In order to provide an efficient and system driven withdrawal process to NPS subscribers, PFRDA is proposing the following operational procedure for withdrawal of benefits under NPS.

Keeping the above in perspective, the draft operational withdrawal process is proposed and comments from the public and all concerned are invited. It may also be noted that suggestions on improving/ simplifying the process can also be given. Comments/Feedback may be forwarded by email to the e-mail id k.sumit@pfrda.org.in latest by 31.01.2014. Comments should be given in the following format:

Written comments in the above format may be addressed to:

Mr. Sumit Kumar

Dy. General Manager

Pension Fund Regulatory & Development Authority

1st Floor, ICADR Building, Vasant Kunj Institutional Area Phase – II

Vasant Kunj, New Delhi – 110070

PENSION FUND REGULATORY AND DEVELOPMENT AUTHORITY

INTRODUCTION

National Pension System is a long term retirement savings product which strives to accumulate and generate maximum pension wealth at the time of planned retirement or while moving away from the regular work life due to the age related factors. NPS is mandatory for all Central government employees who have joined the service on or after 01/01/2004 and almost all the state governments have also entered into agreement with PFRDA, making NPS mandatory for their employees. Apart from government employees, NPS is open to any and all the citizens of India with effect from 1st May, 2009 subject to the eligibility criteria as laid down by PFRDA. Currently, the following are the different variants of NPS that are in existence:

• NPS for Government Sector (Central, State govt’s, Central and State Autonomous bodies etc)

• NPS for All citizens including corporates covering their employees.

• NPS – Swavalamban scheme targeted towards low income individuals.

Under NPS, the subscriber is encouraged to save as much as possible during his younger years so that he can accumulate adequate pension wealth through proper and effective investment management of his corpus. This prudential investment management and maintenance of his Permanent retirement account is regulated and managed as an effective system providing for a lump sum corpus and an annuity providing for the monthly pension to the subscriber when he attains 60 years of age or normal age of superannuation as provided in the exit rules for NPS.

The Central Recordkeeping Agency (CRA) has been entrusted with the responsibility of receiving instructions related to all types of withdrawals under NPS. CRA has created a special NPS claim processing cell (NPSCPC) for this purpose and which would be operating on the basis of such instructions as provided by PFRDA regarding the withdrawals. The CRA shall process and monitor the abovementioned instructions through the Settlement process which will run on daily basis.

Under NPS, a withdrawal claim can be made for the benefits based purely on the permitted ways of exit only. However, the exit rules allow maximum possible leverage to the subscriber in case if he wishes to exit from the scheme at any point of time. The complete details of the exit rules / guidelines are provided in the next section and which shall act as the guiding rules for the entire withdrawal claim processes and procedures.

The exit rules vary slightly between the government employee subscribers and all other subscribers covered under the National Pension System. The primary difference being the maximum age up to which a person can continue to contribute to the NPS and seek complete withdrawal after reaching maximum age permissible under normal circumstances.

EXIT / WITHDRAWAL GUIDELINES UNDER NATIONAL PENSION SYSTEM (NPS)

The exit / withdrawal guidelines under NPS are framed in such a manner that the subscriber has a long period of accumulation of corpus for providing him with a decent accumulated pension wealth when he retires or he moves out of the regular work routine due to age. Also, it lets the subscriber have the freedom to move out of the scheme at any point of time, irrespective of cause or reason.

The following are the current rules/guidelines for withdrawals under NPS as approved by PFRDA:

a) Exit from NPS upon attaining the age of Normal superannuation (for govt. employees only) or upon attaining the age of 60 years (for all subscribers other than govt. employees): At least 40% of the accumulated pension wealth of the subscriber needs to be mandatorily utilized for purchase of an annuity providing for the monthly pension of the subscriber and the balance is paid as a lump sum payment to the subscriber.

b) Exit from NPS before attaining the age of Normal superannuation (for govt. employees only) or before attaining the age of 60 years (for all subscribers other than govt. employees): At least 80% of the accumulated pension wealth of the subscriber needs to be utilized for purchase of an annuity providing for the monthly pension of the subscriber and the balance is paid as a lump sum payment to the subscriber.

c) Upon Death: The entire accumulated pension wealth (100%) would be paid to the nominee /legal heir of the subscriber.

For Swavalamban withdrawals under (a) & (b) in the previous page, there is an overriding condition on

the lump sum payment payable due to which the entire accumulated pension wealth would be annuitised in case if the monthly pension obtained by using the 40%/80% of the pension wealth is below Rs.1000/- per month. Also, these exit/withdrawal rules as applicable to NPS can be modified/altered from time to time by the Authority as the NPS progresses.

