CONTROLLER GENERAL OF DEFENCE ACCOUNTS

CENTRALISED PENSION DISBURSEMENT SYSTEM

CONCEPT PAPER

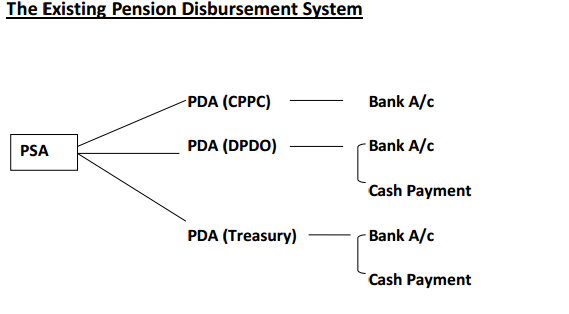

Ministry of Defence disburses appx Rs. 51,000 crore every year as pension benefits to 24.16 lakh defence pensioners – both service personnel as well as defence civilians. While pension sanction is being done in a centralised way – by PCDA (Pension) Allahabad in r/o Army and defence civilians; by PCDA (Navy) in r/o Navy personnel and by JCDA (AF) Subroto Park, New Delhi in r/o Air Force personnel, pension disbursement is being carried out by a number of

agencies who are working as PDAs (Pension Disbursing Agencies) – 28 Public Sector and 4 Pvt Sector Banks, 63 DPDOs, State Treasuries and Post Offices.

Banks have the largest number of pensioners on their roll – appx 18.06 lakh pensioners or 75% of the total number of defence pensioners. And they disburse Rs. 3800 crores every month (or Rs. 45,600 crores per annum which is almost 90% of the total pension disbursement to defence pensioners) as pension to these pensioners. Instances have come to notice where different practices have been followed by banks or where different interpretation have

been arrived at and implemented for one government order, resulting in complaints from pensioners. An analysis of grievances received at the Ministry or at CGDA office or at PCDA (Pension) office reveal that more than 95% of the complaints pertain to pensioners drawing their pension from the banks. The task of addressing these grievances and providing services to pensioners to their complete satisfaction is an arduous one. This, however, could be changed

by adopting a new paradigm for pension disbursement.

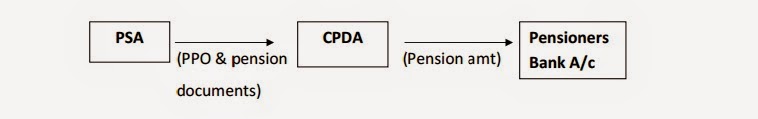

2. This new paradigm is centralised disbursement of pension. This simply means disbursing pension from a central agency viz. Centralised Pension Disbursement Agency (CPDA) to all the pensioners.

3. The present system of pension imbursement is an opaque one in the sense that it does not easily provide details reg. no of pensioners, category wise distribution of pensioners, amount of pension disbursed in a month and govt’s pension liability. Collation of the information from various sources is quite difficult and the output is not always accurate.

4. Further, in the existing system, there is a multiplicity of PDAs ‐ 29 Banks, 63 DPDOs and a large number (500+) of State Treasuries. As mentioned earlier, many a times PDAs tend to interpret Govt. Orders differently. This, in some cases delays the implementation of the order itself and in some other cases the order gets to be implemented differently by different PDAs. In both cases, generally, pensioner is the sufferer. There are other issues/difficulties in the existing pension disbursement system:‐

I. With multiple PDAs, the system is not amendable to effective monitoring as well as grievance handling. It makes the task of all decision makers including the Ministry, a very difficult one.

II. There is a delay in booking the pension amount to Govt. account. This also makes it relatively difficult to know the exact pension liability.

III. Even at a given time, it becomes an arduous task to exactly find out the number of active defence pensioners (including categories‐wise) as the information is to be collated from a large no. of PDAs.

IV. Maximum pensioners are drawing pension from banks. It has been experienced that they (Banks) do not have dedicated staff to deal with pensioners’ issues. Also, they are not well conversant with orders/issues peculiar to Defence pension.

The Proposed System

5. The proposed system of Centralised disbursement of pension is not only transparent but easy for information processing and retrieval.

