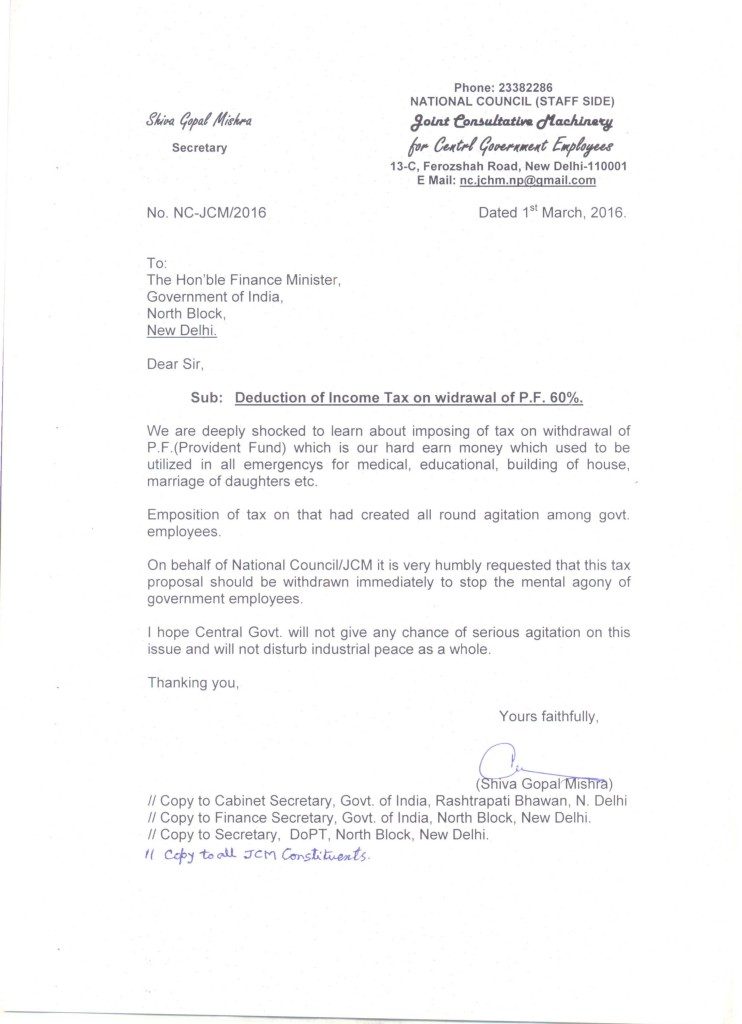

Deduction of Income Tax on withdrawal of Provident Fund 60%

NATIONAL COUNCIL (STAFF SIDE)

Joint Consultative Machinery for Central Government Employees

13-C, Ferozshah Road, New Delhi – 110001

E Mail: [email protected]

No. NC-JCM/2016

Dated:- 1st March, 2016

To

The Hon’ble Finance Minister,

Government of India,

North Block,

New Delhi.

Dear Sir,

Sub: Deduction of Income Tax on withdrawal of P.F. 60%

We are deeply shocked to learn about imposing of tax on withdrawal of P.F.(Provident Fund) which is our hard earn money which used to be utilized in all emergencies for medical, educational, building of house, marriage of daughters etc.

Imposition of tax on that had created all round agitation among govt. employees.

On behalf of National Council/JCM it is very humbly requested that this tax proposal should be withdrawn immediately to stop the mental agony of government employees.

I hope Central Govt. will not give any chance of serious agitation on this issue and will not disturb industrial peace as a whole.

Thanking you ,

Yours faithfully,

sd/-

(Shiv Gopal Mishra)

Source: www.ncjcmstaffside.com

[http://ncjcmstaffside.com/2016/deduction-of-income-tax-on-withdrawal-of-p-f-60/]

Stay connected with us via Facebook, Google+ or Email Subscription.

Subscribe to Central Government Employee News & Tools by Email [Click Here]

Follow us: Twitter [click here] | Facebook [click here] | Google+ [click here]

Admin

COMMENTS