ANNUITY, ANNUITY SERVICE PROVIDERS (ASP’S) AND ANNUITY SELECTION

Under NPS, the subscriber can choose/opt for any of the variants of annuity that are available in the Indian market but from any of the IRDA registered life insurance companies empanelled by PFRDA as Annuity Service Providers (ASP’s) for providing the annuity services to the NPS subscribers. The list of existing ASPs is provided on PFRDA’s website at pfrda.org.in. At the time of exit from NPS for reasons other than death of the subscriber, the subscriber is required to purchase an annuity providing for a monthly pension to the subscriber.

BACKGROUND ON OPERATIONAL WITHDRAWAL PROCESS

Currently the withdrawal claims are handled through an interim arrangement by way of manual processing which involves lot of time and efforts to process the withdrawal claims. The proposed process is a system driven process followed by manual documentation and runs at macro level as per below mentioned steps:

• Intimation of claim to the Claimant/Nodal office

• Online submission of claim form by Claimant/Nodal Office.

• Claimant to submit the duly signed and completed withdrawal form along with the complete set of required documents

• CRA NPS Claim cell to take decision on the withdrawal basing on the application and documents submitted and verify the claim through online module.

• CRA to settle the claim by making the necessary payments as per the product structure.

FEEDBACK /COMMENT PERIOD

The Feedback /Comments on this exposure draft received till 31st January, 2014 would be considered for evaluation by PFRDA. The decision of PFRDA on all and any matters related to the subject matter is final and binding on all stakeholders.

Proposed Operational Withdrawal Process for claims under National

Pension System (NPS)

Basically, the withdrawal process at NPSCPC of CRA would involve the following:

A. Claim Registration

B. Monetization of Accumulated Pension Wealth

C. Claim settlement

D. MIS and data management

A. Claim Registration

The permitted type of withdrawals Under NPS are as follows:

1. Upon attaining the age of normal superannuation or attaining 60 years of age involving payment of a certain lump sum amount and a payment to ASP towards the purchase of annuity ( a minimum of 40% of the monetary value of total accumulated pension wealth)

2. Upon death of the Subscriber involving a lump sum payment of 100% of accumulated pension wealth.

3. Before attaining the age of normal superannuation or attaining 60 years of age involving payment of a certain lump sum amount and a payment to ASP towards the purchase of annuity ( a minimum of 80% of the monetary value of total accumulated pension wealth)

4. For Subscribers re-employed after the age of superannuation (60 years) in regulatory bodies where Chairman/Members are appointed after the age of superannuation (60 years) and the retirement age being the age prescribed by their employer. The process and procedure for the withdrawal would be same as per the normal exit and entire accrued pension wealth would be paid to the subscriber in one lump sum without any mandatory annuitisation.

a) Upon attaining the age of normal superannuation or attaining the age of 60 years: CRA will initiate the withdrawal process 6 months prior to his/ her attaining age of 60 years or on attaining normal age of superannuation by suo motto registration of the claim and allotment of a specific system generated claim number which would act as a Claim Ack ID for all future references and tracking. Additionally, NPSCPC would send communications on a quarterly basis to all the PAO/DDO/DTO’s seeking information on the impending superannuation cases due in next 6 months to take care of those cases where the age of normal superannuation is below 60 years and register the claim and generate the Ack ID. The NPSCPC would send a reminder after 3 months through a system generated auto communication followed by monthly reminder till the application form is submitted by the subscriber. Also, pop-up windows would be generated on the PAO/DDO/DTO’s/POP-SP/Aggregator system, the moment they log on to the CRA system for any activity informing them the details of pending withdrawal applications and the requirements thereof.

b) Upon Death of the Subscriber: CRA will register the claim immediately upon written intimation about the death of the subscriber either from any of the PAO/DDO/DTO’s/POP-SP/Aggregator or the claimants of the deceased subscriber and generate the Ack ID.

c) Any time before attaining the age of normal superannuation or attaining the age of 60 years: CRA will register the claim immediately upon written intimation about the voluntary withdrawal request of the subscriber either from any of the PAO/DDO/DTO’s/POP- SP/Aggregator or directly from the subscriber and generate the Ack ID.

d) Chairman/Members of Regulatory bodies: In case of NPS accounts of such subscribers whose subscription/NPS account has been accepted specifically by PFRDA, the entire accumulated pension wealth would be paid to the subscriber in one lump sum without any mandatory annuitisation at the time of exit from NPS due to completion of the term or upon superannuation from the subject position.

