Tag: IT Return

Income Tax – New disclosure Norms in IT Return

Income Tax – New disclosure Norms in IT Return

Know the new disclosure norms in income tax return forms

Amendments in the ITR forms are a move [...]

Verification of tax-returns for Assessment Years 2009-2010 to 2014-2015 through EVC which are pending due to non-filing of ITR-V

Verification of tax-returns for Assessment Years 2009-2010, 2010-2011, 2011-2012 2012-2013, 2013-2014 and 2014-2015 through EVC which are pending du [...]

Release of E-filing of Income Tax Returns (ITR) and other forms at https://incometaxindiaefiling.gov.in

Release of E-filing of Income Tax Returns (ITR) and other forms at https://incometaxindiaefiling.gov.in: PIB News

Press Information Bureau

[...]

E-filing Vault: New functionality to secure Income Tax E-filing account

E-filing Vault: New functionality to secure Income Tax E-filing account

Press Information Bureau

Government of India

Ministry of Finance

04-Apri [...]

Revised timeline for verification of arrear demand under section 245 of the Income-tax Act, 1961

Revised timeline for verification of arrear demand under section 245 of the Income-tax Act, 1961: CBDT

F.No.312/109/2015-OT

Government of indie.

[...]

Redressal of Taxpayer grievances raised due to TDS mismatches

Redressal of Taxpayer grievances raised due to TDS mismatches - Reg.

DIRECTORATE OF INCOME TAX (SYSTEM)

ARA Center, Ground Floor, E-Z, Ihandewalan [...]

E-filing of Income Tax Return: Additional modes of generating Electronic Verification Code (EVC)

Additional modes of generating Electronic Verification Code (EVC) have been notified in addition to EVC notified vide earlier Notification No. 2/201 [...]

Person responsible for deducting tax and their duties: IT Circular 20/2015

Person responsible for deducting tax and their duties: IT Circular 20/2015

4. PERSONS RESPONSIBLE FOR DEDUCTING TAX AND THEIR DUT [...]

Validation of tax-returns pertaining to the Assessment Year 2014-2015 through Electronic Verification Code

Validation of tax-returns pertaining to the Assessment Year 2014-2015 through Electronic Verification Code-reg

Government of India

Mini [...]

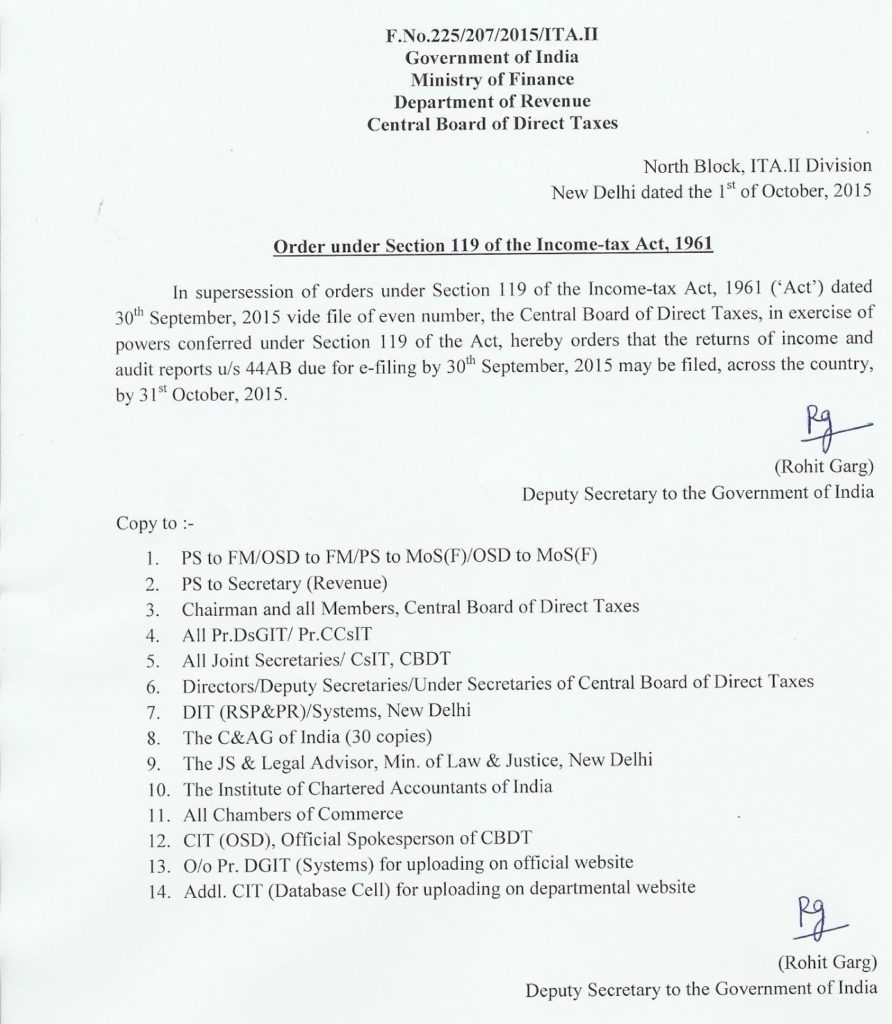

The due date for ITR and audit reports u/s 44AB has been extended to 31st October 2015 for the entire country

The due date for ITR and audit reports u/s 44AB which were due by 30th September 2015 has been extended to 31st October 2015 for the entire country

[...]