|

New Pension Scheme

(Defined Contributory Pension Scheme)

PRELIMINARY STUDY REPORT

Presented by

K.V.RAMESH, SSE/ICF

JGS (Finance & Administration) /IRTSA

|

|

Pension – Greatly Valued

|

|

Defined Benefits Pension & GPF

(prior to

1.1.2004)

|

|

Types of Pension

(1) Superannuation

(2) Family Pension

(3) Voluntary Retirement (VR )

|

|

COMMUTATION OF PENSION

|

|

Gratuity

|

|

New Pension Scheme(Defined Contributory Pension Scheme)

Salient Features

CONTRIBUTION TO TIER-I

To leave the scheme before 60 years of age

|

|

Six Pension Fund Managers

|

|

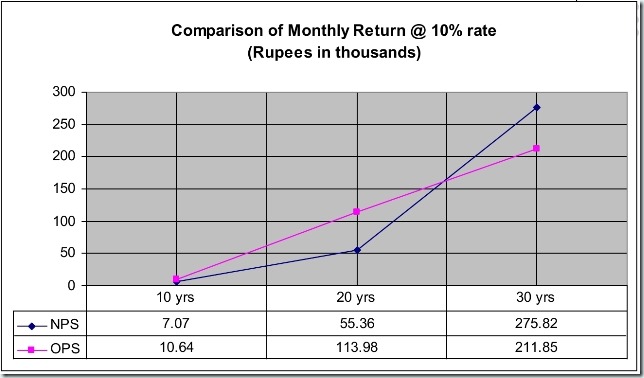

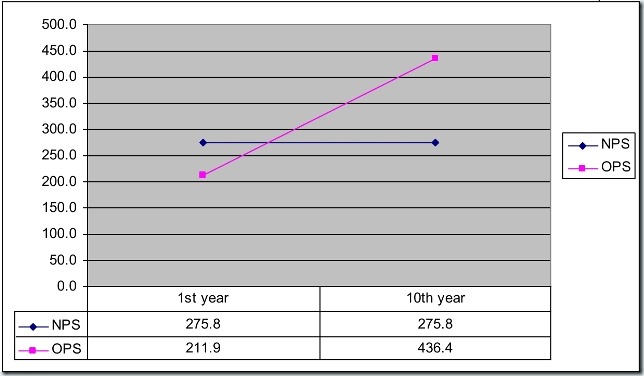

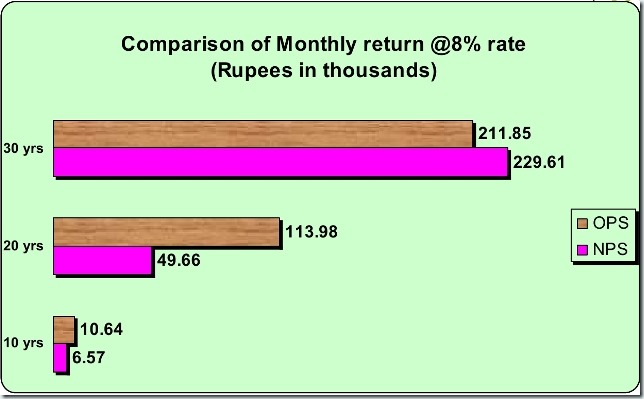

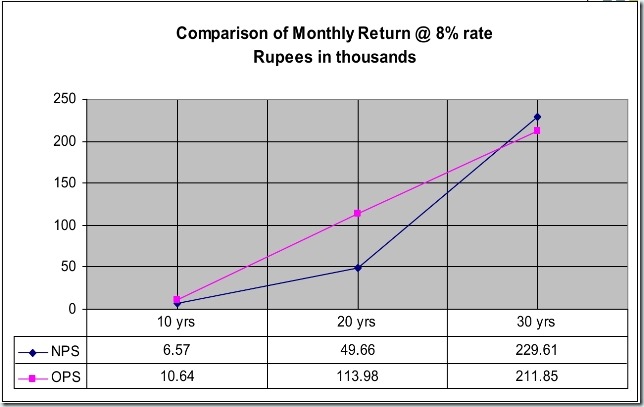