B. Monetisation of Accumulated Pension Wealth

1. The claims module of CRA system / NPSCPC would automatically initiate a process of monetization of units held in accounts of the NPS subscribers who have attained the age of 60 years on the next day of attaining the age of 60 years and or on the last working day/business day of the month in which the age of normal superannuation falls and as confirmed by the PAO/DDO/DTO’s. The last business day may be taken as the last working day of any commercial bank (preferably SBI) for the banking settlement. This involves instructions from CRA to PFM on monetizing the entire accumulated pension wealth of the subscriber and moving into a separate WITHDRAWALS bank account held with PFM. By this the NAV as on the date of completion of 60 years is safeguarded and the severance of the account from NPS is indicated for initiating the final withdrawal process for crediting the subscribers account.

2. For claims other than attaining the age of 60 years or the age of normal superannuation or upon the death of the subscriber, the monetization of accumulated pension wealth would be only after processing the claim as per approved process and the approval of the claim by the NPSCPC.

3. In case Deferred withdrawal is indicated in the withdrawal application form and received before attaining the age of 60 years or normal age of superannuation, the monetization of the lump sum withdrawal would not happen and it stays invested in the NPS under the same PFM and investment choice, unless specifically requested for a change by the subscriber. Also, the same would be followed even where the physical application form indicating deferred withdrawal form is not received but where there is an electronic request or updation of the CRA system claim module for the deferred withdrawal. However, accumulated corpus, if any in the Tier II account of the subscriber would be monetized.

4. Once monetization(partial or complete) of the units held in a particular account happens, no further contributions are allowed under the subject NPS account and if any previous our outstanding sums are to be credited they would be dealt out of the system by way of transferring back to the employer for direct distribution to the subscriber as there is no possibility of investment of such amounts after the subscriber has attained the age of 60 or the age of normal superannuation or upon request for withdrawal by the subscriber /claimants.

C. Claim settlement

The claim settlement mechanism consists of two parts namely,

Part A deals with crediting of the eligible lump sum amount in the bank account of the subscriber as provided by him.

Under this the Withdrawal requests will be dealt by NPSCPC as given below:

- If application submitted before attaining the age of 60 years or normal age of superannuation, request will be processed as per the set guidelines for the CRA claim cell and the request is either accepted or rejected including lodging of a pending memo where additional information or clarifications are sought. If the claim is accepted, the claim will be executed (i.e. redemption of units) not before the next day on which subscriber attains age of 60 years or normal age of superannuation.

- If withdrawal application submitted before attaining age of 60 years or normal age of superannuation or exit request arising out of the death of the subscriber, request will be processed as per the set process and the request is either accepted or rejected including lodging of a pending memo where additional information or clarifications are sought. If the claim is accepted, the claim will be executed (i.e. redemption of units) immediately without waiting for the subscriber to attain 60 years of age or normal age of superannuation. However, the claim processing including processing of documents, acceptance of the claim and execution of the withdrawal should be within the timelines fixed or agreed for processing and settlement of withdrawal claims.

Part B deals with the payment of the annuity premium to the ASP by CRA, equivalent to monetary value/ % choice of the accumulated pension as opted by subscriber and as permitted under NPS scheme to the ASP’s designated bank account. This would happen necessarily after attaining the age of normal superannuation or attainment of 60 years of age as we need to have specific value of the corpus available for purchase of annuity.

Part A – Settlement of Lump Sum amount

- Followed by the Suo motto registration of the claim, CRA would send a written communication to be sent by courier/post to the last known address of the Subscriber and to the mapped PAO/DDO/DTO’s/POP-SP/Aggregator specifying the impending withdrawal upon normal superannuation or upon attaining the age of 60 years and this needs to be supplemented by E-mail/SMS/system generated communication. The communication must provide the Claim number allotted by the CRA system for further reference along with the Statement of Transaction (SOT) for the current year and seeking confirmation on the contributions made by them as reflected in the statement. If no conflicting claim is received on the SOT within a period of 30 days, CRA will proceed with withdrawal process upon receipt of necessary requirements. If conflicting claim is received on the SOT matter will be examined and the final execution of the claim would be initiated only upon resolution of the issue. However, the processing of the claim would be done and the file kept ready for execution of the request as and when the matter is resolved.

