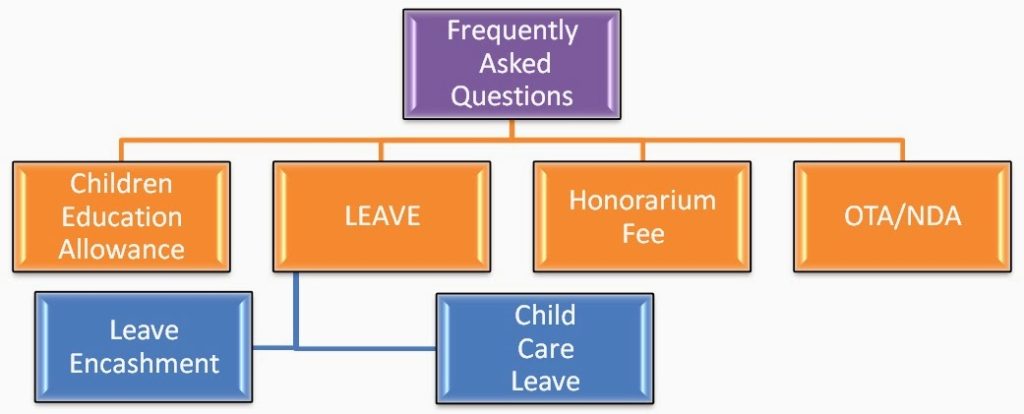

FAQ on Children Education Allowance, OTA/NDA, Honorarium/Fee, Child Care Leave to Male Employees, Leave Encashment on LTC.

No.1-11020/1/2014-Estt.(AL)

Government of India

Ministry of Personnel, Public Grievances and Pensions

Department of Personnel & Training

|

Establishment (Allowance) Section

|

|||

| SI. No | Question |

Answer

|

|

|

|||

| 1. |

Whether reimbursement of Children Education Allowance

is admissible for the: |

||

| (a) | Nursery/LKG/UKG as there is no provision of recognition of these classes in most of the States/UTs; |

Reimbursement is permissible only if the child is studying in a recognised educational institution. |

|

| (b) | Third child if either of the first two children is disabled to the extent that he/she cannot go to school; |

Reimbursement is allowed to only the two eldest surviving children of the Government servant except when the 2nd child birth results in multiple births or the 3rd child is born due to failure of sterilization operation. |

|

| (c) | The children borne out of second marriage or the children of second wife/husband in additions to children from first marriage; |

Reimbursement is allowed to only the two eldest surviving children of the Government servant. |

|

| (d) | Entitlement of number of Note Books. | Reimbursement is permissible for any number of note books as may be prescribed by the recognised educational institution. |

|

|

|||

| 2. | The reasons for not enhancing rates of OTA/NDA |

The 5th and the 6th Central pay Commission did not recommend enhancement of rates of OTA/NDA. |

|

|

|||

| 3. | Whether honorarium is payable to the Chairperson/Members of the DPC and also such other Departmental Committees, viz., Committee on Sexual Harassments at work place, etc.? |

In terms of the provisions of FR 46 (b), the Central Government may grant or permit a Government servant to receive an honorarium as remuneration for work performed which is occasional or intermittent in character and either so laborious or of such special merit as to justify a special reward. Except when special reasons, which should be recorded in writing, exist for a departure from this provision, sanction to the grant or acceptance of an honorarium should not be given unless the work has been undertaken with the prior consent of the Central Government and its account has been settled in advance. Guidelines for payment of Honorarium under FR 46 (b) have already been laid down inter alia vide this Department’s OM No. 17011/9/85- Estt. (AL), dated 23.12.1985 and OM No. 17020/1/91- Estt. (AL), dated 18.11.1991. It has also been clarified that no honorarium should be granted for temporary increases in work. |

|

|

Whether retention of “Fee” for delivering lectures in

Government/private bodies is permissible? |

As per para 6 of DOP&T’s O.M. No.16013/1/79-Estt.(AL) dated 11th February, 1980, payments received by Government servants as income from books, articles, papers and lectures on literary, cultural, artistic, technological and scientific subjects including management sciences; will not be subject to crediting one-third of the amount to the general revenues |

||

|

Establishment (Leave) Section

|

|||

| 5. |

Whether male Government servant, who is single

parent, can be allowed Child Care Leave? |

No. CCL can be granted to female employees only. |

|

| 6. | Whether Bond on Study Leave can be transferred from Central Government to State Government? |

No. Bond executed by the Government servant while proceeding on study leave cannot be transferred on his/her appointment in State Government/PSU/Autonomous bodies. |

|

| 7. | What is the limit of leave encashment while availing LTC by dependents or spouse within the same block year? |

The Government Servants governed by the CSS (Leave) Rules, 1972 and entitled to avail LTC may en-cash earned leave up to 10 days at the time of availing both types of LTCs., i.e., ‘Hometown’ and ‘Anywhere in India’. However, when the one and the same LTC is being availed of by the Government Servant and his family members separately in a block year, encashment of leave would be restricted to one occasion only. |

|

(Narendra Gautam)

Under Secretary to the Government of India

Source: www.persmin.nic.in

[http://documents.doptcirculars.nic.in/D2/D02est/I-11020_1_2014-Estt.AL-28042015.pdf]

Stay connected with us via Facebook, Google+ or Email Subscription.

Subscribe to Central Government Employee News & Tools by Email [Click Here]

Follow us: Twitter [click here] | Facebook [click here] | Google+ [click here]

Admin

COMMENTS