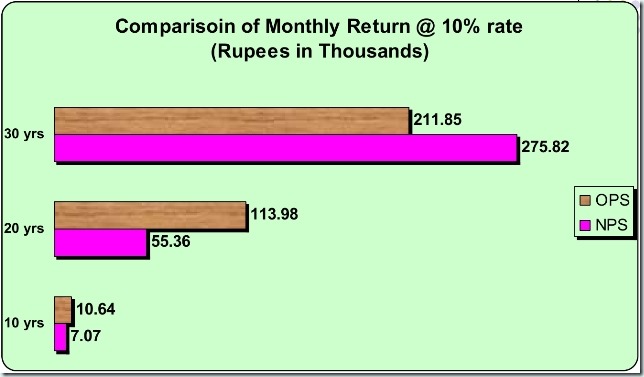

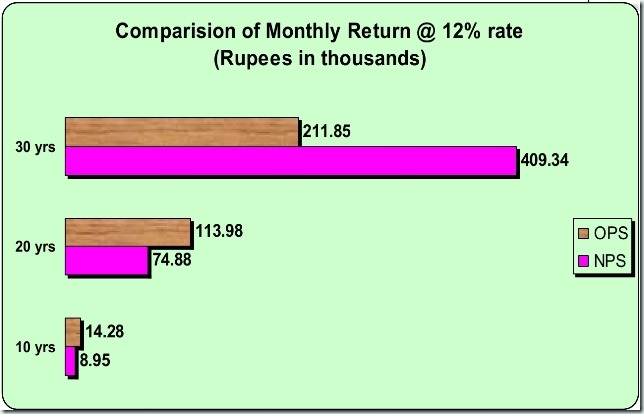

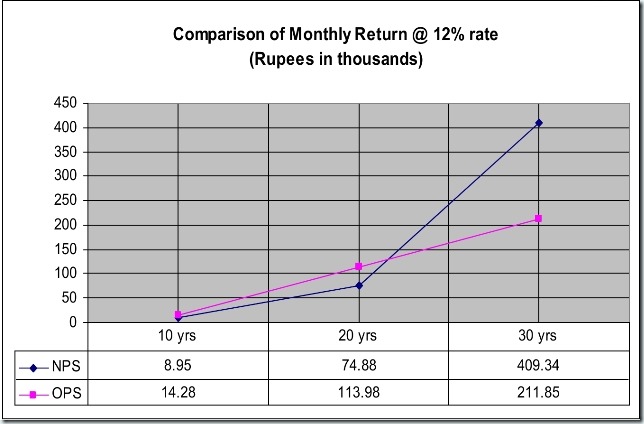

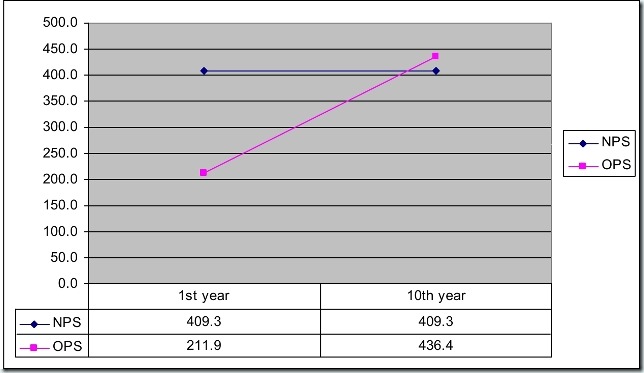

Comparison of Earnings of

Old Pension Scheme and NPS

CIRCUMSTANCES ASSUMED

|

Inflation proof for new Pension not available (Rs. in thousands)

Inflation proof for new Pension not available (Rs. in thousands)

THE

IMPLICATIONS

ARE

QUITE DEEP

Right for dignified life stripped

- In a single swoop the idea of pensions being rights of workers, has been thrown into the neo-liberal dustbin.

- Fundamental issue of stripping of employees’ right to a life of dignity

- The return under NPS is market driven.

- There is no guaranteed/defined amount of return.