- The subscriber using his TPin/IPin can log into the CRA portal and using the ACKID provided and enters into the claims module screen duly auto-populated from the CRA system. The subscriber can provide the information in the editable fields like bank a/c details, nomination details and the withdrawal details on lump sum and annuity components of the withdrawal application form. After the data has been provided the subscriber has to save the form which would be accessed by the concerned PAO/DDO/DTO’s/POP-SP/Aggregator for attestation purpose. The PAO/DDO/DTO’s/POP-SP/Aggregator would access the withdrawal application through normal log in process and check for consistency with the KYC documents submitted, the information provided in the application form and attest the documents after taking the printout of the withdrawal application form which needs to be sent to NPSCPC.

- Alternatively subscriber can submit the completely filled in and duly signed physical copy of the designated withdrawal form along with the relevant documentation to the the concerned PAO/DDO/DTO’s/POP-SP/Aggregator who in turn can log into the CRA system for accessing the withdrawal application online and fill in all relevant fields (editable fields)

- Once the PAO/DDO/DTO’s/POP-SP/Aggregator or subscriber accesses the application form online and fills in the rest of the fields, the system will check for completeness of the data at the time of online submission and if any mandatory fields are not filled will prompt the same to be filled. If some information is not available the work can be saved and the rest of the required information can be filled at a later date. If all the required information is filled in by the subscriber through his PAO/DDO/DTO’s/POP-SP/Aggregator or subscriber online and after a successful submission, the system will provide for a PRINT option through which the entire filled in application would be printed.

- Once the printed application is available the same needs to be duly signed by both the subscriber as well as the PAO/DDO/DTO’s/POP-SP/Aggregator wherever applicable and dispatch the same along with the necessary documents like ID proof and Address proof etc (Copy duly verified with original and attested accordingly) to NPSCPC for initiating the final withdrawal procedure for transferring the proceeds to the subscribers account. Alternatively, the physical application form submitted needs to be attested and sent to NPSCPC in case the print out from the system is not used and the physical application form submitted by the subscriber is used. However, it is preferable that the system generated application form be submitted to NPSCPC after getting it signed by Subscriber, witnesses and with due attestation by PAO/DDO/DTO’s/POP-SP/Aggregator.

- Upon receipt of physical copy of the application by the NPSCPC, it would check with the online application for consistency of the data and documents provided and Process the Claim as per exit guidelines Cell resulting in:-

i. Intimation of deficiencies / requirements, if any by raising “Pending Memo”

“Pending Memo” will be issued to the subscriber as well as the PAO/DTO/DDO/POP/POP-SP/Aggregator through whom the application was submitted by the subscriber clearly indicating the deficiencies and the requirement. The pending memo will be sent through email/SMS and a written communication / system generated letter to the Subscriber’s last known address.

The “pending memo” will be resent once again at the end of the next month in which the pending memo was initially sent and followed by one more final reminder in the same manner. If there is no reply or required documents/deficiency rectification is received by NPSCPC at the end of 30 days from the final reminder date, the claim file will be kept on hold and treated as “inactive”.

ii. Approval of Claim withdrawal by CRA Claims cell (60% 40% 100% etc) basing on the entitlement as per NPS Exit rules

iii. Instructions to PFM crediting lump sum withdrawal into subscribers account online through NEFT /RTGS. However, for NPS-Swavalamban subscribers the crediting of lump sum amount would not be carried out till the annuity purchase process is complete as the scheme has the overriding condition of annuitizing the entire accumulated pension wealth in case if the annuity/pension obtainable with the 40/80% is below Rs.1000/- p.m.

iv. PFM uploads the data on transfer of funds to subscriber in the CRA system.

- Intimation to Subscriber/Govt/POP/Aggregator on the crediting of the lump sum amount with full details.

- CRA will discontinue the online access provided to particular subscriber; in case of deferred withdrawal online access will be provided to subscriber by CRA till the time subscriber has completely withdrawn NPS corpus (maximum at the age of 70 years).

- PRAN, Name and other basic information will be restored and the same PRAN will not be issued to any other subscriber.

Part B – Purchase of annuity

Under this there would be two modules, namely

1. Quote generation module

2. Annuity purchase module

Quote generation module

The quote generation module would made available on the CRA website for the benefit of the subscribers who need to login through their TPIN/IPIN or Claim ID / any authentication prescribed like combination of PRAN and date of birth etc. The subscriber would be able to check the amount of annuity that he would be able to get the monthly pension for all the options that are available with the choosen % of the accumulated pension wealth (taking the value of the accumulated pension wealth as reflected in SOT as on that date through a system generated process). This would be available to the subscribers at all times whether they intend to exit from NPS or otherwise for checking the monthly pension they may get in case if they choose to exit from NPS.

