Prevention of illegal theft/misappropriation of Provident Fund dues by the contractors. How the Contractors cheat’Govt. Departments and swallow P.F. money paid by them? How to prevent misappropriation of P.F. Dues by the Contractors:-

INDIAN COUNCIL OF AGRICULTURAL RESEARCH

KRISHI BHAWAN: NEW DELHI

F. No. GAC-21-49/2014-CDN

Dated the 12.11.2014

ENDORSEMENT

Office of the Addl. Central Provident Fund Commissioner (Delhi & Uttrakhand), Employees’ Provident Fund Organisation, Government of India, New Delhi has issued D.O. letter and Gazette Notification regarding prevention of illegal theft/misappropriation of Provident Fund dues by the contractors. As approved by the competent authority, this D.O. No. ACC(DL&VK)/CONT.EMP/CORD(42)/2011/1413 dated 8.10.2014 and Gazette Notification dated 19.8.2014 and 22.8.2014 have been uploaded on the lCAR web-site www.icar.org.in and e-office for information and strict compliance.

sd/-

(JN. Bhagat)

Under Secretary (GAC)

OFFICE OF THE

ADDL. CENTRAL P.F. COMMISSIONER (Delhi & Uttarakhand)

(Employees Provident Fund organisation~Ministry of Labour & Employment, GOI)

Bhavishya Nidhi Bhawan

28, Community Centre, 8th Floor, Wazirpur Industrial Area, Delhi-52

K.L. Taneja,

Addl. Central P.F. Commissioner (DL. & Uk)

D.O. No. : Acc(DL & Uk)/Cont.emp/coord(42)/2011/1413

Dated: 8-10-2014

Respected

I would like to invite your personal attention to prevent illegal theft/misappropriation of Provident Fund dues paid by the Govt. Departments to various contractors who grab it and do not fully/partly deposit the same with concerned Regional P.F. Commissioners (RPFCs) in respect of such D.E.O’s / housekeeping or other staff/ casual workers deployed through such contractors.

2. From the investigations made by this office regarding P.F. compliances by the contractors, in respect of employees deployed at various Govt.. Departments / Agencies, this office has listed out the most common practices adopted by these Contractors to pocket the Provident Fund Contributions of the poor workers (ANNEXURE- I ), thus depriving them of Provident Fund, pension and insurance benefits, it is felt that to take steps to curtail these malpractices all the Officers and DDO’s be directed to make themselves aware of the modus operandi of the contractors. Most common excuse that EPF Act is not applicable on employees drawing more than Rs. 6500/- does not exist now. A Notification enhancing the wage ceiling limit from 6500/- pm. to Rs. 15000/- pm. has been issued ( ANNEXURE – II ) and is also available on our website

www.epfindia.gov.in.

3. In this regard I would like to request you to issue suitable directions to all your Heads of Offices and DDO’s to prevent misappropriation by taking simple precautions (ANNEXURE – III ).

