Tag: TDS

Provisions related to TDS on withdrawal from Employees Provident Fund Scheme, 1952

Provisions related to TDS on withdrawal from Employees Provident Fund Scheme, 1952

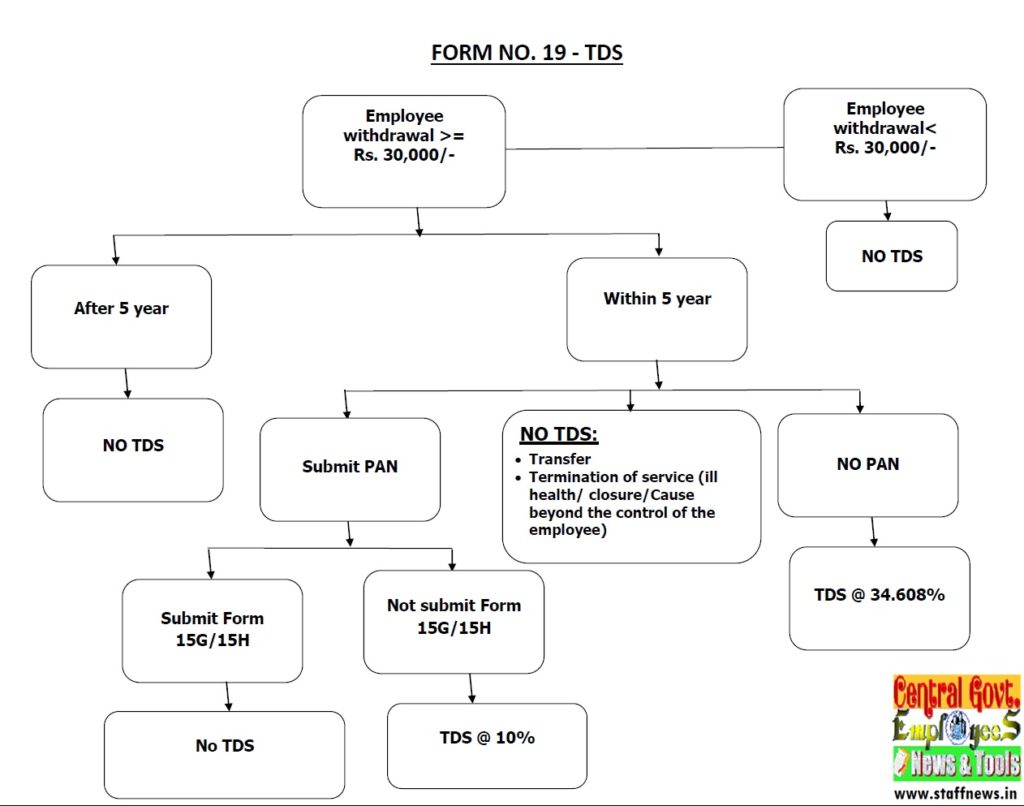

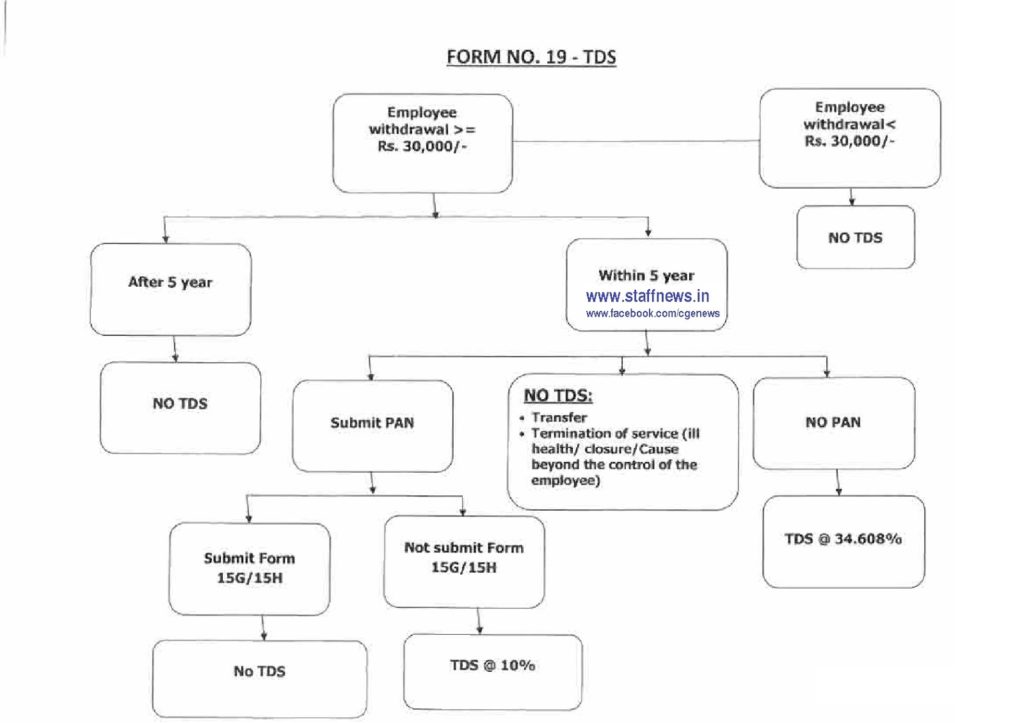

(FORM No. 19)

No TDS in respect of the following cases:-

Tr [...]

TDS on PF Withdrawals भविष्य निधि से निकासियों पर टी.डी.एस.

TDS on PF Withdrawals भविष्य निधि से निकासियों पर टी.डी.एस.

GOVERNMENT OF INDIA

MINISTRY OF FINANCE

DEPARTMENT OF REVENUE

RAJYA SABHA

UNSTARRED [...]

EPFO: Instructions for deduction of TDS on withdrawal from PF

Amendment in Section 192A of the IT Act, 1961 - Instructions for deduction of TDS on withdrawal from PF

For Web Circulation

Employees' Provident F [...]

TDS on Recurring Deposits from June 1

TDS on recurring deposits from June 1 force investors to close down deposits prematurely

NEW DELHI: Days after the Budget announced that tax deduc [...]

Details of provision for Income Tax, TDS, Exemption limit in Budget 2015-16 – Finance Bill 2015

FINANCE BILL, 2015

PROVISIONS RELATING TO DIRECT TAXES

Introduction

The provisions of the Finance Bill, 2015 relating to direct taxes seek to [...]