Annuity purchase module

The subscriber has to log in to the CRA system through the PAO/DDO/DTO’s/POP-SP/Aggregator or by using his TPIN/IPIN / any authentication prescribed like combination of PRAN and date of birth etc. and click on the Annuity Purchase button and provide the claim number at the given field. This will lead to the annuity purchase window containing the following:

a. Page 1 – Provides the information on annuities both in English and Hindi (at the option of subscriber). This sheet can also be printed from the menu provided or alternatively can be accessed directly from CRA system by anybody from the customer information page.

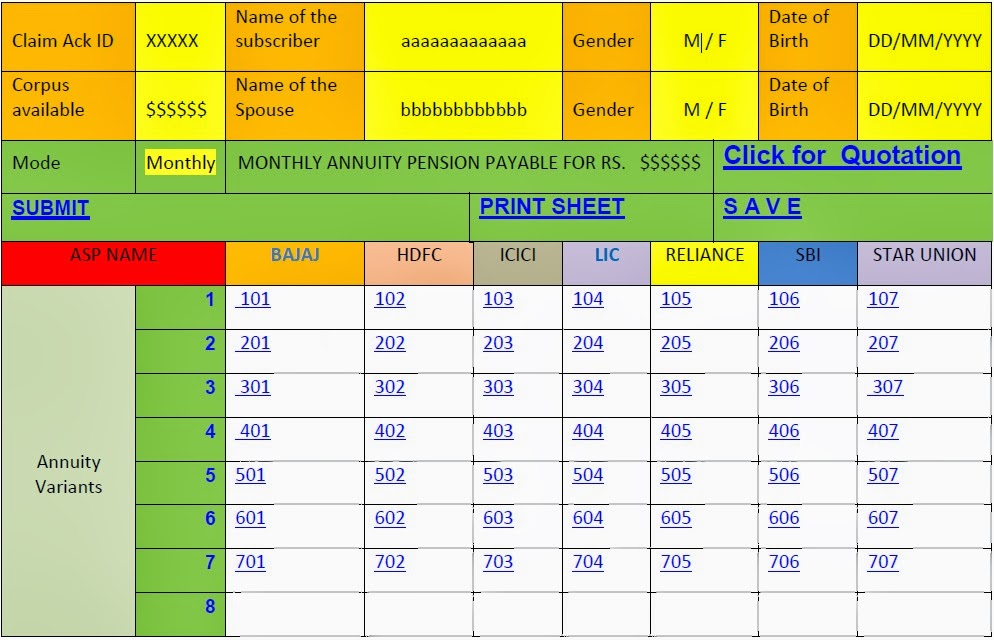

b. Page 2 – Contains the corpus available, and links to the ASP’s depicted below and the entire demographic information including bank account details are auto-populated the moment the claim number is keyed in.

The entire effort would be to make the entire process seamless and hassle free to the NPS subscriber with minimal manual intervention. Alternatively, the subscriber can download/submit the annuity application of the chosen ASP directly to the NPSCPC for arranging the purchase of annuity.

PART 1 –

ANNUITY

1. Introduction

Under National Pension System (NPS), Annuity is a financial instrument which provides for a monthly payment of pension against a fixed lump sum amount and which under NPS is the monetary or money value of the specified % of the accumulated pension wealth in the subscribers account. The subscriber has to mandatorily buy the annuity as specified in the exit rules of NPS and from a PFRDA empanelled Annuity Service Provider. At present there are 7 Annuity Service Providers who are empanelled by PFRDA.

2. Premium/ Purchase Price- Payable in lump sum and equivalent to monetary or money value of the specified % of the accumulated pension wealth in the subscribers NPS account and which is paid to the Annuity Service Provider by CRA/PFM directly.

3. Mode of payment of pension under NPS: Annuity/ pension will be paid by the Annuity Service Provider (ASP) as monthly pension by directly crediting into the bank account of the subscriber.

4. Annuity Options Available:

The annuity options that are generally available with the ASP’s in the Indian market are as follows. However, all the ASP’s may not offer all the options and may offer only few of the given below options depending on the availability of such product with them.

Type of Annuities or Annuity Choices: The following are the variants of annuity that are generally available with all the empanelled ASP’s.

1. Annuity/ pension payable for life at a uniform rate.

2. Annuity payable for 5, 10, 15 or 20 years certain and thereafter as long as the annuitant is alive.

3. Annuity for life with return of purchase price on death of the annuitant.

4. Annuity payable for life increasing at a simple rate of 3% p.a.

5. Annuity for life with a provision of 50% of the annuity payable to spouse during his/her lifetime on death of the annuitant.