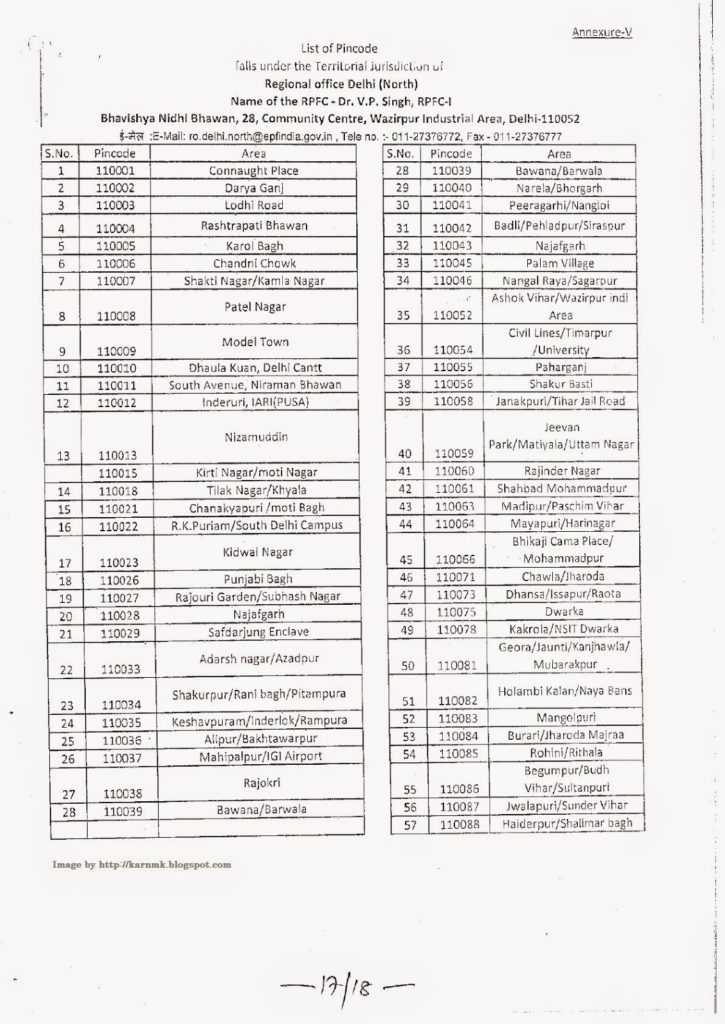

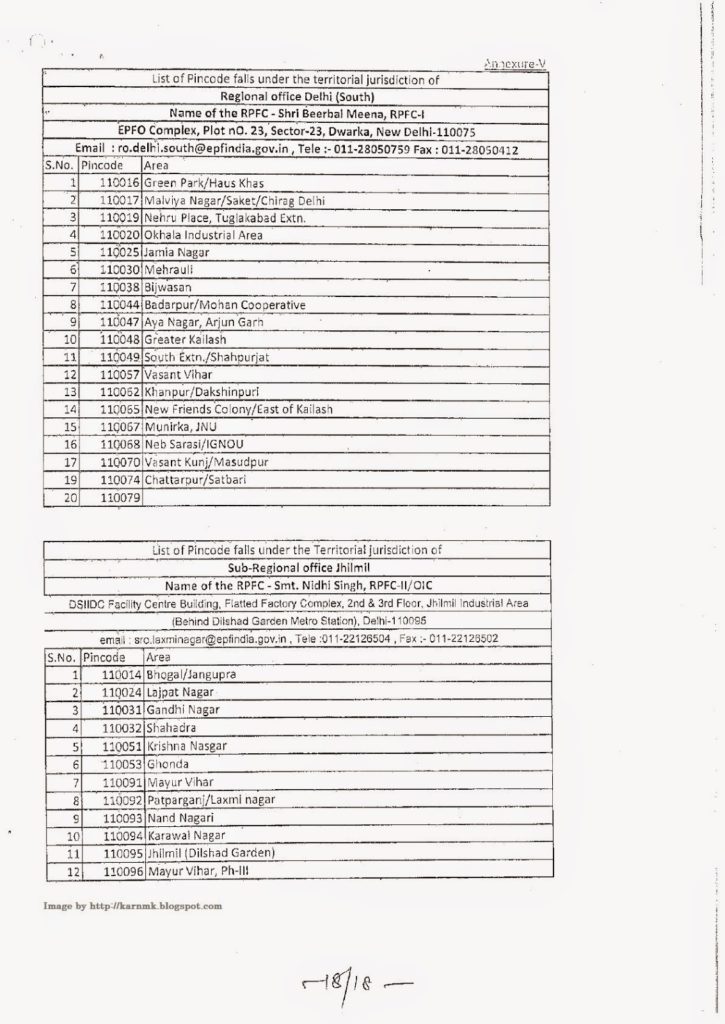

4. In case of any complaint against any contractor who is/ was not remitting or less depositing P.F. contributions into the P.F. accounts of the contractual employees, information in enclosed format (ANNEXURE – IV) be furnished to concerned Regional P.F. Commissioner (RPFC) for taking statutory actions under the EPF & MP Act/ u/s 406/ 409 of IPC for misappropriation of RF dues. Heads of Offices/DDO’s may also be directed to file FIR’s against contractors after getting the payment position verified from the concerned RPFC’s / from our website. Territorial jurisdiction of RPFC’s is enclosed (ANNEXURE V).

