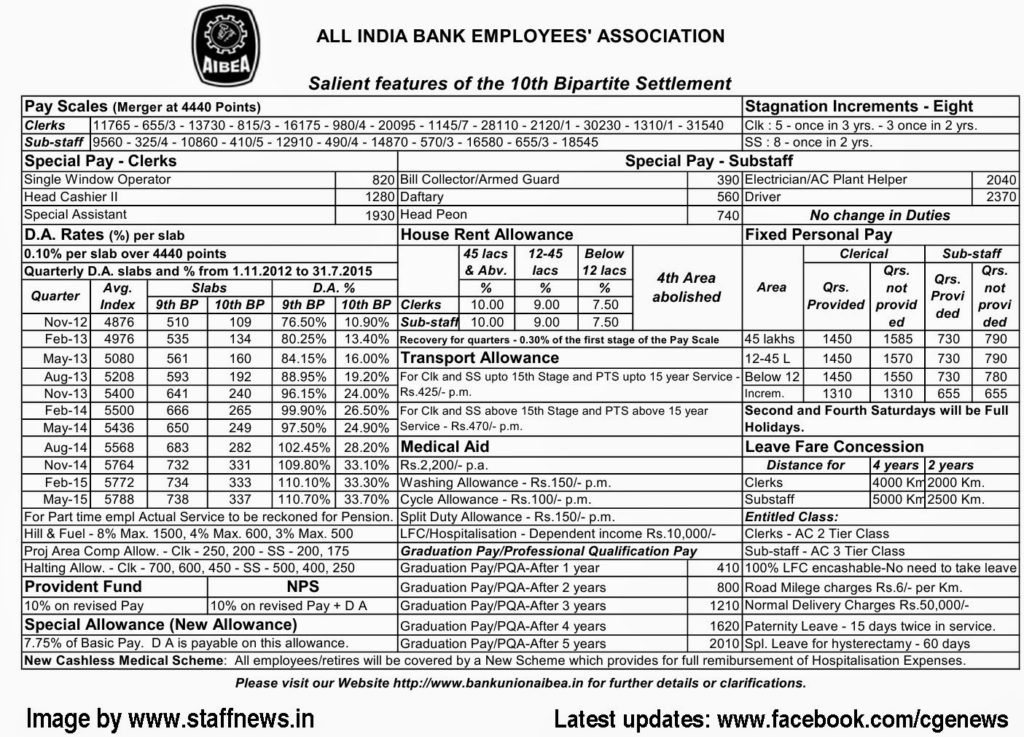

| Pay Scales (Merger at 4440 Points) | |

| Clerks | 11765 – 655/3 – 13730 – 815/3 – 16175 – 980/4 – 20095 – 1145/7 – 28110 – 2120/1 – 30230 – 1310/1 – 31540 |

| Sub-staff | 9560 – 325/4 – 10860 – 410/5 – 12910 – 490/4 – 14870 – 570/3 – 16580 – 655/3 – 18545 |

Stagnation Increments – Eight

Clk : 5 – once in 3 yrs. – 3 once in 2 yrs.

SS : 8 – once in 2 yrs.