6. Annuity for life with a provision of 100% of the annuity payable to spouse during his/her lifetime on death of the annuitant.

7. Annuity for life with a provision of 100% of the annuity payable to spouse during his/ her life time on death of annuitant. The purchase price will be returned on the death of last survivor.

Any one option can be chosen. Once chosen, the option cannot be altered.

5. What happens in case of death of annuitant?

i. Under option (1) annuity ceases after the annuitant dies.

ii. Under option (2)

I. On death of the annuitant during the guaranteed period – annuity is paid to the nominee till the end of the guaranteed period after which the same ceases.

II. On death after the guaranteed period – annuity ceases.

iii. Under option (3) annuity ceases after death of the annuitant and the purchase price is paid to the nominee.

iv. Under option (4) annuity ceases after death of the annuitant.

v. Under option (5) payment of 100% annuity ceases after death of the annuitant and 50% of the annuity is payable to the surviving named spouse during his/her life time. If the spouse predeceases the annuitant, the annuity ceases after death of the annuitant.

vi. Under option (6) payment of annuity ceases after death of the annuitant and full annuity is payable to the surviving named spouse during his/her life time. If the spouse predeceases the annuitant, the annuity ceases after death of the annuitant.

vii. Under option (7) payment of annuity ceases after death of the annuitant and full annuity is payable to the surviving named spouse during his/her life time. If the spouse predeceases the annuitant, the annuity ceases after death of the annuitant and purchase price is paid to the nominee.

6. Default option for annuity service provider and annuity scheme:

The following default annuity service provider along with the annuity scheme is available to all the subscribers under National Pensions System. However, it may be noted that default option is being purely provided in the subscribers’ interest and to avoid any delay in claim processing and is not with a view to endorse/promote any particular ASP or annuity variant being offered by the ASP.

1. Default Annuity Service Provider – Life Insurance Corporation of India (LIC)

2. Default Annuity Scheme – Annuity for life with a provision of 100% of the annuity payable to spouse during his/her life on death of annuitant’ and Under this option, payment of monthly annuity would cease once the annuitant and the spouse die or after death of the annuitant if the spouse pre-deceases the annuitant, without any return of purchase price.

3. However, where the corpus is not adequate to buy the default annuity variant and from the default ASP, the subscriber has to compulsorily choose an ASP who offers an annuity at the available corpus in the account of the subscriber.

7. Service Tax:

The amount of service tax as per the prevailing rates shall be payable by the policyholder along with the purchase price.

8. Paid-up value/ Surrender Value/ Loan:

The policy does not acquire any paid-up value and no surrender value and no loan will be available under the policy.

Note: The above is an attempt to provide you with the generic information on annuity and annuity options available in the Indian market. This is for illustrative purpose only. This does not represent any guarantee or promise and for detailed information on the annuities offered or the ASP’s you may approach the empanelled ASP’s and also at https://www.npscra.nsdl.co.in/annuity-service-providers.php.

ANNUITY SERVICE PROVIDER’S(ASP’s)

Annuity Service Providers are IRDA licensed and regulated Life Insurance companies, transacting annuity business in India and who are empanelled by PFRDA for servicing the annuity requirements of the NPS subscribers. At present the following 7 ASP’s are providing the Annuity services to NPS subscribers and the contact details of these ASP’s can be seen at https://www.npscra.nsdl.co.in/annuity-service-providers.php.

– Life Insurance Corporation of India

– SBI Life Insurance Co. Ltd.

– ICICI Prudential Life Insurance Co. Ltd.

– HDFC Standard Life Insurance Co Ltd

– Bajaj Allianz Life Insurance Co. Ltd.

– Reliance Life Insurance Co. Ltd.

– Star Union Dai-ichi Life Insurance Co. Ltd.

These ASP’s are prudentially regulated and monitored by Insurance Regulatory and Development Authority (IRDA).

PART 2 –

PROCESS FOR ANNUITY SELECTION AND ONLINE PURCHASE:

The starting screen would have a declaration that the subscriber had read and understood the information on annuities, aware of the implications of the annuity option chosen by him and that he would like to proceed further for selecting the annuity option and Annuity Service Provider.

i. The subscriber or PAO/DDO/DTO’s/POP-SP/Aggregator inputs the claim number as provided by CRA in the above page and the other fields providing the demographic information are auto- populated from the CRA system.