- The returns generated through investments are accumulated and is not distributed as dividend or bonus

Why Armed Forces kept away

- If the expected return under NPS is much higher than the return under existing old Pension Scheme, why does not the government allow the members of the Armed Forces to exercise this option? Armed force are the most valued functionaries of the nation. That the members of the Armed Forces are being kept under old pension scheme does indicate that there is something shady in the argument that NPS would earn better; at least the government itself is not convinced that NPS would give better benefits to its employees. One can never be sure that the returns from equities would always be better than the guaranteed returns.

Govt arguments not true

- While introducing the NPS, the Government had argued in the same way as one would find in the IMF Report (2001).

- Briefly speaking, the argument is that DBS is unsustainable because the pension expenditure is increasing at a very high rate.

- Thus, over 1993-94 to 2004-05, the pension expenditure of the GOI has increased by 21 per cent; for the state governments, the rate of increase is still higher (27 per cent over the same period).

Is DBS unsustainable in India

- What the Government did not mention is that the government’s pension expenses as a percentage of GDP is quite negligible in India (less than 0.1 per cent).

- In South Korea or in Hongkong it is about 2 per cent.

-

In Italy, France and Germany where the coverage under DBS pension is wide, the pension expenses as percentage of GDP is much higher in these countries.

- In Italy it is 14 per cent; in France and Germany the ratio is 12 per cent. In Japan 9 per cent of the GDP is spent on DBS pension.

- One wonders how it becomes unsustainable in India where the expenses on DBS pension is so low.

NPS SHOULD GO

- The argument that DBS would render all governments ‘bankrupt’ thus appears to be untenable.

- Why should the small pensioners who usually do not have savings to tide over the crisis should be driven to uncertain situation?

- Global capital does not have any moral obligation to honour the right of the citizen to live with dignity even in the retired life.

Thank you

M. SHANMUGAM, Central President,

# 4, Sixth Street, TVS Nagar,

Padi, Chennai- 600050.

Email- [email protected]

Mob: 09443140817

K.V.RAMESH, Zonal Secretary, IRTSA,

G3-LIKITH HOMES, 3-Lakshmanan Nagar west street,

Peravallur, Chennai-600082

Email: [email protected]

(Mob:9003149578, 09444100842

Source: http://www.irtsa.net

COMMENTS

I m a just a 12 th student .

Can anybody please explain me in easy language that "pension will be given to retired people now ,or not ?" .

Cause I don't want to give my service in government sector in future if it is not given .

Nd I need to know more about it for my father too

Sale of pension is also a fraud on employee. The factor of multiplication is based on 7 years of pension. But full pension restored only after 15 years. Yet no one question the same

NPS is no more than a scheme for gov. to roll our money and hand it over to likes of Vijay mallya .. where is all our money going and what is being done?? Earlier it was SBI, LIC and choice of fund management was there but now we were not even informed that lic has been changed..it was the only profit making organization.

Does any state is giving old pension scheme still? Thanks for this informative article.

NEW PENSION SCHEME IS WORST FOR ANY GOVT. EMPLOYEE…. It is basically NO PENSION SCHEME…. with NO DEARNESS ALLOWANCE, NO GUARANTEED FIXED RETURN AND NO FAMILY PENSION…… NO DEATH BENEFIT FOR DEPENDENT CHILD…

All EMPLOYEE should have to greatly Worried about their Retirement Life under New Pension Scheme!!!

1000% worst

which one is the best for government and which one best for employees

Very well written.

There is another article among many which is also beautifully written.

http://cgstaffnews.com/?page_id=8052

It was a cruel,selfish and inhumane decision.It will ruin the life after retirement of millions ,now one can’t even get social security from the govt job after giving decades of service to the public.It is a shame to be born in a country where government doesn’t care about it’s employees and acts as a private company where greed comes first and employee or society’s benefit comes nowhere.The govt has become so corrupt and greedy that doesn’t leave a chance of fulfilling it’s greedy and selfish objectives.I hope they restore defined benefit pension.

Many people don’t understand the new pension scheme right now but will understand when they will retire.It will be a nightmare when their pension i.e annuity while remaining constant will decrease instead of remaining constant with the increase.With the passage of time they will find their pension i.e annuity decreasing due to the time value of money effect.

armed forces have people retiring from 17 years of service onwards……

hence they will be reduced to worse than beggers that they have been made into( see table)….

life for fauji is tough ;

is anyone working in civil department ready to don the uniform even for a year…