| Special Pay – Clerks | |

| Single Window Operator | 820 |

| Head Cashier II | 1280 |

| Special Assistant | 1930 |

| Special Pay – Substaff | |

| Bill Collector/Armed Guard | 390 |

| Daftary | 560 |

| Head Peon | 740 |

| Electrician/AC Plant Helper | 2040 |

| Driver | 2370 |

| No change in Duties | |

D.A. Rates (%) per slab

| Quarterly D.A. slabs and % from 1.11.2012 to 31.7.2015 | |||||

| Quarter | Avg. Index | Slabs | D.A. % | ||

| 9th BP | 10th BP | 9th BP | 10th BP | ||

| Nov-12 | 4876 | 510 | 109 | 76.50% | 10.90% |

| Feb-13 | 4976 | 535 | 134 | 80.25% | 13.40% |

| May-13 | 5080 | 561 | 160 | 84.15% | 16.00% |

| Aug-13 | 5208 | 593 | 192 | 88.95% | 19.20% |

| Nov-13 | 5400 | 641 | 240 | 96.15% | 24.00% |

| Feb-14 | 5500 | 666 | 265 | 99.90% | 26.50% |

| May-14 | 5436 | 650 | 249 | 97.50% | 24.90% |

| Aug-14 | 5568 | 683 | 282 | 102.45% | 28.20% |

| Nov-14 | 5764 | 732 | 331 | 109.80% | 33.10% |

| Feb-15 | 5772 | 734 | 333 | 110.10% | 33.30% |

| May-15 | 5788 | 738 | 337 | 110.70% | 33.70% |

House Rent Allowance

| 45 lacs & Abv. |

12-45 lacs |

Below 12 lacs |

4th Area

abolished |

|

| % | % | % | ||

| Clerks | 10.00 | 9.00 | 7.50 | |

| Sub-staff | 10.00 | 9.00 | 7.50 | |

| Recovery for quarters – 0.30% of the first stage of the Pay Scale | ||||

Fixed Personal Pay

| Area | Clerical | Sub-staff | ||

| Qrs. Provided |

Qrs. not provided |

Qrs. Provided

|

Qrs. not provided |

|

| 45 lakhs | 1450 | 1585 | 730 | 790 |

| 12-45 L | 1450 | 1570 | 730 | 790 |

| Below 12 | 1450 | 1550 | 730 | 780 |

| Increm. | 1310 | 1310 | 655 | 655 |

Transport Allowance

| For Clk and SS upto 15th Stage and PTS upto 15 year Service – | Rs.425/- p.m. |

| For Clk and SS above 15th Stage and PTS above 15 year Service | Rs.470/- p.m. |

Medical Aid – Rs.2,200/- p.a.

Washing Allowance – Rs.150/- p.m.

Cycle Allowance – Rs.100/- p.m.

Split Duty Allowance – Rs.150/- p.m.

Hill &; Fuel – 8% Max. 1500, 4% Max. 600, 3% Max. 500

Proj Area Comp Allow. – Clk – 250, 200 – SS – 200, 175

Halting Allow. – Clk – 700, 600, 450 – SS – 500, 400, 250

Graduation Pay/Professional Qualification Pay

| Graduation Pay/PQA-After 1 year | 410 |

| Graduation Pay/PQA-After 2 years | 800 |

| Graduation Pay/PQA-After 3 years | 1210 |

| Graduation Pay/PQA-After 4 years | 1620 |

| Graduation Pay/PQA-After 5 years | 2010 |

Special Allowance (New Allowance)

7.75% of Basic Pay. D A is payable on this allowance.

| Provident Fund | NPS |

| 10% on revised Pay | 10% on revised Pay + D A |

Leave Fare Concession

| Distance for | 4 years | 2 years |

| Clerks | 4000 Km | 2000 Km. |

| Substaff | 5000 Km | 2500 Km. |

| Entitled Class: Clerks – AC 2 Tier Class Sub-staff – AC 3 Tier Class 100% LFC encashable-No need to take leave

|

||

Road Mileage charges Rs.6/- per Km.

Second and Fourth Saturdays will be Full Holidays.

LFC/Hospitalisation – Dependent income Rs.10,000/-

Normal Delivery Charges Rs.50,000/-

Paternity Leave – 15 days twice in service.

Spl. Leave for hysterectamy – 60 days

For Part time empl Actual Service to be reckoned for Pension.

New Cashless Medical Scheme: All employees/retires will be covered by a New Scheme which provides for full reimbursement of Hospitalisation Expenses.

Source: http://www.bankunionaibea.in for further details or clarifications.

Stay connected with us via Facebook, Google+ or Email Subscription.

Subscribe to Central Government Employee News & Tools by Email [Click Here]

Follow us: Twitter [click here] | Facebook [click here] | Google+ [click here]

Admin

COMMENTS