ii. The system would generate the monthly annuity amount once the subscriber or PAO/DDO/DTO’s/POP-SP/Aggregator clicks the Quotation button on the screen and check the monthly annuity/pension that could be obtained with the given corpus. In case of NPS- Swavalamban subscribers, the condition of annuitizing the entire accumulated pension wealth in case if the annuity/pension obtainable with the 40/80% is below Rs.1000/- p.m. would be applied, through a systemic check taking the annuity rates of LIC as benchmark for deciding on the issue.

iii. The subscriber through his PAO/DDO/DTO’s/POP-SP/Aggregator has to choose the ASP and the annuity variant that best suits him. Alternatively, he can save the quotation and take a printout of the screen shot with necessary disclaimers and finalise the same at his convenience. However, it should be noted that the depicted figures of monthly annuity have a limited validity in terms of days.

iv. Alternatively, once the subscriber chooses his ASP upon going through the quotations generated in the above steps or after satisfying himself on the ASP and scheme can either download the application form of the ASP and submit it to the NPSCPC after completing all the documentary formalities. Also, he can obtain the annuity proposal or application from any of the offices of the concerned ASP and submit it to NPSCPC as provided above. However, the online purchase process is recommended as majority of the information pertaining to the subscriber is auto populated from the CRA system and which would be more consistent.

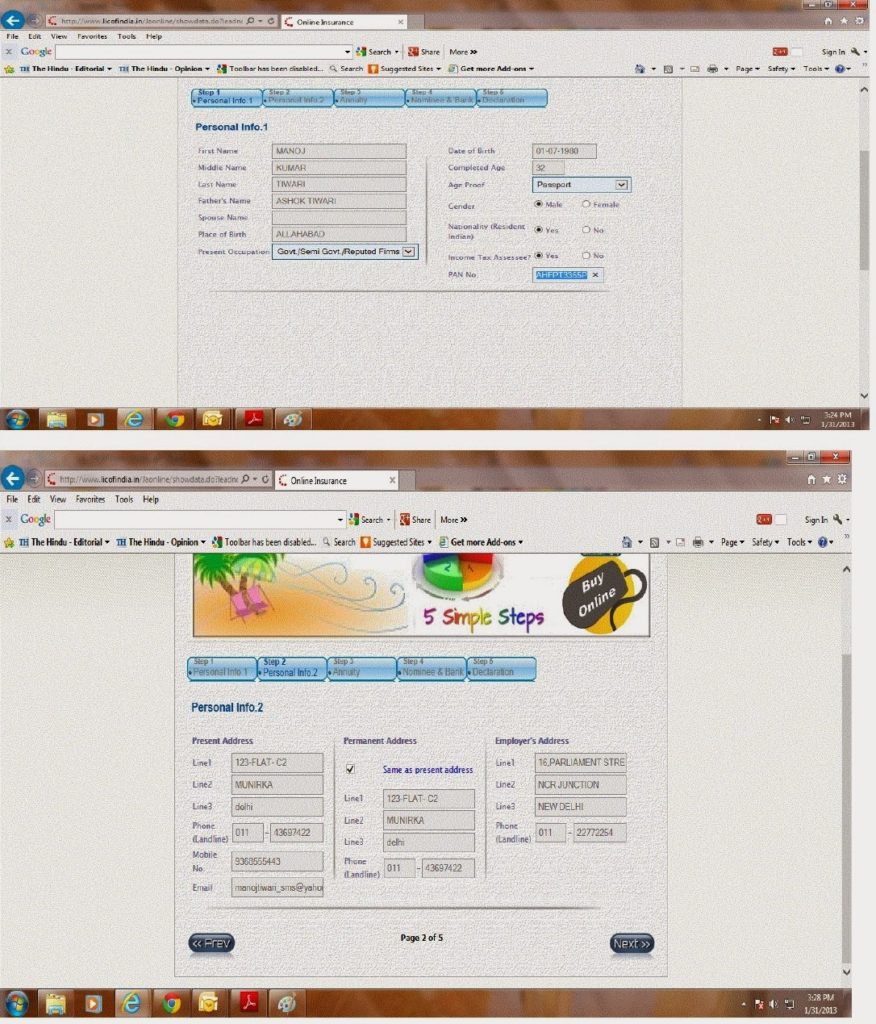

v. The subscriber choosing to purchase annuity online has the option to choose any of the ASP’s and the variant and can simply CLICK on the ASP name which he is opting for. This would lead him to the online platform of the ASP for purchase of the annuity showing the monthly pension payable for all the annuity variants for the given purchase price. Here, the subscriber has to choose an annuity scheme specifically and which will take him to the online platform where all the fields would be auto populated except for those specific fields which needs to be filled in by the purchaser on line. The subscriber through his PAO/DDO/DTO’s/POP-SP/Aggregator has to complete all the screens and SUBMIT the proposal as provided in their online platform.

vi. In case if the subscriber is not able to choose the ASP and annuity variant and he intends to utilize the default ASP and annuity scheme, he may directly click the SUBMIT button for availing the same.