Your directions to DDO’s and information sharing initiative will be instrumental for social justice to your own contractual employees by way of old age PF/ Pension, widow/ disablement pension and insurance benefits.

With Regards

Yours Sincerely

(K.L. TANEJA)

ANNEXURE -I

How the Contractors cheat’Govt. Departments and swallow P.F. money paid by them.

Example (i) The contractors claim and get P.F. contributions @ 13.61% of the wages/ salary from the Govt. Departments. it includes Employer’s Contribution to P.F. @ 12% and Admn. & insurance Charges @ 1.61%. This 12% Employer’s Contribution together with employees contribution, which is 12% of the wages / salary, deducted from the salary of such employee is to be deposited in the Provident Fund & Pension Fund accounts of the individual employees. For example a contractor claiming P.F. Employer contribution of 1361/- @13.61% on wages of say 10000/- p.m needs to deposit 12% viz.. Rs. 1200/- (termed as Employer Contribution alongwith with 1200/- of Employees Contribution i.e. Rs. 2400/- in the Provident and Pension Fund accounts of the employee . The Electronic Challan cum Return (ECR) of the said month shall reflect a total of Rs. 2400/- as remitted dues in respect of the said employee. However, the Contractor tends to reduce the‘wages/ salary of the employee say to Rs. 4000/- (by either breaking up the salary into various components like HRA, and other allowances or by reducing the number of working days of the employee ) and remits only 24% (12% + 12% ) of Rs. 4000/-, which comes to a total of Rs. 960/- into the Provident and Pension Fund accounts of the employee thereby pocketing Rs.1440/- of the contributions meant for the said employee.

(ii) in the above case if there are say 100 employees deployed through the said contractor at a specific Govt. Department and the contractor adopts similar practice in respect of all the employees, he will thereby siphon off Rs. 1,44,000/- pm. of the employees social security money. Longer the period of contract larger will be the misappropriation of funds.

(iii) It is also seen that at times the contractor do not remit the P.F. dues at all and pockets the 100 % contributions made by the Govt. Department/ Agency.

Considering a large workforce of contract employees deployed in Govt. Sector, the financial and social impact of such practice is shocking. To play these tactics the contractors submit fake P.F. Account Numbers of the employees, fake declarations/ undertakings that the Provident Fund is being regularly deposited by him, he is also likely to submit fake ECR’s and e-challans. Further, where the contractor has multiple clients he submits the e-challans of one client to other clients as proof of PF deposit.

It may also be noted that the above examples are only illustrative and not exhaustive.

ANNEXURE – II

Gazette Notification regarding increase in wage ceiling from Rs.6500/- to Rs.15,000/- under EPS,1995, EPFS,1952 & EDLI,1995

ANNEXURE-III

HOW TO PREVENT MISAPPROPRIATION OF P.F. DUES BY THE CONTRACTORS

1.1 In the tender for labour/ manpower supply contracts, compliance by contractors regarding compliance of EPF & MP Act’1952, needs be specified alongwith other labour laws, Names of contractors covered under the EPF & MP Act can be searched and downloaded from website – epfindiagov.in.

1.2 Principal employers/ D.D.O’s should get a copy of ECR, e- challan and salary/ wages register reflecting P.F. deductions before releasing payments to contractors.

