Tag: TDS

Calling of option for new personal taxation regime as provided u/s 115 BAC of the IT Act, 1961 (applicable w.e.f. AY 2021-22)

Calling of option for new personal taxation regime as provided u/s 115 BAC of the IT Act, 1961 (applicable w.e.f. AY 2021-22)

Taxation Sect [...]

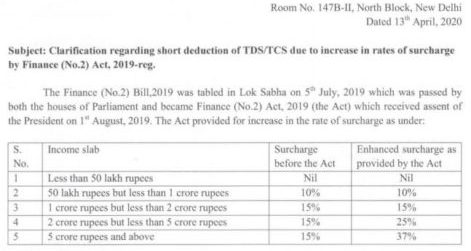

Clarification regarding short deduction of TDS/TCS due to increase in rates of surcharge by Finance (No.2) Act, 2019: IT Circular No. 8/2020

Clarification regarding short deduction of TDS/TCS due to increase in rates of surcharge by Finance (No.2) Act, 2019: Income Tax Circular No. 8/2020 d [...]

Clarification on Order u/s 119 of IT Act on issue of certificates for F.Y. 2019-20 & F.Y. 2020-21 for lower rate/nil deduction/collection of TDS or TCS

Clarification on Order u/s 119 of IT Act on issue of certificates for F.Y. 2019-20 & F.Y. 2020-21 for lower rate/nil deduction/collection of TDS o [...]

सीबीडीटी ने करदाताओं को टीडीएस/टीसीएस प्रावधानों के अनुपालन में हो रही कठिनाइयों को कम करने के लिए ऑर्डर जारी किया

सीबीडीटी ने करदाताओं को टीडीएस/टीसीएस प्रावधानों के अनुपालन में हो रही कठिनाइयों को कम करने के लिए ऑर्डर जारी किया CBDT issues orders u/s 119 of IT Ac [...]

COVID-19: Order u/s 119 of IT Act on issue of certificates for F.Y. 2019-20 for lower rate/nil deduction/collection of TDS or TCS

COVID-19: Order u/s 119 of IT Act on issue of certificates for F.Y. 2019-20 for lower rate/nil deduction/collection of TDS or TCS u/s 195, 197 and 206 [...]

COVID-19: Order u/s 119 of IT Act on issue of certificates for F.Y. 2020-21 for lower rate/nil deduction/collection of TDS or TCS

COVID-19: Order u/s 119 of IT Act on issue of certificates for F.Y. 2020-21 for lower rate/nil deduction/collection of TDS or TCS u/s 195, 197 and 206 [...]

TDS guidelines on payments to BSNL VRS 2019 Optees – TDS on ex-gratia/Leave Encashment, Form 16, Tax Exemption etc.

Tax Deduction at Source (TDS) guidelines - TDS on ex-gratia, TDS on Leave Encashment, Form 16, Tax Exemption on payments to BSNL VRS 2019 Optees

[...]

Corrigendum to Circular No. 4/2020 : Income-Tax Deduction from Salaries during the Financial Year 2019-2020

Corrigendum to Circular No. 4/2020 : Income-Tax Deduction from Salaries during the Financial Year 2019-2020 under Section 192 of the Income-Tax Act, [...]

National Savings Schemes : Deduction of TDS in respect of Cash Withdrawal above Rs. 1 Crore

National Savings Schemes : Deduction of TDS in respect of Cash Withdrawal above Rs. 1 Crore

SB Order No. 02/2020

F.No 109-27/2019-SB

Govt. of I [...]

Income-Tax deduction at source from salaries during the financial year 2019 – 20 – Information regarding – Proforma

Income-Tax deduction at source from salaries during the financial year 2019 - 20 (U/S 192 of the Income Tax Act, 1961) -information regarding in profo [...]