Standard Operating Procedure for Prosecution in Cases of TDS/TCS Default

STANDARD OPERATING PROCEDURE FOR PROSECUTION IN CASES OF TDS/TCS DEFAULT

Introduction:

1.1 As per the Income Tax Act, all cases where TDS/TCS is de [...]

Computation of Income Tax – Income Chargeable Under the Head Salaries: Income Tax on Salaries Circular 17/2014

5. COMPUTATION OF INCOME UNDER THE HEAD "SALARIES"

5.1 INCOME CHARGEABLE UNDER THE HEAD "SALARIES":

Click to view Part I

Income T [...]

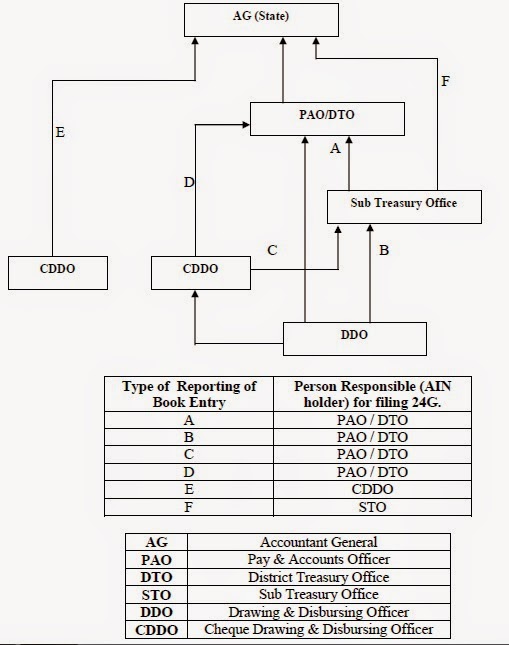

Persons responsible for Deducting Tax and their Duties: Income Tax on Salaries Circular 17/2014

4. PERSONS RESPONSIBLE FOR DEDUCTING TAX AND THEIR DUTIES:

Click to view Part I

Income Tax on Salaries - Circular No. 17/2014

[...]

Scheme of Tax Deduction at Source from Salaries – Circular No. 17/2014

3. SECTION 192 OF THE INCOME-TAX ACT, 1961: BROAD SCHEME OF TAX DEDUCTION AT SOURCE FROM "SALARIES":

3.1 Method of Tax Calculation:

[...]

Rates of Income Tax on Salaries for the Fin Year 2014-15: Income Tax Circular 17/2014

Click to view Part I of Income Tax on Salaries - Circular No. 17/2014

2. RATES OF INCOME-TAX AS PER FINANCE (No. 2) ACT, 2014:

As per the Fina [...]