6. Under the proposed system, after sanctioning pension and issuing Pension Payment Order (PPO), the pension sanctioning authority will forward the PPO and other details – including bank details – of the pensioner to the Centralised PDA (CPDA) on soft format through a secured channel. It could be on the CGDA intranet and for enhanced security could also be with digital signature. The CPDA will process the papers and will initiate first payment as well as subsequent monthly pension payments for credit to the pensioners’ bank accounts (as given by the PSA along with the PPO) through the NEFT/RTGS or the CMP (on‐line payment mechanism with SBI). Since the CPDA is making payment of pension – he can directly book the amount to the government account, avoiding any delay or suspense head booking. For the pensioners, there will be no change as they would receive pension in their

bank account, as is the status presently. The proposed system only replaces the multitude of PDAs with a single PDA without affecting the pensioners’ interest and rather bringing about a focused delivery mechanism. There are a number of benefits of the proposed system –

i. Uniform interpretation and implementation of govt orders ii. Instant booking of pension payment to govt accounts – giving authorities a true picture of the pension liability and payment.

iii. Better grievance monitoring system can be instituted with a single PDA.Easier for everybody.

iv. Centralised database will help in better exploitation of information and communication technology for the betterment of services to the pensioners.

v. There will be no change as far as pensioners are concerned. They will continue to receive their pension in their given bank accounts.

vi. No loss to the banks in terms of accounts maintenance as they will continue to be the final pension paying agency.

vii. Future scalability is possible and relatively simple. For example, a centralised call centre could provide solutions to the pensioners for their queries or complaints.

7. In addition to these benefits, the proposed system will also result into a large saving to the Ministry of Defence (MoD). Presently, MoD pays Rs. 60 per transaction to Banks; and with 12 regular payments and 4 DA payments in a year, MOD pays Rs 960 per pensioners per year. For 18.06 lakh Bank pensioners, this amounts to almost Rs. 180 Cr. every year. If all pensioners are brought under the centralised PDA system ‐ where CPDA will credit pension in pensioners Bank A/c through NEFT/RTGS ‐ saving of Rs. 180 Crore could be achieved.

Implementation Modalities

8. Phase I can cover all new pensioners – appx. 80,000 per year – coming into pension fold. This can be done from a particular date which can be decided after taking decision on centralised pension disbursement and creating necessary IT and Communication infrastructure.

9. In Phase II all DPDO pensioners can be covered. All original files may be shifted to the CPDA DPDO‐wise. Given that out of 63 DPDOs, 52 have been centralised under Project Ashraya (Pension disbursement system), this is likely to be smoother phase wherein shifting of files and their appropriate indexing will be the main activity / focus.

10. In Phase III existing bank pensioners can be covered depending upon the response of the banks.

This would be the toughest phase both in terms of making banks agree to the new model and in database management Banks revenue loss will also be a big issue from their perspective. As such this phase will require perseverance and a different strategy (including for database management) which can be derived and decided later from the success of the first two phases.

11. An issue which may require a conscious decision would be whether the centralised disbursement should be from one location or multi‐location. It is considered that in a networked environment, location may not be an important factor from the view‐point of users. However, for the ease and adaptability with the existing pension set‐up, it is recommended to have three centres associated with the existing pension sanctioning authorities, viz. PCDA

(P), Allahabad, PCDA (N), Mumbai and JCDA (AF), New Delhi. It is also recommended to have a centralised call centre, which can have access to the complete database of the three centres of CPDA. The call centre can be co‐ located with one of the three centres for the purpose of administrative convenience.

Role of DPDOs in the proposed centralised system

12. DPDOs are Pension Disbursement Agencies (PDAs) in the exiting set‐up. Each DPDO is a distinct PDA. Presently, 63 DPDOs – 51 in northern India and 12 in Southern India (Eastern central and Western India have no DPDOs) – are working as PDAs for 4.7 lakh pensioners.

13. If we divide the role of a DPDO in terms of (i) processing of monthly pension payments and (ii) identification exercise (which is not restricted to any specific month (e.g. November for bank pensioners) and continues for the whole year) then it can be stated that in the proposed CPDA paradigm, role of DPDOs will not be there for first part (i.e. payment processing). However, they can be effectively used for the second part ‐ identification of pensioners. This would mean that DPDOs would need to be remodelled as service centres for pensioners/ which will carry out their annual identification, accept change requests/applications on behalf of CPDA (for cases related to re‐marriage, re‐ employment, death, Bank account changes etc.) and can also act as grievance handling /settlement centre as they would be linked with the CPDA server and can have a higher protocol communication with the CPDA call centre. It is

considered that in the proposed model ‐ one DPDO may only require one AO, one AAO (or two AAOs) and one MTS ‐ all proficient on the new system. Savings achieved in manpower (to be assessed) can be used for opening up a few more service centres in areas where pensioner concentration is relatively very high or in existing offices of DAD or even with the Zila Sainik Board Offices.

Infrastructure requirements

14. To start the work at the CPDA, it is assessed that manpower strength of one IDAS, One AO, two AAOs, 4 Adrs and 2 MTS would be sufficient and can even last for the first two phases with 2‐4 additional Adrs. It is assessed that this manpower can be spared from the existing resources of the organization of CDA (PD). For more Click here

Stay connected with us via Facebook, Google+ or Email Subscription.

Subscribe to Central Government Employee News & Tools by Email [Click Here]

Follow us: Twitter [click here] | Facebook [click here] | Google+ [click here]

Admin

COMMENTS

Without any doubt the psa and pdas are executing an enormous task…month after month and year after year…