Tag: RBI Circular

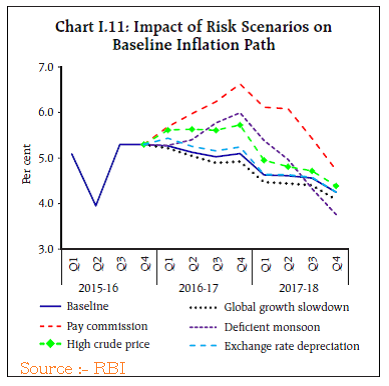

Delay In 7th CPC HRA in view of RBI Monetary Policy Report?

Delay In 7th CPC HRA in View Of RBI First Bi-monthly Monetary Policy Report ?

Central Government Employees are eagerly waiting for hike in allowa [...]

Refund of overpayment of pension to the Government Account – Recovery of excess/wrong pension payments made to the pensioners: RBI Circular

Refund of overpayment of pension to the Government Account – Recovery of excess/wrong pension payments made to the pensioners

RESERVE BANK OF INDIA [...]

Recovery of excess payments made to pensioners: RBI Circular

Recovery of excess payments made to pensioners: RBI Circular

RESERVE BANK OF INDIA

RBI/2015-16/340

DGBA.GAD.NO.2960/45.01.011/2015-16

Marc [...]

Payment of Agency Commission on pension accounts: RBI Circular

Reserve Bank circular on Payment of Agency Commission on pension accounts – Transaction in pension more than allowed numbers would not fetch agency [...]

Bank: Mandatory Leave for Employees Posted in Sensitive Positions or Areas of Operation

Mandatory Leave for Employees Posted in Sensitive Positions or Areas of Operation: RBI Order

RESERVE BANK OF INDIA

RBI/2014-15/563

DBR.No.BP.BC.88/ [...]

Levy of charges for non-maintenance of minimum balance in savings bank account: Additional Guidelines effective from 01.04.2015

Levy of charges for non-maintenance of minimum balance in savings bank account shall be subject to the following additional guidelines:

(i) In the e [...]

Usage of ATMs –Rationalisation of number of free transactions – Clarifications

RESERVE BANK OF INDIA

Usage of ATMs –Rationalisation of number of free transactions - Clarifications

Date: Oct 10, 2014

RBI/2014-15/260

DPSS. [...]

Implementation of Cheque Truncation System (CTS):revised procedure in respect of government cheques has been extended by three months to January 1, 2015

Implementation of Cheque Truncation System (CTS): RBI Circular for revised procedure in respect of government cheques has been extended by three month [...]

Opening of Bank Accounts in the Names of Minors

Reserve Bank of India

Date: Sep 09, 2014

Opening of Bank Accounts in the Names of Minors

RBI/2014-15/225

RPCD.CO.RCB.BC.No.29/07.51.010/2014-15

S [...]

Upper age limit for Whole Time Directors on the Boards of Banks: RBI Circular

Reserve Bank of India

Date: Sep 09, 2014

Upper age limit for Whole Time Directors on the Boards of Banks

RBI/2014-15/217

DBOD. APPT.BC.No. 40 /29. [...]