1.3 Under the statutory provisions, employee wise details of PF dues deducted from the salary/ wages of the employees, alongwith 12% employer share are submitted in the form of electronic challan cum return (ECR), thereafter, e – challan is generated from the EPF website. Since the consolidated ECR’s of the contractor regarding manpower supplied to all public and private sectors will be very bulky and will create confusion/ excessive time and energy consumption at the level of DDOs, hence separate ECR’s and a separate e-challan as stated above are very important to prevent manipulations. Cheating by the contractors can be prevented by demanding separate ECR and e-challan every month in respect of manpower deployed in a particular office/ departments for which DDO is to release the payments to the contractors.

1.4 DDOs can check the name of all the employees with regard to ECR from the website of EPFO i.e. epfindia.gov.in.

1.5 EPF Organisation has provided a facility to the payment of dues with reference to transaction number of e- challans. Whenever any challan is received alongwith ECR for crediting PF dues in the accounts of individual members, a TRRN No. is generated for e-challan. With reference to this TRRN No. actual deposit can be verified from the EPFO website to prevent submission of fake challans by the contractors.

1.6 From April’2012 onwards, monthly contributions received throuogh ECR and e-challans are being credited in the individual members account within one month from the date of deposit. individual members can also verify the same by registration on the EPF website, A DDO can ask any member at random to check whether the dues are being deposited by the contractor fully without any manipulation/ mis-appropriation.

1.7 At the end of the year, EPFO generates statement of accounts of individual members account reflecting opening balance, contributions, withdrawals, interest and closing balance etc. DDO should ask for distribution of these annual statements of accounts in the Office/ Department.