If the form is submitted before the monetization of the accumulated pension wealth, the request for purchase of the annuity would be executed only upon monetization of the accumulated pension wealth as per NPS guidelines.

vii. Once the application form is submitted to the ASP, the screen would prompt him to take a print out of the application form, affix the signature and send it to the ASP at the designated address which is printed on the application form.

viii. Also, once the application form is submitted online to the ASP, as a background process the system sends a communication to the CRA system/CRA on the successful submission of the application and requesting for the remittance of funds. CRA in turn would issue instruction to PFM to transfer the fund to ASP and the PFM transfers the funds online through NEFT/RTGS within 1 working day. CRA dispatches the KYC documents and DOB confirmation to ASP electronically to complete the process.

ix. ASP upon receipt of the physical application form from the subscriber would match with the funds received from the PFM and issue the necessary Annuity contract along with the receipt to the subscriber directly and send a confirmation in this regard to CRA either by way of weekly MIS in the agreed format or in the manner mutually agreed. Alternatively, a mutually acceptable system between CRA and ASP wherein the policy issuance software is loaded on to the CRA system for issuance of the annuity policies by CRA as a pre-underwritten product and remittance of funds and documents as per mutually agreed norms can be implemented.

x. Also, the ASP would ensure that in case if any of the subscriber annuitant wishes to utilize the “Free look in period” the proceeds or premium of such account is transferred to the account from which the funds are received.

Thematic illustration of the above process is as given below:

The subscriber through his PAO/DDO/DTO’s/POP-SP/Aggregator keys in the claim number provided by CRA on the screen and the data in Yellow is auto-populated from CRA system taking inputs from the main CRA module and withdrawal application submitted.

On clicking the quotation button, the system auto-populates the monthly annuity that can be obtained with the given corpus for various ASP’s against the annuity option.

The customer has the option to print the sheet or save the work for his for completing it at a later date or time.

The subscriber has to compulsorily choose one of the annuity option and the ASP through which he wants to buy the same. In case if he is not able to decide on the same (irrespective of the reason) he can click on the SUBMIT FOR DEFAULT ASP AND OPTION which will automatically route the link to the online annuity purchase platform of the ASP. Once the subscriber chooses the annuity option basing on the monthly pension or basing on the ASP he clicks on the cell against the annuity option which will take him to the online annuity purchase platform of the ASP.

Example: Mr. Manoj decides to buy annuity for life with a provision of 100% of the annuity payable to spouse during his/her lifetime on death of the annuitant through LIC and he clicks on 604 in the given below screen.

Note: In the above illustration fileds like 101, 102, 201, 202 etc represent the annuity variants available with the ASP’s and which can be opted by the subscriber.

This will take Mr. Manoj to the online annuity purchase platform of LIC as given below and all the fields in the screens are auto-populated from the CRA system claims module basing on the withdrawal application form submitted including KYC details provided with due verification.

Finally, once the SUBMISSION is made through the SUBMIT button at the end the process would be

complete and the screen would prompt for taking the print out of the Annuity application form and send it to the designated address provided on the application form.

Also, once the application form is submitted online to the ASP, as a background process the system sends a communication to the CRA system/CRA on the successful submission of the application and requesting for the remittance of funds. CRA in turn would issue instruction to PFM to transfer the fund to ASP and the PFM transfers the funds online through NEFT/RTGS within 1 working day. CRA dispatches the KYC documents and DOB confirmation to ASP electronically to complete the process.

ASP upon receipt of the physical application form from the subscriber would match with the funds received from the PFM and issue the necessary Annuity contract along with the receipt to the subscriber directly and send a confirmation in this regard to CRA either by way of weekly MIS in the agreed format or in the manner mutually agreed.

This completes the Annuity purchase process of Mr. Manoj and he would start getting the chosen monthly pension from the designated day of next month.

Documents to be submitted along with the withdrawal application

The nature and type of documents required depends on the nature and cause of withdrawal being sought. The following are the complete details of the documents that are required for various types of permissible exits under NPS.

a. Documents to be submitted in case of: upon attaining the age of Normal superannuation (for govt. employees only) or upon attaining the age of 60 years (for all subscribers other than govt. employees) apart from the completely filled and signed application form for withdrawal of benefits.

COMMENTS