1.8 Employees may be guided to obtain e-passbooks from EPFO website.

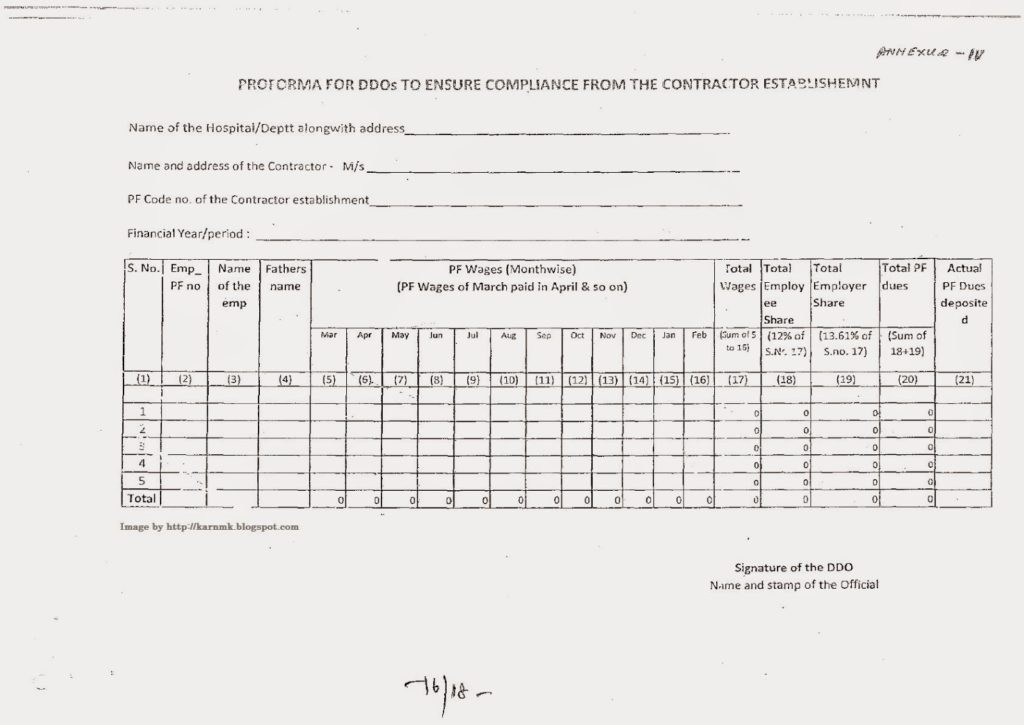

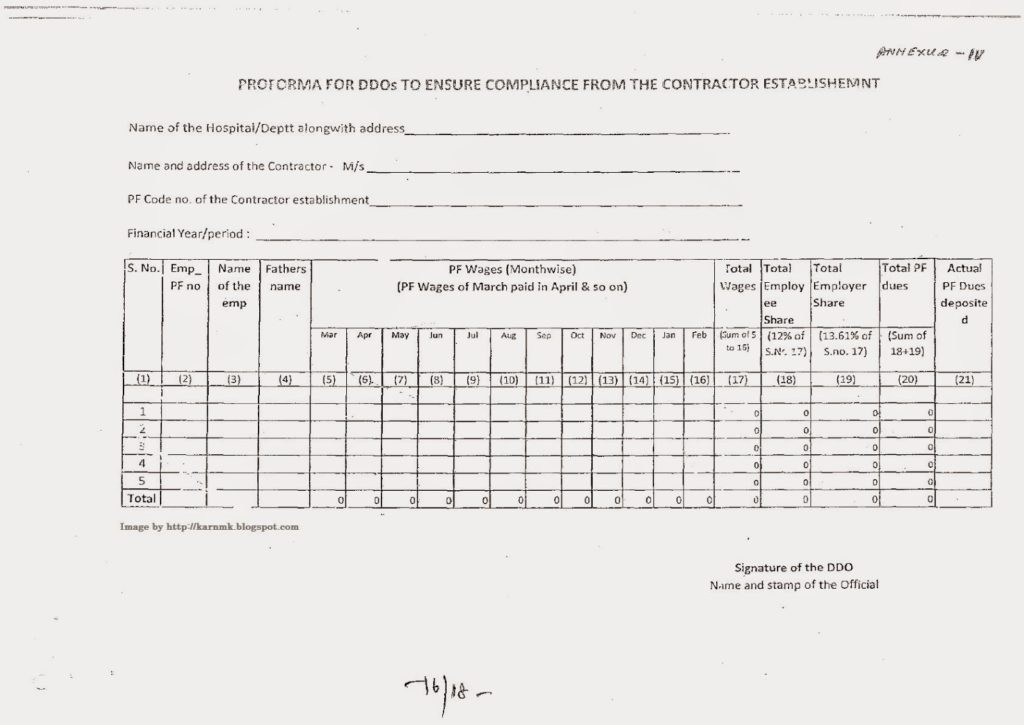

ANNEXURE – IV

|

| Proforma for DDOs to Ensure Compliance from the Contractor Establishment |

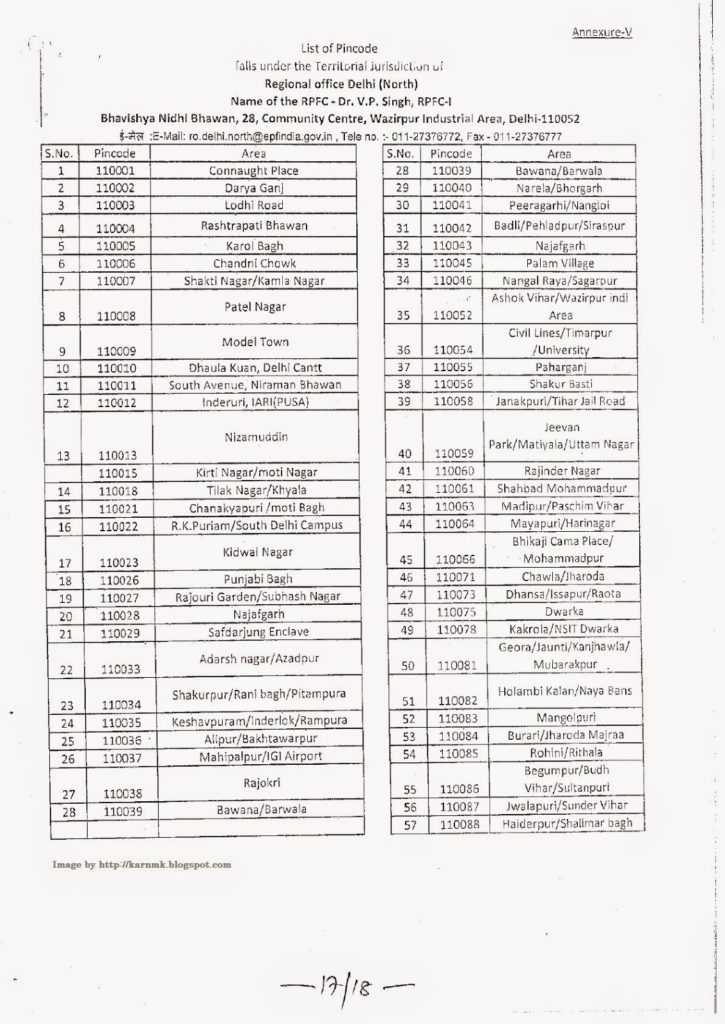

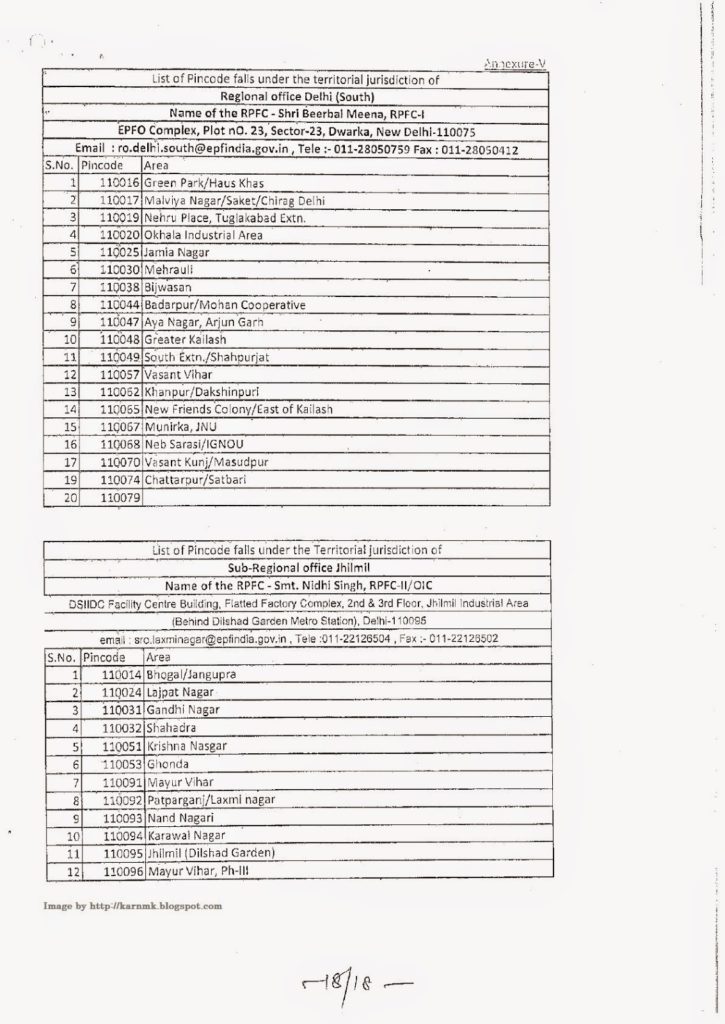

ANNEXURE-V

|

| List of Pin Code Regional EPFO Delhi North |

|

| List of Pin Code Regional EPFO Delhi South |

Source: www.icar.org.in/files/gpf-prevention-2014.pdf

Stay connected with us via Facebook, Google+ or Email Subscription.

Subscribe to Central Government Employee News & Tools by Email [Click Here]

Follow us: Twitter [click here] | Facebook [click here] | Google+ [click here]

Admin

COMMENTS